General Fund Revenue Report - July 2023

By Brittany Van Strien , Budget Analyst | one year ago

Tax & Revenue Analyst: Adrian Buckner, Budget Analyst

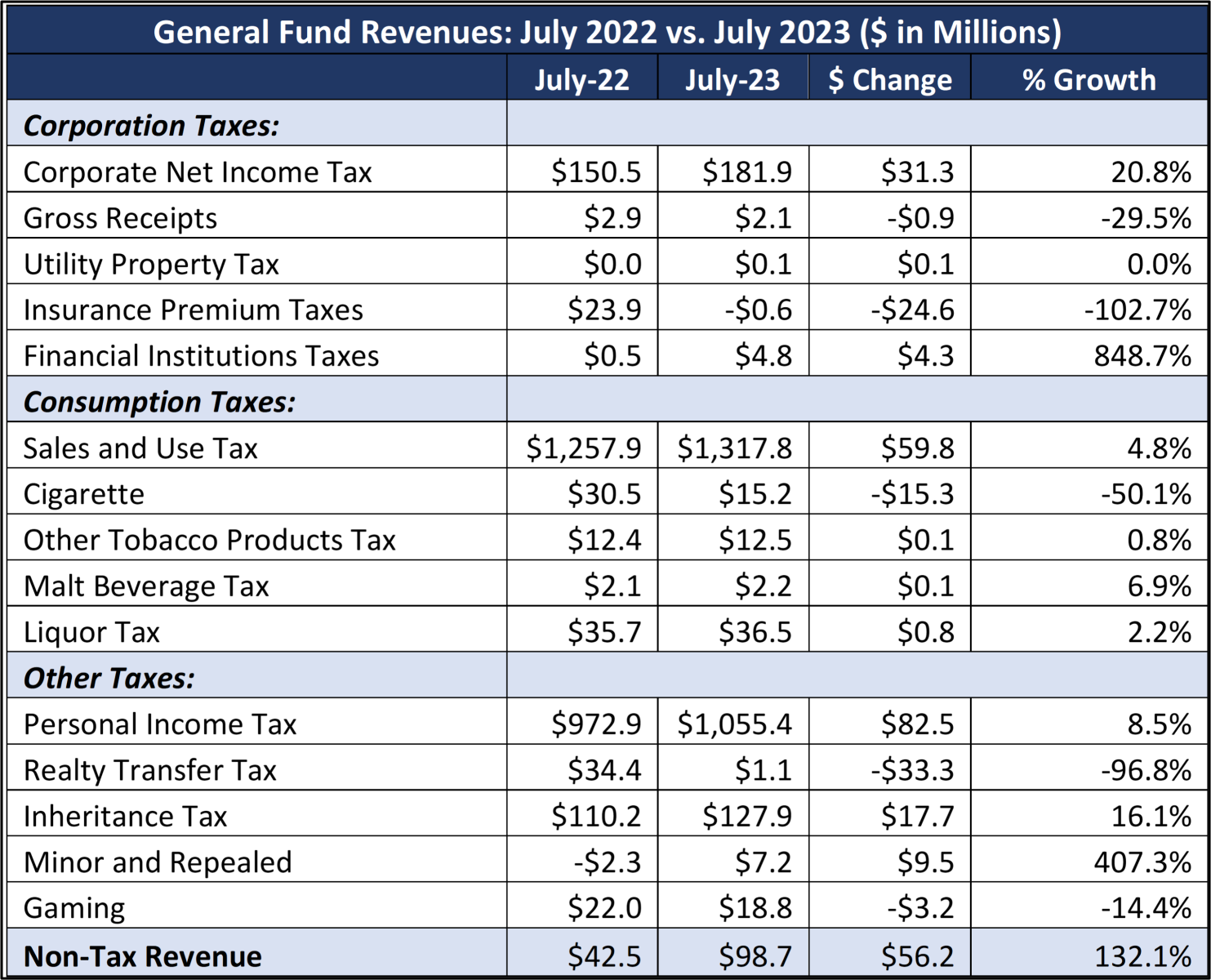

The commonwealth collected $2.9 billion in General Fund revenues in July, a 6.9% increase over the same month last year.

The official revenue estimate for 2023/24 has not yet been certified while the budget has yet to be finally enacted. Revenues continue to be collected and once the official estimate is certified, the Department of Revenue will prepare a monthly revenue distribution.

Overall, monthly tax revenue for the General Fund was 4.9% higher than last year. Corporate net income tax revenue for the month totaled $181.9 million, or $31.3 million more than last July. Sales and use tax revenues were $1.3 billion, or $59.8 million higher year-over-year, while the personal income tax brought in $1.1 billion for July 2023, or $82.5 million above last year.

For other tax types:

- Financial institutions taxes – July 2023 revenues were $4.8 million, which is $4.2 million higher than 2022.

- Inheritance tax – July 2023 revenues were $127.9 million, or $17.7 million more than 2022.

- Total nontax revenue – July 2023 revenues were $98.7 million, or $56.2 million above 2022.

- Cigarette tax – July 2023 revenues were $15.2 million, or $15.3 million lower than 2022.

Net collections for both the realty transfer tax and the insurance premiums tax were impacted by changes to transfers from those tax types compared to last year.