Medical Assistance

By Ronni Burkhart , Assistant Executive Director | 3 years ago

Health & Human Services Analysts: Aniam Iqbal - Budget Analyst , Mara Perez - Senior Budget Analyst

Medicaid is a means-tested entitlement program that provides health care, including behavioral health services, to low-income individuals, as well as long-term services and supports to low-income individuals with certain conditions. The program is jointly administered and financed by the federal government and states. Because Medicaid is means-tested, most people must meet financial requirements based on income, and sometimes resources (assets), to qualify for coverage.

Medical Assistance (MA), the name of the Pennsylvania’s Medicaid program, currently serves over 3.3 million Pennsylvanians. The Department of Human Services (DHS) administers the program, subject to federal oversight by the Centers for Medicare & Medicaid Services (CMS). To receive federal Medicaid funds, DHS must adhere to federal requirements and rules. Within these federal guidelines, the department has some flexibility in establishing covered populations, eligibility criteria, benefit packages, provider payment rates, and program administration.

The design of Pennsylvania’s MA program is detailed in the Medicaid State Plan submitted to and approved by CMS. Additionally, Pennsylvania has received various Medicaid waivers that give DHS additional flexibility to operate the program outside specific federal requirements.

This primer provides comprehensive information on the MA program health care services available to MA recipients. Separate forthcoming primers address:

- Children’s Health Insurance Program (CHIP)

- Behavioral health services including those provided under MA

- MA services for seniors and adults with physical disabilities, including long-term services and supports,

- MA long-term service and support programs for individuals with intellectual disabilities and autism.

Medicaid covers a diverse population that includes children, pregnant women, parents, low-income adults, individuals with disabilities, and seniors. People who meet state and federal eligibility criteria are entitled to Medical Assistance (MA) in Pennsylvania. Eligibility is based on a combination of categorical factors (such as age, disability, and family composition) and financial requirements.

To be eligible for Medicaid, a person must be a United States citizen or a qualified immigrant. Federal law identifies certain eligibility groups that states are required to cover and other groups that are optional.

The mandatory Medicaid groups include the following populations:

- Low-income children through age 18,

- Low-income pregnant women,

- Low-income families,

- Aged, blind, or disabled individuals who qualify for federal Supplemental Security Income (SSI) cash benefits,

- Low-income individuals in certain Medicare eligibility categories,

- Children receiving Title IV-E adoption assistance, foster care, or guardianship care,

- Youth (up to age 26) who were formerly in foster care, and

- Qualified non-citizens after any applicable required waiting period or in cases of emergency condition.

The Patient Protection and Affordable Care Act (ACA) extended Medicaid eligibility to most low-income adults under age 65 with incomes up to 133 percent, or 138 percent with statutory income disregard, of the federal poverty level. The law as written required all states to expand Medicaid to this new adult group, beginning January 1, 2014. However, the June 28, 2012 United States Supreme Court decision in National Federation of Independent Business v. Sebelius effectively made Medicaid expansion optional for states when the court limited the U.S. Department of Health and Human Services’ authority to enforce the ACA’s Medicaid expansion requirements.

Other optional groups that states may choose to cover include: low income children through age 21, working people who have disabilities, individuals in need of family planning services, women receiving treatment for breast or cervical cancer, among others. States also have the flexibility to provide Medicaid coverage to permanent residents and other qualified immigrants (who meet other Medicaid eligibility criteria) after the five-year waiting period.

Financial requirements vary by Medicaid group. Federal law establishes minimum and maximum income criteria, often based on the federal poverty level. For some groups, states have the flexibility to expand income beyond the minimum federal standard so that additional people may obtain coverage. Resource or asset tests may apply to certain populations such as the elderly and individuals with disabilities.

States may also extend Medicaid coverage to individuals whose income exceeds the limit for a specific eligibility category by allowing them to “spend down.” Individuals who spend down to qualify for Medicaid are categorized as medically needy; they often incur high expenses (for hospital or long-term care) as the result of an accident, catastrophic illness, or ongoing care. To qualify for coverage, individuals use their medical expenses as a deduction to reduce their income below the medically needy eligibility standards established by the state.

To be eligible for MA in Pennsylvania, an individual must have a Social Security number and be a Pennsylvania resident; there is no requirement regarding the length of time that a person must live in Pennsylvania to receive benefits. Additionally, individuals must meet state and federal requirements regarding citizenship and immigration status. MA is available to United States citizens, refugees and certain lawfully admitted immigrants – individuals must have documentation proving their U.S. citizenship or legal immigration status. Except for emergency treatment, most legal immigrants are not eligible for MA during their first five years in the United States. Undocumented immigrants, regardless of how many years they have been in the country, are never eligible for MA other than for emergency treatment.

Pennsylvania has opted to expand income eligibility above the federal minimum for recipients of SSI benefits, pregnant women and children under age one, and to offer the medically needy option for various groups. (Appendix A provides more information on MA spend-down.) MA also covers several optional groups, including women receiving treatment for breast and cervical cancer, workers with disabilities, residents in long-term care facilities, individuals receiving home and community-based waiver services, and newly eligible adults under the ACA’s Medicaid expansion.

In January 2015, Pennsylvania became the 28th state to expand Medicaid, a year behind many other states. DHS implemented the Corbett Administration’s alternative approach to Medicaid expansion, known as Healthy PA, on January 1. Healthy PA was a federally approved waiver program that enrolled newly eligible adults in private coverage option health plans under contract with the department. Six weeks later, the new Wolf Administration announced its plan to withdraw the Healthy PA waiver and replace it with full Medicaid expansion as envisioned in the ACA. In April, the department began transitioning newly eligible adults from private coverage option health plans to existing MA managed care organizations; the transition to full Medicaid expansion was completed by September 2015.

MA has dozens of eligibility categories and special programs, each with its own qualifying criteria. DHS county assistance offices are responsible for determining the appropriate eligibility category and program for each person who is applying for, or receiving, MA services.

After the initial approval of MA benefits, the county assistance office must periodically review an individual’s information. MA eligibility generally applies for 12 months before a redetermination of eligibility must occur; semi-annual reviews are required for individuals who qualify for MA in cases of age or disability related eligibility. Caseworkers use the department’s Income Eligibility Verification System (IEVS) to verify factors affecting MA eligibility and benefits. IEVS consists of state and national data matched with information in the MA eligibility database to verify an individual’s income and assets, check a person’s criminal history and immigration status, and discontinue benefits for a person who is deceased.

MA recipients generally fall into one of four broad groups: children and families; elderly age 65 and older; individuals with disabilities, and newly eligible adults. The following sections contain more Information about the populations that comprise each group.

Newly eligible adults are individuals, age 19 through 64, with household incomes up to 138 percent of the federal poverty level, who are not receiving federal Medicare coverage, and who do not qualify for any other Medicaid category.

The ACA requires states to use Modified Adjusted Gross Income (MAGI) when determining income eligibility for newly eligible adults. MAGI starts with adjusted gross income on the federal IRS tax form and adds three types of income: tax-exempt interest, the non-taxable portion of Social Security benefits, and income earned overseas. The MAGI eligibility rules allow a standard disregard (deduction) equal to 5 percent of the federal poverty level. While the ACA established income eligibility for newly eligible adults at 133 percent of the federal poverty level, the 5 percent disregard effectively raises the income eligibility threshold to 138 percent.

MA recipients covered under Medicaid expansion include the following low-income individuals: optionally covered children ages 19 and 20, non-disabled adults with no dependent children, non-disabled parents and caretakers, and adults with a permanent disability with income above the required coverage limits or whose disability has not yet been verified by the Social Security Administration or a medical review team.

Some of these adults were previously eligible for Medicaid Assistance benefits through one of the following MA programs: Medically Needy (under which persons with high medical bills qualify for Medicaid through the “spend down” process), SelectPlan for Women (a limited benefit program providing family planning services) and General Assistance (an MA category, funded entirely with state dollars, for adults who did not qualify for federal Medicaid benefits but met General Assistance eligibility criteria established in Pennsylvania law).

Federal Medicaid funds pay most of the costs for MA coverage provide to newly eligible adults. The ACA set the federal share of coverage costs at 100 percent in calendar years 2014 through 2016, then gradually phased it down to 90 percent in calendar year 2020 and each year thereafter. States pay the share of costs not paid by the federal government, or 10 percent beginning in calendar year 2020.

This MA group is comprised of families (children, parents, and caregivers) that meet the eligibility requirements for TANF cash assistance and medically needy families that qualify for MA by spending down. It also includes low-income pregnant women, uninsured children up to age 19 who do not have a disability, and former foster care youth up to age 26.

Effective January 1, 2014, income eligibility for most children, parents, caretakers and pregnant women is determined using MAGI as a percent of the federal poverty level. Table 1 shows the financial requirements for some of the major MAGI categories. MAGI-eligible groups have no asset or resource requirements to qualify for MA. However, there is an asset limit for individuals that qualify through the “spend down” program. Former foster care youth are eligible for MA regardless of income or assets.

|

MA Eligibility Criteria for Children, Pregnant Women and Parents/Caretakers

|

|

Major Categories

|

Income Limits

|

Comments

|

|

Children under age 1

|

220% FPL*

(Federal Poverty Level)

|

The income limit reflects the maximum threshold that states may choose for this group of children.

|

|

Children age 1 through 5

|

162% FPL*

|

The income limits reflect the minimum federal standard that states must use for these two groups of children.

|

|

Children age 6 through 18

|

138% FPL*

|

|

Pregnant Women

|

220% FPL*

|

The income limit reflects the maximum federal threshold that states may chose for pregnant women. Women with a verified pregnancy receive MA benefits for the duration of their pregnancy and through a 60 day post-partum period. NOTE: extension of the post-partum coverage period to 12 months is currently being implemented effective April 1, 2022.

|

|

TANF Households

|

33% FPL

|

Parents/caretakers and children are automatically eligible for MA if they receive TANF cash assistance or meet the eligibility requirements for TANF (but do not receive the cash benefit). The income limit is based on Pennsylvania’s eligibility requirements for the former AFDC cash assistance program as of July 16, 1996.

|

|

TANF-Related Medically Needy

|

See Appendix A

|

This federal option includes children, pregnant women and other adults who qualify for MA through the “spend down” process.

|

|

MA Eligibility Criteria for Children, Pregnant Women and Parents/Caretakers

|

* Income limits include the 5 percent disregard allowed under MAGI rules. The disregard does not apply when determining eligibility for individuals in TANF households.

Most elderly and disabled individuals who receive MA benefits qualify because they either meet federal SSI requirements or Pennsylvania medically needy requirements, both of which have income and asset limits.

- Countable income includes wages, salaries, commissions, bonuses, interest, dividends, retirement benefits, pensions, Social Security, veteran’s benefits, spouse’s income, and lottery winnings. Certain types or amounts of income are disregarded and certain expenses are allowed as deductions when determining final countable income to qualify for MA.

- Countable resources include cash, checking and savings accounts, stocks and bonds, life insurance, vehicles (the first vehicle does not count), and non-resident property. An individual’s primary residence does not count, nor does their burial space and marker.

Elderly and disabled MA recipients who also receive Medicare benefits are known as “dual eligibles.” This population often has substantial needs and relies upon both programs for services. Medicare covers most basic health care needs, including physician services, prescription drugs, and hospital services; MA covers benefits that Medicare excludes or limits, such as nursing facility care and home and community-based services. Because Medicaid is the payor of last resort, Medicare pays first for any services it covers and MA pays the balance (up to the Medicaid rate). MA also assists dual eligibles in paying their premiums and cost sharing for Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

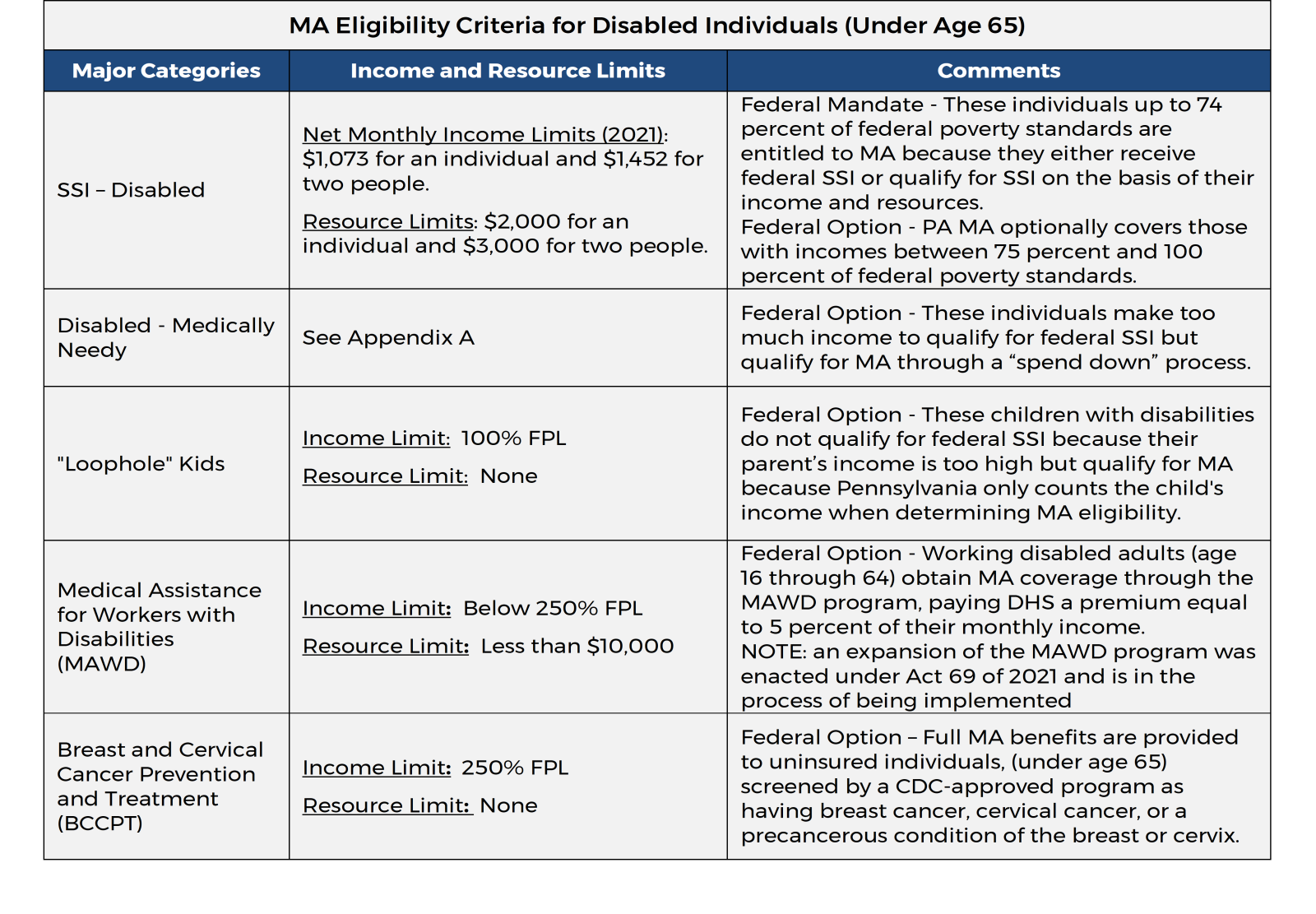

Disabled Individuals. This eligibility group is comprised of non-elderly individuals with disabilities who have various health needs, many of whom receive Supplemental Security Income (SSI). The non-SSI individuals in this group include: “loophole kids” who have disabilities such as autism or Down’s Syndrome; working individuals with disabilities enrolled in the Medical Assistance for Workers with Disabilities (MAWD) program; and uninsured women in the Breast and Cervical Cancer Prevention and Treatment Program. This group also includes non-elderly individuals with disabilities who qualify for MA by spending down.

Elderly. This group is comprised of individuals age 65 or older. It includes seniors who qualify for federal Supplemental Security Income benefits and medically needy seniors who spend down to qualify for MA.

|

MA Eligibility Criteria for Elderly (Age 65 or Older)

|

|

Major Categories

|

Income and Resource Limits

|

Comments

|

|

SSI - Aged

|

Net Monthly Income Limits (2021): $1,073 for an individual and

$1,452 for two people.

Resource Limits: $2,000 for an individual and $3,000 for two people.

|

Federal Mandate - These individuals up to 74 percent of federal poverty standards are entitled to MA because they either receive federal SSI or qualify for SSI on the basis of their income and resources.

Federal Option - PA MA optionally covers those with incomes between 75 percent and 100 percent of federal poverty standards.

|

|

Aged - Medically Needy

|

See Appendix A

|

Federal Option - These individuals have too much income to qualify for SSI but qualify for MA through the “spend down” process.

|

Dual Eligibles. MA recipients who are dually eligible for Medicare and Medicaid may receive financial assistance in paying their Medicare premiums, deductibles, and coinsurance through the MA program. The financial assistance is federally mandated and varies depending upon the individual’s income and resources.

|

Dual Eligibility Requirements and MA Benefits

|

|

Major Categories

|

Federal Income and Resource Limits *

|

MA Benefits

|

|

Qualified Medicare Beneficiary (QMB) – Categorically Needy

|

Income Limits: 100% FPL (federal poverty level)

Resource Limits (2021): $2,000 for an individual and $3,000 for two people.

|

MA pays Medicare Part A and Part B premiums, deductibles and coinsurance.

Individuals also receive the full MA benefits through a PA MA program.

|

|

Qualified Medicare Beneficiary (QMB) – Medicare Cost Sharing

|

Income Limits: 100% FPL

Resource Limits (2021): $7,970 for an individual and $11,960 for two people.

|

MA pays Medicare Part A and Part B premiums.

|

|

Specified Low-Income Medicare Beneficiary (SLMB)

|

Income Limits: More than 100%, but less than 120% FPL.

Resource Limits (2021): $7,970 for an individual and $11,960 for two people.

|

MA pays the Medicare Part B premium only.

|

|

Qualifying Individual (QI)

|

Income Limits: At least 120%, but less than 135% FPL.

Resource Limits (2021): $7,970 for an individual and $11,960 for two people.

|

MA pays the Medicare Part B premium only. However, the federal government fully reimburses the state up to a maximum allocation. To date, the allocation has been sufficient to fully reimburse MA for the costs.

|

Policy changes and economic conditions impact MA caseload. State and federal policies that drive MA enrollment include eligibility requirements, program expansions, and application/renewal processes. The number of MA recipients rises during economic downturns as unemployed people, who have lost their employer sponsored insurance or can no longer afford private insurance, enroll for MA after their incomes have fallen below the eligibility limits.

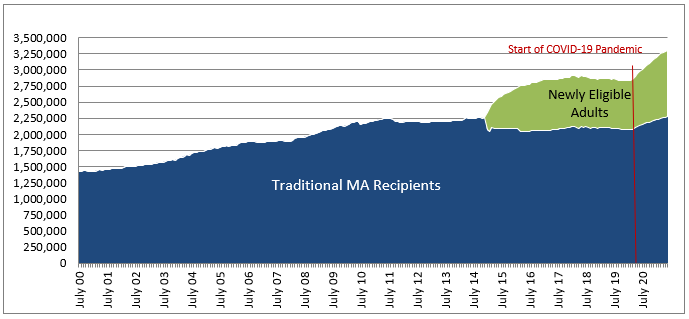

The following figure shows historical MA monthly enrollments over the past twenty fiscal years. Caseload grew by over 1.8 million during this period, with Medicaid expansion accounting for most of the growth since 2015. As of June 2021, one out of every four Pennsylvanian (3.3 million) receive MA. More than 40 percent of enrollees (1.35 million) are children under age 21.

Medical Assistance Monthly Caseload

(July 2000 through June 2021)

Source: PA Department of Human Services, Medical Assistance eligibility on LISTSERV.DPW.STATE.US.

Data for Newly Eligible Adults is from the DPW Enterprise Data Warehouse (extracted 07/13/21).

Note: The drop in traditional MA enrollments in January 2014 reflects the re-categorization of existing MA enrollees (i.e., General Assistance) into the Medicaid expansion category of newly eligible adults.

The dip in caseload from September 2011 through 2013 reflects the impact of policies regarding MA eligibility redeterminations (instituted during the second half of 2011) and General Assistance eligibility requirements (effective August 2012). In 2011, the department directed county assistance offices to clear a large backlog of files for MA recipients whose time for eligibility redetermination was past due. The focused procedures used to review eligibility (and ultimately close cases) resulted in more than 100,000 children and adults having their coverage discontinued in a matter of months – by year end, the number of children on MA had dropped 88,000, or 7.5 percent. Legislation enacted in 2012 (Act 80) revised the state General Assistance program, removing approximately 40,000 adults from the MA rolls.

Child enrollments drove the 2014 increase in MA caseload. The increase was partially due to ACA requirements that raised the Medicaid income limits for children, age 6 through 18, beginning in 2014 – this resulted in approximately 35,000 children moving from CHIP (Children’s Health Insurance Program) to Medical Assistance for their health care coverage. In addition, the ACA required states to extend Medicaid coverage to former foster care youth up to age 26.

Also contributing to the 2014 increase were provisions in the ACA requiring states to use streamlined application, enrollment, and renewal procedures for their Medicaid programs. The new procedures reduced cumbersome paperwork and replaced burdensome rules with a simplified, modernized approach that transformed Medicaid enrollment into a consumer-friendly process.

MA enrollments jumped to nearly 2.7 million in 2015 after Pennsylvania implemented Medicaid expansion. Caseload continued to grow through 2017 and peaked at 2.91 million in February 2018. Enrollments declined over the next two years, falling 76,500 to 2.83 million by February 2020.

The recent spike in caseload was triggered by the loss of jobs and incomes due to the COVID-19 pandemic. MA caseload has soared since March 2020, when the pandemic hit Pennsylvania, with 468,581 individuals added to the rolls between February 2020 and June 2021. This represents an increase of 16.5 percent.

Like eligibility, states have flexibility within federal rules to design the benefit packages of services enrollees may access. In Pennsylvania, MA covers a comprehensive range of services that include preventive, primary, and acute care medical services. As noted previously, detailed information on behavioral health and long-term services and supports are covered in other primers. Some services are mandated by federal law and regulations; others are optional services that Pennsylvania chooses to offer. Mandatory services refer to those basic services that states must cover in order to receive federal matching funds for their Medicaid programs. Optional services refer to the additional services that states may cover and receive federal reimbursement.

States establish their benefits within broad federal guidelines. In general, the amount, duration and scope of each benefit must be reasonably sufficient, equivalent for all enrollees (the “comparability” rule) and the same throughout the state (the “statewideness” rule). Additionally, Medicaid recipients have the freedom to choose which qualified Medicaid providers they use to obtain services (the “freedom of choice” rule).

States may apply for waivers from the federal requirements for statewideness, comparability, and freedom of choice. Pennsylvania uses waivers to operate its managed care programs.

MA recipients are entitled to the following mandatory medical care services:

- Physician services,

- Inpatient hospital services,

- Outpatient hospital services (preventive, diagnostic, therapeutic, rehabilitative or palliative services that are delivered on an outpatient basis),

- Early and periodic screening, diagnosis and treatment (EPSDT) for children under age 21 (includes immunizations and well-child care, vision services, hearing services, dental services, and all other necessary health care and services to treat physical and mental conditions),

- Laboratory and x-ray services,

- Pediatric and family nurse practitioner services,

- Nurse midwife and freestanding birth center services,

- Family planning services and supplies,

- Tobacco cessation counseling and prescription drugs for pregnant women, and

- Rural health clinic and federally qualified health center (FQHC) services.

MA provides the following mandatory long-term services:

- Nursing facility services for individuals 21 years and older; and

- Home health care for persons eligible for nursing facility services, including: part-time or intermittent nursing services; home health aide services; and medical supplies, equipment, and appliances suitable for use in the home.

In addition, federal regulations require states to ensure necessary transportation for beneficiaries to and from Medicaid-covered services. Pennsylvania’s MA program covers ambulance services as well as non-emergency medical transportation to and from appointments for covered services.

Optional benefits provided by MA include a variety of medical services, mental health services, and long-term care. The inclusion of these services allows MA to meet the diverse and complex needs of individuals enrolled in MA, especially the elderly and the disabled. Pharmacy benefits are among the most significant of optional services because prescription drugs are an integral component in the treatment and management of many illnesses and conditions. Home and community-based services are critical optional benefits that enable seniors and individuals with disabilities to live safely in their homes rather than a nursing facility.

The table that follows lists the optional services covered by Pennsylvania’s MA program. All optional services are mandatory for children under age 21 when they are deemed “medically necessary.”

|

Medical Assistance Optional Services

|

|

Medical Care

|

|

|

Prescription drugs

|

Dental care services

|

|

Outpatient clinic services

|

Dentures

|

|

Ambulatory surgical center

|

Optometry services

|

|

Therapy (physical, occupational, speech)

|

Eyeglasses

|

|

Targeted case management

|

Chiropractic services

|

|

Medical supplies and equipment

|

Podiatry services

|

|

Rehabilitative services

|

Prosthetic devices

|

|

Private duty nursing *

|

Hospice care

|

|

Mental Health

|

|

|

Psychiatric clinic services

|

Services in an institution for mental disease, for adults who are 65 years of age or older

|

|

Psychiatric partial hospitalization

|

|

* Private duty nursing is only covered for children under age 21.

MA imposes nominal copayments for certain prescriptions and non-emergency services. Federal law and regulations cap the amounts that can be charged and limit the populations required to pay. They also prohibit states from imposing copayments on emergency services, family planning services and supplies, pregnancy-related services, preventive services for children under age 18, and services resulting from provider preventable conditions (such as an adverse hospital event).

In accordance with federal requirements, MA excludes the following groups from copayments: children under age 18, pregnant women, residents of a long-term care facility, women in the Breast and Cervical Cancer Treatment Program, individuals receiving hospice care, and children receiving Titles IV-B and IV-E foster care and adoption assistance.

The total amount of copayments incurred by a household cannot exceed a federal cap of 5 percent of family income. Federal and state rules prohibit MA providers from denying services to any recipient who is unable to pay the copayment.

The following table shows the current MA copayments. Some copayments are a fixed amount per unit of service; other copayments are a sliding scale amount based on the MA fee for that service.

|

Medical Assistance Copayments

|

|

Services With Fixed Charges

|

Copayments

|

|

Prescription drugs *

|

Generic: $1 per prescription or refill

Brand Name: $3 per prescription or refill

|

|

Inpatient services (general hospitals, rehabilitation hospitals, and private psychiatric hospitals)

|

$3.00 per day, up to $21.00 per admission

|

|

Diagnostic radiology, nuclear medicine, radiation therapy and medical diagnostic tests

|

$1 per unit

|

|

Outpatient psychotherapy services

|

$0.50 per unit

|

|

Non-Emergency Services With Sliding Scale Charges Based on the MA Fee for that Service

|

|

|

MA fee $2 -$10

|

$0.65 per unit

|

|

MA fee $10.01 -$25

|

$1.30 per unit

|

|

MA fee $25.01 -$50

|

$2.55 per unit

|

|

MA fee $50.01 or more

|

$3.80 per unit

|

* Excludes Naloxone and drugs generally used for the treatment of high blood pressure, cancer, diabetes, epilepsy, heart disease, HIV/AIDS, and psychosis. Also excludes drugs and vaccines dispensed directly by a physician or certified registered nurse practitioner.

The MA program provides services to recipients either on a fee-for-service basis or through managed care plans.

MA recipients who are not enrolled in a managed care plan receive their services through the fee-for-service system. DHS enrolls providers – such as doctors, hospitals, pharmacies, and clinics – and pays them for each service rendered. Providers submit claims to the department and are paid for each covered service in accordance with promulgated fee schedules or rates of reimbursement. Fee-for-service providers agree to accept the MA reimbursement as payment in full along with any applicable copayment.

MA recipients participating in managed care receive coordinated services through a managed care organization (MCO) under contract with DHS. Each MCO agrees to provide at least the MA determined benefit package of services in exchange for an actuarially sound, fixed rate per enrollee. MCOs build a provider network and pay providers for services furnished to the plan’s enrollees. A MCO may provide additional services beyond the specified MA benefits, but generally it does so at its own cost. The department pays the MCOs a monthly capitated rate for each MA recipient enrolled in their plans, regardless of the amount of services actually used by the enrollee; the MCOs do not receive supplemental payments for operating at a loss or not fulfilling their performance commitment.

Since 1997, MA has evolved, on a region-by-region basis, from a primarily fee-for-service system to mandatory managed care. As of June 2021, more than three million MA recipients were in a managed care program. There are three managed care programs:

- Physical Health HealthChoices – PA’s mandatory managed care program that provides quality medical care and timely access to physical health services.

- Community HealthChoices (CHC) – PA’s mandatory managed care program for individuals dually eligible for Medicare and MA, older adults, and individuals with physical disabilities that provides quality medical care and timely access to physical health services and long-term services and supports. More detail on this part of the MA program is covered in another primer.

- Behavioral Health HealthChoices – PA’s mandatory managed care program that provides high quality and timely access to appropriate mental health and drug and alcohol services. Enrollees can be enrolled in both Behavioral Health HealthChoices and either Physical Health HealthChoices or CHC. More detail on this part of the MA program is covered in another primer.

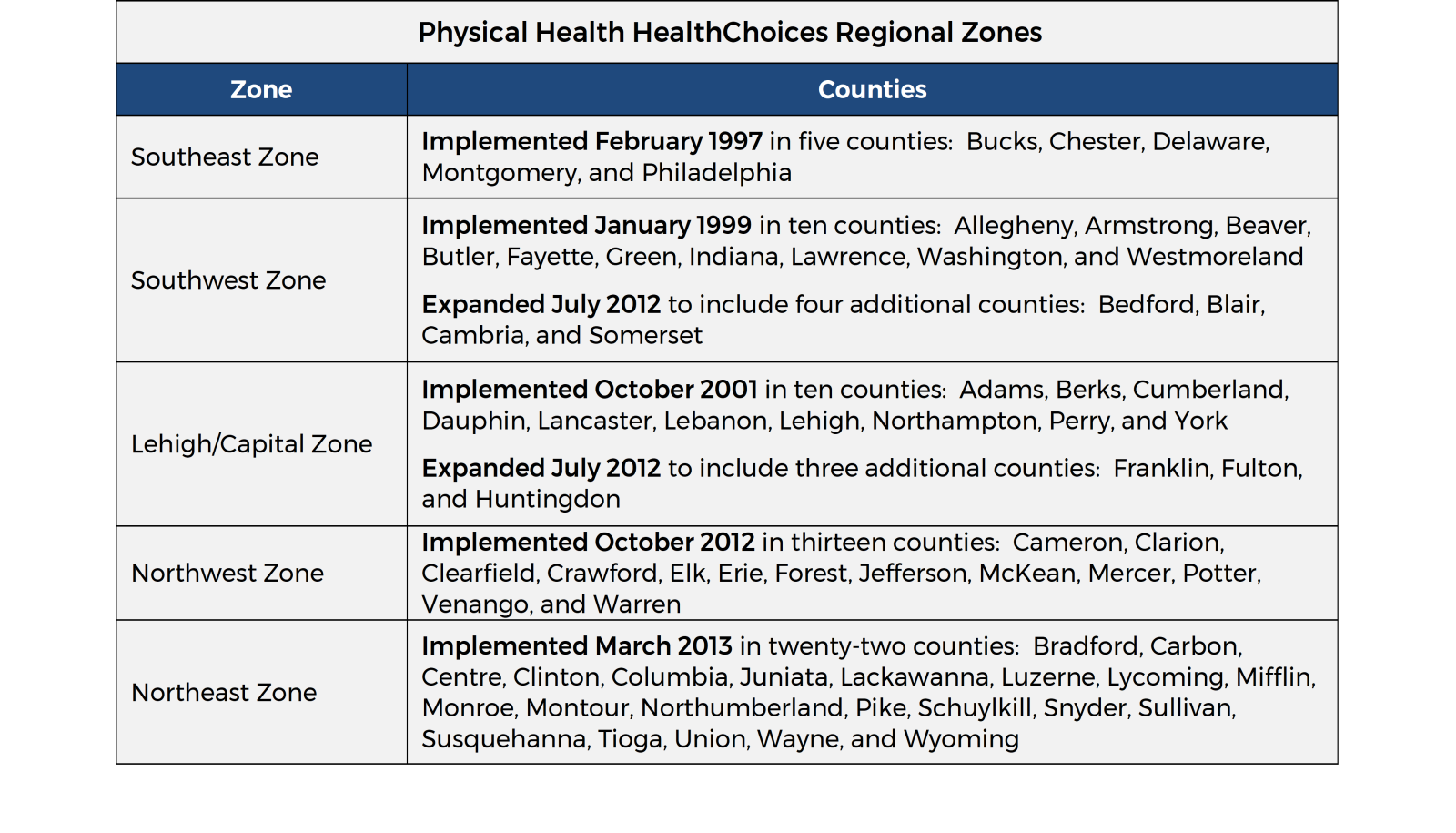

The Physical Health HealthChoices managed care program operates in five geographic zones covering all 67 counties in Pennsylvania (see following table). DHS currently contracts with three to five physical health MCOs per zone, giving MA recipients who reside in that zone a choice of plans in which they may enroll. MA recipients may change MCOs at any time, for any reason. Each managed care enrollee must choose a primary care provider who delivers most of their basic services and coordinates care with other health care providers, including specialists and hospitals.

Physical health MCOs provide a comprehensive benefit package that includes prescription drugs and up to 30 days of nursing facility care. The pharmacy benefit covers prescribed medications for the enrollee’s physical health and behavioral health needs (except methadone, which is covered by behavioral health MCOs). Prior to 2020, each MCO had its own formulary, or list of brand name drugs and generic drugs covered by the plan. On January 1, 2020, DHS implemented a statewide preferred drug list (PDL) for prescription drugs covered by MA in the fee-for-service system, as well as the HealthChoices and Community HealthChoices managed care programs. Prescription drugs not listed on the PDL, in an applicable drug class, require prior authorization.

DHS pays the physical health MCOs a monthly capitated rate per enrollee plus a lump-sum maternity care payment per live delivery.

As of June 2021, 2.68 million (or 81.2 percent) of MA recipients were enrolled in the Physical Health HealthChoices program. This includes children through age 20, pregnant women, adults under age 65 who are not dually eligible for Medicare, workers with disabilities in the MAWD program, and women in the Breast and Cervical Cancer Prevention and Treatment Program.

MA recipients who receive physical health services through Community HealthChoices (CHC), Living Independence for the Elderly (LIFE), or Adult Community Autism Program (ACAP) are excluded from Physical Health HealthChoices. All other MA recipients not enrolled in Physical Health HealthChoices receive their physical health coverage through the department’s fee-for-service system.

The following MA recipients are automatically enrolled in fee-for-service: residents of state psychiatric hospitals, individuals with intellectual disabilities who are admitted to an intermediate care facility, certain youth in a juvenile detention center, residents of state veterans’ homes, correctional facility inmates with a qualifying inpatient hospital stay, legal immigrants subject to the five-year bar and immigrants who are only eligible for emergency medical services.

A significant number of fee-for-service users are individuals (such as those newly approved for MA) who are in the process of selecting a managed care plan and receive health care temporarily on a fee-for-service basis during the managed care enrollment window. Individuals who do not choose an MCO by the date on their enrollment form are automatically assigned to one.

Fee-for-service also covers certain benefits for individuals participating in the Health Insurance Premium Payment (HIPP) program. The HIPP program helps families with at least one person eligible for MA pay for their employer-sponsored health insurance. When a MA applicant or recipient is identified as having access to employer-based group health insurance and DHS determines the private insurance is cost effective, MA purchases the employer-based insurance. Any MA covered services not covered by the private insurance plan are provided through fee-for-service.

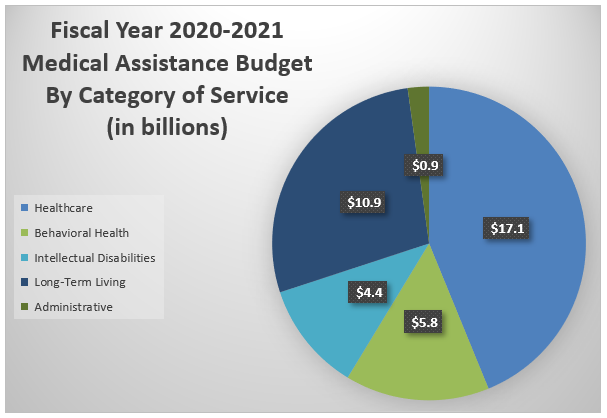

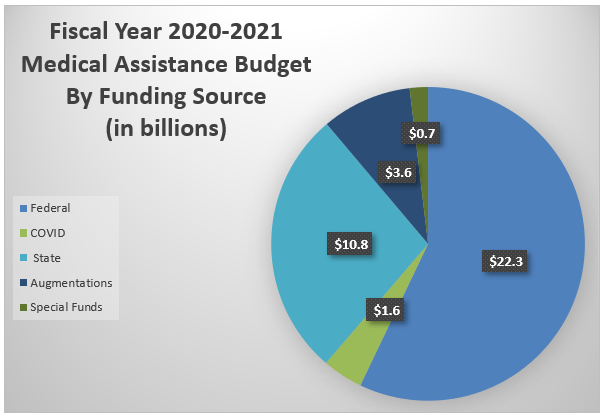

The final fiscal year 2020/21 Medical Assistance program budget in DHS totaled over $39 billion, with most costs falling in the category of healthcare (44 percent), followed by long-term living (28 percent), behavioral health (15 percent), and services for individuals with intellectual disabilities and autism (11 percent). DHS’s costs to administer the MA program account for slightly more than two percent of the total MA budget.

Medicaid is funded jointly by the state and federal government. The federal government’s share of a state’s Medicaid expenditures is determined by the federal medical assistance percentage (FMAP) rate. The remaining expenditures are referred to as the state share, or nonfederal share. States can use a variety of funding sources to finance the non-federal share of Medicaid expenses. Allowable funding sources include state general funds (i.e., revenue from sales tax, personal income taxes, and corporate taxes), special funds, local funds (i.e., intergovernmental transfers), and other nonfederal sources.

The FMAP for most Medicaid services is calculated annually using a formula in the Social Security Act that compares each state’s per capita personal income to the national average over a three-year period. The formula is designed to pay higher federal reimbursement to states with lower per capita incomes and lower federal reimbursements to higher per capita income states. The resultant state FMAPs have a statutory minimum of 50 percent. The annual (regular) FMAP is in effect during the twelve-month period of the federal fiscal year, which begins October 1.

- Over the past decade, the regular FMAP for Pennsylvania ranged between 51.78 percent and 55.07 percent. Since October 2014, Pennsylvania’s regular FMAP has been approximately 52 percent.

Fiscal Relief. During the last three economic downturns, Congress has provided additional federal funds to states through a temporary increase in each state’s FMAP. To receive the higher FMAPs, states could not reduce their Medicaid eligibility during the timeframe for fiscal relief.

- The federal Jobs and Growth Tax Relief Reconciliation Act of 2003 gave all states a 2.95 percentage point increase in FMAP for five quarters, April 2003 through June 2004.

- The federal American Recovery and Reinvestment Act of 2009 (ARRA), and subsequent legislation, significantly increased state FMAPs for eleven quarters, October 2008 through June 2011. During the thirty-three months of federal stimulus, Pennsylvania’s quarterly FMAPs increased, on average, by nearly 10 percentage points.

- The Family First Coronavirus Response Act of 2020 – amended by the Coronavirus Aid, Relief, and Economic Security (CARES) Act – increases each state’s FMAP by 6.2 percentage points, beginning on the first day of the calendar quarter in which the COVID-19 public health emergency period began (January 1, 2020) and ending on the last day of the calendar quarter in which the public health emergency period ends (to be determined).

Enhanced FMAPs. Federal law provides states an enhanced FMAP (above the regular FMAP) for certain Medicaid services and populations. In many cases, the higher federal match is meant to incentivize states to cover specific services and populations. Examples of enhanced FMAPs received by the Pennsylvania MA program are listed below.

- The Affordable Care Act (ACA) provides generous federal matching funds to states implementing Medicaid expansion. For calendar years 2014 through 2016, the ACA set the FMAP at 100 percent of Medicaid expenditures for newly eligible adults. The law reduced the FMAP to 95 percent in calendar year 2017, 94 percent in 2018, 93 percent in 2019, and 90 percent in 2020 and each calendar year thereafter.

- The federal government reimburses 90 percent of costs for family planning services and supplies.

- For services provided to women in the Breast and Cervical Cancer Prevention and Treatment Program, the federal government reimburses the MA program using the state enhanced FMAP (e-FMAP) rate. The e-FMAP is defined as the state’s annual FMAP plus 30 percent of the number of percentage points by which the regular FMAP is below 100 percent. Pennsylvania’s e-FMAP is currently about 66.9 percent. This eFMAP also applies to the children transitioned from the CHIP program to MA under the ACA’s mandatory income expansion to children ages six to 18 with family incomes between 100 percent and 133 percent of the federal poverty level.

- The federal government reimburses MA the full cost of Medicare Part B premiums for dual eligibles who have incomes between 120 percent and 135 percent of the federal poverty level. Total federal reimbursements, however, are limited to the federal amount annually allotted to Pennsylvania for this purpose.

Administrative FMAPs. The FMAP for administrative costs does not vary by state and is generally 50 percent. Some functions performed by states qualify for enhanced FMAPs of 75 percent or more, as specified in the Social Security Act. Examples of activities qualifying for 75 percent reimbursement include the operation of a Medicaid fraud control unit, the operation of a citizenship verification system, and the implementation of information technology.

Pennsylvania relies heavily upon revenue sources, other than the General Fund, to pay for the MA program. These other revenue sources include special funds (Tobacco Settlement Fund and Lottery Fund), assessments levied on health care providers, and intergovernmental transfers (IGTs) from counties.

Provider assessments must meet stringent federal requirements to qualify as the non-federal share to receive Medicaid matching funds. Pennsylvania uses revenue generated from assessments levied on nursing facilities, managed care organizations, intermediate care facilities, and hospitals to fund MA provider rates and other payments.

Revenue from the Tobacco Settlement Fund finances the hospital uncompensated care payment program established in Act 77 of 2001, The Tobacco Settlement Act, as well as Medical Assistance for Workers with Disabilities. For additional details, please see the Tobacco Settlement Fund primer.

Profits from the Lottery Fund are used to support seniors served in the Community HealthChoices program receiving both nursing facility and home and community-based services. Beginning in 2014/15, Lottery revenue also supports seniors in the Medical Assistance Transportation Program. For additional details, please see the Lottery Primer.

Finally, DHS implemented a voluntary county IGT program to support access to county services provided to MA enrollees.

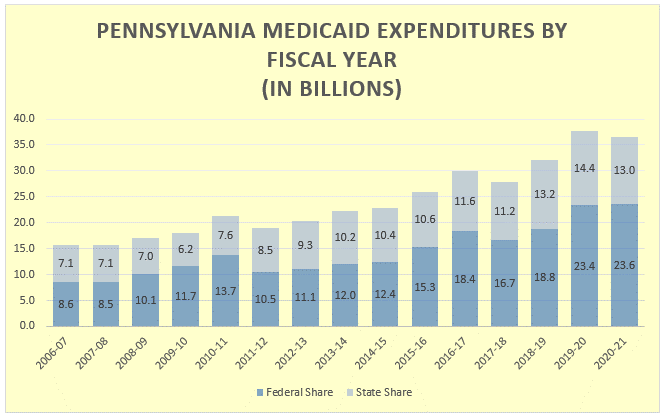

The chart above shows a 15-year Medicaid expenditure history as compiled through expenditure reports to CMS. The expenditures are reported when paid, therefore, annual amounts are impacted by payment date and program implementation changes, including delays in payments due to budgetary constraints.

MA budgets increased significantly after Pennsylvania expanded Medicaid in January 2015. From 2015/16 through 2020/21, MA budgets grew 41 percent ($10.6 billion). Increases in long term care expenditures for seniors and individuals with physical disabilities contribute significantly to the growth in recent budgets. The administration reported in the Governor’s Executive Budget for 2021/22 that 25 percent of the covered MA enrollees were elderly or individuals with disabilities, although those enrollees accounted for 71 percent of the MA program’s costs.

The chart illustrates how costs increase in times of economic recessions, such as 2008-09 to 2010-11 and during the COVID pandemic beginning in 2019-20. Also, reflected are the federal fiscal relief during those same times.

Individuals who meet the eligibility requirements for a particular Medical Assistance (MA) category, but have too much income to qualify for MA, may obtain medically needy eligibility through the “spend-down” process. Under this process, individuals may deduct medical expenses, both paid and unpaid, to reduce their incomes to the medically needy eligibility level. Deductible medical expenses are limited to those incurred within the three-month period prior to applying for MA, provided they were not previously deducted to meet a spend-down.

The table below shows Pennsylvania’s Medically Needy income criteria, which varies by household size. These limits apply to all medically-needy categories: TANF-related groups (families, children and pregnant women) and SSI-related groups (elderly and disabled). When income less medical expenses meets the income criteria, medically needy eligibility is established and the individual qualifies for MA for the remainder of the period.

Medically Needy Spend-Down Income Limits *

|

Number of People

|

Net Monthly Income Limit

|

Net 6-Month Income Limit

|

|

1

|

$425

|

$2,550

|

|

2

|

$442

|

$2,650

|

|

3

|

$467

|

$2,800

|

|

4

|

$567

|

$3,400

|

|

5

|

$675

|

$4,050

|

|

6

|

$758

|

$4,550

|

|

7

|

$850

|

$5,100

|

|

8

|

$942

|

$5,600

|

|

each additional person

|

$92

|

$550

|

* These income limits are tied to the cash grants for families under the previous AFDC (Aid to Families with Dependent Children) levels established in 1990. Federal rules require that the medically needy income limit be no higher than 133 percent of the maximum state AFDC levels as of July 16, 1996.

The table below shows the medically needy resource limits for the SSI-related groups. TANF-related groups have no resource requirements.

Medically Needy Spend-Down Resource Limits

|

Number of People

|

Net Monthly Income Limit

|

|

1

|

$2,400

|

|

2

|

$3,200

|

|

each additional person

|

$300

|