Pennsylvania Corporate Tax Structure - 2/14/2020

By Wendy Lewis , Senior Budget Analyst | 6 years ago

Tax & Revenue Analyst: Adrian Buckner, Budget Analyst

This Budget Briefing provides detail regarding the corporate tax structure in Pennsylvania.

Background

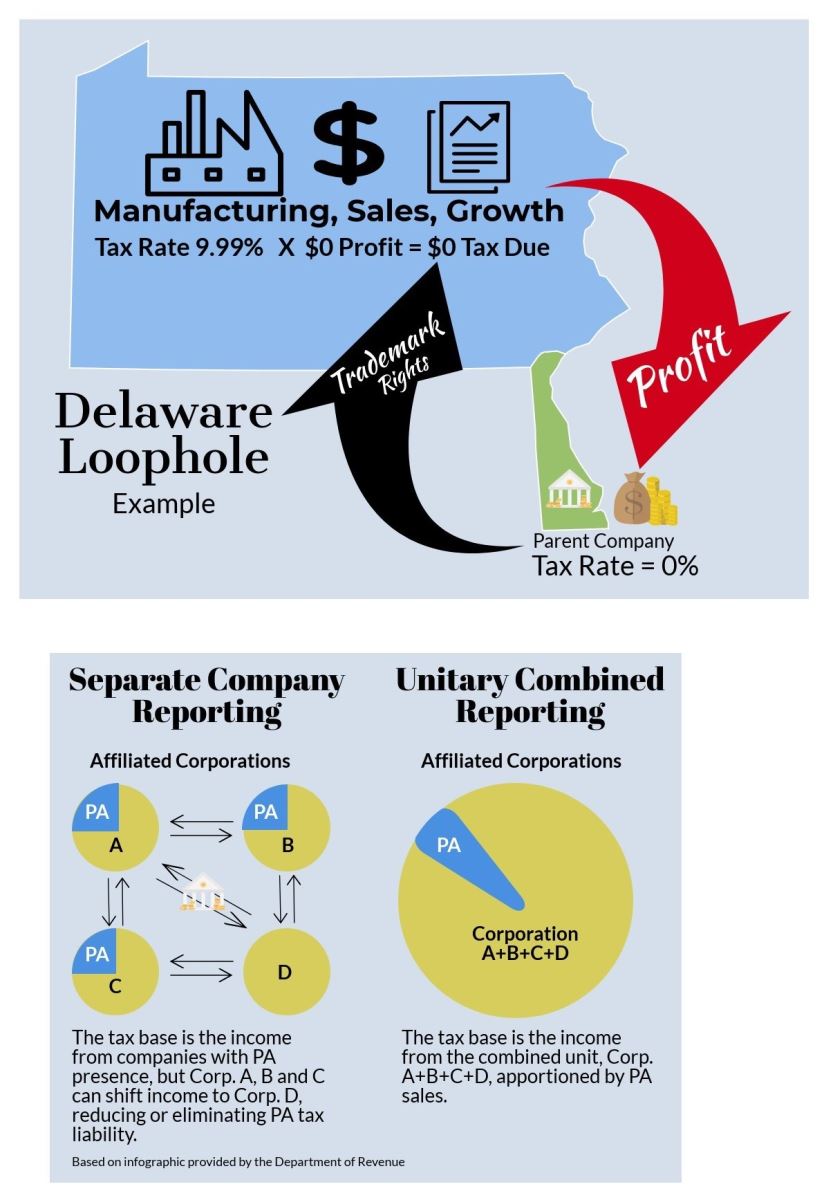

Pennsylvania’s corporate tax structure is a system of separate company reporting where each subsidiary or affiliate of a corporation files a separate return. This system reflects a narrow tax base and allows tax planning opportunities such as the use of passive investment companies to shift income outside of the state. This is often referred to as the Delaware loophole since many companies set up shell corporations or holding companies using a Delaware address. Even though the company might not have any assets or employees in Delaware, they are able to shift income to those companies and avoid paying all or part of the tax owed to Pennsylvania.

An alternative to Pennsylvania’s current system is mandatory unitary combined reporting, which would require a related group of businesses, such as parent companies and subsidiaries, to combine their income for tax purposes. The combined net income of the group would then be apportioned to the commonwealth.

-

- According to a Business Tax Reform Commission report, mandatory unitary combined reporting would provide a more accurate method of measuring the net income of affiliated corporations as it would substantially broaden PA’s tax base and be less subject to manipulation.

Policies aimed at closing specific individual loopholes tend to fall short, as accountants create new ways to transfer income to tax haven states. Combined reporting is the most comprehensive way to eliminate all potential tax advantages that can be derived from moving corporate income between states (Institute on Taxation and Economic Policy, “Combined Reporting of State Corporate Income Taxes: A Primer”, August 2011).

In Act 52 of 2013, the General Assembly enacted an “addback” provision to limit the ability of a corporation to deduct certain transactions that are clear attempts at blatant tax avoidance. However, this provision only applies to single transactions and businesses are able to negate the effect through a subsequent transaction. The provision has not substantially increased compliance.

The concept of combined reporting has been studied and proposed for a very long time in Pennsylvania. In 2004, under Gov. Ed Rendell, the Pennsylvania Business Tax Reform Commission released an extensive report recommending combined reporting in conjunction with a lower corporate net income tax rate. Gov. Tom Wolf proposed this same plan structure in five of his first six budgets (excluding 2016/17) with varying rate phase-down schedules each time.

Despite proposed rate cuts of 40 to 50 percent, these proposals have not gained. Many multi-state corporations are structured to take advantage of loopholes and shift income out of Pennsylvania. Therefore, the greatest obstacle for these plans tends to be opposition from these businesses who would pay additional tax, despite the rate cut. Less than five percent of corporations would experience increased tax liability under combined reporting, according to estimates by the Department of Revenue. Remaining corporations would either receive a tax cut or would not be impacted.

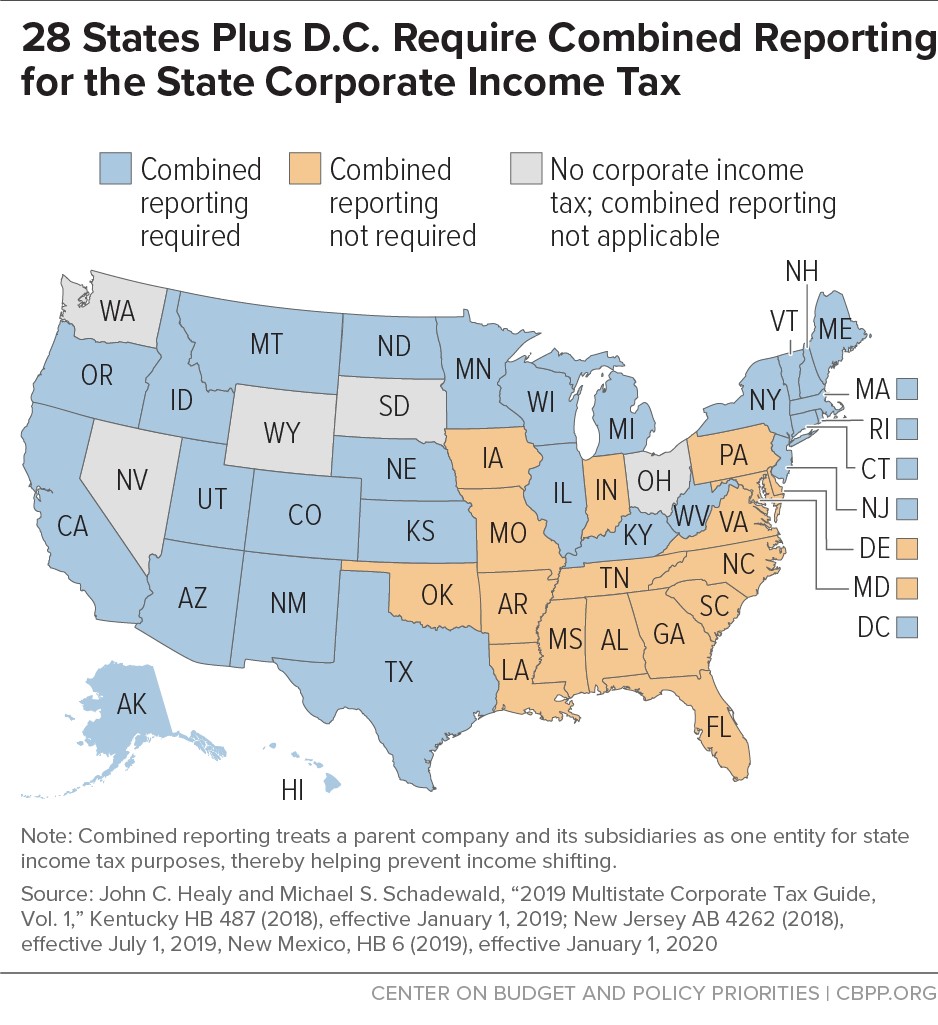

Twenty-eight states plus Washington D.C. require combined reporting. The states that do not require combined reporting are primarily in the southeast. Some states that recently adopted combined reporting did not see revenue increases, and critics point to this as a failure of combined reporting policy. However, the success or failure of combined reporting depends on how well, and how broadly, a “unitary business” is defined.

Revenue Estimates in the Governor’s Proposal

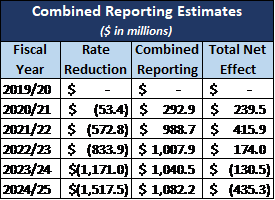

The Department of Revenue provided revenue estimates for the governor’s 2020/21 budget proposal to require combined reporting in conjunction with a corporate net income tax rate reduction. Although the net revenue effect would result in more revenue for the first three years, it then results in a revenue loss for the commonwealth each year thereafter. In the long term, this proposal cuts business taxes overall.

The estimates provided by the Department of Revenue and the Independent Fiscal Office in prior years differ significantly as they utilize different methodology. The Department of Revenue argues that it is the only entity able to base estimates on actual taxpayer information. Also, the department won an award from the Federation of Tax Administrators in 2005 for outstanding research and analysis for the methodology they used for this specific estimate.

It is difficult to estimate the possible revenue that could result from combined reporting as we don’t know how much we don’t know. The goal of combined reporting is tax fairness by requiring corporations to report all income from affiliated businesses throughout the country. Since that information is currently not reported to Pennsylvania, the scope of possible revenue is unknown. Analyzing the experience of other states is helpful; however, other elements of the corporate net income tax law - such as net operating loss caps – differ significantly in other states.

The estimates provided by the Department of Revenue are based upon rate reductions to 8.99 percent in tax year 2021; 8.29 percent in 2022; 7.49 percent in 2023; 6.99 percent in 2024 and 5.99 percent in 2025 and thereafter.

Talking Points

- Combined reporting increases tax fairness and levels the playing field among corporations.

- Under current law, smaller corporations that only operate in Pennsylvania shoulder a larger share of the corporate tax burden, whereas larger, multi-state corporations have the flexibility to create the most advantageous tax-avoidance structure.

- Instead of a narrow tax base with a high rate, Pennsylvania could have a broader tax base with a lower rate through combined reporting.

- Combined reporting helps stop corporate tax avoidance.

- The primary way corporations avoid taxes is by using intercompany transactions between affiliated companies. They shift profits out of state or shift deductible expenses into Pennsylvania to eliminate tax liability. Combined reporting negates those transactions to shed full light on true taxable income.

- Combined reporting modernizes the tax system.

- Most corporations are now structured as part of a group of companies with parent, subsidiaries and affiliated companies. The tax code has not been updated in decades to reflect current realities of corporate structure.

- A majority of states already require combined reporting.

- Under current law, businesses must take extra steps to modify their federal return by creating a pro-forma return specific to Pennsylvania constraints. Combined reporting would eliminate the extra steps for businesses, and taxable income would be based directly on the federal return.

- Administering combined reporting would require additional staffing at the Department of Revenue, however the benefits outweigh the costs. The Department and Administration are aware of the additional work and are prepared to handle it efficiently.

- Critics might claim that combined reporting is not business friendly, but it is only unfriendly for tax avoiders.

- Cutting the rate by 40 percent, in conjunction with combined reporting, is certainly business friendly. If corporations are opposed to this plan, it probably means they have been paying little or no corporate net income taxes in Pennsylvania.

There is no evidence of job losses in the 28 states that have already implemented combined reporting, and the lower tax rate should attract new business to the state.

Click here to download PDF.