General Fund Revenue Report - May 2024

By Gueorgui Tochev , Senior Budget Analyst | one year ago

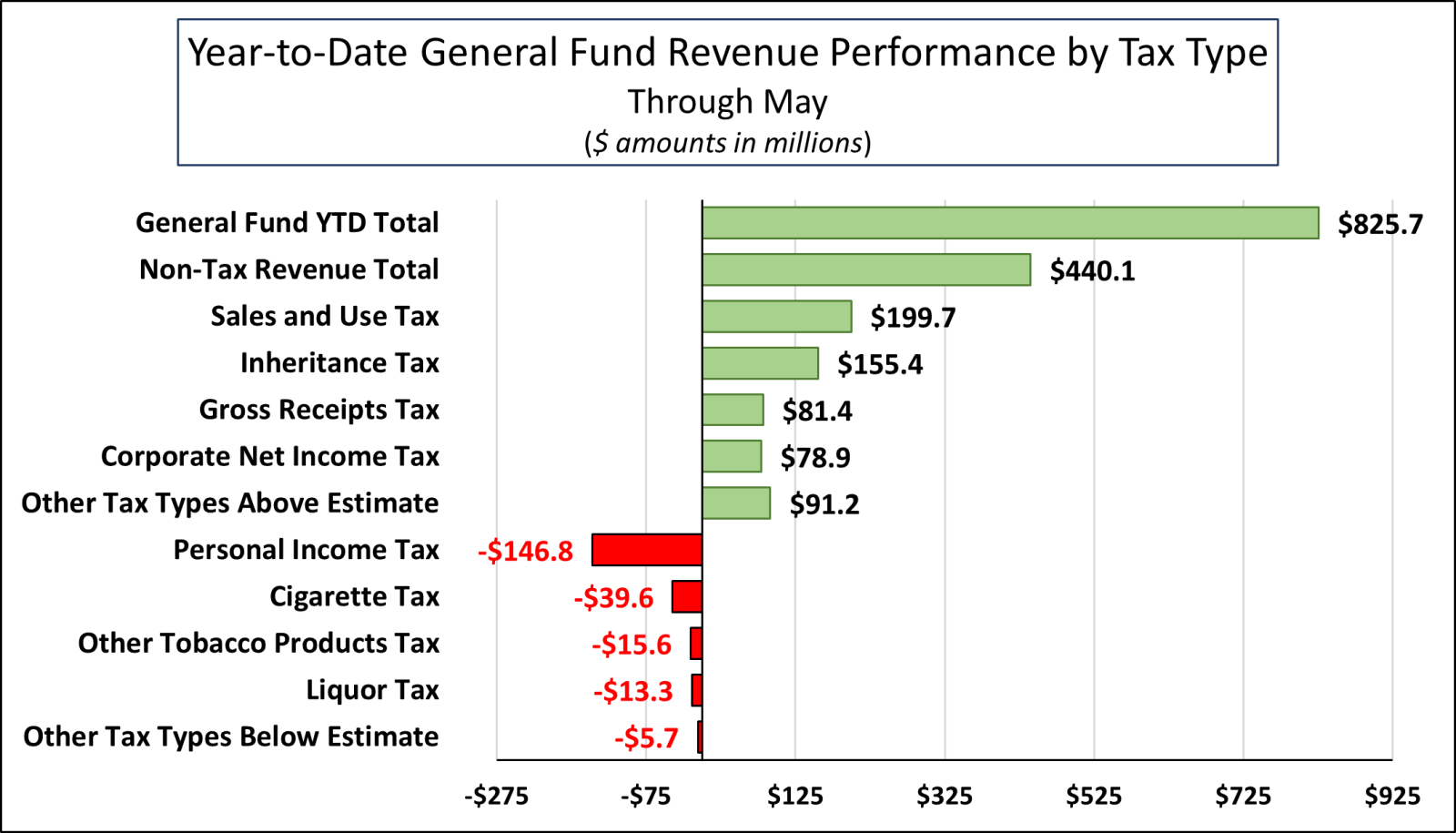

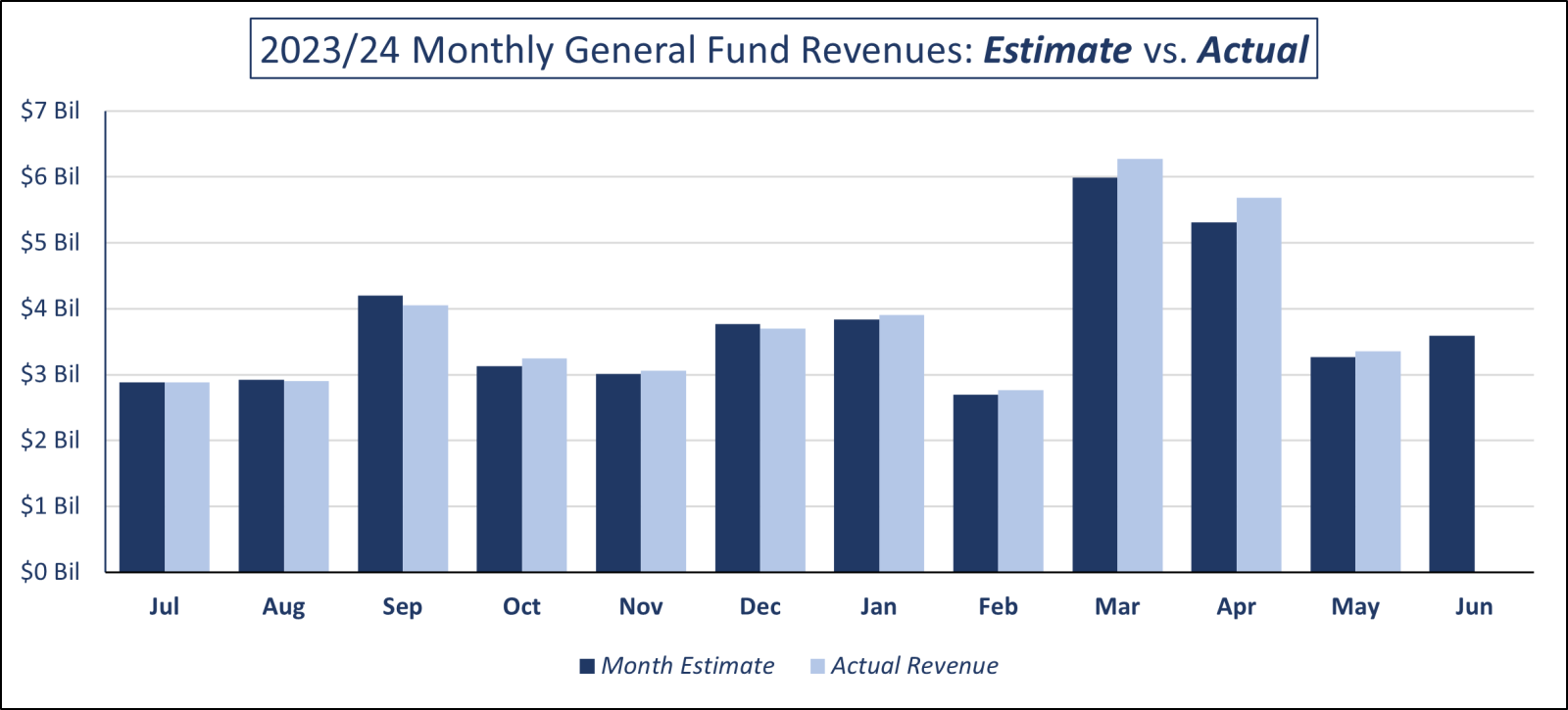

General Fund revenues in May were $86.4 million or 2.6% higher than expected. For the year-to-date, General Fund revenues are $825.7 million or 2.0% above estimate.

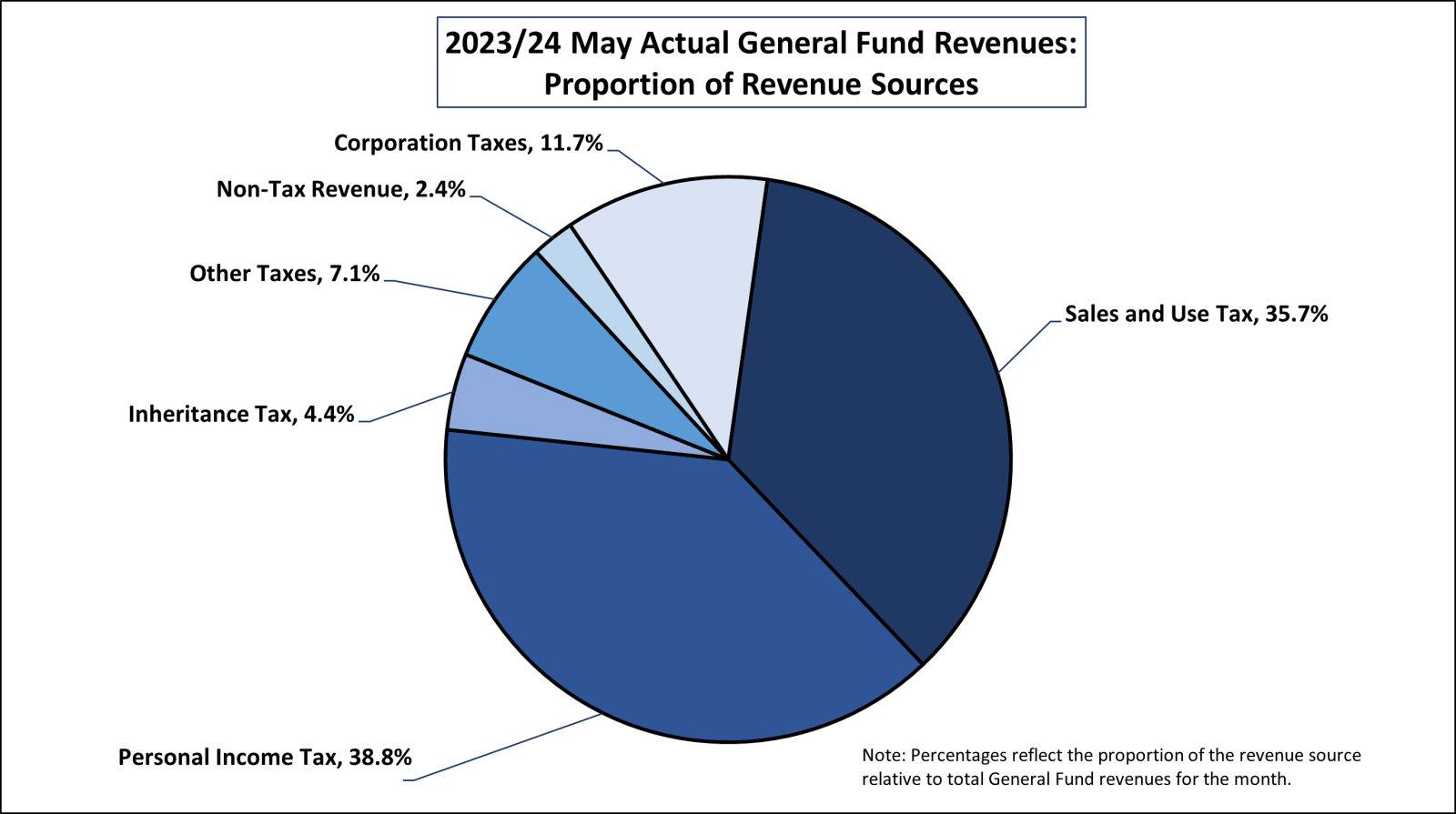

Overall, Personal Income Tax (PIT) collections outperformed for the month by $10.6 million or 0.8%. As a component of PIT, withholding payments finished the month $8.4 million (0.7%) over estimate, and non-withholding payments were $2.3 million or 1.8% higher than expected. For the year-to-date, PIT collections are $146.8 million or 0.9% below expectations.

Sales and Use Tax (SUT) collections were $117.1 million over estimate, or 10.8% for the month. In turn, year-to-date SUT collections are still above estimate by $199.7 million or 1.6%.

Corporate Net Income Tax (CNIT) collections were $109 million or 23.5% lower than projected in May. For the year-to-date, CNIT revenue exceeds projections by $78.9 million or 1.7%. Similarly, Inheritance Tax revenue was $18.1 million or 14.0% higher than expected for the month, putting year-to-date collections $155.4 million or 11.4% ahead of estimate.

Non-tax revenue was also $42.8 million or 110.4% above estimate. For the year-to-date, non-tax revenue is $440.1 million or 40.3% higher than expected, making it the highest outperforming General Fund revenue source through the end of May.

| 2023/24 General Fund Revenues |

| ($ amounts in millions) |

| |

May Revenues |

Year-to-Date Revenues |

| |

Month Estimate |

Month Revenues |

$ Chng |

% Chng |

YTD Estimate |

YTD Revenues |

$ Chng |

% Chng |

| General Fund Total |

$3,270.0 |

$3,356.4 |

$86.4 |

2.6% |

$41,015.1 |

$41,840.8 |

$825.7 |

2.0% |

| Tax Revenue |

$3,231.2 |

$3,274.8 |

$43.6 |

1.3% |

$39,921.7 |

$40,307.3 |

$385.6 |

1.0% |

| Corporation Taxes: |

| Corporate Net Income Tax |

$464.2 |

$355.2 |

($109.0) |

-23.5% |

$4,655.3 |

$4,734.2 |

$78.9 |

1.7% |

| Gross Receipts Tax |

($2.5) |

$4.1 |

$6.6 |

265.0% |

$1,303.7 |

$1,385.1 |

$81.4 |

6.2% |

| Public Utility Realty Tax |

$22.7 |

$16.7 |

($6.0) |

-26.2% |

$46.4 |

$44.1 |

($2.3) |

-5.1% |

| Insurance Premiums Taxes |

$4.4 |

$8.1 |

$3.7 |

83.8% |

$997.8 |

$1,009.4 |

$11.6 |

1.2% |

| Financial Institution Taxes |

$0.6 |

$7.3 |

$6.7 |

1124.1% |

$325.1 |

$389.8 |

$64.7 |

19.9% |

| Consumption Taxes: |

| Sales and Use Tax |

$1,080.8 |

$1,197.9 |

$117.1 |

10.8% |

$12,831.0 |

$13,030.7 |

$199.7 |

1.6% |

| Cigarette Tax |

$80.1 |

$71.4 |

($8.7) |

-10.9% |

$628.6 |

$589.0 |

($39.6) |

-6.3% |

| Other Tobacco Products Tax |

$13.3 |

$12.4 |

($0.9) |

-6.7% |

$149.2 |

$133.6 |

($15.6) |

-10.4% |

| Malt Beverage Tax |

$1.7 |

$2.0 |

$0.3 |

15.4% |

$19.7 |

$19.4 |

($0.3) |

-1.5% |

| Liquor Tax |

$39.9 |

$39.5 |

($0.4) |

-0.9% |

$425.7 |

$412.4 |

($13.3) |

-3.1% |

| Other Taxes: |

| Personal Income Tax |

$1,290.9 |

$1,301.5 |

$10.6 |

0.8% |

$16,472.8 |

$16,326.0 |

($146.8) |

-0.9% |

| Realty Transfer Tax |

$47.8 |

$51.5 |

$3.7 |

7.7% |

$461.7 |

$478.9 |

$17.2 |

3.7% |

| Inheritance Tax |

$128.8 |

$146.9 |

$18.1 |

14.0% |

$1,359.8 |

$1,515.2 |

$155.4 |

11.4% |

| Gaming Taxes |

$36.1 |

$37.7 |

$1.6 |

4.4% |

$345.6 |

$342.0 |

($3.6) |

-1.0% |

| Minor and Repealed |

$22.4 |

$22.5 |

$0.1 |

0.6% |

($100.7) |

($102.5) |

($1.8) |

1.7% |

| Non-Tax Revenue |

$38.8 |

$81.6 |

$42.8 |

110.4% |

$1,093.4 |

$1,533.5 |

$440.1 |

40.3% |