Gaming in Pennsylvania

By Wendy Lewis , Senior Budget Analyst | 4 years ago

Gaming Analyst: Adrian Buckner, Budget Analyst

| Category 4 Casino Auction Results as of August 2021 |

| Casino |

County |

Final Location |

Auction Date |

Bid Amount |

| Hollywood |

York |

Springettsbury Township, York Galleria Mall |

1/10/2018 |

$50,100,000 |

| Live |

Westmoreland |

Hempfield Township, Westmoreland Mall |

1/24/2018 |

$40,100,005 |

| Parx |

Cumberland |

Shippensburg Township near Rt. 81 |

2/22/2018 |

$8,111,000 |

| Hollywood |

Lancaster |

Caernarvon Township, Berks County near PA Turnpike |

4/4/2018 |

$7,500,003 |

| Rivers |

Centre |

Union Borough, Centre County |

9/2/2020 |

$10,000,101 |

| Total |

$115,811,109 |

| Invalidated Auction Attempt |

| Sands |

Mercer |

Hempfield Township |

2/21/2018 |

$9,885,000 |

| Mount Airy |

Lawrence |

Big Beaver, Beaver County

Application denied 11/19/2019. 75% of fee returned. |

2/8/2018 |

$21,188,889 |

Appendix A - License Fees, Tax Rates, and Distributions

| Gaming License and Certificate Fees |

| One-Time Fees |

Fee |

Devices Allowed |

Additional Information |

| Slot Machine License Fee - Category 1 & 2 |

$50 million |

3,000 |

Up to 2,000 more slots after 6 months of operation, if approved by the Board. Deposited into the State Gaming Fund prior to 2017/18, after that to the General Fund. |

| Slot Machine License Fee - Category 3 |

$5 million |

500 |

Deposited into the State Gaming Fund. Additional 100 slots permitted with a table games certificate. |

| Table Games Certificate Fee - Category 1 & 2 |

$16.5 million |

250 |

For certificates issued before June 1, 2010. |

| Table Games Certificate Fee - Category 1 & 2 - after June 1, 2010 |

$24.75 million |

250 |

For slot machine licenses issued in 2017/18, the table games fee is due before June 30, 2018. |

| Table Games Certificate Fee - Category 3 |

$7.5 million |

50 |

100 more slots allowed if casino also holds a table games certificate. |

| Expanded Gaming - All Fees Deposited into the General Fund |

| Category 3 - Additional Slot Machine Fee |

$2.5 million |

250 |

Allows for additional slot machines. |

| Category 3 - Additional Table Games Fee |

$1 million |

15 |

Limited to only poker tables. |

| Category 3 - Patron of the Amenities Waiver |

$1 million |

N/A |

Allows public to patronize casino without patronizing resort amenities or paying a membership fee. |

| Category 4 Casino - Slot Machine License Fee |

$7.5 million minimum bid |

300-750 |

Fees are based on auction price. Number of devices may not exceed total complement of the licensee. |

| Category 4 Casino - Table Games Certificate Fee |

$2.5 million |

30 |

Optional certificate fee after slot machine license is approved. |

| iGaming Certificate |

$10 million |

No limit |

Additional $1 million fee for contracted operators. $10 million for current casinos to purchase all 3 (poker, tables, slots) certificates in first 90 days. After that, PA casinos and other qualified entities can purchase any remaining certificates for $4 million each. |

| Airport Gaming Fee |

$125,000 to $2.5 million |

No limit |

Must first have iGaming Certificate. $2.5 million in first-class county, $1.25 million in 2nd class, $500,000 in all other counties with an international airport. For other qualified airports, $125,000. Only available to iGaming certificate holders. |

| Fantasy Contest License |

$50,000 |

No limit |

Allows fantasy sports operators, regardless of location, to collect taxes on contest net revenues adjusted for PA in-state participants. |

| Video Gaming Terminal License |

$250 per VGT |

5 per truck stop |

Truck stop must sell 50,000 gallons of diesel per month, have 20 commercial parking spaces, and occupy at least 3 acres. |

| Sports Wagering Certificate |

$10 million |

N/A |

Certificate fee deposited into the General Fund. Must first have an iGaming certificate. |

| Simulcasting Permit of Horse Races |

No Fee |

N/A |

Allows Category 1,2,3 and 4 casinos to simulcast live races from any location for conducing pari-mutuel wagering. |

Gaming Taxes, Assessments and Distributions

Slot Machines and Table Games - Prior to Expanded Gaming

($ amounts in millions) |

| Taxes and Assessments |

Rate |

Revenue

2017/18 |

CumulativeThrough 6/30/2018 |

Distribution of Funds |

| Slot Machine Tax - State Share |

34% |

$ 799.8 |

$ 8,419.5 |

Local property tax relief (wage tax relief in Philadelphia); local law enforcement grants ($2 million per year); compulsive gambling treatment program (at least $2 million per year); drug and alcohol treatment services ($3 million to Dept. of Health); volunteer fire company grants ($30 million). |

| Slot Machine Tax - County Local Share Assessment |

2% |

$ 23.3 |

$ 911.5 |

Distributed to host counties to be used for security, road construction, traffic systems, and other local government services needed to support orderly operation of slots facilities. |

| Slot Machine Tax - Municipal Local Share Assessment |

$10 Million |

|

|

Act 42 of 2017 changed the rate from the greater of 2% or $10 million to a fee of $10 million. Windfall provisions roll excess revenues over to the host county. |

| Race Horse Improvement Assessment1 |

12% |

$ 240.2 |

$ 2,728.4 |

Funds allocated to the horsemen's orgainzation must be used to benefit all horsemen. Benevolent programs include pension and health insurance benefits for the horsemen. |

| Gaming Economic Development and Tourism Assessment |

6% |

$ 129.6 |

$ 1,250.1 |

Funds are distributed to specific projects via separate capital budget bills, Act 53 of 2007 and Act 63 of 2008 (H2O PA). Of the 6%, 0.5% of Category 1, 2 and 3 gross terminal revenue goes to the Casino Marketing and Capital Development Account. Category 4 casinos are assessed at 6%, all going to the GEDTF. |

| Table Games - State Share2 |

12% |

$ 126.2 |

$ 791.6 |

Deposited in the General Fund. If Rainy Day Fund reaches $750 million, revenues would go to Property Tax Relief Fund. |

| Table Games - Local Share |

2% |

$ 17.9 |

$ 119.9 |

1% to the host county and 1% to the host municipality. |

1The race horse improvement assessment is a formula based on each entity's gross terminal revenue and the gross terminal revenue at all Category 1 licensees, which is capped at 12% of gross terminal revenue. Actual rates are closer to 10%.

2The table games tax rate is 14% for the first two years of table games operation at each casino, then drops to 12%.The state tax rate on fully automated table games is 34% in addition to the base rate of either 12% or 14%. Effective August 1, 2016, there is an additional 2% tax on table games revenue, which is set to expire on June 30, 2019 (Act 84 of 2016 amending the Tax Reform Code). |

Expanded Gaming Taxes, Assessments and Distributions

($ in millions) |

| Taxes and Assessments |

Rate |

Distribution of Funds |

| Category 4 Slot Machine Tax |

50% |

34% deposited into the Property Tax Relief Fund.

5% to the Commonwealth Financing Agency for project grants in the public interest in any county.

5% distributed to counties whose local share funding levels decrease below 2017/18 levels.

6% to the PA Gaming Economic Development and Tourism Fund. |

| Category 4 Slot Machine Local Share |

4% |

2% to the host county.

2% to the host municipality. |

| iGaming - Table Games and Poker |

14% |

Deposited into the General Fund. |

| iGaming - Slot Machine Style |

52% |

34% to the Property Tax Relief Fund.

5% to counties whose local share decreases below 2017/18 levels.

13% to the CFA for grants in any county for projects in the public interest. |

| iGaming - Local Share |

2% |

1% to the host county of the licensed casino, added to and distributed according to county slot machine distributions.

- Philadelphia: 1% to the school district.

- Delaware County (Harrahs): 1% to the county authority for municipal police and

emergency services or other economic development.

- If the certificate holder is not a PA casino, 1% added to and distributed with the

amount below to the CFA for projects in any county.

1% to the CFA for projects in the public interest in any county. |

| Airport Gaming - Table Games and Poker |

14% |

Tax rates and local share are the same as iGaming rates; however all taxes deposited into the General Fund. |

| Airport Gaming - Slot Machine Style |

52% |

Tax rates and local share are the same as iGaming rates; however all taxes deposited into the General Fund. |

| Airport Gaming - Local Share |

2% |

1% to the CFA for grants in the host county.

- Philadelphia Airport: 0.5% to the Philadelphia school district and 0.5% to

Delaware County.

1% to the CFA for grants in any county. |

| Fantasy Sports |

15% |

Deposited into the General Fund. Tax collections began May 2, 2018. Each year 0.2% transferred to the Department of Drug and Alcohol Programs for drug and alcohol addiction treatment services. |

| Video Gaming Terminals |

42% |

Deposited into the Video Gaming Fund. 0.2% of revenues transferred for compulsive and problem gambling; remaining revenue transferred to the General Fund. |

| Video Gaming Terminals - Local Share |

10% |

Distributed to the CFA for grants in the commonwealth. |

| Sports Wagering |

34% |

Deposited into the General Fund. Each year 0.2% transferred to the Department of Drug and Alcohol Programs for drug and alcohol addiction treatment services and 0.2% of revenues transferred to the Compulsive and Problem Gambling Treatment Fund. |

| Sports Wagering - Local Share |

2% |

Distributed to the CFA for grants in the commonwealth. |

| Simulcasting |

1.5% |

Same as pari-mutuel wagering: 1.5% of the amount wagered on win, place or show wagers and 2.5% on exotic wagers (exacta, daily double, quinella and trifecta). Distributed to the State Racing Fund for regulation of the Racing Commission and for promotion of horse racing. |

Appendix B - Slot Machine Revenue Deposits and Fund Transfers

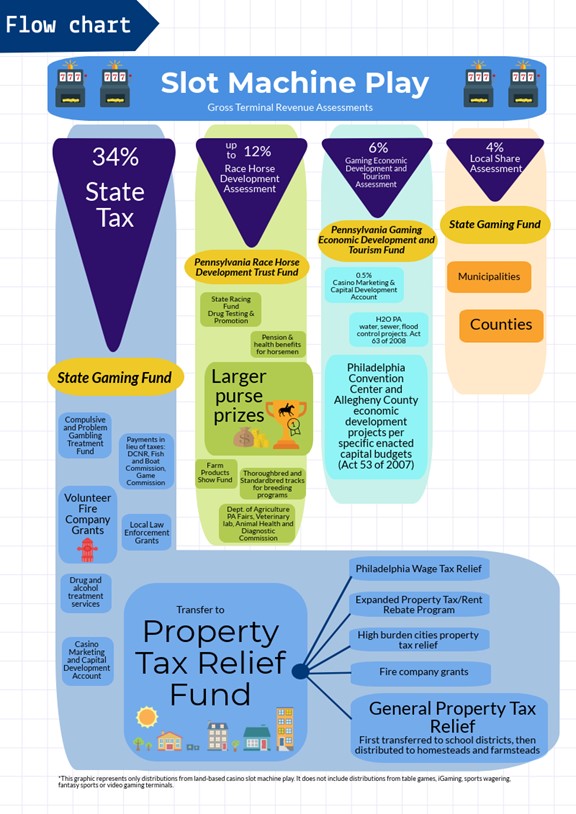

The diagram below shows a basic distribution of the taxes and assessments on slots gaming at land-based casinos. The base of the assessments is gross terminal revenue. For information on distributions from other types of gaming, such as table games and iGaming, see Appendix A.

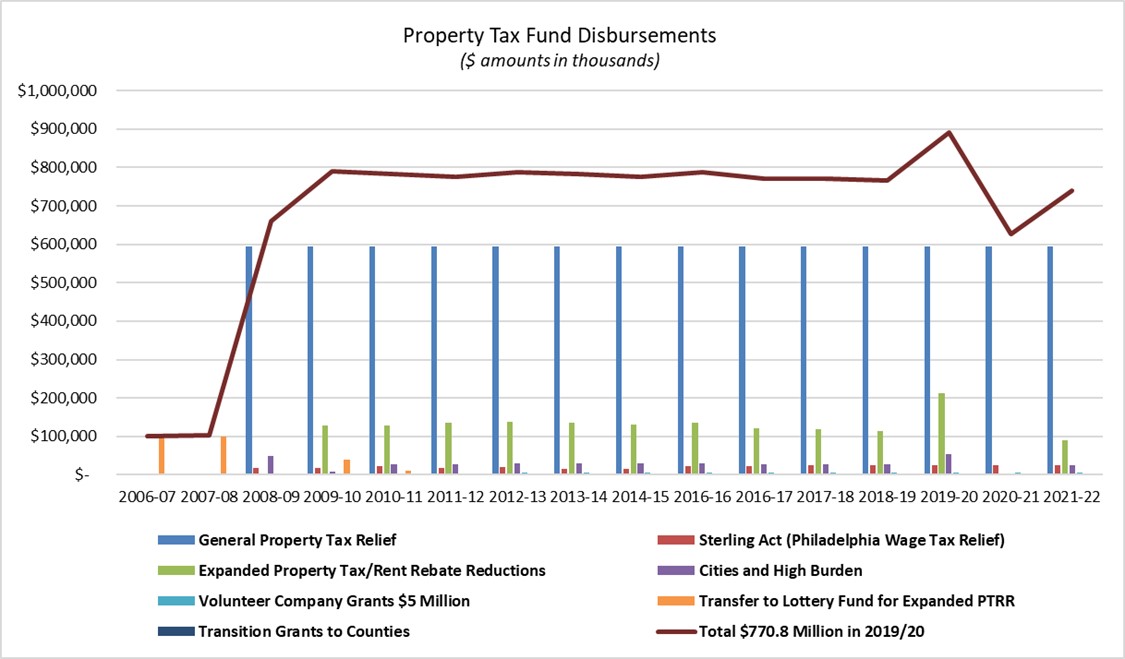

| Property Tax Relief Fund Disbursements |

| |

General Property Tax Relief |

Sterling Act (Philadelphia Wage Tax Relief) |

Expanded Property Tax/Rent Rebate Reduction |

Cities and High Burden |

Volunteer Company Grants $5 Million |

Transfer to Lottery Fund for Expanded PTRR |

Transition Grants to Counties |

Total |

| 2006-07 |

$ - |

$ - |

$ - |

$ - |

$ - |

$ 100,000 |

$ - |

$ 100,000 |

| 2007-08 |

$ - |

$ - |

$ - |

$ - |

$ - |

$ 100,000 |

$ 2,760 |

$ 102,760 |

| 2008-09 |

$ 594,571 |

$ 17,887 |

$ - |

$ 48,500 |

$ - |

$ - |

$ 229 |

$ 661,187 |

| 2009-10 |

$ 595,000 |

$ 18,200 |

$ 127,500 |

$ 9,200 |

$ - |

$ 40,000 |

$ - |

$ 789,900 |

| 2010-11 |

$ 595,000 |

$ 21,500 |

$ 129,100 |

$ 26,900 |

$ - |

$ 9,900 |

$ - |

$ 782,400 |

| 2011-12 |

$ 595,000 |

$ 17,100 |

$ 135,900 |

$ 28,200 |

$ - |

$ - |

$ - |

$ 776,200 |

| 2012-13 |

$ 595,000 |

$ 20,600 |

$ 137,800 |

$ 29,000 |

$ 5,000 |

$ - |

$ - |

$ 787,400 |

| 2013-14 |

$ 595,000 |

$ 16,600 |

$ 136,700 |

$ 29,800 |

$ 5,000 |

$ - |

$ - |

$ 783,100 |

| 2014-15 |

$ 595,000 |

$ 16,600 |

$ 131,300 |

$ 28,900 |

$ 5,000 |

$ - |

$ - |

$ 776,800 |

| 2016-16 |

$ 595,000 |

$ 21,490 |

$ 136,400 |

$ 30,400 |

$ 5,000 |

$ - |

$ - |

$ 788,290 |

| 2016-17 |

$ 595,000 |

$ 22,900 |

$ 120,700 |

$ 27,300 |

$ 5,000 |

$ - |

$ - |

$ 770,900 |

| 2017-18 |

$ 595,000 |

$ 24,300 |

$ 118,500 |

$ 27,200 |

$ 5,000 |

$ - |

$ - |

$ 770,000 |

| 2018-19 |

$ 595,000 |

$ 24,500 |

$ 114,100 |

$ 27,600 |

$ 5,000 |

$ - |

$ - |

$ 766,200 |

| 2019-20 |

$ 595,000 |

$ 25,500 |

$ 211,500 |

$ 53,500 |

$ 5,000 |

$ - |

$ - |

$ 890,500 |

| 2020-21 |

$ 595,000 |

$ 26,000 |

$ - |

$ - |

$ 5,000 |

$ - |

$ - |

$ 626,000 |

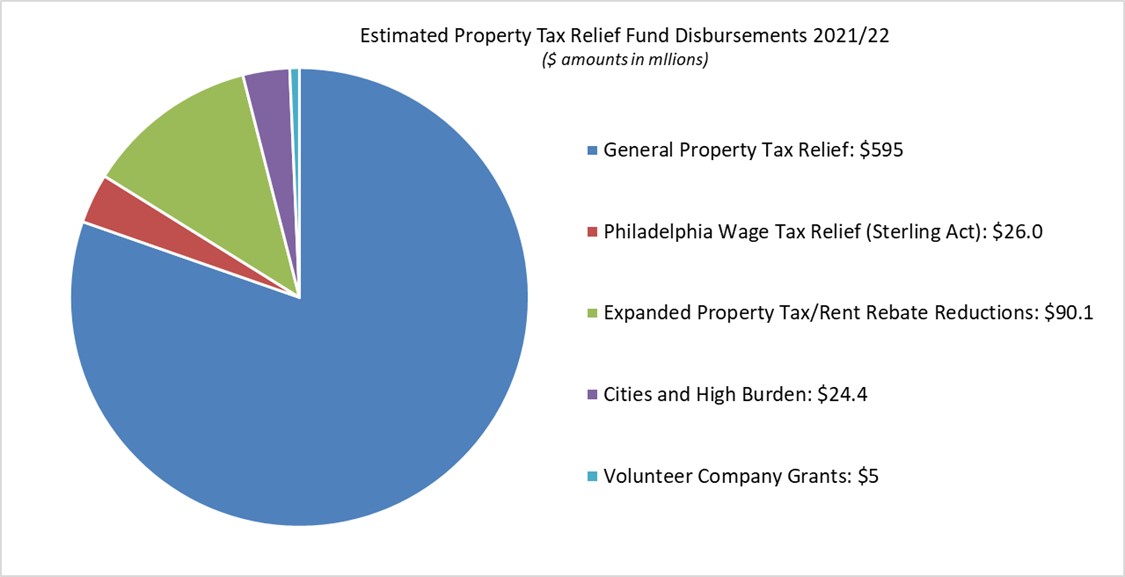

| 2021-22 |

$ 595,000 |

$ 26,000 |

$ 90,100 |

$ 24,400 |

$ 5,000 |

$ - |

$ - |

$ 740,500 |