General Fund Revenue Report - April 2024

By Brittany Van Strien , Budget Analyst | one year ago

Tax & Revenue Analyst: Adrian Buckner, Budget Analyst

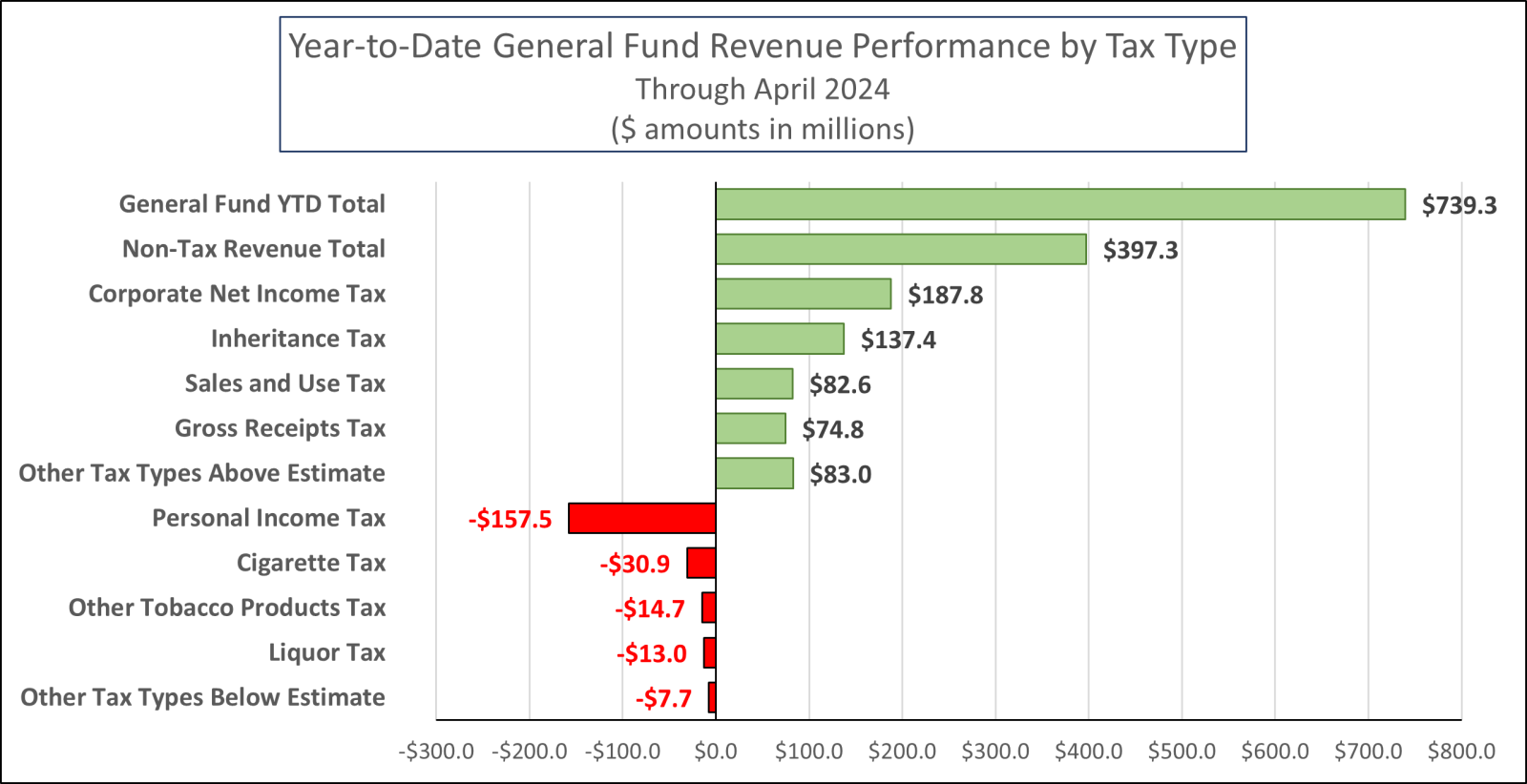

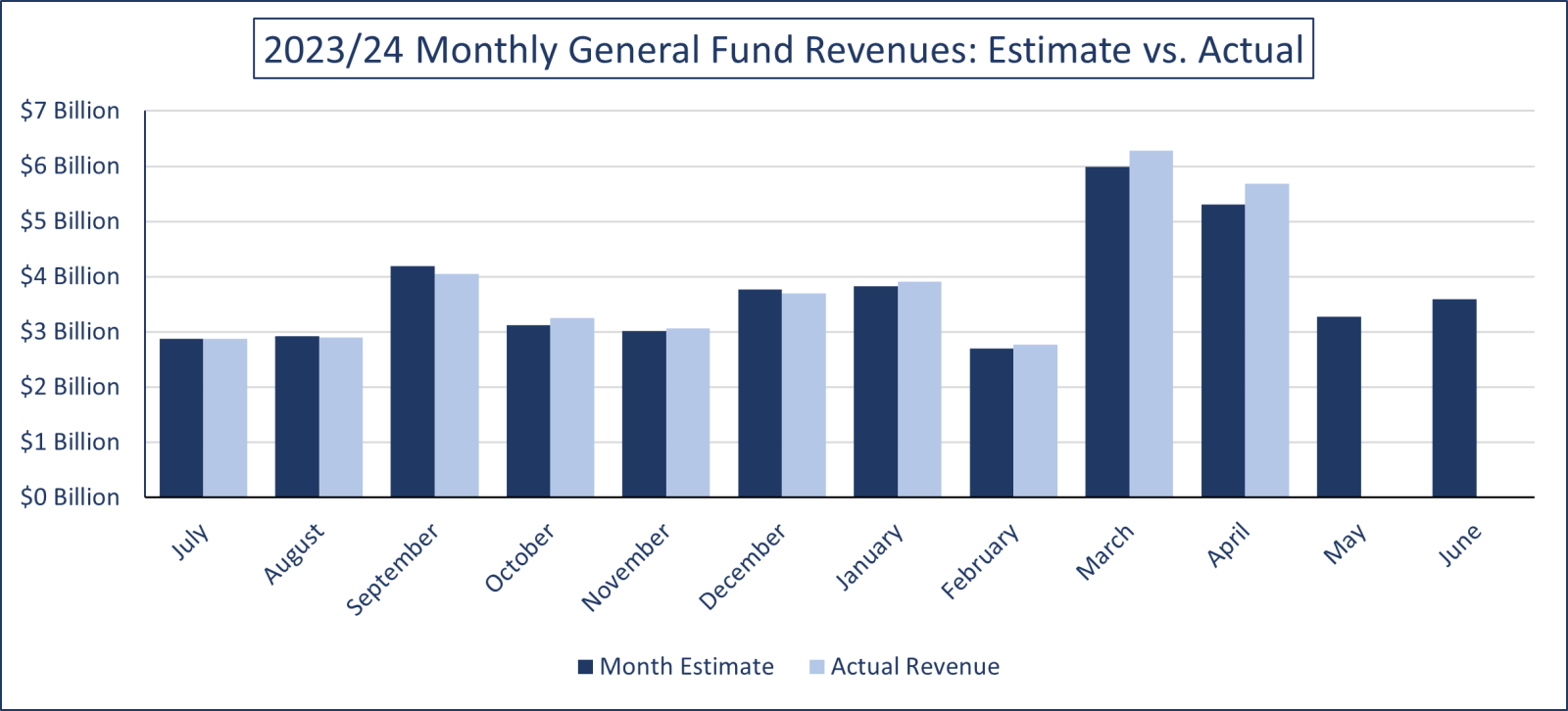

General Fund revenues in April were $373.3 million or 7.0% higher than expected. For the year-to-date, General Fund revenues are $739.3 million or 2.0% above estimate.

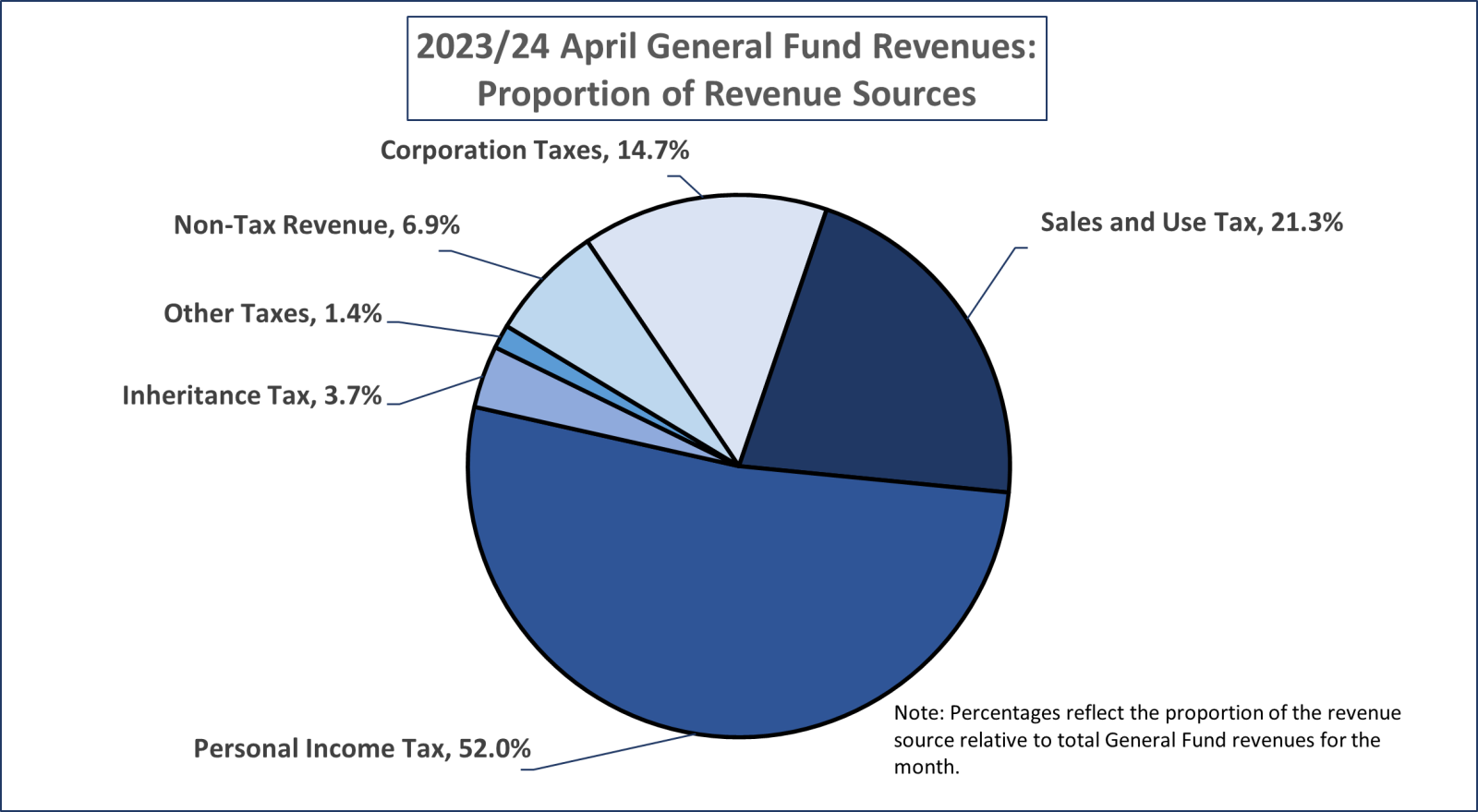

April was a significant month for individual taxpayers as it consisted of the payment deadline for 2023 Personal Income Tax (PIT) payments. Overall PIT collections underperformed for the month by $14.6 million or 0.5%. Although withholding payments finished the month $24.1 million (2.3%) over estimate, non-withholding payments, including estimated quarterly and annual payments, were $38.7 million or 2.0% less than expected. This was largely due to estimated payments finishing the month $50.9 million or 9.9% under estimate. Conversely, annual payments were $12.1 million or 0.9% ahead of estimate. For the year-to-date, PIT collections are $157.5 million or 1.0% under expectations.

Sales and Use Tax (SUT) collections were $0.1 million under estimate for the month. However, year-to-date SUT collections are still above estimate by $82.6 million or 0.7%.

r

Corporate Net Income Tax (CNIT) collections were $162.8 million or 30.2% higher than projected in April. For the year-to-date, CNIT revenue is exceeding projections by $187.8 million or 4.5%. Similarly, Inheritance Tax revenue was $87.4 million or 70.9% higher than expected for the month, putting year-to-date collections $137.4 million or 11.2% ahead of estimate.

Non-tax revenue was also $125.0 million or 46.6% above estimate. For the year-to-date, non-tax revenue is $397.3 million or 37.7% higher than expected, making it the highest outperforming General Fund revenue source through the end of April.

|

2023/24 General Fund Revenues ($ amounts in millions)

|

|

|

April 2024 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$5,312.3

|

$5,685.6

|

$373.3

|

7.0%

|

$37,745.1

|

$38,484.4

|

$739.3

|

2.0%

|

|

Tax Revenue

|

$5,043.9

|

$5,292.2

|

$248.3

|

4.9%

|

$36,690.5

|

$37,032.5

|

$342.0

|

0.9%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$538.9

|

$701.7

|

$162.8

|

30.2%

|

$4,191.1

|

$4,378.9

|

$187.8

|

4.5%

|

|

Gross Receipts Tax

|

$2.0

|

$2.5

|

$0.5

|

24.2%

|

$1,306.2

|

$1,381.0

|

$74.8

|

5.7%

|

|

Public Utility Realty Tax

|

$22.5

|

$24.9

|

$2.4

|

10.8%

|

$23.7

|

$27.3

|

$3.6

|

15.2%

|

|

Insurance Premiums Taxes

|

$85.0

|

$95.4

|

$10.4

|

12.2%

|

$993.4

|

$1,001.3

|

$7.9

|

0.8%

|

|

Financial Institution Taxes

|

$7.4

|

$10.8

|

$3.4

|

46.3%

|

$324.5

|

$382.5

|

$58.0

|

17.9%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$1,211.5

|

$1,211.4

|

($0.1)

|

0.0%

|

$11,750.2

|

$11,832.8

|

$82.6

|

0.7%

|

|

Cigarette Tax

|

($45.9)

|

($46.9)

|

($1.0)

|

-2.1%

|

$548.5

|

$517.6

|

($30.9)

|

-5.6%

|

|

Other Tobacco Products Tax

|

$14.2

|

$11.6

|

($2.6)

|

-18.4%

|

$135.9

|

$121.2

|

($14.7)

|

-10.8%

|

|

Malt Beverage Tax

|

$1.8

|

$1.5

|

($0.3)

|

-14.0%

|

$18.0

|

$17.4

|

($0.6)

|

-3.1%

|

|

Liquor Tax

|

$36.6

|

$34.6

|

($2.0)

|

-5.4%

|

$385.8

|

$372.8

|

($13.0)

|

-3.4%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$2,968.6

|

$2,954.0

|

($14.6)

|

-0.5%

|

$15,181.9

|

$15,024.4

|

($157.5)

|

-1.0%

|

|

Realty Transfer Tax

|

$45.3

|

$48.7

|

$3.4

|

7.6%

|

$413.9

|

$427.4

|

$13.5

|

3.3%

|

|

Inheritance Tax

|

$123.4

|

$210.8

|

$87.4

|

70.9%

|

$1,231.0

|

$1,368.4

|

$137.4

|

11.2%

|

|

Gaming Taxes

|

$30.8

|

$29.8

|

($1.0)

|

-3.3%

|

$309.5

|

$304.3

|

($5.2)

|

-1.7%

|

|

Minor and Repealed

|

$1.8

|

$1.2

|

($0.6)

|

-32.5%

|

($123.1)

|

($125.0)

|

($1.9)

|

-1.5%

|

|

Non-Tax Revenue

|

$268.4

|

$393.4

|

$125.0

|

46.6%

|

$1,054.6

|

$1,451.9

|

$397.3

|

37.7%

|