2024/25 Budget Summary

By House Appropriations Committee Staff , | one year ago

In total, the 2024/25 budget reflects $47.598 billion in enacted state appropriations from the General Fund. This represents a $2.72 billion (6.2%) increase from the prior fiscal year (2023/24).

State appropriations include a year over year increase of $1.68 billion to replace enhanced Federal Medical Assistance Percentage (FMAP) funds that offset Medical Assistance (MA) expenditures within the Department of Human Services (DHS) beginning in fiscal year 2022/23. The enhanced federal match received by states during the pandemic was phased down and ended December 2023.

The 2024/25 budget package includes the following bills:

- General Appropriations Act (SB1001, Act 1A of 2024)

- Fiscal Code (HB2310, Act 54 of 2024)

- Tax Code (SB654, Act 56 of 2024)

- School Code (SB700, Act 55 of 2024)

- Higher education school code package (SB1150, SB1154, HB897)

- Capital budget (HB2328/SB1072)

- “Housekeeping” Appropriations:

- Bureau of Professional and Occupational Affairs (SB1002, Act 2A of 2024)

- Workers’ Compensation Act Administration for the Department of Labor & Industry (SB1003, Act 3A of 2024)

- Office of Small Business Advocate (SB1004, Act 4A of 2024)

- Office of Consumer Advocate (SB1005, Act 5A of 2024)

- Public School Employees’ Retirement System (SB1006, Act 6A of 2024)

- State Employees' Retirement System (SB1007, Act 7A of 2024)

- Philadelphia Parking Authority (SB1008, Act 4A of 2024)

- Public Utility Commission (SB1009, Act 9A of 2024)

- Pennsylvania Gaming Control Board (SB1010, Act 10A of 2024)

- Non-Preferred Appropriations (HB613, Act 11A of 2024)

-

- University of Pennsylvania for Veterinary Activities and for the Center for Infectious Diseases

- State-related universities

- Agricultural College Land Scrip Fund

- K-12 Education Investments

- Standard subsidies:

- $225 million through the basic education fair funding formula (2.9% increase)

- $100 million or 7.2% increase in Special Education Funding

- $100 million for mental health and physical safety

- $30 million increase for Career and Technical Education (CTE)

- $12.7 million or 12% increase for the CTE subsidy

- $5 million or 33% increase for CTE equipment grants

- $12 million for PA Smart (STEM grants)

- NEW subsidies:

- $493 million adequacy supplement (in Ready to Learn Block Grant)

- $32 million tax equity supplement (in Ready to Learn Block Grant)

- $60 million through a new hold harmless relief supplement (in BEF)

- $100 million for a new cyber charter reimbursement

- $100 million for Public School Facility Improvement Grant Program through the Commonwealth Financing Authority (CFA)

- Pre-k Counts - $15 million increase that supports a 5% rate increase

- Early Intervention (age 3-5) - $33 million or 9% increase to meet growing costs

- Dual Enrollment - $7 million

- Cyber charter school tuition reform (takes effect January 1, 2025) [NEW]

- Provides an estimated $34.5 million in savings to school districts in 2024/25 through changes to the special education tuition calculation. Under current law, the special education add-on tuition rate for charter school students is determined by dividing the resident school district’s special education expenditures (net of deductions) by 16% of the school district’s average daily membership. The school code bill changes the calculation to use each school district’s actual special education average daily membership in place of the outdated 16% assumption. For 2022/23, the median school district’s special education population was 19.6%.

- Annualized estimated savings are $69 million

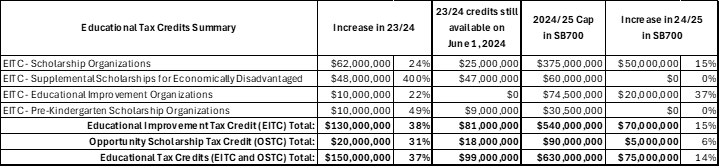

- The cap on the Educational Tax Credit programs increases by $75 million or 14%

Policy [NEW]

- Senate Bill 1150

- Grow Pennsylvania Scholarship Program

- Begins in 2024/25 and is administered by PHEAA

- $5,000 grant award for eligible students, who must be a commonwealth resident, be enrolled in an approved course of study, maintain satisfactory academic progress, not have earned a bachelor’s degree, and enter into an agreement to work in Pennsylvania for 12 months for every year the student receives a grant

- Grow Pennsylvania Merit Scholarship Program

- Allows PASSHE to charge the in-state tuition rate for first-time, freshmen, nonresident students who commit to work in Pennsylvania after graduation

- Begins in 2025/26 and PHEAA administers this program in conjunction with PASSHE

- Eligible nonresident students must be enrolled in an approved course of study, maintain satisfactory academic progress, not have earned a bachelor’s degree, and agree to work in Pennsylvania for 12 months for each academic year the student received the scholarship

- If less than 300 scholarships are awarded (the estimated break-even point for PASSHE), the Commonwealth shall pay PASSHE the difference in the subsequent year

- Ready to Succeed Scholarships – annual household income limit is increased from $126,000 to $175,000

- Name, image or likeness (NIL) is moved from Title 5 to the school code; changes incorporated

- Senate Bill 1154

- Establishes the Performance Based Funding Council within the new State Board of Higher Education to make recommendations for a process to distribute funds to Penn State University, the University of Pittsburgh, and Temple University

- House Bill 897

- Articulation agreements

- Student Fee Transparency – institutions of higher education must describe mandatory fees

- Dual Credit Innovation Grant Program

- Creates the State Board of Higher Education

- Develop a strategic plan

- Promote coordination

- Create a comprehensive data system

- Create procedures to follow in the event of the closure of an Institution of Higher Education

Pennsylvania State System of Higher Education (PASSHE)

- $35.1 million or 6% increase

- $85 million supplemental appropriation for facilities transition

Community Colleges

- $15.7 million or 6% increase

- Funding is maintained for Community College Capital Fund

State-Related Universities

- 13% increase for Lincoln University, Pennsylvania College of Technology, and the Rural Education Outreach under the University of Pittsburgh

- University of Pittsburgh, Temple University, and Penn State University funding maintained at the 2022/23 fiscal year level

Pennsylvania Higher Education Assistance Agency (PHEAA)

- $54 million increase to ensure the maximum State Grant level is maintained

- $20 million for student teacher stipend

- This brings the two-year total to $30 million, which is below the $45 million that is needed to fund all applications for 2024/25

- Grow PA Scholarships – $25 million [NEW]

- Ready to Succeed Scholarships -- $36 million or 150% increase

- Increases for Bond Hill Scholarships, Higher Education for the Disadvantaged, Cheyney University Honors Academy, and the Targeted Industry Scholarship Program

Physical and Mental Health programs increases over fiscal year 2023/24:

- $273.4 million (5.2%) – MA Community HealthChoices

- Includes funding for an increase to Nursing Home rates

- $261 million (11.4%) – Intellectual Disabilities (ID) – Community Waiver program

- Includes additional spots for the Consolidated and Community Living Waivers

- Increases MA rates paid for home and community-based services

- $71 million (8.0%) - Mental Health Services

- Includes an increase of $20 million over fiscal year 2023/24 for county based mental health services.

- $34 million (51.2%) – MA Workers with Disabilities (MAWD)

- Includes increased enrollment for the MAWD program

- $12.6 million (7.3%) – Long-Term Care Managed Care (LIFE program)

- Includes funding for an increase to the LIFE program provider rates.

- $9.1 million (4.9%) – Early Intervention program

- $7 million (190.1%) - Obstetric and Neonatal Services

- Provides an increase for payments to eligible hospitals.

- $4 million (3.7%) – Children’s Health Insurance Program (CHIP)

- Includes funding for increased enrollment.

- $1.4 million (9.8%) – MA Critical Access Hospitals

- Provides an increase for payments to eligible rural hospitals.

Human Services programs with increases over fiscal year 2023/24:

- $55.6 million (60.9%) - Youth Development Institutions

- Includes funding for the new Southeast Secure Treatment Unit.

- $26.2 million (9.6%) – Subsidized Child Care Services

- Includes 75th percentile child care payment rates.

- $5 million (27.0%) – Homeless Assistance

- Includes funding to prevent evictions, provide rental assistance, and other supportive housing services.

- $2.5 million (12.4%) - Domestic Violence

- $2.5 million (60.1%) – Legal Services

- Includes funding for eviction proceedings

Other Human Services Appropriations that increased over 2023/24:

- $34.3 million (10.7%) - County Assistance Offices

- $17.4 million (10%) - ID – Intermediate Care Facilities

- $13.9 million (13.8%) - Intellectual Disabilities – State Centers

- $12.7 million (0.4%) – MA Capitation

- $9.1 million (6.1%) - ID – Community Base Program

- $3.9 million (24%) - Cash Grants

- $3.5 million (11%) - Autism Intervention and Services

- $2 million (0.1%) – County Child Welfare

- $500,000 (5%) - Physician Practice Plans

Appropriations maintained at the 2023/24 level:

- Hospital Burn Centers

- Trauma Centers

- Academic Medical Centers

- Community Based Family Centers

- Rape Crisis

- 211 Communications

- Blind and Vision Services

- Nurse Family Partnership

- Expanded Medical Services for Women

- Behavioral Health Services

- Special Pharmaceutical Services for Schizophrenia

- Child Care Assistance

- Breast Cancer Screening

- Human Services Development Fund

Physical and Mental Health programs decreases over fiscal year 2023/24

- $48.4 million (-6.9%) - MA Fee-for-Services

- Due to decreased enrollment as a result of the MA redetermination process.

- $16 million (-8.5%) - MA Long-term Living

- Due to one-time nonrecurring payments in 2023/24

- Includes payments for certain nursing homes.

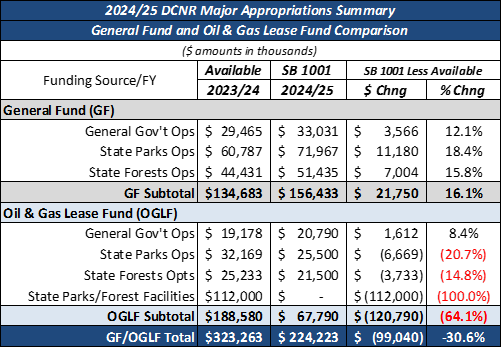

Reduction of $120.79 million in the use of the of the Oil & Gas Lease Fund from fiscal year 2023/24

- Oil & Gas Program Oversight Funding

- Permitting process/activities initiative

- $7 million within General Government Operations

- $3.5 million within Environmental Protection Operations

- $6 million Transfer from the General Fund to the Well Plugging Account Energy Programs Office

- $2.49 million within General Government Operations

- Expansion of PFAS water testing

- $1.5 million within Environmental Protection Operations

- $9.89 million increase in General Government Operations

- $2.79 million increase for Environmental Program Management

- $9.4 million increase for Environmental Protection Operations

- $2.53 million in General Government Operations for Asbestos Remediation in Capitol Complex

- $668,000 in General Government Operations for Expansion of Contracting Opportunities for small/diverse businesses

- $10 million for Agricultural Innovation [NEW]

- Supports innovations to improve energy efficiency, water quality, reduce water consumption and odors, and attract new agricultural businesses to the Commonwealth

- $26.688 million for the State Food Purchase Program maintained at fiscal year 2023/24 level

- Appropriation includes funding for:

- Core State Food Purchase Program - $18.688 million

- Pennsylvania Agricultural Surplus System (PASS) - $5.5 million

- The Emergency Food Assistance Program (TEFAP) - $1 million

- TEFAP Distribution - $500,000

- Senior Food Box Program - $1 million

- $11.53 million for the Animal Health and Diagnostic Commission maintained at fiscal year 2023/24 level

- Includes $5.35 million traditionally funded through the Racehorse Development Fund

- Level funding for Penn State Ag Extension within Transfer to Agricultural Land Scrip Fund

- $110 million increase for Highway Maintenance

- $1.2 million increase Real ID

- $20 million decrease for Highway and Safety Improvement

- $2.28 million decrease for Safety Administration and Licensing – funding for Drivers License Centers

- $75 million for the Maintenance Program and $50 million for the Construction Program funded by $125 million reduction in utilization of the Pennsylvania State Police$161 million in funding for Transportation and Multimodal Projects in supplemental appropriation for fiscal year 2023/24

- Funding increases compared to 2023/24:

- $903,000 (2.9%) - General Government Operations

- $2.7 million (115.4%) - Health Promotion and Disease Prevention

- $1.4 million (4.7%) - Quality Assurance

- $542,000 (10.5%) - State Laboratory

- $3.1 million (10.9%) – State Health Centers

- $237,000 (3.3%) – Newborn Screening

- $3 million (8.7%) – School District Health Services

- The school code designates these funds for menstrual hygiene product grants

- $824,000 (2.3%) – Local Health Departments

- $9,000 (0.6%) - Maternal and Child Health

- $8,000 (0.9%) - Tuberculosis Screening and Treatment

- $600,000 (5.7%) - Bio-Technology Research

- Funding and allocations maintained at 2023/24 levels:

- Health Innovation

- Sexually Transmitted Disease Screening and Treatment

- Achieving Better Care – MAP Administration

- Diabetes Programs

- Primary Health Care Practitioner

- Community Based Health Care Practitioner

- Cancer Screening Services

- AIDS Programs and Special Pharmaceutical Services

- Regional Cancer Institutes

- Local Health – Environmental

- Renal Dialysis

- Services for Children with Special Needs

- Adult Cystic Fibrosis and Other Chronic Respiratory Illnesses

- Cooley’s Anemia

- Hemophilia

- Lupus

- Sickle Cell

- Lyme Disease

- Regional Poison Control Centers

- Trauma Prevention

- Epilepsy Support Services

- Tourette Syndrome

- Amyotrophic Lateral Sclerosis Support Services

- $73.5 million combined net increase (5.4%) across the General Fund and Motor License Fund

- $77.4 million increase (6.2%) for General Government Operations

- Total State Police Motor License Fund expenditures reduced to $250 million, a reduction of $125 million from fiscal year 2023/24

- $221,000 or 1.4% increase for General Government Operations

- $1.4 million Supplemental Appropriation for 2023/24

- $5 million for Disaster Relief

- $6 million for Urban Search and Rescue [NEW]

- $1.8 million (8.1%) increase for General Government Operations

- $2 million increase for Cultural and Historical Support grants

- $185.9 million (6.3%) increase for Department of Corrections

- $73.9 million in Supplemental Appropriations for 2023/24

- $68.2 million for State Correctional Institutions

- $5.7 million for State Field Supervision

- $804,000 (2%) increase in General Government Operations from 2023/24

- $52.4 million (14.7%) increase in Medical Care from 2023/24

- $800,000 (3.4%) increase for General Government Operations

- $56.5 million in State funds for Violence Intervention and Prevention

- $7.5 million for Indigent Defense

- $5 million increase for Nonprofit Security Grant Fund

- $20.7 for School Safety and Security Fund

- $3.6 million increase (11%) for General Government Operations

- $10.4 million increase (7%) for State Veterans Homes

- $60,000 increase (44.4%) for Education of Veterans Children

- $222,000 increase (5.6%) for Paralyzed Veterans Pensions

- $424,000 increase (9.7%) for Veterans Outreach Services

- Funding increases compared to 2023/24

- $4.514 million (14%) for General Government Operations

- $569,000 (12%) for Center for Local Government Services

- $17,000 (1%) for Marketing to Attract Business

- $11,000 (2%) for Base Realignment and Closure

- $2.35 million (100%) for Invent Penn State

- $5 million (15%) for Pennsylvania First

- $20 million (100%) for Main Street Matters [NEW]

- $500,000 (50%) for Tourism – Accredited Zoos

- $2.5 million (100%) for Local Government Emergency Housing Support [NEW]

- $7 million (88%) for Workforce Development

- $15.404 million (100%) for PA SITES Debt Service [NEW]

- Funding maintained compared to 2023/24

- Office of International Business Development (World Trade PA)

- Transfer to Ben Franklin Technology Development Authority Fund

- Municipal Assistance Program

- Historically Disadvantaged Business Assistance

- Partners for Regional Economic Performance

- Foundations in Industry

- Appalachian Regional Commission

- Manufacturing PA

- Strategic Management Planning Program

- Supercomputer Center Projects

- Powdered Metals

- Rural Leadership Training

- America 250PA

-

- Attorney General

- $1 million for Human Trafficking Enforcement and Prevention [NEW]

-

-

- $2.7 million for Organized Theft [NEW]

- $27.2 million total increase for the Judiciary, a 6.7% increase to fiscal year 2023/24 (revised)

- Includes $13.3 million in supplemental appropriations for fiscal year 2023/24

- $1.8 million increase for General Government Operations (GGO)

- Includes $1.2 million to improve labor law enforcement

- $2 million increase for Apprenticeship Training