General Fund Revenue Report - January 2024

By Brittany Van Strien , Budget Analyst | 10 months ago

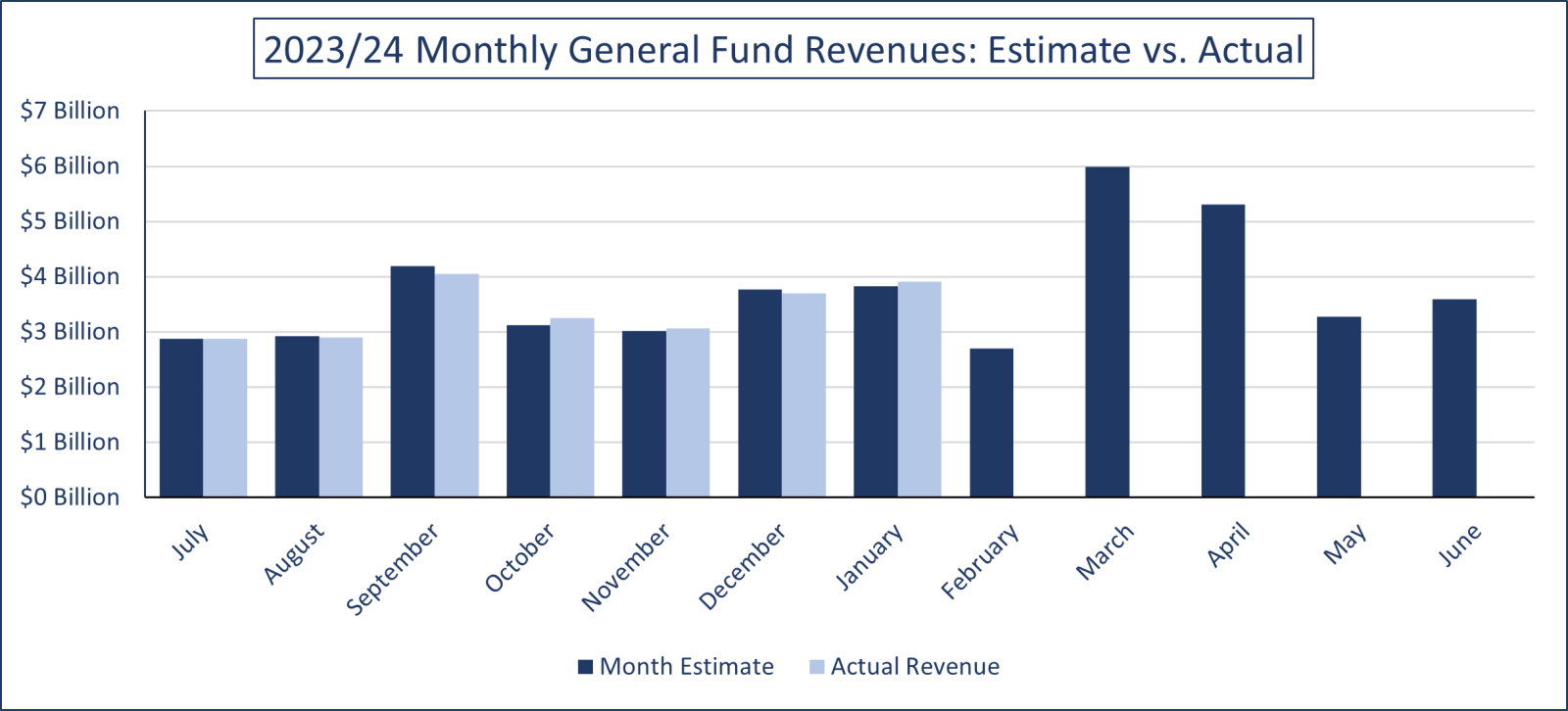

General Fund revenues in January were $74.6 million or 1.9% higher than expected.

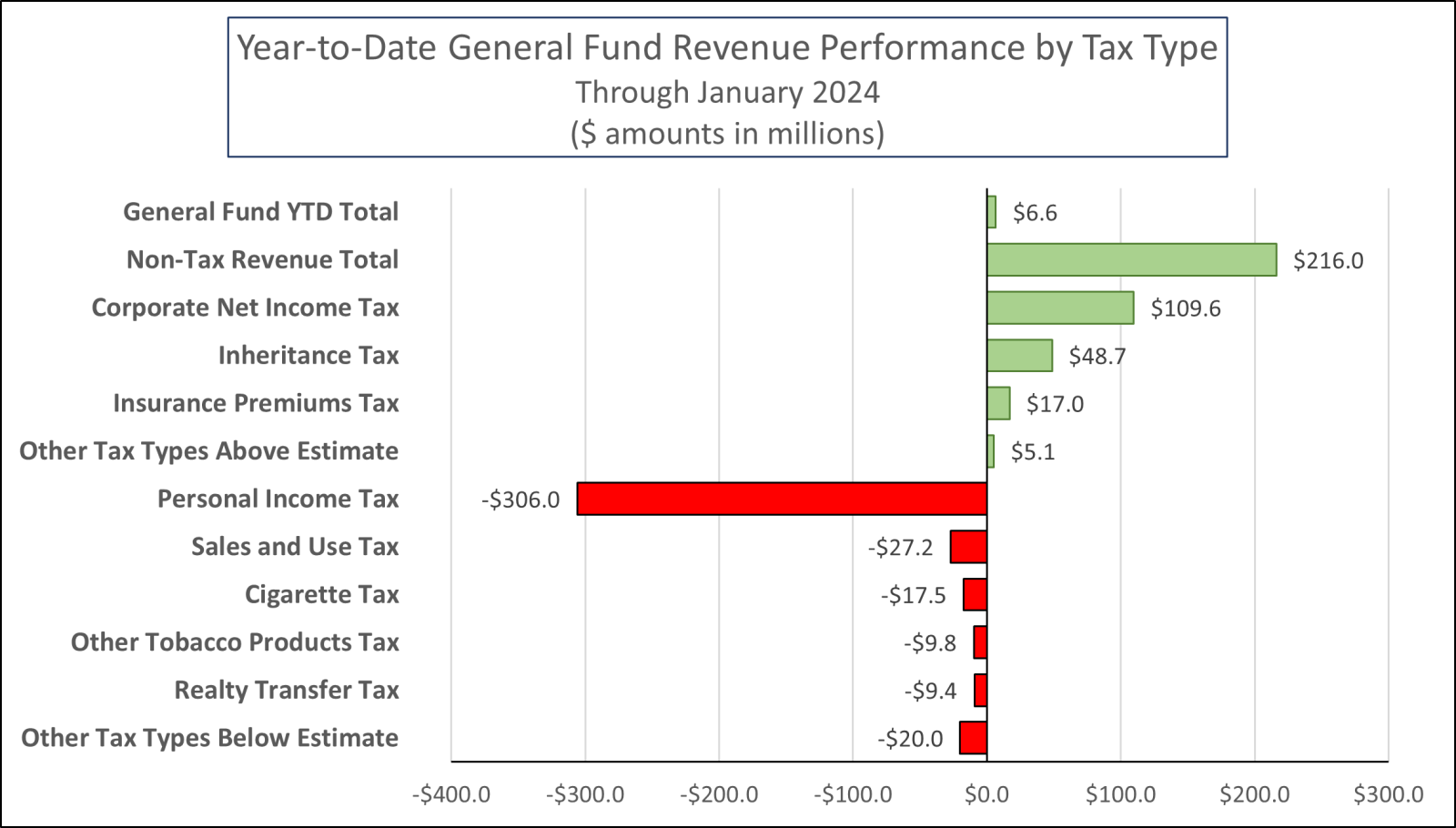

For the Year-to-date, General Fund revenues are $6.6 million or 0.03% above estimate.

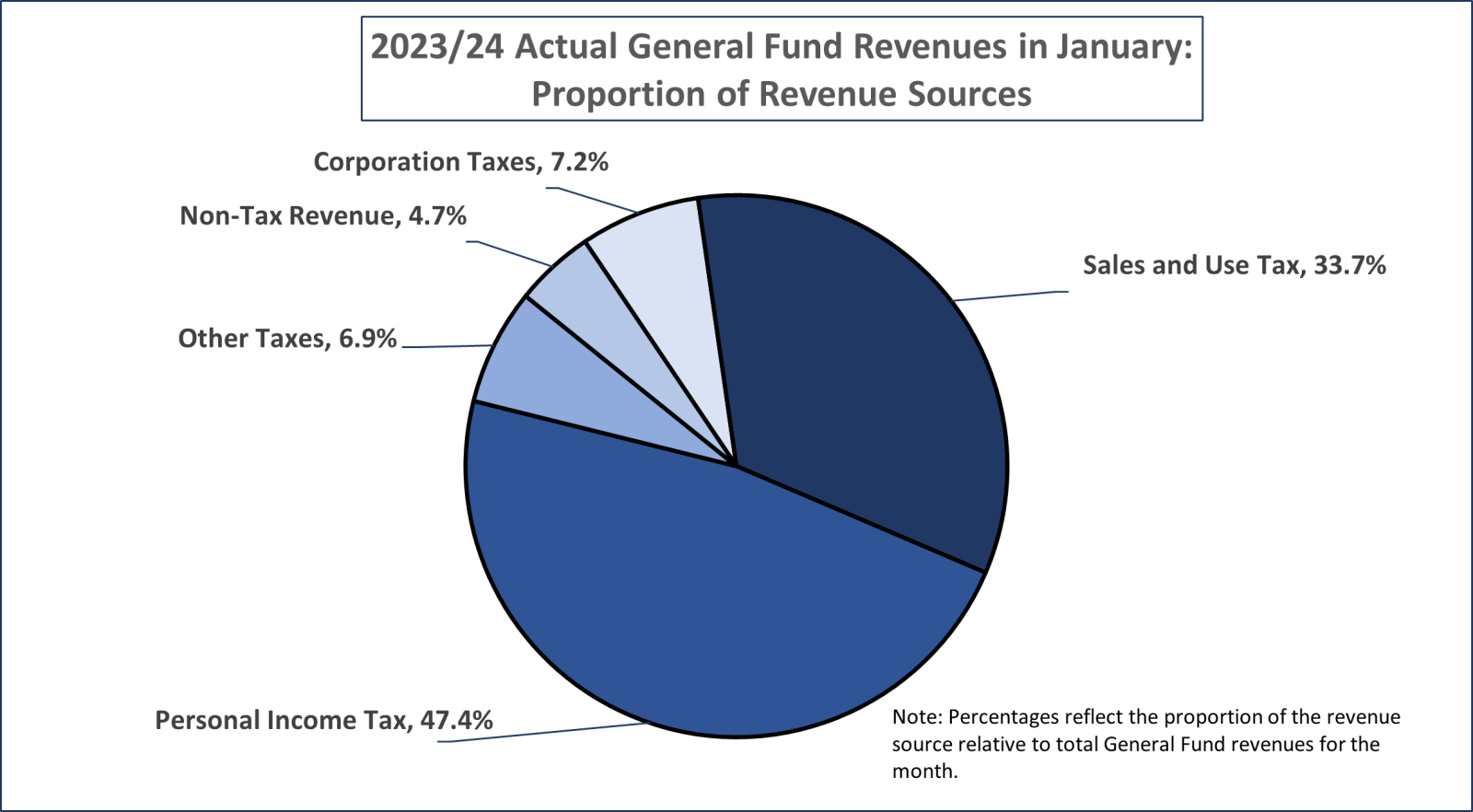

Sales and Use Tax (SUT) revenue outperformed projections for the month by $89.0 million or 7.2%. Collections from nonmotor vehicle sales were the main contributor to this higher-than-expected revenue in January, finishing the month $88.0 million or 7.8% over estimate. Collections from motor vehicle sales were $1.0 million or 1.0% more than estimated. These collections in January bring the year-to-date SUT revenue performance to $27.2 million or 0.3% under estimate.

Corporate Net Income Tax (CNIT) revenue also finished the month $35.2 million or 20.1% above projections. For the year-to-date, CNIT collections are $109.6 million or 4.0% more than estimated. Similarly, non-tax revenue finished $136.2 million or 275.8% more than expected in January, largely due to more interest income than projected for the month and fiscal year.

Personal Income Tax revenue in January was $183.3 million or 9.0% under estimate. For the year-to-date. PIT collections are underperforming by $306.0 million or 3.2%.

Looking ahead, Governor Shapiro will present his 2024/25 Executive Budget proposal on Tuesday, February 6. The House Appropriations Committee will begin budget hearings with agencies on Tuesday, February 20.

|

2023/24 General Fund Revenues ($ amounts in millions)

|

|

|

January 2024 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$3,833.5

|

$3,908.1

|

$74.6

|

1.9%

|

$23,746.3

|

$23,752.9

|

$6.6

|

0.03%

|

|

Tax Revenue

|

$3,784.1

|

$3,722.5

|

($61.6)

|

-1.6%

|

$23,223.0

|

$23,013.7

|

($209.3)

|

-0.9%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$175.2

|

$210.4

|

$35.2

|

20.1%

|

$2,742.7

|

$2,852.3

|

$109.6

|

4.0%

|

|

Gross Receipts Tax

|

$5.0

|

$5.9

|

$0.9

|

18.8%

|

$26.3

|

$28.3

|

$2.0

|

7.5%

|

|

Public Utility Realty Tax*

|

$0.0

|

$0.0

|

$0.0

|

0.0%

|

$1.2

|

$2.3

|

$1.1

|

94.2%

|

|

Insurance Premiums Taxes

|

$51.3

|

$61.9

|

$10.6

|

20.7%

|

$53.5

|

$70.5

|

$17.0

|

31.8%

|

|

Financial Institution Taxes

|

$0.6

|

$2.1

|

$1.5

|

252.9%

|

$27.0

|

$29.0

|

$2.0

|

7.4%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$1,227.9

|

$1,316.9

|

$89.0

|

7.2%

|

$8,521.9

|

$8,494.7

|

($27.2)

|

-0.3%

|

|

Cigarette Tax

|

$41.3

|

$34.6

|

($6.7)

|

-16.2%

|

$456.7

|

$439.2

|

($17.5)

|

-3.8%

|

|

Other Tobacco Products Tax

|

$13.9

|

$12.1

|

($1.8)

|

-13.1%

|

$95.7

|

$85.9

|

($9.8)

|

-10.2%

|

|

Malt Beverage Tax

|

$1.5

|

$1.6

|

$0.1

|

3.8%

|

$13.2

|

$12.5

|

($0.7)

|

-5.4%

|

|

Liquor Tax

|

$33.1

|

$29.8

|

($3.3)

|

-9.9%

|

$277.5

|

$269.6

|

($7.9)

|

-2.8%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$2,037.4

|

$1,854.1

|

($183.3)

|

-9.0%

|

$9,682.5

|

$9,376.5

|

($306.0)

|

-3.2%

|

|

Realty Transfer Tax

|

$42.4

|

$47.4

|

$5.0

|

11.8%

|

$310.3

|

$300.9

|

($9.4)

|

-3.0%

|

|

Inheritance Tax

|

$118.4

|

$105.0

|

($13.4)

|

-11.4%

|

$826.0

|

$874.7

|

$48.7

|

5.9%

|

|

Gaming Taxes

|

$33.8

|

$36.4

|

$2.6

|

7.6%

|

$214.2

|

$210.4

|

($3.8)

|

-1.8%

|

|

Minor and Repealed

|

$2.3

|

$4.3

|

$2.0

|

87.9%

|

($25.7)

|

($33.3)

|

($7.6)

|

-29.5%

|

|

Non-Tax Revenue

|

$49.4

|

$185.6

|

$136.2

|

275.8%

|

$523.3

|

$739.3

|

$216.0

|

41.3%

|

|

*Note: Actual Public Utility Realty Tax collections in January were $23,518.

|