Senior's Pharmaceutical Assistance Programs

By Ronni Burkhart , Assistant Executive Director | 3 years ago

Health & Human Services Analysts: Aniam Iqbal - Budget Analyst , Mara Perez - Senior Budget Analyst

The Department of Aging administers three low-cost prescription drug programs for Pennsylvania seniors:

- The Pharmaceutical Assistance Contract for the Elderly (PACE), enacted in November 1983 and implemented July 1, 1984, helps low-income seniors pay for their prescription medications.

- Act 134 of 1996 established the PACE Needs Enhancement Tier (PACENET) program to create a new tier of pharmacy benefits for qualified seniors who have incomes exceeding PACE’s eligibility limits.

- Act 111 of 2006 established PACE Plus Medicare, a voluntary program for PACE and PACENET cardholders that coordinates PACE/PACENET pharmacy benefits with the federal Medicare Part D drug benefit.

This primer is an overview of Aging’s pharmaceutical assistance programs, including descriptions of the eligibility criteria, benefits, program funding, enrollment history and expenditure trends. Detailed information on the Medicare Part D drug benefit can be found in the included appendix.

Pharmaceutical assistance is available to seniors who are 65 years of age or older and do not receive prescription drug benefits through Medical Assistance (the name of Pennsylvania’s Medicaid program). Seniors must be Pennsylvania residents at least 90 days prior to applying for assistance and must meet income eligibility requirements.

PACE is the traditional program for seniors whose annual income is $14,500 or less for a single person and $17,700 or less for a married couple. PACE cardholders pay no monthly PACE fees or premiums, but must cover co-payments, which are $6 for generic prescription drugs and $9 for brand-name prescription drugs.

Effective February 20, 2022, PACENET assists single seniors whose annual income is between $14,500 and $33,500 and married couples with incomes between $17,700 and $41,500. Seniors in PACENET pay a monthly premium equal to the Medicare Part D benchmark premium ($37.45 for 2021). In addition, PACENET cardholders pay higher co-payments for prescriptions: $8 for generic prescription drugs and $15 for brand-name prescription drugs.

| Income Eligibility and Enrollee Costs (effective 2/20/2022) |

|

|

| |

PACE |

PACENET |

| Income Eligibility: |

|

|

| Single Individual |

$14,500 or less |

$14,500 to $33,500 |

| Married Couple |

$17,700 or less |

$17,700 to $41,500 |

| Monthly Premium (2021) |

$0 |

$37.45 |

| Co-Payments: |

|

|

| Generic Drugs |

$6 per Rx |

$8 per Rx |

| Brand-Name Drugs |

$9 per Rx |

$15 per Rx |

Both programs cover most medications requiring prescriptions, as well as insulin, insulin syringes and insulin needles. Experimental and over-the-counter medications are not covered by either program.

Eligibility for PACE and PACENET is determined by the applicant’s previous calendar year income. The income eligibility limits for each program are specified in the State Lottery Law. There is no automatic inflator or annual adjustment. The General Assembly has increased PACE eligibility four times since its inception and has increased PACENET eligibility four times. The current limits for PACE are in Act 37 of 2003, while the PACENET limits effective February 20, 2022, are in Act 94 of 2021.

In 2014, the General Assembly passed legislation (Act 12) to exclude annual Medicare Part B premiums from income when determining eligibility for PACE and PACENET. This change had the same effect as raising the income limits by that premium amount. For 2021, the excluded amount for most Medicare beneficiaries is $1,735.20 per individual and $3,470.40 for married couples. This is based on the 2020 monthly Medicare Part B premium of $144.60.

For the past several years, the General Assembly has enacted temporary moratoriums so seniors could maintain PACE and PACENET eligibility when their income exceeded the statutory limit solely due to a Social Security cost-of-living increase. These moratoriums have allowed tens of thousands of seniors to retain pharmaceutical assistance when annual Social Security cost-of-living increases would have otherwise disqualified them. The moratorium was again extended most recently in Act 92 of 2021 through December 21, 2023.

PACE Plus Medicare

The PACE Plus Medicare program supplements PACE/PACENET coverage with the Medicare Part D prescription drug benefit. Each year, the department partners with select Medicare Part D plans authorized to provide Medicare prescription drug coverage in Pennsylvania. PACE and PACENET cardholders are encouraged to enroll in the Medicare Part D plans the department has recommended for them, based on their prescription medications and pharmacy preferences. However, enrollment in PACE Plus Medicare is voluntary. Cardholders who do not enroll in partner Medicare Part D plans continue to receive prescription benefits through the PACE and PACENET programs.

PACE Plus is designed to allow PACE and PACENET cardholders to keep their same prescription benefits (often at a lower cost) even though they are enrolled in Medicare Part D prescription drug plans. When Medicare Part D does not cover a PACE/PACENET covered benefit, PACE Plus supplements the Medicare Part D plan’s coverage and fills the gap. Key elements of PACE Plus are summarized below.

Drugs. If a Medicare Part D plan’s formulary (or covered pharmaceuticals list) does not include a PACE/PACNET covered medication, the PACE Plus program will either pay for that prescription or work directly with the plan to process a prior authorization so that the pharmaceutical is covered by the Medicare Part D plan. Also, PACE Plus pays for pharmaceuticals that cardholders purchase during the Medicare Part D deductible phase and coverage gap phase.

Co-Payments. PACE and PACENET cardholders enrolled in PACE Plus pay the lower of the PACE/PACENET co-payments and the Medicare Part D plan co-payments. If the Medicare Part D plan charges higher co-payments, the program pays the difference between the Medicare Part D co-payments and the PACE/PACENET co-payments.

Premiums. Medicare Part D monthly premiums depend upon whether the enrollee is a PACE cardholder or a PACENET cardholder.

PACE Plus pays the monthly Medicare Part D premium if a PACE cardholder enrolls in a partner plan (the maximum amount paid by the PACE program is the Medicare Part D regional benchmark premium: $37.45 for 2021). PACE cardholders who enroll in a non-partner Medicare Part D plan must pay the plan’s full monthly premium.

PACENET cardholders enrolled in a Medicare Part D partner plan pay the plan’s premium at the pharmacy when they have a prescription filled. If the cost of the medication is less than the premium, the cardholder only pays the medication cost and the remaining amount of the premium owed is carried over until the next time another medication is filled. PACENET cardholders who do not enroll in a Medicare Part D partner plan must pay the full premium directly to the plan each month, regardless of whether they had any prescriptions filled.

Low-Income Subsidy. The Department of Aging helps qualified seniors sign up for the federal Medicare Part D Low-Income Subsidy, allowing them to take advantage of prescription drug co-payments that are significantly lower than those required by PACE and PACENET. Seniors must have annual income less than 150 percent of the federal poverty level and must meet an asset test to qualify for the subsidy. For 2022, the co-payments for PACE Plus cardholders qualifying for the Medicare Part D Low-Income Subsidy are no more than $3.95 for generic drugs and $9.85 for brand-name drugs.

Enrollment Trends

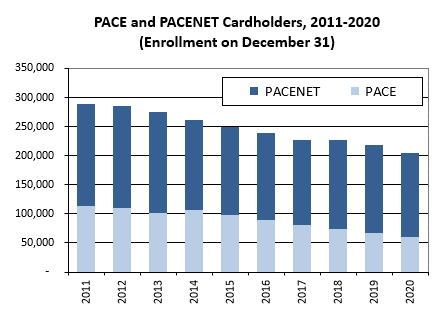

Nearly 240,000 seniors benefited from the department’s pharmaceutical assistance programs during 2020. This total included 73,274 PACE cardholders and 166,241 PACENET cardholders.

- 90.4 percent of all cardholders were enrolled in a Medicare Part D plan under PACE Plus Medicare.

- More than 65,000 PACE Plus enrollees qualified for the federal low-income subsidy.

The number of PACE and PACENET cardholders depends upon several factors, including: statutory changes that expand income eligibility requirements, changes in household income that push seniors above the income limits, and the other prescription drug coverage choices available to seniors (such as retirement benefits or Medical Assistance).

The bar graph below shows PACE and PACENET enrollment, as of Dec. 31, for the past ten calendar years.

SOURCE: PA Department of Aging, PACE Annual Reports, Table 4.1 (PACE and PACENET Cardholder Enrollments by Quarter)

Program Funding

The Pharmaceutical Assistance Fund is the state revenue source for the three prescription drug programs. It is comprised primarily of revenue annually transferred from the Lottery Fund.

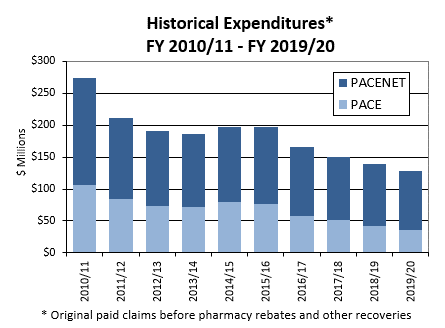

The amount of the annual Lottery Fund transfer to the Pharmaceutical Assistance Fund is based on estimated state expenditures for the three programs. PACE and PACENET are paid entirely with state revenue, whereas federal Medicare funds are the predominant funding source for PACE Plus.

Because the federal government subsidizes most of the Medicare Part D pharmacy drug benefit, enrolling seniors in PACE Plus substantially reduces state pharmaceutical assistance expenditures and frees Lottery Funds for other senior programs. This is especially so for each PACE Plus enrollee who qualifies for the federal low-income subsidy that helps pay premiums, deductibles, and other “wrap around” costs that PACE Plus would otherwise have to cover.

To incentivize more cardholders to enroll in PACE Plus, Act 87 of 2018 allows the department to pay the Medicare late enrollment penalty for seniors who missed the federal deadline to sign up for Medicare Part D. For any senior who signs up late for Medicare Part D and qualifies for the federal low-income subsidy, Medicare will pay the penalty rather than PACE Plus.

The bar graph below shows historical state spending for pharmaceutical assistance provided to PACE and PACENET cardholders for the last ten state fiscal years for which data is available.

Source: PA Department of Aging, PACE Annual Report, Tables 2.1A and 2.1B (PACE and PACENET Claims and Expenditures by Semi-Annual Period Based on Date of Service)

The decrease in state expenditures beginning in 2011/12 reflects savings from Medicare provisions in the Affordable Care Act (ACA) that closed the Medicare Part D doughnut hole, reducing the “wrap around” cost that PACE Plus must pay for drugs purchased by enrollees in the doughnut hole.

APPENDIX A. The Medicare Part D Drug Benefit

Medicare Part D is a voluntary prescription drug benefit for people with Medicare, the federal health insurance program for seniors aged 65 or older and non-elderly people with a permanent disability. It was created by the Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) and began operating January 1, 2006.

The Medicare Part D prescription drug benefit is offered through private plans approved by the Centers for Medicare & Medicaid Services (CMS). These include stand-alone prescription drug plans (PDPs), which only offer prescription drug coverage, and Medicare Advantage prescription drug plans (such as health maintenance organizations) that cover prescription drugs and all other Medicare benefits.

Medicare Part D Benefit

All Medicare Part D plans must offer a “standard” drug benefit or an alternative of equivalent actuarial value (the average cost sharing under the alternative plan is comparable to the standard benefit).

The standard Medicare Part D benefit, as described in the MMA, consists of four payment phases.

- Deductible. At the beginning of the calendar year, enrollees pay the full cost of prescription drugs until they reach the annual deductible amount, $480 for 2022.

- Initial coverage. After meeting the annual deductible, enrollees pay 25 percent of total drug costs (or actuarially equivalent co-payments) and Medicare pays the remaining 75 percent until total spending for covered drugs reaches the initial coverage limit, $4430 for 2022. Total spending includes the amount paid by the enrollee and the plan.

- Coverage gap. Once the initial coverage limit is reached, enrollees enter the coverage gap (formerly known as the “doughnut hole”) where they remain until they qualify for catastrophic coverage. This occurs when the enrollee reaches the out-of-pocket maximum, $7,050 for 2022. Prior to 2011, Medicare provided no coverage during this phase and enrollees paid the full cost of their drugs. The ACA began closing the “doughnut hole” in 2011, gradually reducing enrollee coinsurance to 25 percent (the same as the initial coverage phase) by 2020.

- Catastrophic coverage. After enrollee drug spending reaches the out-of-pocket threshold, the enrollee qualifies for catastrophic coverage and pays significantly lower costs for their drugs. The enrollee pays the greater of 5 percent of the drug cost or the following copayments: $3.95 per generic prescription and $9.85 per brand-name prescription.

The following drug expenses count toward the amount Medicare Part D enrollees need to spend to reach the out-of-pocket threshold: the annual deductible, co-insurance/co-payments during the initial coverage phase, and amounts paid for prescriptions while in the coverage gap phase (this includes manufacturer discounts enrollees receive at the pharmacy for brand-name drugs). Monthly Medicare Part D premiums and payments for medications not covered by the Medicare Part D plan are not countable expenses.

The deductible, initial coverage limit, and out-of-pocket threshold are indexed to change each calendar year. The following table shows the standard benefit parameters for 2019 through 2022.

| Medicare Part D Standard Benefit Parameters |

| |

2019 |

2020 |

2021 |

2022 |

| Deductible |

$415 |

$435 |

$445 |

$480 |

| Initial Coverage Limit |

$3,820 |

$4,020 |

$4,130 |

$4,430 |

| Out-of-Pocket Threshold * |

$5,100 |

$6,350 |

$6,550 |

$7,050 |

| Catastrophic Coverage Cost-Sharing |

|

|

|

|

| Enrollees pay the greater of 5 percent of |

|

|

|

|

| drug costs or the following co-payments: |

|

|

|

|

| Generic Drugs |

$3.40 per Rx |

$3.60 per Rx |

$3.70 per Rx |

$3.95 per Rx |

| Brand-name Drugs |

$8.50 per Rx |

$8.95 per Rx |

$9.20 per Rx |

$9.85 per Rx |

* The 2020 increase of $1,250 is due to expiration of a provision in the ACA that temporarily slowed the growth in the out-of-pocket threshold between 2014 and 2019.

Closing the Doughnut Hole

The ACA, as modified by the Balanced Budget Act of 2018, closed the doughnut hole for generic and brand-name prescription drugs through a phased-in combination of discounts and subsidies. In the following table, the green column shows the enrollee’s share of costs for prescription drugs purchased in the doughnut hole. (Medicare Part D plan share reflects Medicare coverage funded with the subsidies provided by the federal government.)

| Cost Sharing in the Doughnut Hole |

|

|

|

|

|

| |

Generic Drug Purchases |

Brand-Name Drug Purchases |

| |

Enrollee |

Part D Plan |

Enrollee |

Manufacturer |

Part D Plan |

| Year |

Share |

Share |

Share |

Discount |

Share |

| 2006-2010 |

100% |

|

100% |

|

|

| 2011 |

93% |

7% |

50% |

50% |

|

| 2012 |

86% |

14% |

50% |

50% |

|

| 2013 |

79% |

21% |

47.5% |

50% |

2.5% |

| 2014 |

72% |

28% |

47.5% |

50% |

2.5% |

| 2015 |

65% |

35% |

45% |

50% |

5% |

| 2016 |

58% |

42% |

45% |

50% |

5% |

| 2017 |

51% |

49% |

40% |

50% |

10% |

| 2018 |

44% |

56% |

35% |

50% |

15% |

| 2019 |

37% |

63% |

25% |

70% |

5% |

| 2020 and |

25% |

75% |

25% |

70% |

5% |

| thereafter |

The Balanced Budget Act of 2018 included modifications to the ACA, reducing enrollee coinsurance for brand-name drugs to 25 percent beginning in 2019 and thereby closing the brand-name doughnut hole one year sooner than the ACA. Congress shifted additional brand-name drug costs to pharmaceutical manufacturers, increasing the discount to 70 percent (up from the 50 percent required in the ACA), and decreased Medicare Part D’s coverage for brand-name drugs to 5 percent (down from the ACA’s stipulated coverage of 20 percent in 2019 and 25 percent in 2020 and thereafter).