2025/26 Executive Budget Briefing

By House Appropriations Committee Staff , | one year ago

2025/26 Combined operating Budget

Gov. Shapiro’s 2025/26 executive budget proposes a combined total operating budget of $133.7 billion. The operating budget is comprised of:

- $51.5 billion in state General Fund expenditures, representing an increase of $3.5 billion or 7.5%

- $53.1 billion in federal funds, an increase of $3.2 billion or 7%

- $2.1 billion in Lottery Fund expenditures, representing a decrease of $56.3 million or 2.5%

- $3.2 billion in Motor License Fund expenditures, an increase of $34.4 million or 1.1%

- $23.7 billion in other special funds, augmentations, and restricted accounts

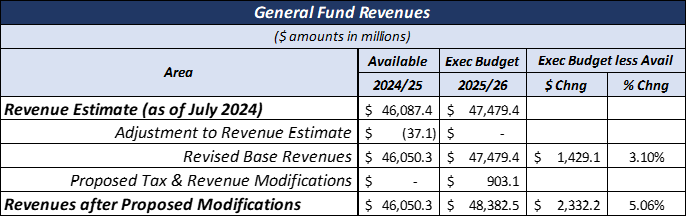

On July 11, 2024, the Official Estimate for Fiscal Year (FY) 2024/25 was certified at $46.08 billion. The executive budget proposal projects that 2024/25 General Fund revenues will be $37.1 million lower than the Official Estimate for a total of $46.05 billion. As of January 31, 2025, year-to-date General Fund revenues were $148.3 million or 0.6% below estimate.

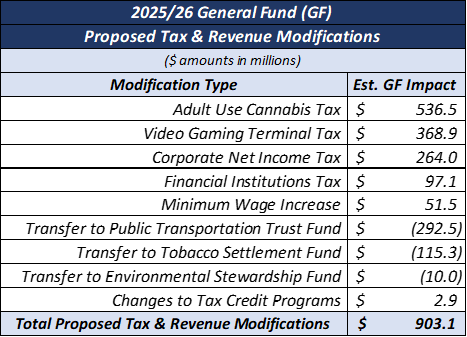

Based on the projected revenues for FY 2024/25, base revenues for FY 2025/26 are projected to increase by $1.4 billion, or 3.1% year-over-year. The executive budget proposes $903.1 million in tax and revenue modifications, resulting in a FY 2025/26 General Fund revenue estimate of $48.3 billion, an increase of $2.3 billion or 5.06% over the prior year.

The executive budget proposes the implementation of a new tax and expands and eliminates several existing taxes:

Adult Use Cannabis Tax

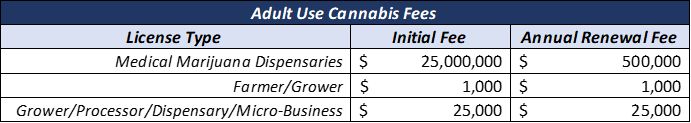

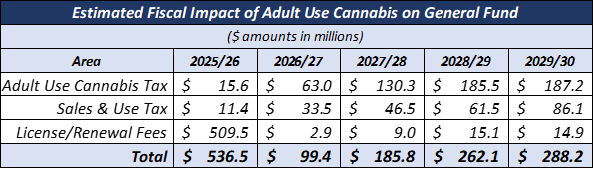

The governor proposes to legalize Adult Use Cannabis and imposes a 20% tax on the wholesale price of products sold through the regulated framework of the production and sales system. The proposal assumes that sales would commence January 1, 2026, with initial revenues realized in FY 2025/26. Furthermore, the tax revenues generated would be deposited into the General Fund, whereas license and fee revenues would be deposited into a restricted account created within the General Fund. Lastly, the proposal provides for the following off-the-top distributions:

- $10 million to the Commission on Crime and Delinquency (PCCD) for restorative justice

- $15 million to the Department of Agriculture for operations

- $25 million to the Department of Agriculture to assist small & diverse businesses entering the Adult Use market

- $2.25 million to the State Police for enforcement and expungement

- $1.5 million to the Department of Revenue for administration

This budget proposes the following license fees for Adult Use Cannabis:

Projected revenues from Adult Use Cannabis are as follows:

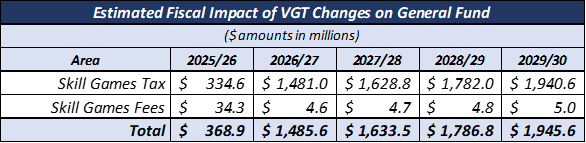

Video Gaming Terminal (VGT) Tax

The 2025/26 executive budget proposes regulating currently unlicensed skill games, gaming machines that involve an element of skill, under the existing Video Gaming Terminal (VGT) tax structure starting July 1, 2025. These games would be regulated by the Pennsylvania Gaming Control Board. Like existing VGTs, skill games would be taxed at 52% of Gross Terminal Revenue (GTR) with revenue proceeds deposited into the Video Gaming Fund. The proposed license, application, and renewal fees would be deposited into the General Fund.

While the overall VGT tax would remain at 52%, the budget proposes a modification of individual segments of the assessment and distribution of the revenues. Additionally, the proposal limits the number of machines per establishment to a maximum of 5. The tax on all machines consists of two assessments:

- 5% of Gross Terminal Revenue (GTR) to be transferred to the Lottery Fund

- 47% of Gross Terminal Revenue (GTR) to be transferred to the General Fund

Corporate Net Income Tax (CNIT) Accelerated Reduction

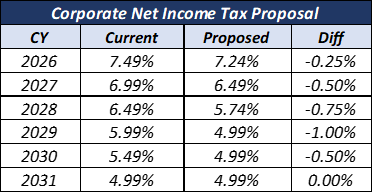

The 2025/26 executive budget also proposes an acceleration of the CNIT reductions from 0.5 to 0.75% per year, starting January 1, 2026. Additionally, the proposal includes adopting uniform filing requirements for Pennsylvania corporations in addition to including financial institutions to the tax base beginning January 1, 2026. Proposed rate cuts:

Financial Institutions Tax

The 2025/26 executive budget proposes the elimination of three taxes on financial institutions: the bank and trust company shares tax, mutual thrift institutions tax, and private bank tax. The elimination of these taxes would subject these companies to the Corporate Net Income Tax, beginning January 1, 2026.

Minimum Wage Increase

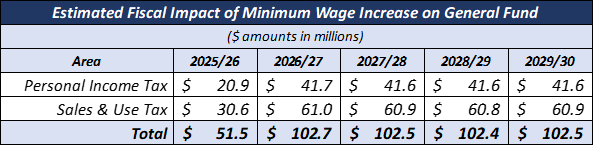

The 2025/26 executive budget also proposes to increase the minimum wage from $7.25 to $15.00 per hour for non-tipped workers and $9.00 per hour for tipped workers effective January 1, 2026. The 2025/26 budget estimates that raising the minimum wage will increase personal income tax proceeds by $20.9 million and sales and use tax proceeds by $30.6 million projecting $51.5 million in the budget year, annualized to over $100 million.

The 2025/26 executive budget proposes the following transfers from the General Fund (GF):

- From the GF to the Tobacco Settlement Fund, $115.3 million from cigarette tax to replace monies deducted from the Master Settlement Agreement to pay for debt service associated with the Tobacco Settlement Bonds

- From the GF to the Environmental Stewardship Fund, $10 million from personal income tax revenues for the Growing Greener debt service payments

- From the GF to the Public Transportation Trust Fund (PTTF), a new transfer of 1.75% of total sales and use tax beginning on July 1, 2025, totaling $292.5 million to support public transit agencies

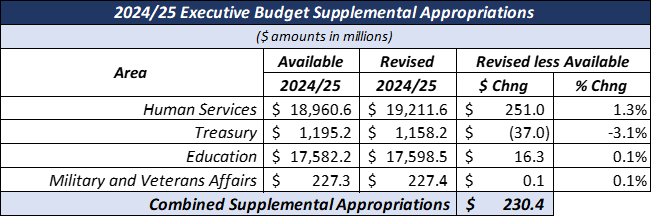

The 2025/26 executive budget proposes supplemental appropriations of $230.4 million that will increase FY 2024/25 General Fund spending to $47.9 billion. A significant portion of this increase is attributed to supplemental appropriations for the Department of Human Services (DHS) programs, which reflect increased projections of utilization, caseloads, and enrollments through the end of FY 2024/25.

The 2024/25 revenue estimate has been revised down by $37.1 million to $46.05 billion. The revised revenues along with the proposed supplemental appropriations for FY 2024/25 lead to a projected ending balance of $3.21 billion in the General Fund prior to the 10% statutory transfer to the Budget Stabilization Reserve Fund (a.k.a. the Rainy Day Fund). The executive budget assumes a transfer of $321.5 million to the Rainy Day Fund at the conclusion of the current fiscal year, resulting in an available balance of approximately $7.58 billion.

The 2025/26 executive budget proposal provides for $51.47 billion in General Fund expenditures which includes a $1.6 billion transfer from the Rainy Day Fund. The proposed expenditures for FY 2025/26 represent an increase of $3.5 billion or 7.4%. Furthermore, the executive budget also continues the utilization of $6 billion in federal funds made available through the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) in FY 2025/26.

According to the most recent data from 2022/23, Pennsylvania’s school districts, in aggregate, receive 37.3% of their revenue from state sources, 55.5% from local sources, 6.6% from federal sources, and 0.6% from other sources. This places Pennsylvania 42nd in terms of state support for education according to the U.S. Census. When state support is insufficient, communities with low property values cannot make up the difference needed to adequately fund schools no matter how much they tax themselves.

The Commonwealth Court declared Pennsylvania's public school funding system unconstitutional in William Penn School District, et al. v. Pennsylvania Department of Education, et al. (587 M.D. 2014), holding that Pennsylvania’s overreliance on local sources of funding contributes to a system of public education that discriminates against students based upon income and value of property, depriving many students of their constitutional right to a “meaningful opportunity to succeed academically, socially, and civically.”

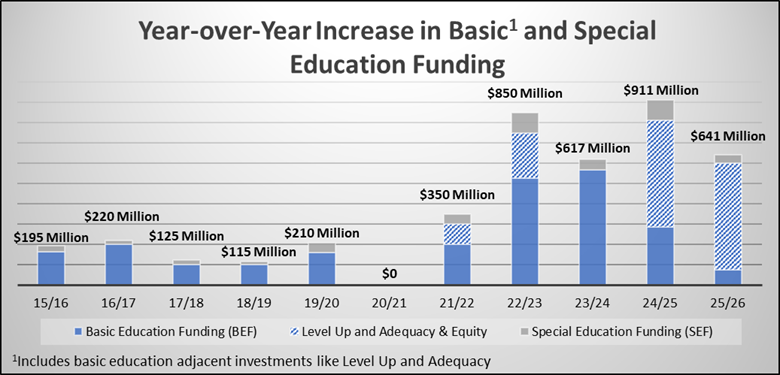

To improve state support for education, funding is typically provided through appropriations that offer general support, including basic education funding, special education funding, and the new adequacy and equity formulas. Gov. Shapiro’s 2025/26 budget proposal calls for increased investments in all three:

- $526 million increase in the Ready to Learn Block Grant

- $494 million more through the adequacy supplement (second installment; same amount as last year)

- $32 million more through the tax equity supplement (second installment; same amount as last year)

- $75 million or 0.9% increase in basic education funding (BEF)

- Last year’s budget reset the BEF base, bringing added stability and predictability to funding by locking in the $2 billion added since FY 2015/16. It also added $285 million, with $225 million going through the fair funding formula and $60 million allocated via a new hold-harmless relief supplement

- With a $75 million increase, $300 million or 3.6% of BEF would be distributed using the fair funding formula’s most up-to-date factors

- $40 million or 2.7% increase in special education funding (SEF)

Additionally, the governor proposes cyber charter school funding reform that is projected to save school districts $378 million. From a budgetary perspective, cost avoidance (savings) counts the same as revenue increases.

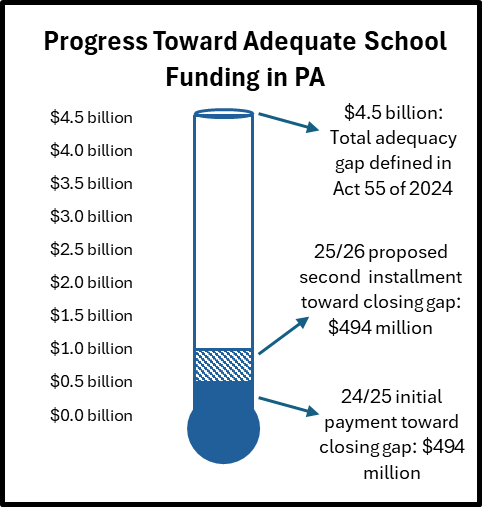

Adequacy and Equity

Last year, in response to the court ruling, the General Assembly enacted Act 55 of 2024, which calculated a state funding shortfall or “adequacy gap” of $4.5 billion statewide. A school district has an adequacy gap if it spends less per weighted student than the spending level of the median school district that is meeting the state’s academic standards. Out of PA’s 500 school districts, 348 have an adequacy gap defined in statute, with 274 districts’ shortfalls exceeding $1,000 per student.

The second installment of $494 million toward the adequacy gap continues the nine-year schedule to close the adequacy gap in Pennsylvania. The adequacy funding is contained in the Ready to Learn Block Grant appropriation. Districts are entitled to no less than the amount of Ready to Learn funding they received the year prior, which means that the adequacy payments made to districts in FY 2024/25 are included in the foundation amount for the next year. The adequacy formula prorates the $494 million increase based upon each qualifying school district’s share of the total adequacy gap.

Per Act 55, districts are required to report how adequacy money was used in accordance with allowable uses, which include: establishing, maintaining, or expanding programs that focus on high-quality academics, foster supportive learning environments, promote data-informed decision making, or design a system of multitiered supports.

The tax equity supplement is also in the Ready to Learn Block Grant appropriation. This funding is for the 50 school districts with the highest tax burdens in the commonwealth. Act 55 of 2024 calculated a $258 million total tax equity gap, which is the amount needed to offset the local revenue generated by these districts from taxing above the 90th percentile rate. The governor’s proposed 2025/26 budget provides a second installment of the tax equity supplement in the same amount as FY 2024/25 -- $32 million. This continues the eight-year schedule to close the tax equity gap in Pennsylvania.

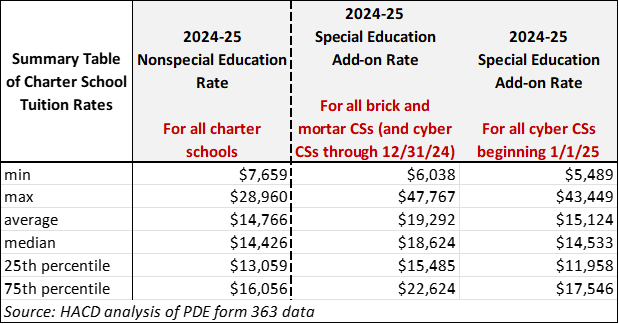

The governor’s proposed budget includes $378 million in cyber charter school tuition savings to school districts. These savings are generated by introducing a uniform cyber charter tuition rate of $8,000 per student, with no changes to the special education add-on payment.

The $100 million cyber charter transition reimbursement appropriation, which was implemented in the 2024/25 budget, is discontinued in this year’s executive budget proposal. Therefore, the statewide net impact of these two proposals reflects $278 million in savings to school districts.

The $378 million in savings to school districts from the proposed cyber charter funding reform constitutes about 35% of the $1.1 billion school districts spent on cyber charter tuition in FY 2022/23.

The cyber charter tuition rate calculation is established in statute, so any modifications require action by the General Assembly. Under current law, the school district where a cyber charter student resides is responsible for a tuition payment to the cyber school equal to the school district’s expenditures per student net of some deductions (e.g., transportation costs that remain the responsibility of the school district). There is no distinction between the payment to a brick and mortar charter school and a cyber charter school for a nonspecial education student. In FY 2024/25, the nonspecial education tuition payments ranged from $7,659 to $28,960, with a median tuition rate of $14,426.

The 2024/25 budget package included reforms to the special education tuition rate for cyber charter students. If a student requires special education services, the school district is responsible for paying an “add-on” amount on top of the nonspecial education rate. The add-on rate owed to cyber charter schools is calculated by dividing the school district of residence’s special education expenditures by its number of special education students. The add-on rate for brick and mortar charter schools is still predicated on the underestimation that 16% of students are special education students – an outdated assumption that artificially inflates the add-on tuition rate.

These changes were effective January 1, 2025, and are estimated to save school districts about $40 million for the second half of the school year and $80 million on an annualized basis.

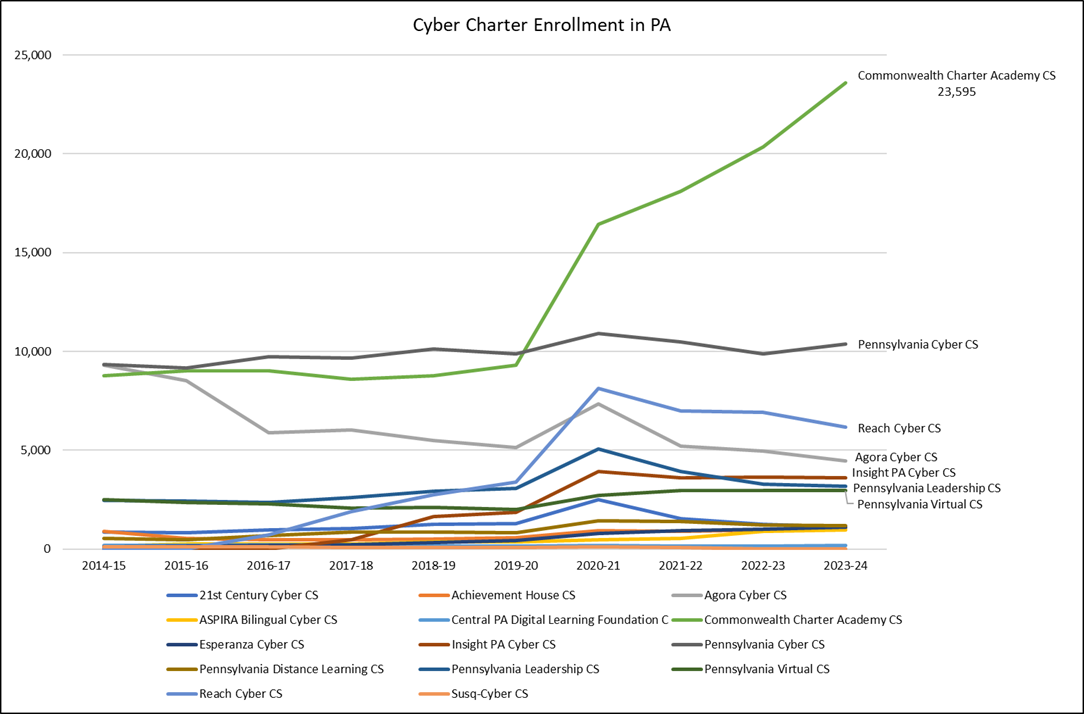

Currently, cyber charter schools make up about 4% of total average daily membership and brick and mortar charter schools make up about 6%. According to the most recent enrollment figures, cyber charter schools enrolled 59,913 students in FY 2023/24, and a historical trend shows cyber enrollments spiking after the onset of the COVID pandemic.

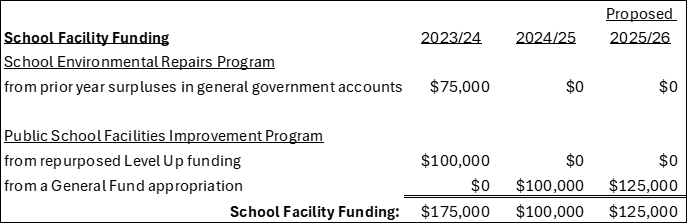

Gov. Shapiro’s 2025/26 budget proposal increases funding for the Public School Facility Grant Program by $25 million for a total of $125 million. These competitive grants are administered by the Commonwealth Financing Authority (CFA) and support a broad range of projects such as roof or window repairs, HVAC needs, and plumbing systems.

The 2024/25 fiscal code (Act 54 of 2024) required $25 million of the $100 million provided in FY 2024/25 to be used for the Solar for Schools Grant Program. The governor’s 2025/26 budget proposal recommends continuing the $25 million investment in solar projects.

Although PlanCon, the state’s school facility reimbursement program for new buildings or major renovations, is not open for applications, the state is still paying the legacy costs of PlanCon 1.0, which has not accepted new projects since 2016. In 2019, the legislature enacted the PlanCon 2.0 recommendations of a bipartisan committee; however, no funding has been allocated to reopen PlanCon.

- Early Childhood Education

- $15 million initiative to increase the reimbursement rates in the Pre-K Counts program

- Level funding for Head Start Supplemental Assistance

- $14.3 million or 3.4% increase for Early Intervention after a recommended $16.3 million supplemental increase for the current fiscal year; the governor proposes to increase provider rates

- Maintains the $100 million allocation for School Safety – Physical and Mental Health

- Maintains the $7 million for Dual Enrollment

- A $2.5 million or 50% increase for teacher professional development programs

- A $6 million initiative within Adult and Family Literacy to improve the quality and capacity of programs

- Providing a $150 million or 4.9% increase in pension reimbursement in order to meet the Public School Employee’s Retirement System’s (PSERS) actuarially required contribution for the 11th straight year

State funding for Penn State University, University of Pittsburgh, and Temple University has remained level for the past five years. The governor proposes an additional $60 million in new competitive funding be made available to these three state-related universities. This competitive funding is intended to incentivize these institutions to provide results that directly benefit the commonwealth.

Distribution of the proposed competitive funding would likely be based on the recommendations of the Performance-Based Funding Council (PBFC), which was established in Act 90 of 2024 to develop a process to distribute funding to state-related universities utilizing performance-based metrics. Per Act 90, the PBFC’s recommendations are due no later than April 30, 2025.

Outside of the performance-based funding process, the budget proposal provides a 5% increase to both Lincoln University and the Pennsylvania College of Technology.

The governor’s 2025/26 budget proposes:

- $40.3 million or 6.5% increase for the Pennsylvania State System of Higher Education (PASSHE), which is the amount requested by its Board of Governors in order to keep tuition frozen for an eighth straight year

- $13 million or 4.7% increase for Community Colleges

- Flat funding for the Community College Capital Fund

- $1.1 million or 4.9% increase for Thaddeus Stevens College of Technology

PHEAA’s flagship program is the State Grant Program, which provides needs-based financial aid to Pennsylvania students that attend an approved postsecondary institution. The 2024/25 budget proposal includes a slight increase to maintain the maximum grant award level at $5,750.

The 2025/26 budget proposal includes $40 million for student teacher stipends. The 2023/24 budget appropriated $10 million for the new student teacher support grant program, but with the program enacted in December of 2023, PHEAA began the program with fall 2024 student teachers. The 2024/25 budget included an additional $20 million, resulting in a total of $30 million available for the 2024/25 school year. Based upon application demand (over 4,000 applications), PHEAA estimated that it would need $45 million to provide the $10,000 stipend to each eligible student teacher and $2,500 grant to each cooperating mentor teacher for the 2024/25 school year.

The 2025/26 executive budget includes a myriad of funding changes and new initiatives, as well as the addition of 37 new positions. Changes occur within the following areas:

- Office of Administration - $1.48 million increase, which includes $610,000 in IIJA matching funds

- The addition of 23 new positions

- 1 new position for a Penn Fellow

- 34 new positions transferred from Department of Corrections

- A reduction of 12 positions transferred to the Office of Digital Experience

- Commonwealth Office of Digital Experience – $10.2 million increase, including $500,000 in IIJA matching funds

- Includes $6.9 million initiative for the improvement of user digital experience

- Includes the transfer of 12 positions from the Office of Administration

- Enhanced Enterprise Cybersecurity – new $10 million line item

- Transfer to Enterprise Systems Lifecycle - $20 million to continue replacement of Commonwealth’s Enterprise Resource Planning (ERP) software system

The 2025/26 proposed budget includes an overall supplemental increase to General Fund request for FY 2024/25 for the Department of Human Services (DHS).

The proposed supplemental increase to Human Services appropriations totals $357 million and reflects increased projections of utilization, caseloads and enrollments anticipated through June 2025.

This supplemental increase is offset by reductions in appropriations, including a $106 million supplemental decrease, resulting in a net increase of $251 million in General Fund appropriations for 2024/25.2024/25 Highlights

The governor’s proposed budget includes $21.2 billion for FY 2025/26 for Human Services programs. This is an increase of $2 billion, or 10.2%, over 2024/25. Major factors for this increase fall into the following categories:

- The impact of changes in federal funding,

- Costs to maintain the current programs, and

- Program initiatives.

American Rescue Plan Act Funding – Medical Assistance

The American Rescue Plan Act provided a temporary 10% in additional Federal Medical Assistance Percentage (FMAP) for MA Home and Community-Based Services (HCBS) between April 1, 2021, and March 31, 2022. The federal government required that any state savings from the temporary FMAP increase must be used to implement programs that enhance, expand, or strengthen the HCBS services available under the MA program. The proposed 2025/26 budget includes approximately $203.6 million in state General Funds to maintain some of the HCBS initiatives.

Federal Medical Assistance Percentage (FMAP)

Under the formula in the Social Security Act, Pennsylvania’s regular FMAP will increase effective October 1, 2025, from 55.09% to 56.06%. As this increase takes effect on October 1, 2025, the governor’s executive budget uses a blended rate to account for the fact that the July to September 2024 quarter will have a different FMAP. This blended rate will increase from 54.85% in 2024/25 to 55.82% in FY 2025/26. State savings due to the higher regular FMAP are estimated to be $420 million.

MA Managed Care Rates

The MA - Capitation appropriation provides funding for the MA managed care program for physical and behavioral health services, also known as the HealthChoices program. The 2025/26 proposed budget for this program assumes an increase in state General Funds of $919.2 million over FY 2024/25.

The MA – Community HealthChoices appropriation provides funding to the MA managed care program that provides a wide array of services to low-income older adults, low-income individuals with qualifying disabilities, or individuals that are eligible for both Medicare and Medical Assistance programs. The 2025/26 proposed budget also includes an increase of $861 million over FY 2024/25 to continue the current program.

Increases in these appropriations are attributed to changes in the number of individuals that are eligible for each program and changes to the rates paid by DHS to the participating MA managed care organizations.

Intellectual Disabilities – Community Waiver Program

The 2025/26 budget proposal includes an increase of $167.6 million to continue the current program and fund the 250 spots in the Consolidated Waiver and 1,250 spots in the Community Living Waiver that were added in FY 2024/25 for a full 12 months.

The governor’s proposed budget for 2025/26 includes several new initiatives for Human Services programs.

Medical Assistance – Hospital Access and Services

The 2025/26 budget proposes an increase to state General Funds for the MA – Fee-for-Service appropriation of $20 million for hospitals which will be matched with federal funds. From this amount $10 million will help to maintain access and services to hospitals throughout the commonwealth and $10 million will help maintain access and services in rural hospitals.

Patient Safety & Support for Hospitals

The 2025/26 budget proposes to fund a new appropriation totaling $20 million which provides for patient safety and support to hospitals to help address barriers to care which include affordability, transportation, and access to reliable providers.

Medical Assistance – Reentry

In addition to hospital access and services, the budget also proposes an increase to state General Funds for the MA – Fee-for-Service appropriation of $4.8 million to provide Medical Assistance coverage for individuals that are expected to reenter the community after incarceration and provides DHS with funds to make infrastructure changes necessary to provide these individuals with Medical Assistance services 90 days prior to the date of their release.

Medical Assistance - Long-Term Care Managed Care

The governor’s proposed budget includes an increase of $2.3 million in state General Funds to add 180 spots in the Living Independence for the Elderly, or LIFE program.

Medical Assistance – Long-Term Services and Supports

The governor’s executive budget proposes a $20 million increase to MA – Community HealthChoices appropriation and $1 million increase to the MA – Long-Term Living appropriation for a combined increase of $21 million in state General Funds which will be used to increase Direct Care Worker wages paid under the participant-directed model of care in DHS’ MA Long-Term Living programs. This increase includes wage increases, paid time off, and increases to help these direct care workers afford insurance.

Mental Health Services

The governor’s budget proposes an increase of $5.8 million to expand diversion and discharge programs for individuals with mental illness currently in the criminal justice system, and an increase of $1.6 million to fund home and community-based services to 20 individuals currently residing in the state hospitals.

Mental Health - County Based Services

The 2025/26 budget proposal maintains $40 million for county based mental health services which was added to the appropriations in prior fiscal years and proposes to increase this amount by an additional $20 million for a total of $60 million.

Mental Health - Crisis Intervention & 988 Network Services

In addition to the county based mental health services, the 2025/26 budget proposes an increase of $10 million over the prior year to provide support for the 988 network and an increase of $5 million to maintain walk-in mental health crisis stabilization centers.

Early Intervention – Rate Increase

The proposed budget includes a $10 million increase in the Early Intervention appropriation to provide a rate increase to Early Intervention providers.

Subsidized Child Care

The governor’s executive budget includes an increase of $2.7 million to provide an increase in the minimum wage for child care workers.

Child Care Recruitment and Retention

In addition to increasing the minimum wage for child care workers, the proposed 2025/26 budget includes a new appropriation totaling $55 million which will be used to support the child care workforce through recruitment and retention of child care workers. This funding would provide grants in the amount of approximately $1,000 per year for each child care worker employed by licensed childcare centers that have an agreement to provide services to children in the commonwealth’s subsidized child care program.

The governor’s proposed 2025/26 budget includes $1.5 billion for County Child Welfare appropriation which is flat funded to the appropriated amount for FY 2024/25. In addition to state General Funds, the County Child Welfare program also receives appropriations from federal funds. The combined total state and federal appropriations total $2.1 billion.

The proposed budget includes an increase in state funds to the Youth Development Institutions and Forestry Camps appropriation totaling $5.6 million to allow DHS to build capacity to accept court-order placements to adjudicated male youth.

The governor’s executive budget maintains funding at the same overall level as the prior year for:

- MA – Physician Practice Plans - $10.6 million

- MA – Hospital Burn Centers - $4.4 million

- MA – Obstetric and Neonatal Services - $10.7 million

- MA – Trauma Centers - $8.7 million

- MA – Academic Medical Centers - $24.7 million

- Community-Based Family Centers - $34.6 million

- Expanded Services for Women - $8.3 million

- Nurse Family Partnership - $14 million

- Domestic Violence - $22.6 million

- Rape Crisis - $11.9 million

- Human Services Development Fund - $13.5 million

- Legal Services - $6.7 million

- Homeless Assistance - $23.5 million

- Services for the Visionally Impaired - $4.7 million

The proposed budget reflects a transfer of $7.9 million in state General Funds from the MA – Critical Access Hospital appropriation to the MA – Capitation appropriation due to a change in the payment methodology. With this transfer, the 2025/26 budget proposes to eliminate the MA – Critical Access Hospital appropriation.

The proposed budget does not include funding for the Health Program Assistance Services appropriation which is a decrease to state General Funds of $32.8 million.

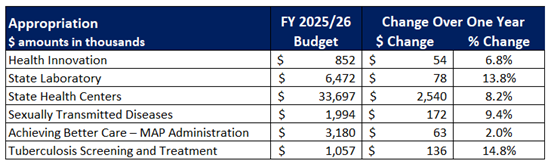

The 2025/26 executive budget proposes $276.6 million in state General Funds for the Department of Health (DOH), a $24.5 million, or 9.7% increase over FY 2024/25. The governor’s budget proposes to increase General Government Operations (GGO) by $2.2 million, or 6.9%, to a total of $34.2 million. Included in this increase is $994,000 to support the Department of Health’s (DOH) Viral Hepatitis Elimination Plan. The governor’s budget proposes adding eight new positions to support DOH’s administrative efforts toward the PA viral Hepatitis Elimination Plan, maternal health, long-term care facilities, and to implement the certified medication aides program.

The governor’s budget includes the following new appropriations for FY 2025/26:

- $5 million for Neurodegenerative Disease Research which will provide research grants related to neurodegenerative illnesses.

- $7.5 million for Long-Term Care Transformation Office which will provide state resources to the Long-Term Care Transformation Office to continue to support Pennsylvania’s long-term care facilities.

The governor’s budget proposes to increase the following appropriations to include new initiatives:

- $15 million or 179.7% increase to Primary Health Care Practitioner appropriation

- $10 million to expand the program to address workforce shortages in behavioral health.

- $5 million to expand the program to address workforce shortages in rural communities.

- $3 million or 9.9% increase to Quality Assurance appropriation

- $216,000 to implement the Certified Medication Aides program that was established through Act 109 of 2024.

The governor’s budget proposes to increase the following appropriations over FY 2024/25 to continue the current programs:

The governor’s executive budget proposes to reduce or eliminate the following appropriations:

- Bio-Technology Research ($11.2 million, program elimination)

- Local Health Departments ($755,000 or 2.1% decrease)

The governor proposes level funding for the many disease-specific appropriations. The governor’s executive budget maintains funding at the same overall level as the prior year for:

- Health Promotion and Disease Prevention - $5 million

- Community-Based Health Center Subsidy - $2 million

- Newborn Screening - $7.3 million

- Cancer Screening Services - $2.6 million

- AIDS Programs and Special Pharmaceutical Services - $10.4 million

- Regional Cancer Institutes - $2 million

- School District Health Services - $37.6 million

- Local Health – Environmental - $2.7 million

- Maternal and Child Health Services - $1.4 million

- Diabetes programs - $112,000

- Renal Dialysis - $6.7 million

- Services for Children with Special Needs - $1.7 million

- Adult Cystic Fibrosis and Other Chronic Respiratory Illness - $795,000

- Cooley’s Anemia - $106,000

- Hemophilia - $1 million

- Lupus - $106,000

- Sickle Cell - $1.3 million

- Regional Poison Control Centers - $742,000

- Trauma Prevention - $488,000

- Epilepsy Support Services - $583,000

- Tourette’s Syndrome - $159,000

- Amyotrophic Lateral Sclerosis Support Services - $1.5 million

- Lyme Disease - $3.2 million

The 2025/26 executive budget proposes $48.4 million in state General Funds for the Department of Drug and Alcohol Programs. The governor’s budget proposes to increase General Government Operations by $123,000 or 3.5% to a total of $3.6 million. Funding available for Drug and Alcohol programs is level funded to FY 2024/25 levels at $44.7 million.

- General Government Operations - $3.6 million

- Assistance to Drug and Alcohol Programs - $44.7 million

The 2025/26 executive budget proposes a $4 million increase to the Pennsylvania Health Care Cost Containment Council to establish an All-Payer Claims Database. This Database will collect medical claims information and eligibility and provider information from both private and public payers, including managed care organization participating in MA managed care and Medicare.

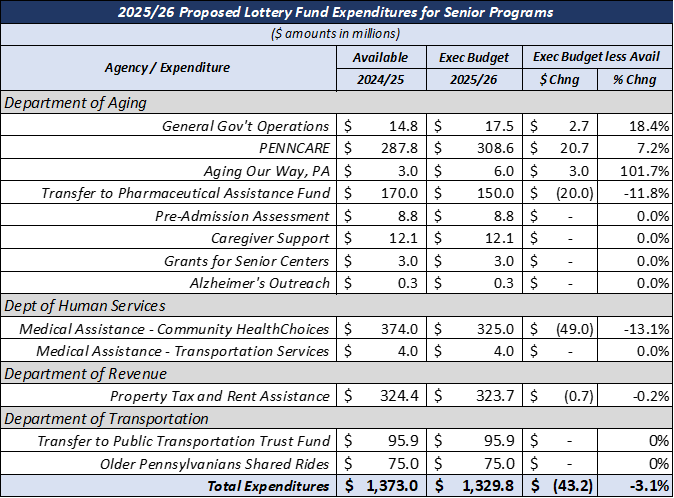

There is a proposed increase of $20 million for the PENNCARE appropriation over FY 2024/25 to provide operational resources to the Area Agencies on Aging (AAAs) to meet increased service needs of older adults. The PENNCARE appropriation funds the OPTIONS program, which provides home and community-based services to qualified older adults so that they can continue to live in their homes.

The 2025/26 executive budget proposal also includes an increase to the General Government Operations appropriation of $2 million for the Department of Aging to improve oversight and accountability of the Area Agencies on Aging network.

The governor’s executive budget also includes an increase of $3 million over FY 2024/25 for the Aging Our Way, PA appropriation. This appropriation funds initiatives identified within the Aging Our Way, PA plan which proposed to transform the infrastructure and coordination of services for older adults in the commonwealth. This funding will be used by the Department of Aging to modernize PA Link which serves as the commonwealth’s Aging and Disability Resource Center.

Finally, there is a decrease in the transfer from Lottery Funds to the Pharmaceutical Assistance Fund of $20 million from the prior year. This transfer of funds to the Pharmaceutical Assistance Fund is used for the Pharmaceutical Assistance Contract for the Elderly (PACE) and the PACE Needs Enhancement Tier (PACENET) programs.

In addition to the decrease in this transfer, the 2025/26 budget also proposes a decrease of $49 million over FY 2024/25 for the MA-Community HealthChoices appropriation.

|

($ amounts in millions)

|

2024/25

|

2025/26

|

$ Change

|

% Change

|

|

Attorney General

|

$143.9

|

$156.7

|

$12.8

|

8.9%

|

|

Auditor General

|

$45.8

|

$48.0

|

$2.2

|

4.8%

|

|

Treasury (excl. debt service costs)

|

$59.2

|

$59.4

|

$0.2

|

0.3%

|

The governor’s budget proposal includes no new initiatives for the Attorney General, the Auditor General, or the Treasury Department.

The budget proposal does include a $9.5 million, or 17.7%, increase for the Attorney General’s Government Operations appropriation. Funding for Drug Law Enforcement would increase by $2.4 million, or 4.0%, to $62.1 million. The School Safety appropriation, which provides for the Safe2Say Something program, would increase by $93,000, or 3.6%, to $2.7 million. The executive budget proposes increasing the Human Trafficking Enforcement and Prevention appropriation to $1.6 million, a $551,000 or 55.1% increase over FY 2024/25. The budget also provides for small cost-to-carry increases to the Witness Relocation Program, Child Predator Interception Unit, and Tobacco Law Enforcement appropriations.

The governor’s executive budget decreased the Joint State-Local Firearm Taskforce and Organized Retail Theft Prevention appropriations by 1.9% and 4.6% respectively. The Joint State-Local Firearm Taskforce, a collaborative effort program to reduce gun crime in Philadelphia and Pittsburgh, would see its appropriation decrease by $262,000 to $13.7 million. The Organized Retail Theft Prevention would decrease by $125,000 to $2.6 million.

After not receiving an increase in the Auditor General’s office in FY 2024/25, this budget proposes a $2.2 million, or 4.8%, increase for the office. The Treasury Department General Government Operations appropriation receives a $2.1 million, or 4.6%, increase in the proposal. This is offset by a $2.3 million, or 94%, decrease in reimbursements for the divestiture of commonwealth investments.

The executive budget increases state funding to the Department of Military and Veterans Affairs by $9.3 million, or 4%, to a total of $236.7 million. $3.4 million of this increase is directed at the six veterans’ homes run by the department. Funding for the department’s General Government Operations is increased by $3.6 million to $40.1 million. A portion of this increase will support the creation of a new position to ensure compliance with environmental laws and regulations.

The governor’s budget also proposes increasing funding for Armory Maintenance and Repair by $250,000 to continue the current program while ensuring continued solvency in the State Treasury Armory Fund.

The budget also includes small increases for the National Guard Youth Challenge Program ($447,000 or 20.6%), the Educational Assistance Program Fund ($1 million or 7.4%), Paralyzed Veterans Pensions ($386,000 or 9.2%), Veterans Outreach Services ($120,000 or 2.5%), Education of Veterans Children ($30,000 or 9.4%), and Civil Air Patrol ($20,000 or 20%).

The budget proposes a supplemental appropriation for the Education of Veterans Children appropriation for FY 2024/25 of $125,000. This appropriation provides an educational gratuity not to exceed $500 per semester to children of veterans who are 100% disabled.

The 2025/26 executive budget proposal increases the Department of Community and Economic Development (DCED)’s General Government Operations by $245,000 to $429.9 million.

Job Creation, Workforce Training, Business Growth and Attraction

The FY 2025/26 budget proposes a $1 million increase to PA First, DCED’s comprehensive program aimed at job creation and retention, to continue providing adaptive equipment and opportunities for children with special needs as well as an additional $4 million increase to provide further financial assistance to increase economic investment.

To develop the commonwealth’s workforce, the budget proposes a $10 million transfer from PA First to the newly created Workforce and Economic Development Network (WEDnetPA). In addition to this transfer, the Workforce and Economic Development Network appropriation is proposed to receive $2.5 million to increase assistance to employers for incumbent worker training.

The executive budget includes a $2 million increase for the Foundations in Industry appropriation, which will support internships at Pennsylvania companies. It also provides a new $3.5 million Regional Economic Competitive Challenge appropriation, which would be used to provide planning grants for regions throughout the commonwealth to establish locally driven economic growth strategies.

The executive budget proposal includes a $22.79 million appropriation for PA SITES debt service.

Pennsylvania Innovation Economy

The executive budget proposal creates a new appropriation called PA Innovation, which includes a $30 million initiative to spur life sciences job growth and innovation as well as a $20 million initiative to support entrepreneurs scaling their products, innovation, and research in conjunction with federal investment. The governor also proposes restoring the Public Television Technology appropriation, which has not been funded since FY 2020/21, at $875,000.

Pennsylvania Worldwide and Assets

To attract more businesses to Pennsylvania, the executive budget appropriates an additional $3 million to Market to Attract business to enhance site selection and business attraction marketing. The executive budget also transfers $823,000 from Marketing to Attract Business and $2.685 million from the Office of International Business Development to a new appropriation called BusinessPA.

Pennsylvania Communities

Multiple new initiatives are contained in the 2025/26 budget proposal aimed at strengthening communities around the state. The BusinessPA appropriation is created with $8.892 million to implement DCED’s economic development strategy. The Veterans Small Business Assistance line item, aimed at helping veterans establish and grow small businesses, would receive $1 million. The budget proposal also includes $15 million for Regional Events Security and Support to ensure localities have the resources they need to ensure a safe semiquincentennial (250th) celebration.

Finally, the 2025/26 budget proposal aims to make reforms that would improve Pennsylvania’s housing market. The Center for Local Government Reform would receive a $1 million increase to improve zoning, regulation, code enforcement, and other practices that are seen as barriers to housing creation and development. A new appropriation, called Housing Stock Restoration, would receive $50 million to help counties improve or maintain existing housing. A new First-Time Homebuyer Grant would be created with $10 million to assist Pennsylvanians with closing costs when purchasing their first home.

The 2025/26 executive budget proposal increases the General Government Operations for the Department of State by $57,000 for a total of $44.18 million. A new $102,000 appropriation is created under the department’s general government operations to provide technical assistance and support for individuals seeking new licenses in Pennsylvania. Minor increases to appropriations to maintain current programming are offset by a decrease of $1 million in the County Election Expenses appropriation which was funding for nonrecurring recount and special election expenses.

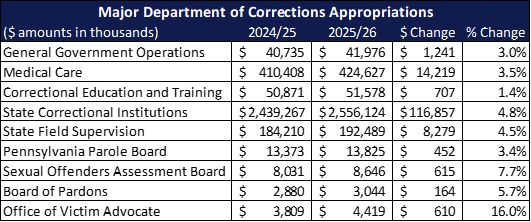

The 2025/26 executive budget proposal includes $3.3 billion from the state general fund dollars for the Department of Corrections, an increase of $143.1 million, or 4.5% over FY 2024/25. The General Government Operations appropriation increased by $1.2 million, or 3% to continue current programming.

The executive budget proposal includes $116.9 million, or a 4.8% increase for the Department of Corrections’ largest appropriation, State Correctional Institutions (SCI). Included in this increase is $86.8 million to replace federal funding received in FY 2024/25 for COVID-19 response and $40 million to continue current programming. This increase is offset by a proposal to close two community corrections centers, for an estimated cost savings of $9.9 million in FY 2025/26. The budget also transfers thirty-four positions to the Office of Administration and eliminates forty-nine.

In addition to closing the two community corrections centers, the budget proposes two additional cost saving measures for the department. The first is to implement a charging policy for county inmates housed at State Correctional Institutions. The DOC currently accepts county inmates without enforcing daily housing cost charges, which shifts the financial burden from counties to the state. Enforcing the policy of charging counties is projected to save the department approximately $1 million annually, although only $351,000 is anticipated by the executive budget for FY 2025/26.

The second proposal is to close two state correctional institutions, which will result in an estimated annual cost savings of over $100 million for the commonwealth when fully implemented. The last prison closure was SCI Retreat in 2020. Before that, SCI Graterford was closed in 2018. The Public Safety Facilities Act (Act 133 of 2018) outlines the process that must be followed to shut down a facility and includes a written report with recommendations from stakeholders and at least one public hearing in the county in which the facility is located. The executive budget does not show any projected cost savings from this proposal in FY 2025/26.

The Sexual Offenders Assessment Board received a $249,000 increase to continue their current program as well as a $366,000 initiative to increase their reimbursement rate per assessment from $350 to $500.

The governor’s budget proposal provides $1.82 billion for the Pennsylvania State Police (PSP), a $111 million, or 6.5% increase from FY 2024/25. Most of this increase is to continue the current programs of the state police, however it does support the creation of five new lab operations positions. The budget also includes $2.3 million for adult use cannabis enforcement and expungement, funded by the proposed Adult Use Cannabis Tax.

The executive budget continues the multi-year effort to reduce the reliance of the PSP on the Motor License Fund (MLF). This budget would reduce expenditures to the PSP from the MLF to $200 million, a $50 million decrease from FY 2024/25. This decrease helps to assure state match requirements for federal transportation infrastructure funding. The entirety of the remaining $200 million is for the general government operations (GGO) of the state police, which continue to be funded by both the General Fund and the Motor License Fund.

The governor’s executive budget includes $14.5 million for 4 new cadet classes with the goal of hiring and training 432 new State Troopers. The proposal also includes $300,000 for the Camp Cadet and Law and Leadership program operated through the PSP to help youth who are interested in exploring careers in law enforcement and public safety.

The 2025/26 budget proposes a $168,000 appropriation increase to support the Pennsylvania Instant Check System (PICS).

The budget also proposes changing the Automated Fingerprint Identification System (AFIS) appropriation to Multi-Biometric Identification System.

The governor’s executive budget proposal provides $32.6 million in state funding to the Pennsylvania Emergency Management Agency (PEMA), a $13.5 million or 29.2% decrease from the prior fiscal year. This decrease is accomplished by eliminating the $6 million Urban Search and Rescue appropriation and zeroing out the Disaster Relief ($10 million in FY 2024/25), Emergency Management Assistance Compact ($4 million in FY 2024/25) and Hazard Mitigation ($1 million in FY 2024/25) appropriations. The Hazard Mitigation appropriation provides state match grants to local governments to implement long-term hazard mitigation measures after a major disaster declaration. The Emergency Management Assistance Compact (EMAC) is a national agreement that allows states to share resources during disasters. The Disaster Relief appropriation provides resources to the state during a proclamation of disaster emergency by the governor. The proposal includes a request for legislative action to allow for existing disaster response funds to be used for mitigation projects, in addition to emergency response.

Funding for state disaster assistance to individuals would be maintained at $5 million.

The budget proposal increases PEMA’s General Government Operations funding by $7.1 million, or 48.2%, after accounting for a $1.2 million FY 2024/25 appropriation reduction. $7 million is to maintain current operations and $87,000 is to meet federal infrastructure matching requirements.

Spending for the Office of the State Fire Commissioner increases in the budget proposal by $417,000 million to a total of $5 million, mostly to maintain current operations. The increase will support the creation of a new position for administrative and programmatic support for the requirements of Fire Relief Associations. The proposed budget provides the office with a $1.2 million FY 2024/25 supplemental appropriation, which complements the reduction in PEMA’s GGO.

The governor proposes a slight decrease in the size of the Fire and Emergency Medical Services Grant Program, for a total of $36.5 million due to an anticipated decrease in fireworks tax revenue. The program, which is overseen by the State Fire Commissioner, distributes grants to volunteer or professional fire companies, EMS providers, and rescue squads. The grants may be used for equipment, facilities, training, debt reduction, and other purposes. FY 2025/26 funding for the program comes from Fireworks Tax transfers ($6.5 million), the State Gaming Fund ($25 million), and the Property Tax Relief Fund ($5 million).

The 2025/26 executive budget proposes spending an additional $30 million from the Property Tax Relief Fund to provide supplemental grants to Fire Companies.

The governor’s executive budget proposes a net $276,000 decrease for the General Government Operations (GGO) of the Pennsylvania Commission on Crime and Delinquency (PCCD). The budget provides $74,000 to continue current programming, $2.2 million to provide additional support to ensure the safety, well-being, and forever home for children affected by abuse and/or neglect, and $1.2 million to implement the provisions of Act 122 of 2024 for a statewide sexual assault evidence tracking system. The budget proposal contains a $2 million reduction in funding for the agency as well as a $1.75 million transfer to the newly created County Probation and Reentry Services appropriation.

The budget appropriates $36.1 million for a new appropriation, County Probation and Reentry Services, to streamline PCCD’s grant programs to county probation services and to improve access to funds. County probation is currently supported through the Improvement of Adult Probation Services and Intermediate Punishment Treatment appropriations and the Justice Reinvestment Fund. The County Probation and Reentry Services combines the Improvement of Adult Probation Services and Intermediate Punishment Treatment Programs funding streams. The proposal also transfers $1.75 million from PCCD’s GGO for nonnarcotic medication substance use disorder treatment to this new appropriation.

The budget proposes $16.6 million for County Probation Grants funded by Justice Reinvestment Initiative (JRI 2) savings (Acts 114 and 115 of 2019). Savings are generated by implementing short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations and are used to fund county probation grants.

Act 44 of 2018 established the School Safety and Security Committee for the administration of the School Safety and Security Grant Program. Act 33 of 2023 transferred the administration of the Targeted School Safety Grants for Nonpublic Schools and School Entities Program to PCCD. Act 55 of 2024 appropriated $100 million to the Department of Education for transfer to the fund and appropriated $20.7 for the Safe Schools Initiative (School Safety and Security Fund-Targeted Grants). The 2025/26 executive budget level funds the School Safety and Security physical and mental health grant program with a $100 million transfer from the Department of Education and authorizes a total of $137.3 million in grants due to a remaining balance in the fund. The executive budget transfers $11 million for targeted school safety grants, a decrease from $20.7 in 2024/25.

In FY 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in FY 2023/24.

The executive budget provides $76.5 million for Violence Intervention and Prevention (VIP) grants to support community-led gun violence prevention efforts and the Building Opportunity through Out of School Time (BOOST) program, a $20 million increase from FY 2024/25. Half of the increase is meant to expand the BOOST program for a total of $21.5 million. The BOOST program received $11.5 million in FY 2024/25. The remaining $10 million is for additional support for community-led gun violence prevention efforts, for a total of $55 million.

Using funds generated by the legalization of adult use cannabis, the budget proposes to invest $10 million in restorative justice initiatives.

The budget addresses concerns over adequate funding for the Victims Compensation fund with a $9 million transfer from the Local Police Enforcement executive authorization (EA) within the Medical Marijuana Program Fund for FY 2025/26. The Victims Compensation Fund provides funding to victims of crime and the victim service community. The fund received a $5 million transfer from the State Gaming Fund in FY 2024/25.

The budget continues the $10 million transfer to the Nonprofit Security Grant Fund and the $7.5 million in funding for indigent defense. Indigent defense was first funded in Pennsylvania in the FY 2023/24 budget at $7.5 million. Funding for indigent defense will continue to flow through PCCD and the Criminal Justice Advisory Committee.

The governor’s executive budget proposes a $705,000 increase for the Juvenile Court Judges’ Commission (JCJC). The JCJC is responsible for advising juvenile court judges regarding the development and improvement of juvenile probation services throughout the commonwealth.

The governor’s executive budget provides $465.9 million from the state General Fund for the Judiciary, a 7% or $30.3 million cost-to-carry increase from FY 2024/25.

The budget proposes a permanent suspension of the Unified Judiciary System transfer to the School Safety and Security Fund from the Judicial Computer System.

The 2025/26 executive budget proposal reduces state General Fund spending to $255.2 million from $261.3 million, or a reduction of 2.3%. The budget proposal transfers funding for the University of Pennsylvania for its Veterinary Activities and the Center of Infectious Disease to the new Veterinary Training and Services Grants line item at the FY 2024/25 funding level.

This budget continues to effectuate Governor Shapiro’s priorities which include bolstering the department and the agricultural community through several initiatives. Specifically, the 2025/26 proposal includes the following initiatives:

- Agricultural Preparedness and Response

- $2 million to increase testing capacity in western Pennsylvania

- Agricultural Innovation Development

- $13 million for increased support and attraction of innovative agricultural businesses

- $2 million for county-based digester pilot program

- Transfer to Agricultural College Land Scrip Fund

- $2.88 million to improve programs related to agriculture

- State Food Purchase Program

- $4 million increase to the core State Food Purchase program

- $4 million increase to the Agricultural Surplus System (PASS)

The 2025/26 executive budget proposal includes an increase in state funding for DCNR to a total of $198.5 million, which represents an increase of $23 million or 13% over the enacted budget. Most of the increase for the agency is related to additional funding allocations to the agency’s major appropriations:

- $2.9 million increase to General Government Operations

- Includes the addition of 2 new positions for petroleum and subsurface geology support

- $9.2 million increase to State Park Operations

- $5.5 million increase to State Forests Operations

Furthermore, the budget proposal includes a $5 million initiative for Infrastructure and Trail Connection improvements.

Lastly, the 2025/26 executive budget proposal provides for a slight increase in utilization of the Oil & Gas Lease Fund to a total of $83.2 million.

The governor’s 2025/26 budget proposal provides an increase of $27.4 million or 11.6% over the prior year for the Department of Environmental Protection for a total of $262.7 million in state funding. Most of the increase is located within the following line items:

- $2.8 million within General Government Operations

- Includes the addition of 1 new position

- $1.5 million within Environmental Program Management

- Includes the addition of 4 new positions for agricultural conservation

- $2.2 million within Chesapeake Bay Agricultural Source Abatement

- Includes the addition of 3 new positions for agricultural conservation

- $6.2 million within Environmental Protection Operations

- Includes the addition of 3 new positions for agricultural conservation

- Includes the addition of 4 new positions for surface mining reclamation and enforcement support

- $13 million within Transfer to Well Plugging Account

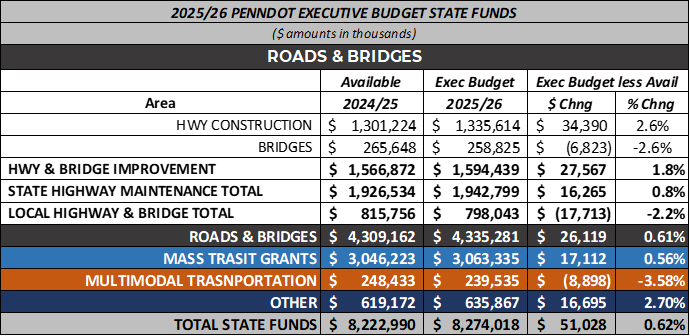

The 2025/26 executive budget proposal includes $8.27 billion in state funds for the PennDOT, an increase of $51 million or 0.6%. Many of those funds are allocated within the Motor License Fund, the Public Transportation Trust Fund, the Public Transportation Assistance Fund, and the Multimodal Fund. There are several factors that contribute to this change affecting several programs within the agency. The affected programs where the changes occur are as follows:

- Highway and Bridge Improvement (Hwy & Bridge Construction) - $3.75 billion (state/federal combined)

- State Highway & Bridge Construction - $1.59 billion or an increase of $27.5 million

- Federal Construction – $2.15 billion or an increase of $91.3 million

- Hwy Research/Planning/Construction – $1.27 billion

- Infrastructure Investment and Jobs Act (IIJA) - $883.7 million

- State Highway Maintenance - $1.94 billion or an increase of $16.3 million

- Local Highway & Bridge Maintenance - $798 million or a decrease of $17.7 million

- Mass Transit Grants - $3.06 billion or an increase of $17.1 million

Like last year’s budget proposal, the 2025/26 executive budget proposal contains an increase in the transfer of Sales & Use Tax (SUT) to provide additional funding for Mass Transit. Under current law (Act 89 of 2013), the transfer of SUT revenues deposited into the Public Transportation Trust Fund (PTTF) includes two components:

- 4.4% transfer from SUT related to non-motor vehicle transactions; and

- 3.28% transfer from SUT related to motor vehicle transactions, calculated as follows:

- Motor Vehicle SUT times the Ratio (determined by dividing $450 million by Motor Vehicle SUT receipts)

The governor proposes to increase the transfer on non-motor vehicle SUT transactions by 1.75% to a new total of 6.15%. Based on the SUT estimates for FY 2025/26 that amount is projected to be approximately $292.5 million.

The executive budget proposes three funding initiatives within the Department of Labor and Industry:

- $5 million increase for Industry Partnerships to address shortages in the nursing profession

- $5 million increase in for the Vocational Rehabilitation Fund to help maintain services for Pennsylvanians with disabilities seeking employment

- $1 million increase to provide additional support for the state-funded Centers for Independent Living

The governor’s executive budget provides $59.9 million for the Historical and Museum Commission. Of this amount, $27.5 million is from the state General Fund. The executive budget includes $25.5 million for General Government Operations, a 5.2%, or $1.3 million increase over FY 2024/25. This increase will, in addition to continuing current programming, support the creation of two new positions for streamlining environmental review of historic properties affected by IIJA projects. The budget includes a $2 million reduction in Cultural and Historical Support grants, which would bring total grant funding to $2 million, in line with the amount appropriated in FY 2023/24.

Though the Pennsylvania Housing Finance Agency (PHFA) does not receive a direct appropriation through the executive budget, the agency is the recipient of taxpayer dollars. The PHFA administers the Housing Affordability and Rehabilitation Enhancement Fund (PHARE). The PHARE program provides funding for affordable housing and receives an annual $5 million transfer from the Unconventional Gas Well Fund in addition to a transfer from the Realty Transfer Tax (RTT) based on the amount of RTT received annually.

The Tax Code for FY 2024/25 increased the transfer caps from the RTT to PHARE as follows:

- For FY 2024/25, a cap of $70 million

- For FY 2025/26, a cap of $80 million

- For FY 2026/27, a cap of $90 million

- For FY 2027/28 and each fiscal year thereafter, a cap of $100 million

Gov. Shapiro’s budget proposal would increase the cap to $110 million for FY 2028/29 and each fiscal year thereafter.

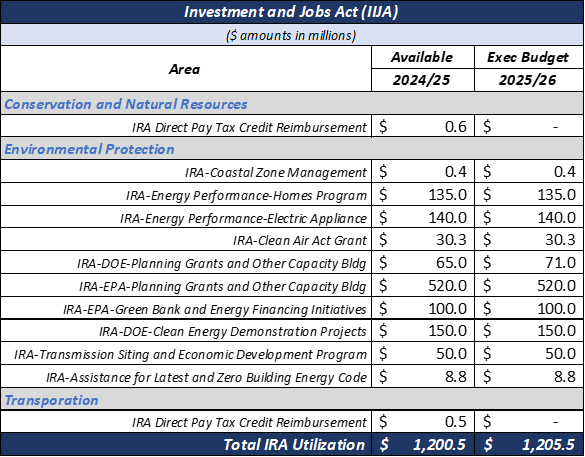

Infrastructure Investment And Jobs Act (IIJA)