General Fund Revenue Report - June 2024

By Gueorgui Tochev , Senior Budget Analyst | one year ago

Monthly Revenue Analyst: Adrian Buckner, Budget Analyst

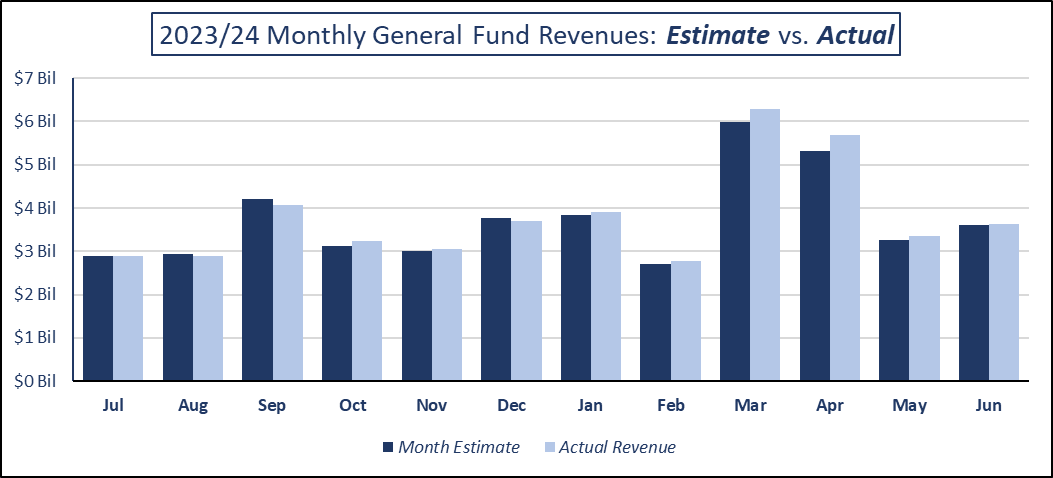

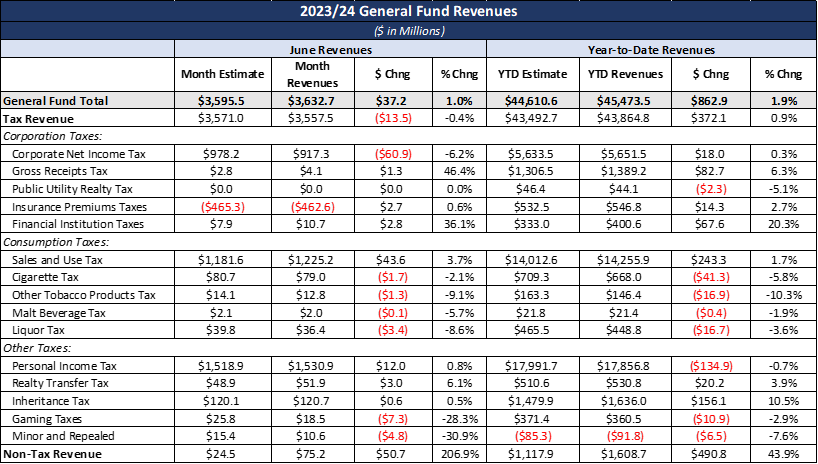

General Fund revenues in June were $37.2 million or 1.0% higher than expected in June.

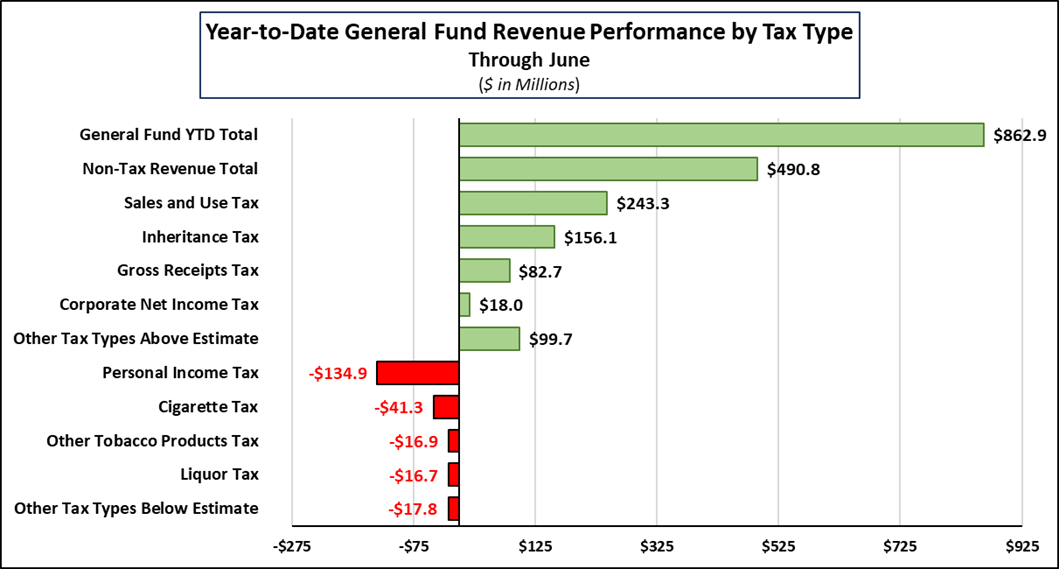

For the 2023/24 fiscal year, total General Fund revenues finished at 45.5 billion, which is $862.9 million or 1.9% above estimate.

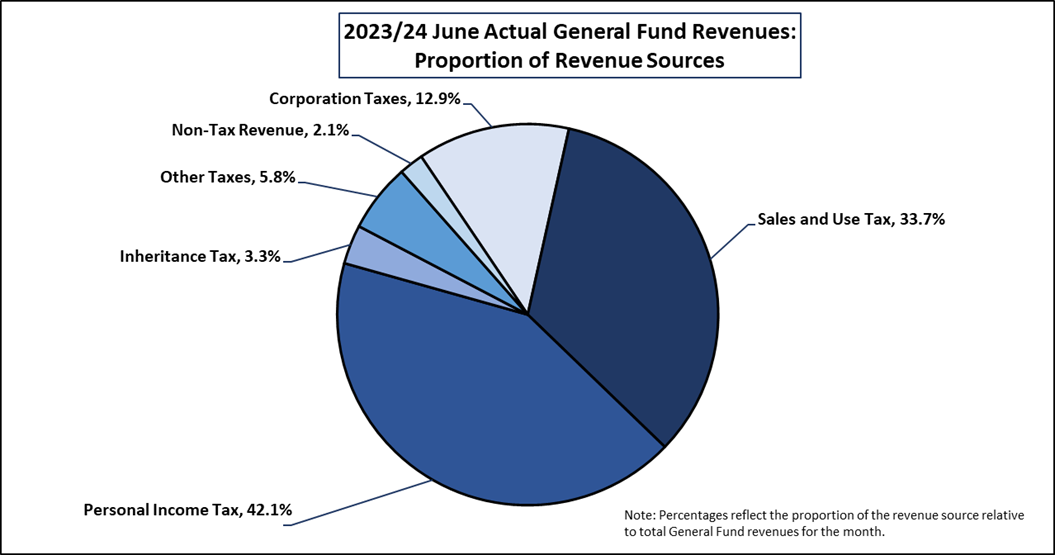

Overall Personal Income Tax (PIT) collections outperformed for the month by $12 million or 0.8%. As a component of PIT, withholding payments finished the month $4.3 million (0.4%) less than estimate, and non-withholding payments were $16.3 million or 3.3% higher than expected. For the year-to-date, PIT collections are $146.8 million or 0.9% below expectations.

Sales and Use Tax (SUT) collections were $43.6 million over estimate, or 3.7% for the month. In turn, year-to-date SUT collections are still above estimate by $243.3 million or 1.7%.

Corporate Net Income Tax (CNIT) collections were $60.9 million or 6.2% lower than projected in June. For the year-to-date, CNIT revenue exceeds projections by $17.9 million or 0.3%. Similarly, Inheritance Tax revenue was $0.6 million or 0.5% higher than expected for the month, putting year-to-date collections $156.1 million or 10.5% ahead of estimate.

Non-tax revenue was also $50.7 million or 206.9% above estimate. For the year-to-date, non-tax revenue is $490.8 million or 43.9% higher than expected, making it the highest outperforming General Fund revenue source through the end of June.