General Fund Revenue Report - March 2024

By Brittany Van Strien , Budget Analyst | one year ago

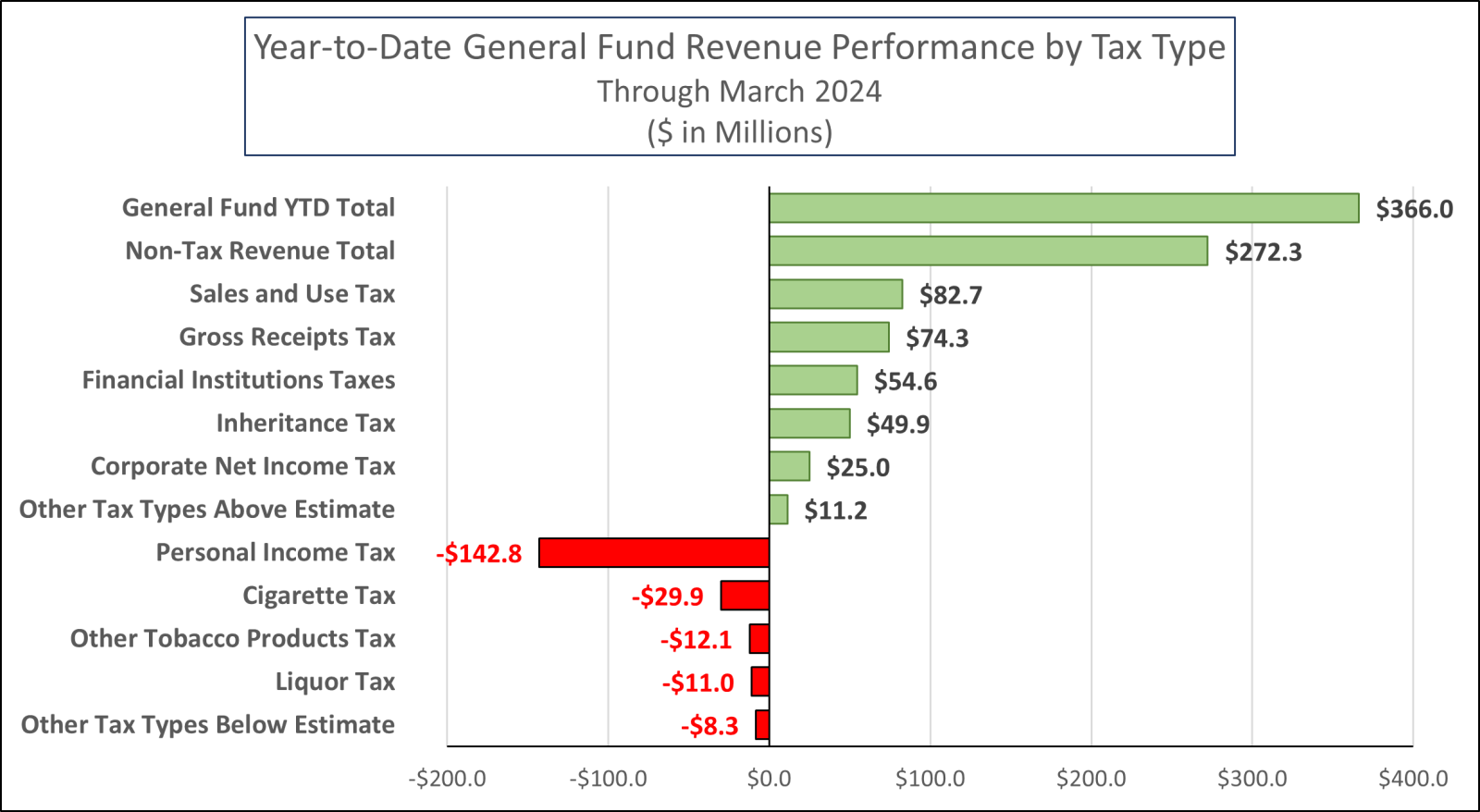

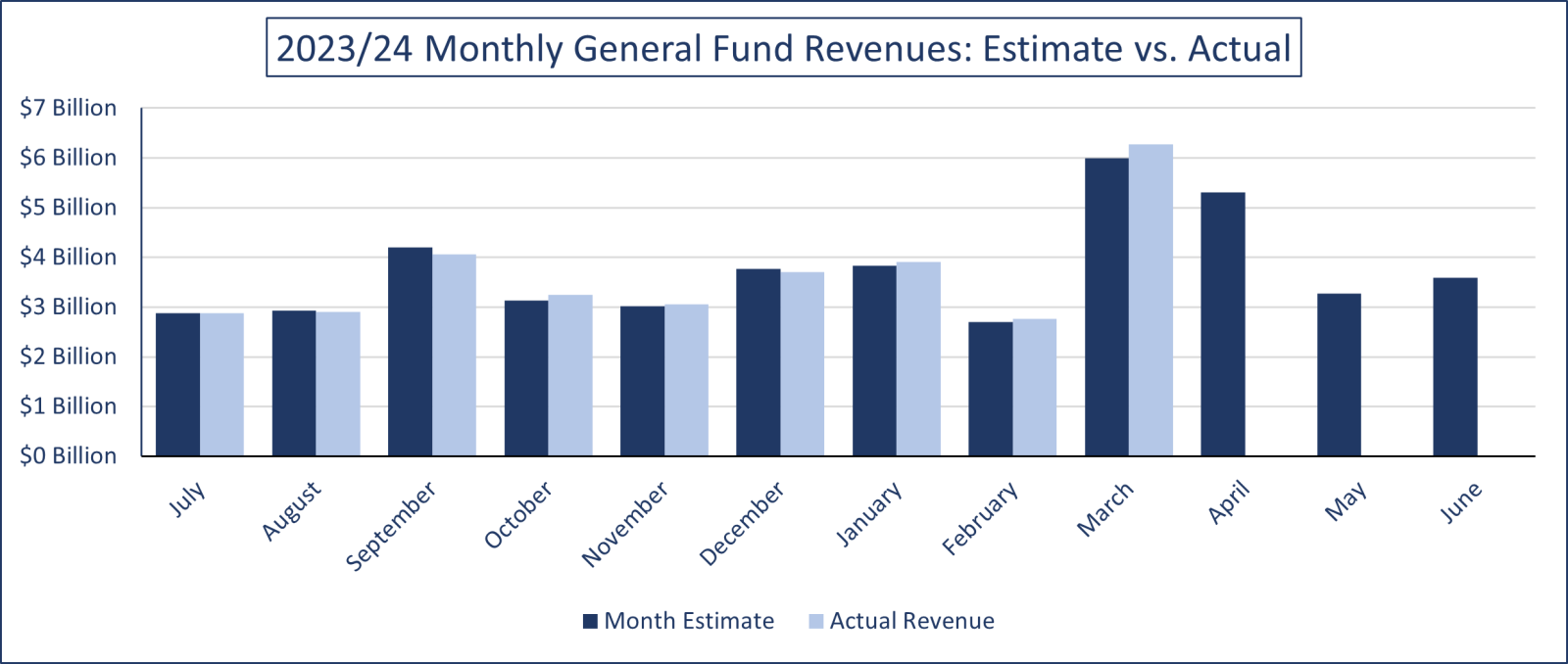

General Fund revenues in March were $289.9 million or 4.8% higher than expected. For the year-to-date, General Fund revenues are $366.0 million or 1.1% above estimate.

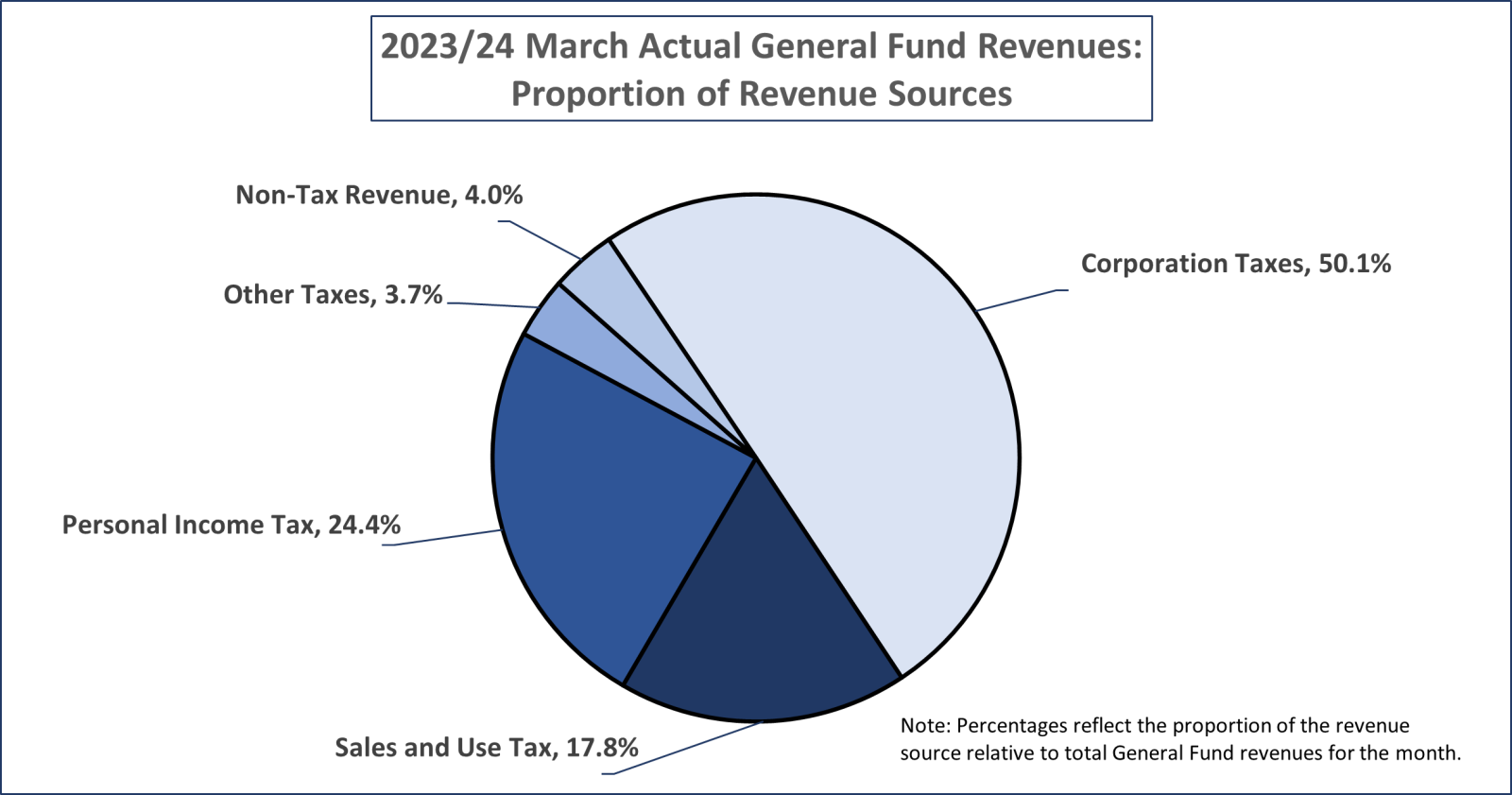

March is typically the largest revenue collection month due to multiple payment deadlines for business taxes – many corporate taxpayers make their first quarterly Corporate Net Income Tax (CNIT) payment, and special business taxes, including Gross Receipts Tax, Insurance Premiums Tax, and taxes on financial institutions, are almost entirely paid in March.

Gross Receipts Tax revenue in March was $87.6 million or 7.0% higher than projected. For the year-to-date, Gross Receipts Tax revenue is $74.3 million or 5.7% above projections. Similarly, taxes on financial institutions also finished the month $55.6 million or 19.9% higher than expected. Year-to-date collections for financial institution taxes are $54.6 million or 17.2% above estimate. Insurance Premiums Tax revenue underperformed by $13.9 million or 1.7% for the month of March and is $2.4 million or 0.3% under estimate for the year-to-date. In addition, CNIT collections in March were $65.4 million or 8.7% less than expected. For the year-to-date, however, CNIT revenue is exceeding projections by $25.0 million or 0.7%.

Sales and Use Tax (SUT) and Personal Income Tax (PIT) revenue outperformed expectations in March by $73.3 million (7.0%) and $122.6 million (8.7%), respectively. For the year-to-date, SUT collections are $82.7 million or 0.8% above estimate. Contrarily, year-to-date PIT collections are $142.8 million or 1.2% below estimate.

The second and final liquor store profit transfer was made in March for the fiscal year in the amount of $85.1 million, bringing the total profit transfer to the expected $185.1 million in 2023/24.

|

2023/24 General Fund Revenues ($ amounts in millions)

|

|

|

March 2024 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$5,989.7

|

$6,279.6

|

$289.9

|

4.8%

|

$32,432.8

|

$32,798.8

|

$366.0

|

1.1%

|

|

Tax Revenue

|

$5,763.7

|

$6,026.4

|

$262.7

|

4.6%

|

$31,646.6

|

$31,740.3

|

$93.7

|

0.3%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$751.1

|

$685.7

|

($65.4)

|

-8.7%

|

$3,652.2

|

$3,677.2

|

$25.0

|

0.7%

|

|

Gross Receipts Tax

|

$1,243.3

|

$1,330.9

|

$87.6

|

7.0%

|

$1,304.2

|

$1,378.5

|

$74.3

|

5.7%

|

|

Public Utility Realty Tax

|

$0.0

|

$0.0*

|

$0.0

|

0.0%

|

$1.2

|

$2.4

|

$1.2

|

98.1%

|

|

Insurance Premiums Taxes

|

$809.3

|

$795.4

|

($13.9)

|

-1.7%

|

$908.4

|

$906.0

|

($2.4)

|

-0.3%

|

|

Financial Institution Taxes

|

$279.9

|

$335.5

|

$55.6

|

19.9%

|

$317.1

|

$371.7

|

$54.6

|

17.2%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$1,041.4

|

$1,114.7

|

$73.3

|

7.0%

|

$10,538.7

|

$10,621.4

|

$82.7

|

0.8%

|

|

Cigarette Tax

|

$69.3

|

$60.9

|

($8.4)

|

-12.1%

|

$594.4

|

$564.5

|

($29.9)

|

-5.0%

|

|

Other Tobacco Products Tax

|

$12.6

|

$11.3

|

($1.3)

|

-10.6%

|

$121.7

|

$109.6

|

($12.1)

|

-9.9%

|

|

Malt Beverage Tax

|

$1.6

|

$1.8

|

$0.2

|

13.0%

|

$16.2

|

$15.9

|

($0.3)

|

-1.9%

|

|

Liquor Tax

|

$38.1

|

$36.0

|

($2.1)

|

-5.6%

|

$349.2

|

$338.2

|

($11.0)

|

-3.1%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$1,408.6

|

$1,531.2

|

$122.6

|

8.7%

|

$12,213.3

|

$12,070.5

|

($142.8)

|

-1.2%

|

|

Realty Transfer Tax

|

$32.6

|

$40.1

|

$7.5

|

23.0%

|

$368.6

|

$378.6

|

$10.0

|

2.7%

|

|

Inheritance Tax

|

$140.4

|

$142.2

|

$1.8

|

1.3%

|

$1,107.6

|

$1,157.5

|

$49.9

|

4.5%

|

|

Gaming Taxes

|

$35.3

|

$34.1

|

($1.2)

|

-3.4%

|

$278.7

|

$274.5

|

($4.2)

|

-1.5%

|

|

Minor and Repealed

|

($99.8)

|

($93.2)

|

$6.6

|

6.6%

|

($124.9)

|

($126.2)

|

($1.3)

|

-1.1%

|

|

Non-Tax Revenue

|

$226.0

|

$253.2

|

$27.2

|

12.0%

|

$786.2

|

$1,058.5

|

$272.3

|

34.6%

|

|

*Note: Actual Public Utility Realty Tax collections in March were $5,454.

|