General Fund Revenue Report - June 2023

By Brittany Van Strien , Budget Analyst | one year ago

Monthly Revenue Analyst: Adrian Buckner, Budget Analyst

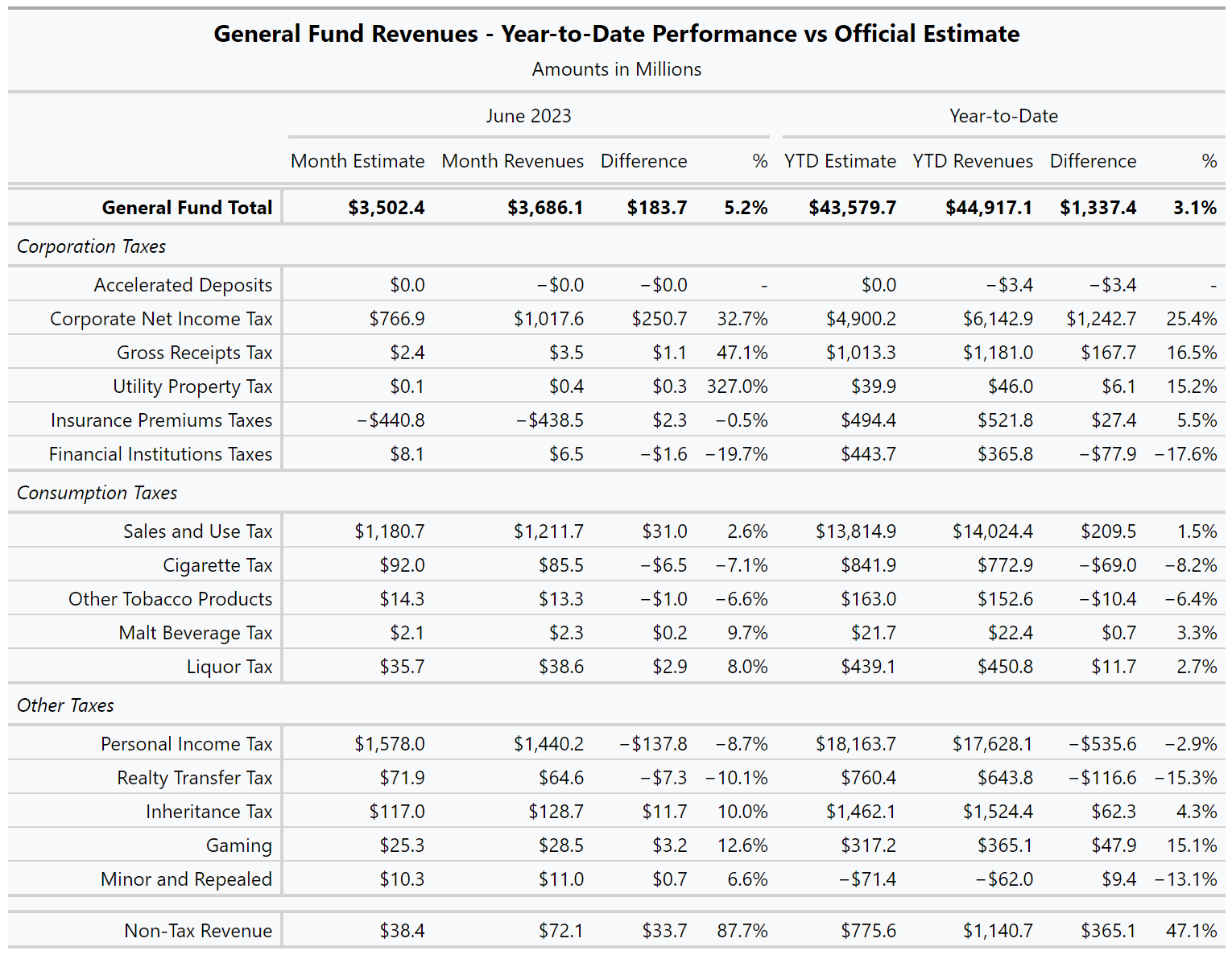

General Fund revenues were $183.7 million or 5.2% higher than expected in June.

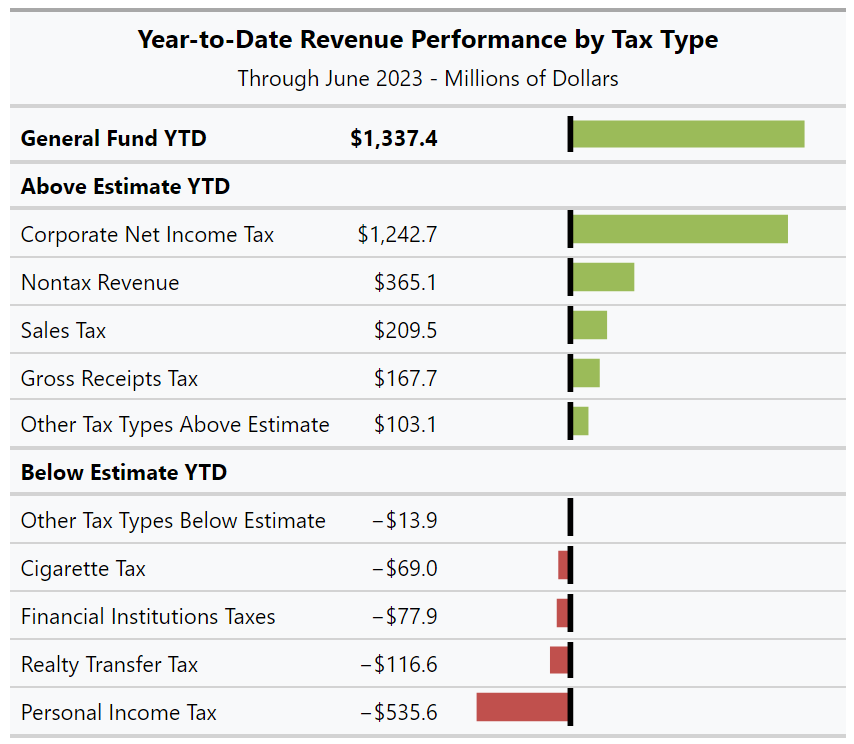

For the 2022/23 fiscal year, total General Fund revenues finished at $44.9 billion, which is $1.3 billion or 3.1% above estimate.

Corporate net income tax revenue significantly outperformed estimates both for the month and for the fiscal year. For June, CNIT revenues were $250.7 million (32.7%) higher than the monthly projection. For the fiscal year, revenues were $1.2 billion (25.4%) higher than estimated.

Sales and use tax revenue also ended the month $31.0 million (2.6%) higher than expectations. For the fiscal year, sales and use tax revenue was $209.5 million (1.5%) above estimate.

Conversely, personal income tax revenue was $137.8 million (8.7%) below estimate in June. Although PIT withholding payments were $10.8 million (1.1%) higher than projections, PIT non-withholding revenue, which is comprised of quarterly individual estimated and annual payments, was $148.6 million (24.6%) lower than expected. For the fiscal year, PIT withholding collections were $48.0 million (0.4%) over estimate, and PIT non-withholding collections were $583.6 million (10.5%) below estimate. As a result, total personal income tax revenue for 2022/23 is $535.6 million (2.9%) under estimate.

Realty transfer tax revenue continued to underperform estimates, which has been consistent since the start of 2023 – revenues were $7.3 million (10.1%) below estimate for the month and $116.6 million (15.3%) below estimate for the fiscal year.