Oil & Gas Management Funding: Primer

By Gueorgui Tochev , Senior Budget Analyst | 4 years ago

Environment & Energy Analyst: Gueorgui Tochev, Senior Budget Analyst

Marcellus Shale is a rock formation sitting beneath two-thirds of Pennsylvania and portions of New York, Ohio, West Virginia, Maryland, Kentucky, and Virginia, and it holds trillions of cubic feet of natural gas. While economically advantageous, the rapid growth of the Marcellus Shale natural gas industry in Pennsylvania has to be responsibly managed and maintained.

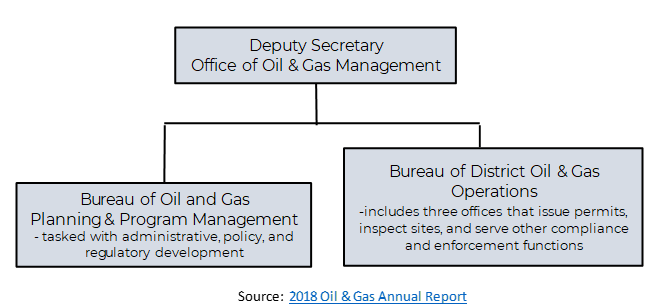

The Department of Environmental Protection (DEP) Office of Oil and Gas Management regulates the exploration, development, and recovery of Marcellus Shale natural gas reservoirs while working to protect the commonwealth’s other natural resources and its environment.

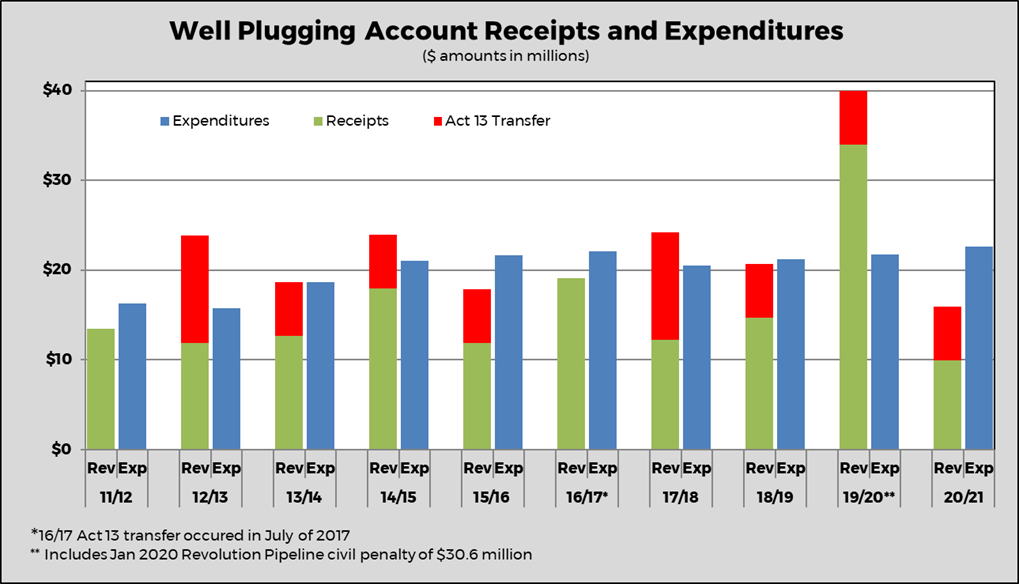

Continuing for a long time, DEP’s legally required oil and gas management efforts have been hampered by fiscal constraints all in the face of a burgeoning natural gas industry. The well plugging account funds these statutorily required operations, but expenditures have outpaced revenues for several years. DEP has supplemented this account with revenue it receives from Pennsylvania’s natural gas impact fee (Act 13 of 2012). However, this critical budget-balancing maneuver has been insufficient to cover expenses.

Ironically, the well plugging account is not indicative of its purpose. Separate accounts pay for plugging abandoned or orphaned wells and today’s businesses are required to plug their own wells, which leads to another issue. In the case of orphaned and abandoned wells, the ability to close these wells is artificially limited by the available funds despite long-term demand.

Funding concerns and environmentally sound policies could be supported through the enactment of a Severance Tax and dedicating a portion of it to managing oil and gas exploration. Enactment of such tax could generate over $300 million annually.

Permit Review Process

The Environmental Quality Board (EQB), associated with DEP, sought for a number of years to increase permitting fees to help cover expenses associated with legally required government oversight of well drilling-related activities. Even prior to the 2020 fee increase, the administration along with DEP has been working to improve administrative efficiencies.

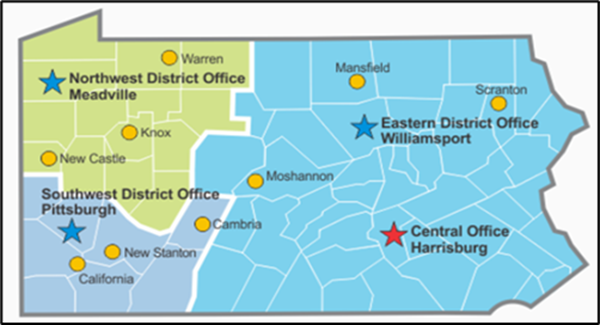

As part of its oversight of the construction of oil and gas wells and the development of drilling sites, the Office of Oil & Gas Management reviews permit applications. Gov. Wolf and DEP have worked to reduce permit backlogs, modernize the permitting processes, and use new technology to improve the commonwealth’s oversight. As part of this effort, DEP developed an online permit application consultation tool, or PACT, designed to help potential applicants determine which environmental permits, authorizations or notifications are needed for a specific project. Furthermore, starting in January of 2021, the department fully transitioned to ePermitting and a complete phase-out the eWell application. The most common permitting options, as provided by the 2020 Annual Report include:

- Erosion and Sediment Control General Permits (E & S Permit) – required for well operators that plan to disturb more than five acres of land during the well construction process;

- Water Obstruction and Encroachment Permits – to build bridges and pipelines that cross waterways; and

- Drill and Operate Well Permits – to authorize the actual construction of a conventional or unconventional well

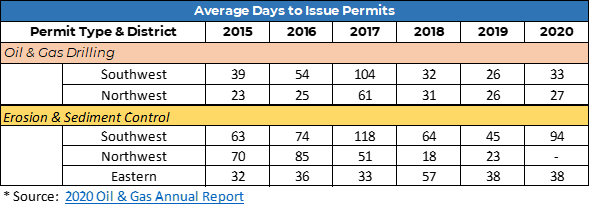

The administration’s efforts to reduce backlogs have played a significant role in reducing the timeframes of Oil & Gas Drilling and E & S permits. As it relates to Oil & Gas Drilling permits, the current review process takes 33 days in the SW District and 27 days in the NW District. In connection to E & S permits within the SW District permit review has been reduced from an average of 118 days in 2017 to 94 days in 2020. Similarly, efforts in timeframe review reduction have resulted in improved turnaround for NW District as well.

Lastly, full-time utilization of the oil and gas mobile Surface Activities Inspection Report (SAIR) application, by inspection staff, has further streamlined the inspection process.

*Source: DEP Website

Statutory Authority for Managing Oil and Gas Activity

Several state and federal regulations direct the Department of Environmental Protection in its management of all oil and gas activity in Pennsylvania.

Title 58 codifies the commonwealth’s oversight and was last amended by Act 13 of 2012. Act 13 is best known for implementing the impact fee on unconventional natural gas wells, but it contains many other oil and gas-related provisions.

Today, under Title 58, the Environmental Quality Board must promulgate regulations affecting the oil and natural gas industry, including fee setting. Other provisions require oil and gas well operators to pay for permits and other fees that are deposited into the well plugging account to support the legally required administration of oil and gas programs. Additionally, DEP annually receives $6 million from the impact fee to administer clean air and water statutes, which DEP has been using to shore up the faltering well plugging account.

Today, Title 58 requires operators to plug non-producing wells. In addition, other permit surcharges are dedicated to separately support orphaned and abandoned well plugging programs housed outside the well plugging account but part of oil and gas management efforts.

Well Plugging Account - Expenditures vs. Revenues

The well plugging account is the depository for revenues generated by permit and registration fees, bond forfeitures, and fines and penalties from oil and gas well operators. Collected revenue finances the Office of Oil & Gas Management. It also pays for personnel, operating, and other miscellaneous costs associated with oil and gas industry oversight, which includes inspectors, permitting enforcement, management, administrative, and legal staff.

Permitting fees held at $100 for nearly a quarter century after the enactment of the Oil and Gas Act of 1984, a pre-cursor to today’s statute. However, in response to the increase in operating expenses required to regulate the burgeoning Marcellus Shale natural gas industry, the EQB increased permit fees in 2009 from $100 to a sliding scale based on the linear length of the drilled well bore. With the sliding scale, the average Marcellus Shale well permit fee increased to $3,200.

In 2013, DEP’s 3-Year Regulatory Fee and Program Cost Analysis Report proposed a rulemaking to change the sliding scale to a flat fee. In 2014, the Independent Regulatory Review Commission approved EQB proposal to implement a flat fee of $5,000 for non-vertical unconventional wells and $4,200 for vertical unconventional wells.

In 2017, as part of its effort to reduce site inspections time, and thus reduce personnel costs, DEP launched a mobile app to enable inspectors to conduct electronic inspections via tablet computers. Electronic inspections increase efficiency and the quality of the collected data and provide faster public access to the inspection results using DEP’s eFACTS database.

In a June 2020 meeting, the Independent Regulatory Review Commission (IRRC) approved final-form rulemaking, as part of which the unconventional well permit application fee was increased to $12,500. Such a fee increase was driven by multitude of reasons. Such reasons include: (1) the disparity between oil and gas program revenues and expenditures (permit fees, inspection & personnel costs, etc.); (2) the department’s cost of administering the program to remain compliant with state law; and (3) as provided for by EPA, DEP lacks adequate resources to carry out its federally mandated responsibilities as it relates to NPDES Program. The Oil and Gas program disparity is caused by a constant change in the number of well permit applications, expansion of DEP program obligations and operations due to well inventory, development and inspection activity, and the need to provide industry guidance and technical tools.

Unconventional vs. Conventional Wells

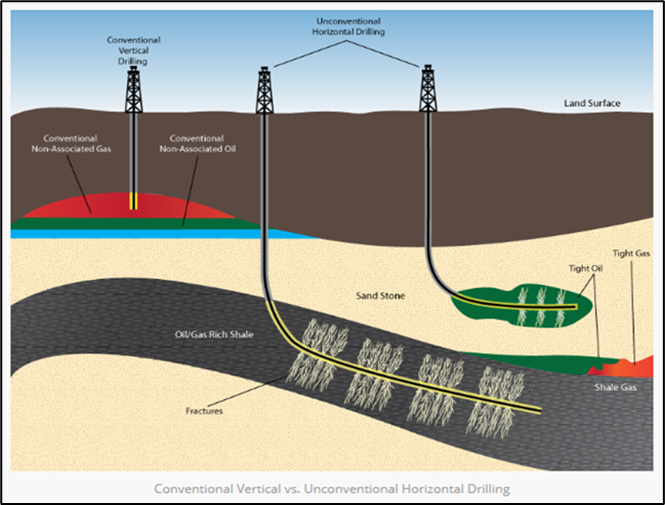

An unconventional well is one that is drilled in an unconventional formation, which is defined as a geologic shale accumulation below the base of the Elk Sandstone or its geologic equivalent where natural gas generally cannot be produced except by horizontal or vertical well bores stimulated by hydraulic fracturing due to low permeability and porosity.

Source: http://www.sanchezenergycorp.com/media-center-2/industry-library/shale-development/

A conventional well is one that produces oil or gas from a more typical formation (rock formations that have high porosity and permeability). In a conventional well, oil/gas is extracted by natural pressure from the well and pumping operations

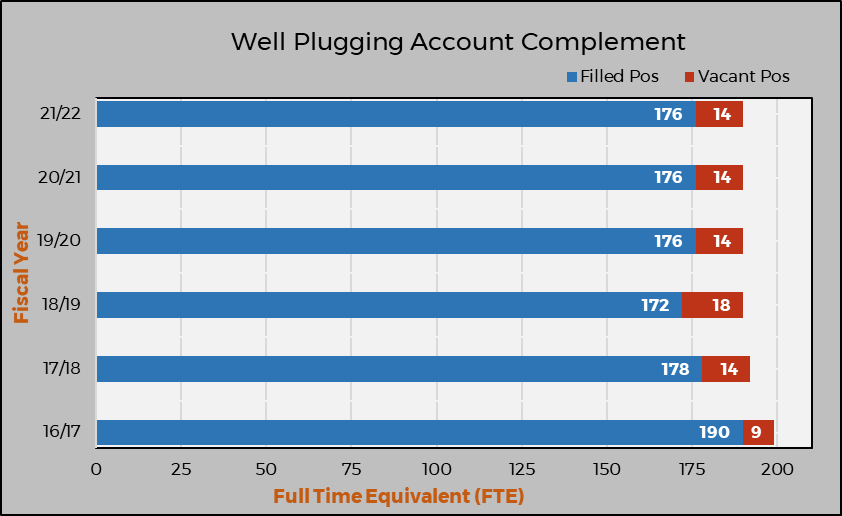

In addition to revenues from various permit fees, DEP utilizes a portion of the Act 13 impact fee levied on unconventional natural gas wells. Since the 2012 amendment to Title 58, the department’s $6 million annual allocation from the impact fee is transferred into the well plugging account. The continuing growth of the Marcellus Shale natural gas industry in Pennsylvania has financially strained the department due to its legally required functions including permitting, inspections, and general industry oversight. Coupled with industry growth, the stagnant level of authorized positions in the Office of Oil and Gas Management has created additional pressure on the department. The complement has not kept up with the demands of industry expansion.

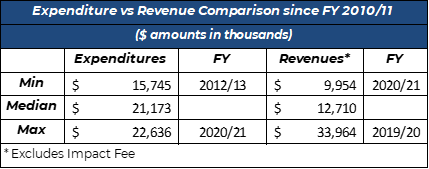

Since the shale boom started, in 2010, well plugging account expenditures have outpaced revenues in all but one year. The Act 13 of 2012 transfer has been vital to DEP’s ability to do this work. From 2010/11 through 2020/21, expenditures averaged about $20.17 million per year, while revenues, excluding impact fee proceeds, have averaged $15.7 million per year. It should be noted that revenue average is volatile and is skewed upward by the 2020 Revolution Pipeline civil penalty of $30.6 million. As a result of this volatility, a comparison of the highest, lowest, and median figures is more suitable. As the Expenditures vs Revenue comparison shows, fiscal year costs are relatively stable, while revenues (aside from the impact fee allocation) fluctuate greatly.

Funds from the well plugging account cover personnel and operational expenditures: the former constituting most of the account’s payments. As previously discussed, disbursements are made for oil and gas field operations, resource management, and water management. Ironically, DEP depends on revenues received by the Marcellus Shale natural gas industry to ensure sound production procedures and the proper use of available resources.

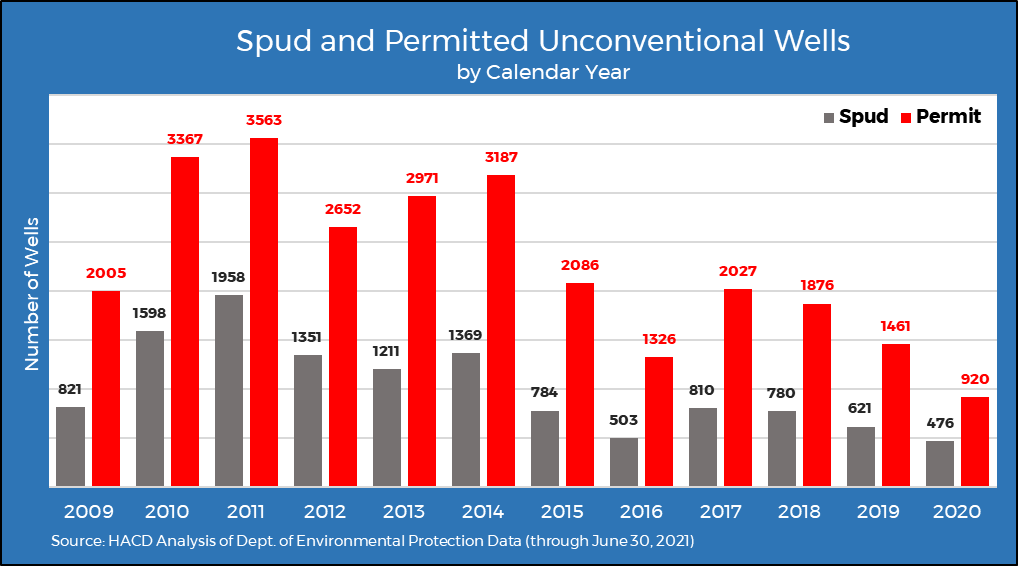

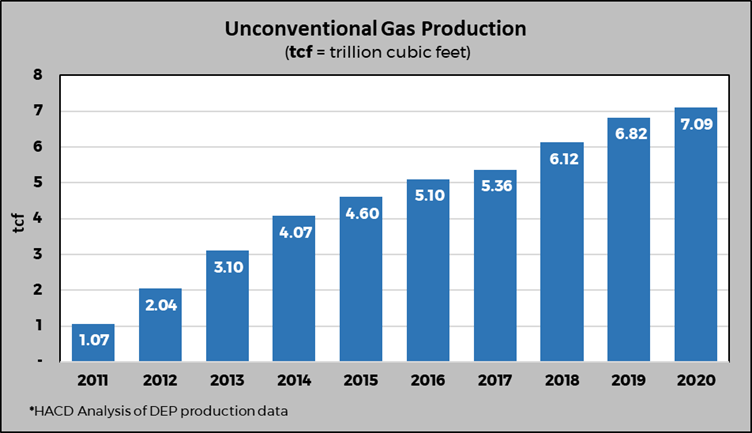

A root cause for the fact that revenues in the well plugging account have not kept pace with a flourishing industry is the drop-off of approved permits. Through the end of 2020, there were 920 permitted and 476 spud unconventional wells -- in other words, a 37 percent drop in permitted unconventional wells, compared to 2020. This trend is consistent with the industry’s improved efficacy of shale gas extraction. This means that while extracted volume has increased since 2011, the trend of well permits has been decreasing, resulting in revenues that are not keeping up with expenditures.

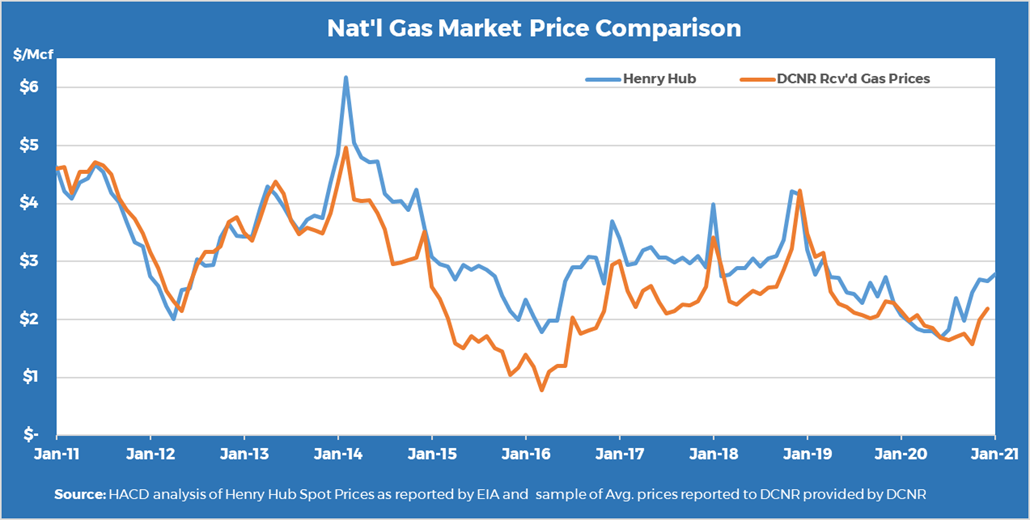

As part of a discussion of production levels, it is worth noting that availability of drilling infrastructure, as well as ever increasing extraction levels, are contributing factors affecting the regional hub prices of natural gas, which producers in the state receive to shore up their bottom line. An unintended consequence of ever-increasing supply of natural gas is the price trend of regional hub prices. An analysis of the gap between regional and national (Henry Hub) natural gas prices reveals that such differences have fluctuated since 2011 but have greatly diminished since the latter part of 2018. Please reference the natural gas market price comparison below.

Abandoned and Orphan Well Plugging Program

DEP pays to close abandoned and orphaned wells with separate appropriations dedicated to each type of well.

An abandoned well is one that has not produced gas or oil within the preceding 12 months or one that no longer holds production equipment. Orphaned wells are those abandoned prior to April 18, 1985 and have not been operated by the present owner or the present owner has not received an economic benefit other than royalty interest.

Plugging abandoned and orphaned wells is prioritized based on DEP inspections. DEP plugged its first abandoned well in 1989. Surcharges to fund orphaned and abandoned well-plugging operations were established in the Oil and Gas Act of 1984, a pre-cursor to current law.

The Oil and Gas Act of 2012 continued the provision for surcharges within Section 3271. Permit surcharges are in addition to the permit application fees paid by oil and gas operators. The abandoned well surcharge is $50 for all permits, while the orphaned well surcharge is $200 and $100 for gas and oil well permits. By law, DEP requires notification within 60 days of an abandoned well discovery.

Since the first commercial oil well in Pennsylvania in 1859, as many as 760,000 oil and gas wells have been drilled, but the locations of nearly three-quarters of them (560,000) are unknown. DEP has plugged 3,433 wells and it counts 8,663 orphaned and abandoned wells in the commonwealth. Unfortunately, demand to address these wells is artificially limited by the funds available.

DEP’s Oil and Gas Management division is critical in ensuring a proper balance between the public health and welfare of the citizens of the commonwealth and support for the natural gas industry. Therefore, proper funding is critical.

The Wolf administration and the General Assembly must work together to determine viable ways to better support Oil & Gas Management and its missions.