General Fund Revenue Update - December 2020

By Eric Dice , Assistant Executive Director | 5 years ago

Monthly Revenue Analyst: Adrian Buckner, Budget Analyst

A new revenue baseline after the November budget

As part of the supplemental budget package enacted in November, Act 114 of 2020 (Fiscal Code) required the Secretary of Revenue and the Secretary of the Budget to reopen the official revenue estimate set in May 2020 and recertify a new total, which became the new basis for the fully enacted budget. This revised estimate incorporates the following:

- updated revenue estimates based upon collections received during the fall;

- transfers from the Rainy Day Fund and other special funds to bolster the General Fund; and

- transfers from General Fund revenues to address shortfalls in the Property Tax Relief Fund.

The new General Fund revenue estimate is $36.95 billion – an increase of $2.3 billion over the May 2020 estimate. The Department of Revenue’s monthly distribution of this total will provide the basis for monthly comparisons going forward through the end of the 2020/21 fiscal year.

December revenues

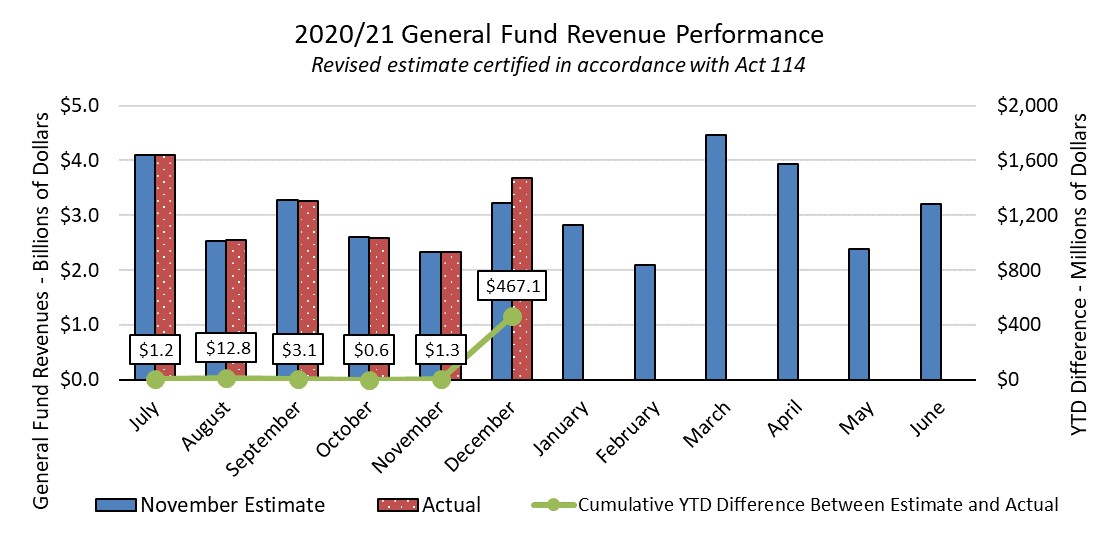

December’s revenues moved considerably past the newly-revised estimate. Total collections last month were $465.8 million, or 14.5 percent, above the revised monthly estimate, bringing the year-to-date total to $467.1 million, or 2.1 percent, more than expected.

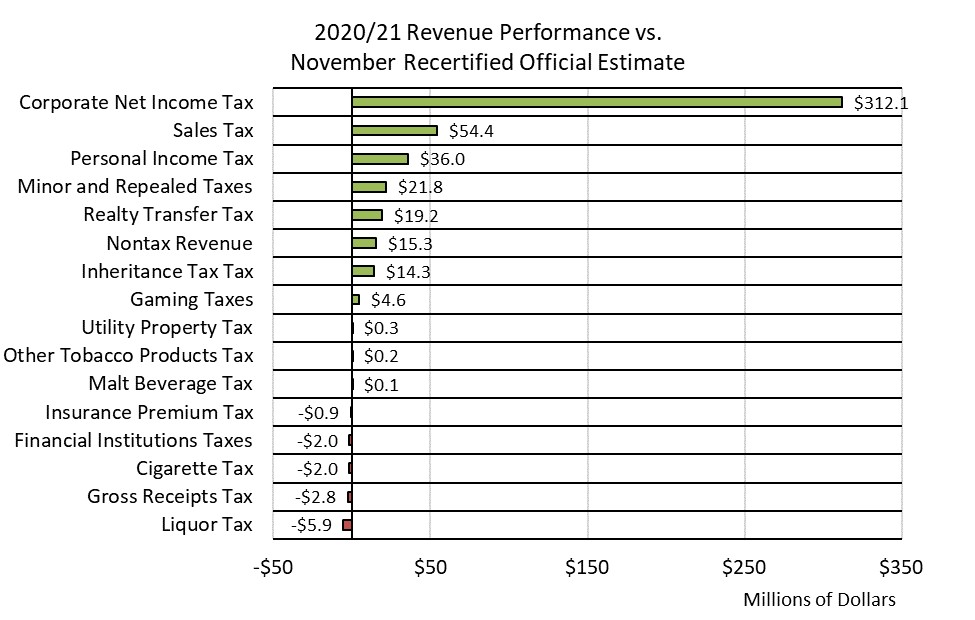

The main driver for December’s performance was the corporate net income tax. Quarterly estimated payments due in December were $248.2 million higher than expected, and CNIT final payments were $64.0 million higher than expected for a total of $312.1 million above estimate.

The total dollar amount collected for the December 2020 CNIT quarterly estimated payments were very abnormal - almost 30 percent higher than the previous highest month of quarterly estimated payments ever collected for this tax type, and 37 percent higher than the estimated payments collected for the last major due date in September 2020. For comparison, the June quarterly payments were 31 percent lower than the prior year, and September’s payments were 5 percent lower.

Sales tax collections finished the month $54.4 million ahead of estimate, or 5.6 percent. Non-motor collections were $57.7 million above estimate, and motor vehicle sales tax collections were $3.4 million lower than expected.

Personal income tax collections were $36.0 million above the estimate, or 3.2 percent. Employer withholdings on wages and salaries were $41.8 million higher than expected, or 4.2 percent, while non-withheld PIT collections were $5.7 million below estimate, or 4.8 percent.

Non-tax revenues were $15.4 million higher than expected, or 4.3 percent. Total non-tax revenues were higher than a typical December, as the administration continued to execute the special fund transfers to the General Fund required under Act 114.

Looking ahead

Like December, January brings an estimated payment cycle and elevated sales tax collections due to the holiday shopping season. PIT estimated payments will be worth monitoring to see if they exhibit patterns similar to the CNIT. In early February, the governor will present his 2021/22 executive budget to the General Assembly.

For the month of December, total General Fund revenues were $465.8 million higher than expected, or 14.5 percent.

- Corporate net income tax collections were $312.1 million higher than expected (69.5 percent)

- Sales and use tax collections were $54.4 million higher than expected (5.6 percent)

- Non-motor sales tax collections were $57.7 million more than estimate (6.9 percent)

- Motor vehicle sales tax collections were $3.4 million below projections (2.6 percent)

- Personal income tax revenues were $36.0 million more than the official estimate (3.2 percent)

- Employer withholdings on wages and salaries were $41.8 million more than anticipated (4.2 percent)

- Non-withheld payments were $5.7 million below estimate (4.8 percent)

- Cigarette tax collections were $3.2 million less than projected (3.3 percent)

- Realty transfer tax collections were $19.2 million more than expected (38.9 percent)

- Inheritance tax collections were $14.4 million higher than anticipated (16.0 percent)

- Non-tax revenues were $15.4 million more than expected (4.3 percent)

Halfway through the fiscal year, and compared to the new baseline:

- Cumulative General Fund revenues are $467.1 million higher than expected (2.6 percent)

- General Fund tax revenues are $451.8 million higher than projected (2.6 percent)

- Corporate net income tax revenues are $312.1 million more than expected (17.1 percent)

- Sales and use taxes are $54.4 million more than expected (0.9 percent)

- Personal income tax collections are $36.0 million higher than anticipated (0.5 percent)

- Cigarette tax collections are $3.3 million lower than expected (0.6 percent)

- Realty transfer tax revenues are $19.2 million above projections (6.5 percent)

- Inheritance tax collections are $14.3 million higher than anticipated (2.4 percent)

- Non-tax revenues are $15.3 million above the estimate (26.4 percent)

|

General Fund Revenues - Year-to-Date Performance vs Revised Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

18,059.4

|

18,526.5

|

467.1

|

|

Tax Revenue Total

|

17,409.4

|

17,861.2

|

451.8

|

|

Corporation Taxes

|

1,865.5

|

2,175.9

|

310.4

|

|

Corporate Net Income Tax

|

1,826.2

|

2,138.3

|

312.1

|

|

Gross Receipts Tax

|

18.2

|

15.4

|

(2.8)

|

|

Utility Property Tax

|

2.2

|

2.5

|

0.3

|

|

Insurance Premiums Taxes

|

2.5

|

1.6

|

(0.9)

|

|

Financial Institutions Taxes

|

16.4

|

14.4

|

(2.0)

|

|

Consumption Taxes

|

7,199.9

|

7,245.4

|

45.5

|

|

Sales and Use Tax

|

6,324.9

|

6,379.3

|

54.4

|

|

Cigarette Tax

|

575.4

|

572.1

|

(3.3)

|

|

Other Tobacco Products

|

66.7

|

66.9

|

0.2

|

|

Malt Beverage Tax

|

12.2

|

12.3

|

0.1

|

|

Liquor Tax

|

220.7

|

214.8

|

(5.9)

|

|

Other Taxes

|

8,344.0

|

8,439.9

|

95.9

|

|

Personal Income Tax

|

7,353.7

|

7,389.7

|

36.0

|

|

Realty Transfer Tax

|

297.7

|

316.9

|

19.2

|

|

Inheritance Tax

|

590.7

|

605.0

|

14.3

|

|

Gaming

|

102.7

|

107.3

|

4.6

|

|

Minor and Repealed

|

(0.8)

|

21.0

|

21.8

|

|

Non-Tax Revenue

|

650.0

|

665.3

|

15.3

|