2024/25 Executive Budget Briefing

By House Appropriations Committee Staff , | 2 years ago

Gov. Shapiro’s 2024/25 executive budget presents a combined total operating budget of $125.3 billion, an increase of $7.2 billion or 6.1% across all funds and sources. The total operating budget consists of:

- $48.3 billion in state General Fund expenditures, an increase of $3.7 billion or 8.4% after adjusting for proposed supplemental appropriation changes that reduce state appropriations for 2023/24 by $411.9 million

- $48.9 billion in federal funds, an increase of $2.7 billion or 5.8%

- $2.2 billion in Lottery Fund expenditures, an increase of $169.5 million or 8.4%

- $3.2 billion in Motor License Fund expenditures, a decrease of $24.8 million or 0.8%

- $22.6 billion in other special fund expenditures, augmentations, and restricted accounts, an increase of $691.4 million or 3.2%

In December 2023, the 2023/24 official revenue estimate was re-certified at $44.6 billion following the passage of Act 34 of 2023 (i.e., the Fiscal Code bill that was a part of the 2023/24 budget package). The governor’s executive budget projects that 2023/24 General Fund revenues will finish $656.5 million higher than the official estimate, for a total of $45.3 billion. Through the end of January, year-to-date General Fund revenues were $6.6 million, or 0.03%, above estimate.

After applying the adjustment to the 2023/24 official revenue estimate, base revenues for 2024/25 are projected to increase by $1.2 billion, or 2.7%, year-over-year. The executive budget proposes $206.5 million in tax and revenue modifications, resulting in a net 2024/25 General Fund revenue estimate of $46.3 billion – reflecting a $1.0 billion, or 2.2%, increase over the prior year.

|

$ amounts in millions

|

2023/24 Available

|

2024/25 Budget

|

$ Change

|

% Change

|

|

Revenue Estimate (as of December 2023)

|

$44,610.6

|

$46,482.3

|

|

|

|

Adjustment to Revenue Estimate

|

$656.5

|

-

|

|

|

|

Revised Base Revenues

|

$45,267.1

|

$46,482.3

|

$1,215.2

|

2.7%

|

|

Proposed Tax and Revenue Modifications

|

-

|

($206.5)

|

|

|

|

Revenues after Proposed Modifications

|

$45,267.1

|

$46,275.8

|

$1,008.7

|

2.2%

|

The governor’s executive budget proposes the implementation of two new taxes.

Adult Use Cannabis Tax

Similar to the proposal in the 2023/24, the executive budget proposes to legalize adult use cannabis and impose a 20% tax on the wholesale price of products sold through the regulated framework of the production and sales system. It is assumed that sales will begin January 1, 2025, with revenues first being realized in 2024/25. New this year, the 2024/25 executive budget proposes that revenue generated from the adult use cannabis tax would be deposited into a restricted account and distributed as follows:

- $5 million for restorative justice;

- $5 million to the Department of Agriculture for operations as the executive agency that would be responsible for regulating adult use cannabis;

- $2 million to the State Police for enforcement;

- $500,000 for the Department of Revenue for administration; and

- Any remaining amounts would be credited to the General Fund – see table that follows.

In addition to the distribution for restorative justice, it should be noted that the executive budget also proposes the immediate expungement of records for those incarcerated for only a possession related offense attributable to cannabis.

After the $12.5 million in initial expenditures, the executive budget estimates that implementation of the Adult Use Cannabis Tax would result in $3.1 million in tax revenue (transferred from the restricted account) and $11.7 million in additional sales and use tax revenue, for a total of $14.8 million in new revenue for 2024/25. By the fourth full year of implementation, the Adult Use Cannabis Tax is estimated to bring in $255 million.

| Estimated Fiscal Impact of Adult Use Cannabis Tax on General Fund ($ amounts in millions) |

| |

2023/24 Available |

2024/25 Budget |

2025/26 Estimated |

2026/27 Estimated |

2027/28 Estimated |

2028/29 Estimated |

| Transfer from Adult Use Cannabis Fund |

- |

$3.1 |

$42.9 |

$109.9 |

$165.2 |

$166.8 |

| Sales and Use Tax Effect |

- |

$11.7 |

$34.2 |

$47.4 |

$62.8 |

$87.9 |

| Total Estimated Fiscal Impact |

- |

$14.8 |

$77.1 |

$157.3 |

$228.0 |

$254.7 |

Skill Games Tax

In addition, the executive budget proposes a new 42% skill games tax on the daily gross gaming revenue from electronic gaming machines that involve an element of skill and are regulated by the Pennsylvania Gaming Control Board, effective July 1, 2024. Revenue estimates for this new tax assume that the board will collect and deposit revenue into a restricted account, all of which will be transferred to the General Fund. This budget estimates that the skill games tax will generate $150.4 million in 2024/25.

| Estimated Fiscal Impact of Skill Games Tax on General Fund ($ amounts in millions) |

| 2023/24 Available |

2024/25 Budget |

2025/26 Estimated |

2026/27 Estimated |

2027/28 Estimated |

2028/29 Estimated |

| - |

$150.4 |

$313.4 |

$314.8 |

$316.8 |

$317.9 |

The governor proposes to increase the minimum wage from $7.25 to $15 per hour for non-tipped workers and $9.00 per hour for tipped workers effective January 1, 2025. The executive budget estimates that raising the minimum wage will increase personal income tax revenue by $22.6 million and sales and use tax revenue by $34.1 million, for a total revenue increase of $56.7 million in 2024/25.

The 2024/25 executive budget proposes four transfers affecting the General Fund.

- From the General Fund to the Tobacco Settlement Fund, $115.3 million from cigarette tax revenues to replace monies deducted from the Master Settlement Agreement to pay debt service associated with the Tobacco Settlement Bonds.

- From the General Fund to the Environmental Stewardship Fund, $9.9 million from personal income tax revenues to the Growing Greener debt service payments.

- From the General Fund to the Pennsylvania Affordability and Rehabilitation Enhancement (PHARE) Fund, an additional $20.4 million from realty transfer tax revenue to replace the current transfer formula with a guaranteed total transfer of $70 million in 2024/25. The budget also proposes to increase the cap by $10 million each year to ultimately reach $100 million by 2027/28.

- From the General Fund to the Public Transportation Trust Fund, a new transfer of 1.75% of total sales and use tax revenue beginning on July 1, 2024, totaling an estimated $282.8 million, to support public transit agencies. For more information on current funding for public transit agencies, please see the Transportation section in this document.

| Proposed Tax and Revenue Modifications 2024/25 ($ amounts in millions) |

| Modification |

Estimated Impact to the General Fund in 2024/25 |

| Adult Use Cannabis Tax |

$14.8 |

| Skill Games Tax |

$150.4 |

| Transfer to Tobacco Settlement Fund |

($115.3) |

| Transfer to Environmental Stewardship Fund |

($9.9) |

| Transfer to the PHARE Fund |

($20.4) |

| Transfer to the Public Transportation Trust Fund |

($282.8) |

| Minimum Wage Increase |

$56.7 |

| Total Proposed Tax and Revenue Modifications |

($206.5) |

The executive budget proposes supplemental appropriations that reduce 2023/24 General Fund spending by $411.9 million. The primary cause of this reduction is related to proposed supplemental appropriations for Human Services programs which are updated to reflect projections of utilization, caseloads, and enrollments for these programs through June 2023.

The updated 2023/24 revenue estimates and spending recommendations lead to a projected balance of $7.9 billion remaining in the General Fund. The executive budget does not propose to suspend the statutory transfer to the Budget Stabilization Reserve Fund (commonly called the Rainy Day Fund), which would be 10% of the 2023/24 budget surplus. Consequently, this budget assumes a transfer of $785.6 million from the General Fund to the Rainy Day Fund at the end of the current fiscal year. The estimated remaining balance that would be carried into 2024/25 is $7.1 billion.

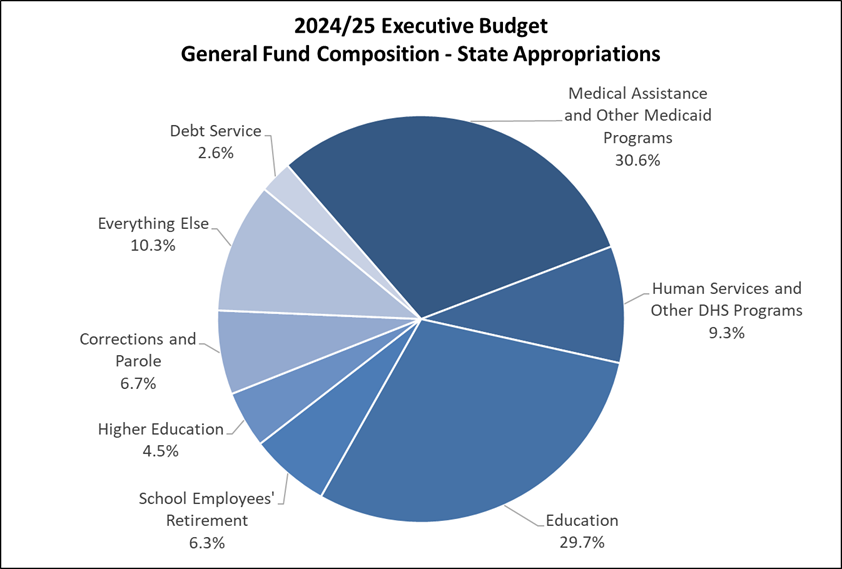

For 2024/25, the executive budget proposes $48.3 billion in General Fund expenditures, a $3.7 billion or 8.4% increase over 2023/24 after adjusting for recommended supplemental appropriations.

The 2024/25 budget also proposes utilizing federal funds made available through the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) to make critical investments in Pennsylvania’s environment. These expenditures include $1.7 billion for energy projects and $821 million in water projects through the Department of Environmental Protection and PennVEST.

With factoring in revenue projections, proposed tax and revenue modifications, refunds, lapses, and recommended spending, General Fund expenditures exceed net revenues by $3.2 billion in the 2024/25 fiscal year, which requires the use of reserves to cover expenditures, starting with the remaining fund balance. As a result, the projected General Fund ending balance declines from $7.1 billion to $3.4 billion in 2024/25, after accounting for the assumed statutory transfers of the budget surplus to the Rainy Day Fund in each fiscal year and continues to drop. Beginning in 2026/27 through 2028/29, the executive budget assumes that transfers from the Rainy Day Fund to the General Fund will be necessary to pay projected expenditures.

Currently, the Rainy Day Fund has an estimated balance of $6.2 billion.

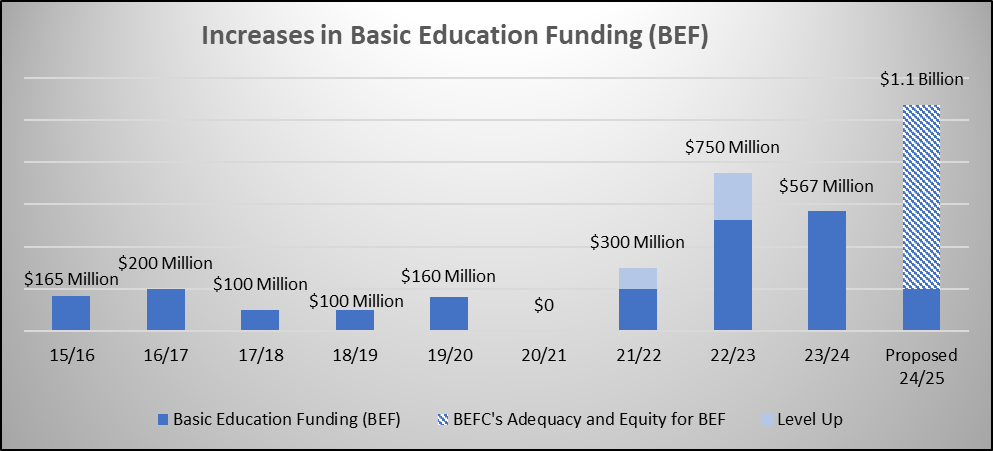

On the eve of the one-year anniversary of the Commonwealth Court ruling declaring Pennsylvania’s public education system unconstitutional, the governor is presenting the General Assembly with a budget that makes a historic investment in public school funding, including significant dollars for Pennsylvania’s most under resourced schools.

The governor’s proposed budget reflects the recommendations contained within the majority report of the Basic Education Funding Commission (BEFC). This includes a record $1.1 billion or 13.6% increase in the BEF appropriation that breaks down as follows:

- $200 million distributed to all 500 school districts through the updated fair funding formula

- $872 million in adequacy and equity supplements

- $735 million in adequacy payments

- This funding is for 371 school districts that spend below $13,704 per weighted student, which is the BEFC’s recommended adequacy target derived from the median spending level of successful school districts.

- $137 million in equity payments

- This funding is for 169 school districts with the highest local tax effort, with the distribution providing proportionately more funding to districts with higher tax burdens and weaker tax bases.

BEF is the largest state subsidy for school districts, accounting for a little more than half of the money Harrisburg distributes to the 500 school districts. The reconstituted BEFC’s majority report contains comprehensive recommendations to address Pennsylvania’s unconstitutional public education funding system.

The 2023/24 proposed budget includes $300 million for the School Environmental Repairs Program, which provides grants requiring a 50% match for projects that abate or remediate environmental hazards, including lead, asbestos, and mold. The maximum grant award is $10 million, and eligibility is limited to school districts, area career and technical schools, and charter schools.

The School Environmental Repairs Program was enacted as part of the final 2023/24 budget package, which provided a combined $175 million for two new school facility grant programs. Therefore, the proposed 2024/25 investment represents a $125 million or 71% increase. There is no funding proposed for the other new program – the Public School Facilities Improvement Program, which supports a broader range of projects such as roof or window repairs, HVAC equipment, and plumbing systems.

| School Facility Funding |

2023/24 |

2024/25 |

| School Environmental Repairs Program |

|

|

| from prior year surpluses in general government accounts |

$75,000 |

$0 |

| from a General Fund appropriation |

$0 |

$300,000 |

| |

|

|

| Public School Facilities Improvement Program |

|

|

| from repurposed Level Up funding |

$100,000 |

$0 |

| School Facility Funding: |

$175,000 |

$300,000 |

| $ amounts in thousands |

|

|

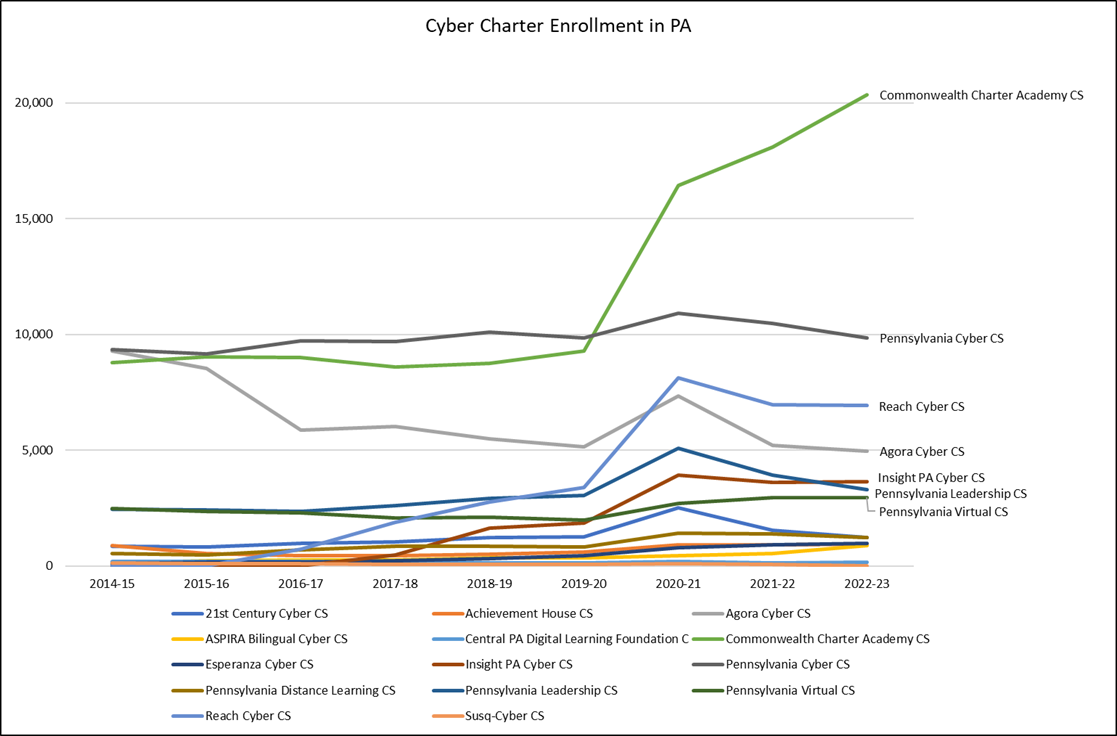

The governor’s proposed budget calls for a uniform cyber charter tuition rate of $8,000 per general education student and estimates that this will generate $262 million in annual savings to school districts.

These proposed savings are roughly 25% of the $1.1 billion that school districts spent on mandated cyber charter tuition in 2021/22. Over the past five years, cyber charter tuition has increased by $593 million or 128%. According to data submitted to PDE, the current charter school tuition rate for general education students ranges from $8,639 to $26,564.

On July 7, 2023, in a bipartisan vote, the PA House of Representatives passed House Bill 1422 (sponsored by Rep. Ciresi), which reforms cyber charter school payments. The bill includes the same recommended general education rate as proposed by the governor ($8,000 per student), but it went further by also calling for reforms for the special education payments. The fiscal note for HB1422 estimated an annual savings for school districts of $456 million, which represents about 43% of school districts’ reported expenditures on cyber charter tuition.

In Pennsylvania, there is no differentiation between how cyber charter schools and brick and mortar charter schools are funded. For a general education student, charter schools receive a per-pupil tuition payment from the school district of residence equal to that school district’s per-pupil expenditures after some deduction allowances for either funding the charter school accesses directly (e.g., federal funds) or funding related to services that the school district is required to provide (e.g., transportation). Therefore, there are 500 charter school tuition rates – one for each school district.

For special education students, charter schools receive an add-on amount equal to the school district of residence’s applicable special education expenditures divided by 16% of the school district’s average daily membership. This methodology is faulty in two ways. First, the average school district’s special education enrollment constitutes 19% of its overall enrollment. Using the 16% assumption artificially inflates the per-pupil rate. Second, this methodology treats each special education student the same when the costs of special education services can range between a few thousand dollars to six figures. Further, data show charter schools educate a disproportionate share of the lowest cost special education students. School entities already report special education students in three cost categories, so fixing these methodology issues would require no additional data collection mandates.

Currently, cyber charter schools make up about 4% of total average daily membership and brick and mortar charter schools make up about 6%. According to the most recent enrollment figures, cyber charter schools enrolled 57,426 students in 2022/23, and a historical trend shows cyber enrollments spiking after the onset of the COVID pandemic.

Over the past ten years, the number of certificates for new teachers (Instructional I Certificates) issued in Pennsylvania has dropped from 19,838 to 6,153, a 69% decline. This and other evidence suggests that investments in the commonwealth’s teacher pipeline are needed.

The 2023/24 budget created a new $10 million appropriation for a Student Teacher Stipend, which helps to mitigate the barrier of unpaid student teaching. The 2024/25 budget proposes to increase this investment to $15 million (note: the appropriation is moved to PHEAA).

Additionally, Gov. Shapiro proposes $10 million for the Talent Recruitment Account and envisions those funds to be used to Grow Your Own educator programs, dual credit programs for prospective educators, and educator apprenticeship programs.

The 2024/25 budget also proposes to double the investment in Teacher Professional Development – from $5 million to $10 million – and upgrade the usability and efficiency of the Teacher Information Management System through an $8 million increase in the Information and Technology Improvement appropriation.

- Early Childhood Education

- $32.5 million or 10.7% increase for Pre-K Counts to increase the per-child reimbursement rates to allow higher compensation for educators

- $2.7 million or 3.1% increase for Head Start Supplemental Assistance to cover increasing costs

- $50 million or 3.6% increase for Special Education Funding (SEF)

- $17 million or 4.8% increase for early intervention (3-5 year olds)

- School Safety

- $50 million for physical safety grants (same amount as last year)

- $100 million for mental health safety grants (same amount as last year)

- Note: the 2023/24 school code charged the School Safety and Security Committee with administering the Safe School Initiative targeted grants, so that funding is now under PCCD

- Note: Under the Violence Intervention and Prevention funding within PCCD, $11.5 million is set-aside for the Building Opportunity through Out of School Time (BOOST) program to keep kids safe and learning in afterschool programs

- $7 million for Dual Enrollment

The governor proposes significant restructuring of higher education in the commonwealth to make the system more affordable, effective, and transparent.

Support for the state-related universities—Penn State, Temple, Pitt, Lincoln—would be combined into a single appropriation. Each of these state-related universities would receive a 5% increase in state funding. The combined appropriation would total $633.7 million, an aggregate increase of $30.2 million over the last fiscal year. Thadeus Stevens College of Technology would receive a 15% increase, bringing its total funding to $22.8 million.

The governor also proposes a $250,000 increase for an initiative to combat campus sexual assaults.

| Grants to State-Related Institutions |

2023/24 |

2024/25 |

Change |

| Penn State - General Support |

$242,096 |

$0 |

|

|

| Pennsylvania College of Technology |

$29,971 |

$0 |

|

|

| Pitt - General Support |

$151,507 |

$0 |

|

|

| Pitt - Rural Education Outreach |

$3,346 |

$0 |

|

|

| Temple - General Support |

$158,206 |

$0 |

|

|

| Lincoln - General Support |

$18,401 |

$0 |

|

|

| Grants to State-Related Institutions |

$0 |

$633,703 |

|

|

| Aggregate: |

$603,527 |

$633,703 |

$30,176 |

5.0% |

| $ amounts in thousands |

|

|

|

|

The governor also proposes to combine the funding for PASSHE and the commonwealth’s community colleges and merge the two systems under a new governance structure. This new framework for public higher education institutions is intended to increase efficiency and affordability while reorienting the system toward meeting the commonwealth’s workforce needs and equipping students for family-sustaining careers.

Funding for the new, combined system would increase by 15%—$127.1 million—to a total of $974.3 million. The governor also proposes a new and transparent performance-based funding formula for the combined public higher education system in future years. The new formula would account for things like on-time degree completion and post-graduation employment rates in distributing future funding.

| Public College and University Funding |

2023/24 |

2024/25 |

Change |

| Community Colleges |

$261,640 |

$0 |

|

|

| PASSHE - State Universities |

$585,618 |

$0 |

|

|

| Public College and University Funding |

$0 |

$974,347 |

|

|

| Aggregate: |

$847,258 |

$974,347 |

$127,089 |

15.0% |

| $ amounts in thousands |

|

|

|

|

The budget proposal increases PHEAA’s grants to students by $31.1 million or 9%. This additional funding would increase grants to maintain their purchasing power. The governor has also proposed a plan to increase the maximum grant awards by $1,000 in the 2025/26 fiscal year as part of an annual investment of $279 million in affordability. The budget also includes a new initiative to encourage people to choose education as a profession. The Student Teacher Stipend program receives $15 million, comprised of $5 million in new spending in $10 million shifted from the budget of the Department of Education.

The 2024/25 budget proposal contains an array of supplemental and new funding initiatives, and 35 new positions.

First, within the Office of Administration, the executive budget includes $562,000 for an initiative to support the use of Artificial Intelligence (AI) technologies, $370,000 for legal and contracting support, a $367,000 initiative to meet the Commonwealth’s accessibility requirements, and the addition of eight new positions. Of the recommended new positions, two would be for Digital Accessibility, three for AI, one to support recruitment and retention, and two to boost IT contracting.

Second, is the Office of Digital Experience, which was created by Gov. Shapiro in 2023 and is utilized to improve online services and streamline the way the public interacts with the Commonwealth. The 2024/25 budget proposal includes a new appropriation of $34.05 million for the office. This funding includes:

- $16.7 million to build a platform which would provide consistent and user-friendly services

- Including the addition of 16 new positions

- $6.54 million to create a centralized repository of agency data

- $6.5 million to provide cross-agency services for scoping and building digital solutions

- $2.8 million to allow for alignment of business or personal profiles across Commonwealth digital platforms

- $1.49 million to encrypt data in order to limit access to personally identifiable information

- Includes the addition of three new positions

Third, is the State Office of Inspector General, which includes a $205,000 initiative to provide legal support related to financial and intergovernmental operations and assumes the addition of one new position.

Also worth highlighting, are a new appropriation for the Enterprise Systems Lifecycle, for which the executive budget provides a $38 million initiative for enterprise migration and the addition of two new positions including $545,000, within the Office of General Counsel.

Furthermore, the 2024/25 proposal includes $600,000 in additional funding and five new positions within the Human Relations Commission, to protect the civil rights of Pennsylvanians.

Lastly, the executive budget proposes a supplemental appropriation for the Office of General Counsel in 2023/24 in the amount of $700,000.

The governor’s proposed budget includes an overall negative supplemental General Fund request for 2023/24 for the Department of Human Services (DHS).

Many of the appropriations with a proposed decrease fund the Medical Assistance (MA) managed care and fee-for-service programs. The combined proposed supplemental decreases to Human Services appropriations total $548.2 million and reflect updated projections of utilization, caseloads and enrollments anticipated through June 2023.

The following appropriations include a supplemental increase for 2023/24:

- Youth Development Institutions and Forestry Camps,

- MA - Long-Term Living,

- MA – Long-Term Care Managed Care, and

- Intellectual Disabilities – Intermediate Care Facilities

The combined increase for these appropriations totals $43.6 million, which when applied to the decrease for the other appropriations results in a net supplemental decrease totaling $504.6 million.

The governor’s proposed budget includes $19.2 billion for 2024/25 for Human Services programs. This is an increase of $1.1 billion, or 6%, over 2023/24. Major factors for this increase fall into the following categories:

- The need to replace federal funding,

- Costs to maintain the current programs,

- Program initiatives, and

- The impact of one-time measures.

Enhanced Federal Medical Assistance Percentage (FMAP)

During the COVID-19 pandemic, the federal government picked up an additional percentage of the Medical Assistance program costs resulting in a reduced need for state General Funds. As part of the federal government’s federal fiscal year 2023 enacted budget the enhanced FMAP decreased from 6.2% to 5% on April 1, 2023, to 2.5% on July 1, 2023, and to 1.5% on October 1, 2023. The enhanced FMAP then ended on December 31, 2023. The cost of replacing the enhanced FMAP with state General Funds is $493 million for 2024/25.

The loss of the enhanced FMAP is offset by changes to Pennsylvania’s regular FMAP. Under the formula in the Social Security Act, Pennsylvania’s regular FMAP will increase effective October 1, 2024, from 54.12% to 55.09%. As this increase takes effect October 1, 2024, the governor’s executive budget uses a blended rate to account for the fact that the July to September 2024 quarter will have a different FMAP. This blended rate will increase from 53.59% in 2023/24 to 54.85% in 2024/25. State savings due to the higher regular FMAP are estimated to be $500 million.

American Rescue Plan Act Funding – Medical Assistance

The American Rescue Plan Act provided a temporary 10% in additional FMAP for MA Home and Community-Based Services (HCBS) between April 1, 2021, and March 31, 2022. The federal government required that any state savings from the temporary FMAP increase had to be used to implement programs that enhance, expand, or strengthen the HCBS services available under the MA program, and the available funding must be spent by March 31, 2025. The proposed 2024/25 budget includes approximately $79 million in state General Funds which will allow DHS to maintain some of the HCBS initiatives through June 30, 2025. Most of these initiatives that will be maintained relate to increased rates paid for certain HCBS services provided in the MA program.

MA Managed Care Rates & Enrollment

The MA - Capitation appropriation provides funding for the MA managed care program for physical and behavioral health services, also known as the HealthChoices program. The 2024/25 proposed budget for this program assumes an increase in state General Funds of $613.8 million over 2023/24 for both changes in individuals that are eligible for this program and changes to the rates paid by DHS to the MA managed care organizations. This increase is partially offset by the decrease in MA enrollment resulting from the MA eligibility redeterminations.

MA Eligibility Redeterminations

In order to receive the enhanced FMAP during the pandemic, DHS was required by the federal government to maintain the MA enrollment for all individuals enrolled in the program on March 1, 2020, through the end of the COVID-19 pandemic and the corresponding Public Health Emergency. DHS was not permitted to terminate MA eligibility, except in specific cases such as death, a move out of state, or if an eligible individual voluntarily withdrew from the program.

With the ending of the pandemic, DHS began MA eligibility redeterminations on April 1, 2023. The federal government requires states to complete eligibility redeterminations in 12 months, so the final redeterminations will be completed in March 2024. The redetermination process has resulted in decreased enrollment during 2023/24. In addition to this decrease, the governor’s proposed budget includes a decrease to state General Funds for 2024/25 of $343.5 million for the continued process of eligibility redetermination and decreases in MA program enrollment.

Retroactive Eligibility

As part of the eligibility redetermination process, DHS was able to use information that is already available to the department to verify eligibility and complete the individual’s redetermination. After implementing the revised process, the federal government notified DHS that changes were needed so the process aligned to the federal requirements. After completing these changes, DHS reviewed the redeterminations for individuals that had been evaluated using this process. In January 2024, DHS retroactively reinstated MA or CHIP eligibility for anyone that was disenrolled and should not have been. Due to this retroactive eligibility, the proposed budget includes an increase of $31.5 million in state funds over the prior year.

Ambulance Transportation Services

Act 15 of 2023 included changes to the Human Services Code which require MA payment for emergency ground ambulance transportation at either the Medicare or MA Fee Schedule rate, whichever is greater. This increase took effect on January 1, 2024. The proposed budget includes an increase to state funds of $28 million for this required change in MA reimbursement.

Children’s Health Insurance Program Enrollment

As MA eligibility redeterminations may result in children no longer eligible for the Medical Assistance program, some of these children will transition to the Children’s Health Insurance Program (CHIP). Therefore, CHIP enrollment is expected to increase for children under age 19. The governor’s executive budget proposes an increase of $15 million for CHIP over the prior year due to increasing enrollment.

Continuous Enrollment for Children Up to Age 19

Beginning January 1, 2024, children under age 19 that are determined to be eligible for the MA program will remain continuously enrolled for 12 months. The governor’s proposed budget includes an increase of $65 million over the prior year due to the continuous enrollment for children.

The governor’s proposed budget for 2024/25 includes several initiatives for Human Services programs.

General Government Operations

The governor’s proposed budget includes an increase of $617,000 to the General Government Operations appropriation to provide increased access to quality services provided by DHS.

Supplemental Nutrition Assistance Program

The budget proposes an increase of $16 million in state General Funds to supplement the federal funding available for the Supplemental Nutrition Assistance Program (SNAP) to increase the minimum monthly benefit for elderly and disabled individuals from $23 to $35 per month. This proposal also includes a $1 million increase for system enhancements related to the increase in the minimum SNAP benefits.

Summer EBT Program

The proposed 2024/25 budget includes $3 million for the summer EBT program that will ensure eligible families that have school aged children will receive needed food resources during the summer months when there is no school.

Medical Assistance

The budget proposes an increase to state General Funds of $1.3 million to increase MA rates for family planning services.

Medical Assistance - Long-Term Care Managed Care

In addition to the family planning MA rates, the governor’s proposed budget includes an increase of $2 million in state General Funds to provide home and community-based services to 180 additional older individuals.

Mental Health Services

The governor’s budget proposes an increase of $5.8 million to expand diversion and discharge programs for individuals with mental illness currently in the criminal justice system, and an increase of $1.6 million to fund home and community-based services to 20 individuals currently residing in the state hospitals.

Mental Health - County Based Services

The proposed budget maintains the $20 million increase for county based mental health services from 2023/24 and adds an additional increase of $20 million for 2024/25 for a total of $40 million.

Mental Health - Crisis Intervention & 988 Network Services

In addition to the county based mental health services, the 2024/25 proposed budget includes an increase of $10 million over the prior year to provide support for the 988 network, and an increase of $5 million to maintain walk-in mental health crisis stabilization centers.

Intellectual Disabilities & Autism Services

The governor’s executive budget proposes an increase of $36 million in state funds to provide home and community-based services to more individuals, and $934,000 to add American Sign Language interpreter services to the Consolidated, Person/Family Directed Services, Community Living, and Adult Autism Waivers. Last year, the governor instructed DHS to review the MA provider rates for home and community-based services in the Intellectual Disabilities programs. As a result of this review, the budget proposes an increase of $217 million in state funds to increase MA rates for providers of home and community-based services.

Subsidized Child Care

The governor’s executive budget includes an increase of $5.3 million to provide an increase in the minimum wage to $15 per hour. Additionally, the budget includes a proposed increase in state General Funds of $96,000 in the Child Care Assistance appropriation to support an increase in the Child Care Works subsidy rates.

Additional Initiatives

The governor’s proposed budget includes:

- An increase of $5 million in state funds for the Domestic Violence appropriation to increase services to domestic violence victims;

- An increase of $10 million for the Homeless Assistance appropriation to improve county capacity to prevent eviction, provide rental assistance, and provide housing stabilization; and

- An increase of $6.8 million in state General Funds for the Legal Services appropriation that will support legal services to help renters avoid eviction and will provide for increases in the statewide legal services for civil cases.

The proposed budget includes a decrease of $353 million due to increased assessment revenue. An increase in assessment revenue collected by DHS reduces the need for state General Funds.

The County Child Welfare appropriation proposed in the governor’s executive budget is $1.49 billion in state general funds. There is a proposed $2 million increase for County Child Welfare to replace the enhanced federal funding from 2023/24.

Additionally, the proposed budget includes an increase in state funds to the Youth Development Institutions and Forestry Camps appropriation totaling $18 million to allow DHS to build capacity to accept court-order placements to adjudicated male youth.

The governor’s executive budget maintains funding at the same overall level as the prior year for:

- MA – Physician Practice Plans - $10 million

- MA – Hospital Burn Centers - $4.4 million

- MA – Critical Access Hospitals - $14 million

- MA – Obstetric and Neonatal Services - $3.7 million

- MA – Trauma Centers - $8.7 million

- MA – Academic Medical Centers - $24.7 million

- Expanded Services for Women - $8 million

- Nurse Family Partnership - $14 million

- Rape Crisis - $11.9 million

- Breast Cancer Screening - $1.8 million

- Human Services Development Fund - $13.5 million

- 211 Communications - $750,000

- Services for the Visionally Impaired - $4.7 million

The proposed budget does not include funding for the Health Program Assistance Services appropriation which is a decrease to state General Funds of $40 million.

Governor Shapiro’s executive budget proposes $259.2 million in state General Funds for the Department of Health (DOH), a $20.3 million, or 8.5% increase above enacted 2023/24 appropriation levels. The governor’s budget proposes to increase General Government Operations (GGO) by $4.3 million, or 14%. Included in this increase is $994,000 to support the Department of Health’s (DOH) plan to reduce and eliminate viral hepatitis.

The governor’s budget includes the following new appropriations:

- Firearm Injury Prevention (at $1 million)

- This appropriation would create a statewide Firearm Injury Prevention Program. The program will empower the DOH to enhance data collection and analysis, engage in community education initiatives, support evidence-based interventions, and collaborate with county coroners and law enforcement

- Medical Debt Relief (at $4 million)

- The Medical Debt Relief appropriation would support a new position and provide medical debt relief for low-income Pennsylvanians

- Long-Term Care Transformation Office (at $10 million)

- The Long-Term Care Transformation Office would provide guidance, support, and technical assistance to long-term care facilities

The governor’s budget proposes to increase the following appropriations:

- Health Promotion and Disease Prevention appropriation (a $2.6 million, or 115% increase)

- These funds are allocated to support the governor’s initiative to continue capacity-building and implement prevention strategies to reduce maternal mortality and morbidity

- School District Health Services appropriation (a $3 million, or 8.7% increase)

- The proposed increase would provide feminine hygiene products in schools at no cost to students

- Quality Assurance appropriation (a $2.4 million, or 8% increase)

- The budget proposes to invest $765,000 to adequately staff quality assurance inspectors to respond to investigation complaints timely and to ensure stability within long-term care facilities and would fund eighteen new positions.

The governor’s executive budget proposes to reduce or eliminate the following appropriations:

- Primary Health Care Practitioner (a $2.8 million, or 34%, reduction)

- Bio-Technology Research (a $10.6 million, program elimination)

The governor proposes level funding for the many disease-specific appropriations.

The governor’s budget proposes to add 17 new positions in the Medical Marijuana Program Fund for safety inspections, lab operations, and program analysis. These positions are funded through the Medical Marijuana Program Fund.

Governor Shapiro’s executive budget proposes a $103,000, or 3%, increase in General Government Operations over 2023/24. Funding for Assistance to Drug and Alcohol Programs was flat funded.

The governor’s executive budget proposes to invest:

- $119,000 from the Compulsive and Problem Gambling Treatment Fund for problem gambling case management services to ensure individuals seeking help from gambling-related issues have access to financial counseling, mental health services, housing, and other resources.

- $228,000 from the federally funded Substance Use Prevention, Treatment, and Recovery Services Block Grant to create an Office of Recovery within the Drug and Alcohol Programs department. The office would take a holistic approach to substance use treatment, emphasizing abstinence and overall well-being.

The governor’s budget proposes a $44.4 million initiative to create a subsidy wrap pilot program for uninsured or underinsured Pennsylvanians. This program would aim to reduce premiums for those at risk of dropping out of the health insurance market. To maintain existing funding for the commonwealth’s reinsurance program while funding this new initiative, a one-time transfer of $50 million will be made from the Workers’ Compensation Security Fund to the Reinsurance Fund.

Lottery Fund expenditures in support of senior programs total $1.36 billion in the 2024/25 executive budget, reflecting an increase of $158.7 million over the prior year.

The largest contribution to this year-over-year increase is the additional $116.8 million in funding for the Property Tax/Rent Rebate Program, which was expanded under Act 7 of 2023. Although participants of the program will be able to apply for a rebate under the expanded program parameters this year for property taxes or rent paid in 2023, the additional program costs associated with the expansion are shifted to 2024/25 because the Department of Revenue cannot begin sending out rebates for claim year 2023 until July 1 under Pennsylvania law, marking the beginning of the next fiscal year. This increase is being supported by increased gaming transfers to the Lottery Fund in compliance with that Taxpayer Relief Act.

There is a proposed increase of $15.2 million for the PENNCARE appropriation over 2023/24, which includes $10 million to provide operational resources to the Area Agencies on Aging and $5.2 million to provide expanded housing options for older adults. The PENNCARE appropriation funds the OPTIONS program, which provides services to certain qualified older adults to continue to live in their homes and communities.

The governor’s executive budget includes a new appropriation for Aging Our Way, PA totaling $11.7 million, which is funding for the governor’s initiative to transform both the infrastructure and coordination of services for older adults in the commonwealth.

Finally, there is an increase in the transfer from Lottery Funds to the Pharmaceutical Assistance Fund of $15 million over 2023/24. The increase in this transfer is to support the Pharmaceutical Assistance Contract for the Elderly (PACE) and the PACE Needs Enhancement Tier (PACENET) programs.

|

Proposed Lottery Fund Expenditures for Senior Programs in 2024/25

($ amounts in millions)

|

|

Agency/Appropriation

|

2022/23 Actual

|

2023/24 Available

|

2024/25 Budget

|

$ Change

|

% Change

|

|

Department of Aging:

|

|

|

|

PENNCARE

|

$282.8

|

$287.8

|

$303.0

|

$15.2

|

5.3%

|

|

Aging Our Way, PA

|

-

|

-

|

$11.7

|

$11.7

|

-

|

|

Transfer to Pharmaceutical Assistance Fund

|

$135.0

|

$155.0

|

$170.0

|

$15.0

|

9.7%

|

|

Pre-Admission Assessment

|

$8.8

|

$8.8

|

$8.8

|

-

|

-

|

|

Caregiver Support

|

$12.1

|

$12.1

|

$12.1

|

-

|

-

|

|

Grants for Senior Centers

|

$2.0

|

$3.0

|

$3.0

|

-

|

-

|

|

Alzheimer's Outreach

|

$0.25

|

$0.25

|

$0.25

|

-

|

-

|

|

Department of Human Services:

|

|

|

|

Medical Assistance - Community HealthChoices

|

$349.0

|

$349.0

|

$349.0

|

-

|

-

|

|

Medical Assistance - Transportation Services

|

$3.8

|

$4.0

|

$4.0

|

-

|

-

|

|

Department of Revenue:

|

|

|

|

Property Tax and Rent Assistance

|

$223.8

|

$207.6

|

$324.4

|

$116.8

|

56.3%

|

|

Department of Transportation:

|

|

|

|

Transfer to the Public Transportation Trust Fund

|

$95.9

|

$95.9

|

$95.9

|

-

|

-

|

|

Older Pennsylvanians Shared Rides

|

$75.0

|

$75.0

|

$75.0

|

-

|

-

|

|

Total Lottery Fund Expenditures for Senior Programs

|

$1,188.4

|

$1,198.4

|

$1,357.2

|

$158.7

|

13.2%

|

| ($ amounts in millions) |

2023/24 |

2024/25 |

$ Change |

% Change |

| Attorney General |

$138.8 |

$155.0 |

$16.2 |

11.7% |

| Auditor General |

$45.8 |

$45.8 |

$0.0 |

0.0% |

| Treasury (excl. debt service costs) |

$55.4 |

$59.2 |

$3.8 |

6.9% |

The governor’s budget proposes no new initiatives for the Treasury Department or the Auditor General. Funding for the Auditor General remains at the same level as in the 2023/24 budget, while Treasury sees an increase of 1.6% for its General Government Operations. The main driver of increased spending for the Treasury is an increase of $2.4 million dollars in reimbursements for the divestiture of commonwealth investments from proscribed countries and companies.

Within the Office of Attorney General, state General Government Operations funding is increased by $11.2 million, or 21.2%, to $63.9 million. Included in this increase is $2.7 million to implement the requirements of Act 42 of 2023, which established within the Office of Attorney General the Office of Deputy Attorney General for Organized Retail Crime Theft. The proposal also includes an additional $759,000 to create a unit to combat human trafficking and $330,000 to provide additional resources for the protection and service of the citizens of the Commonwealth.

Funding for Drug Law Enforcement is increased by $2.8 million, or 4.8%, to $62.5 million. The Joint State-Local Firearm Taskforce, a collaborative effort program to reduce gun crime in Philadelphia, sees its appropriation increased by 5%, or $700,000, to $14.7 million. The School Safety appropriation, which provides for the Safe2Say Something program, is increased by $220,000, or 9.4%, to $2.6 million.

The executive budget increases funding to the Department of Military and Veterans Affairs by $19.2 million, or 9%, to a total of $231.6 million. Much of this increase—$12.8 million—is directed to the six veterans’ homes run by the department. That increase includes $4 million to replace expiring federal COVID-19 funds.

Funding for General Government Operations is increased by $5.2 million to $38.2 million. The governor proposes using $2 million of that increase to create a new walk-in veterans outreach center at Fort Indiantown Gap to make it easier for servicemembers, veterans, and their families to access benefits and services. The governor also proposes to increase funding for outreach by veteran service organizations by $424,000.

Governor Shapiro’s executive budget proposal for the Department of Community and Economic Development (DCED) is $339.4 million. The General Government Operations appropriation contains a $1.53 million, or 4% decrease.

The 2024/25 budget proposal includes a $9 million increase for PA First, DCED’s comprehensive program aimed at job creation and retention using grants and WEDnet, which is Pennsylvania’s workforce development program. Of this $9 million, $2 million is specifically earmarked to support programs statewide impacting Pennsylvanians with intellectual disabilities. To further develop the Commonwealth’s workforce, the executive budget includes a $2 million increase for the Foundations in Industry appropriation, which will support internships at Pennsylvania companies, and proposes a $3 million increase in Marketing to Attract Businesses to enhance site selection and business attraction marketing.

To invest in Pennsylvania’s innovation economy, the executive budget proposes $20 million for the creation of a new appropriation called PA Innovation aimed at supporting entrepreneurs scaling their products, innovation, and research, in conjunction with federal investment. It also provides a new $3.5 million Regional Economic Competitive Challenge appropriation, which would be used to provide planning grants for regions throughout the Commonwealth to establish locally driven economic growth strategies. Moreover, the executive budget proposes a $500 million taxable bond issued by the Pennsylvania Economic Development Financing Authority on behalf of DCED to provide funding for the PA SITES Program. PA SITES would invest valuable funding for on-site readiness and development throughout the Commonwealth. This budget provides $15.404 million for the debt service associated with the bond issued for this program.

The executive budget also proposes a new $25 million dollar initiative known as Main Street Matters to improve capacity and provide flexible resources to revitalize neighborhoods while supporting Main Street and Elm Street programs. The governor proposes a $50 million investment of state funding in the Whole Home Repairs Program and proposes a new $5 million appropriation for Local Government Emergency Housing Support to provide flexible emergency housing response funding. This budget also provides an $8.8 million increase in the transfer to Municipalities Financial Recovery Revolving Fund to provide additional support to communities facing financial distress under Act 47.

Finally, the governor proposes restoring the Public Television Technology line item, which has not been funded since 2020/21, at $875,000. The governor also proposes $2.5 million for America 250PA, which will support efforts to commemorate the 250th Anniversary of the United States in 2026. The budget proposes a $697,000 increase for the Office of Open Records to ensure transparent and efficient administration of the Right-to-Know Law.

Governor Shapiro's executive budget proposal for the Department of State is $42.9 million, a $9.3 million, or 21%, increase over Fiscal Year 2023/24. The bulk of this increase comes from funding to aid Pennsylvania’s elections system. This increase includes a $5 million initiative for voter education and direct outreach, a $250,000 initiative for election security and voter integrity, and a $474,000 initiative through the Statewide Uniform Registry of Elections (SURE) database to aid in the promotion of secure and fair elections.

The executive budget also contains a $1.3 million appropriation for the publishing of constitutional amendments.

The governor’s budget proposes $3 billion in state general funds for the Department of Corrections, an increase of $229.6 million, or 7.7% over 2023/24. This assumes $100.9 million in supplemental appropriations for 2023/24 ($10.4 million in Medical Care, $83.3 million in State Correctional Institutions, and $7.1 million in State Field Supervision).

| Major Department of Corrections Appropriations |

| ($ amounts in thousands) |

2023/24 |

2024/25 |

$ Change |

% Change |

| Medical Care |

$ 368,412 |

$ 412,289 |

$ 43,877 |

11.9% |

| Correctional Education and Training |

$ 47,537 |

$ 51,156 |

$ 3,619 |

7.6% |

| State Correctional Institutions |

$ 2,331,704 |

$ 2,506,319 |

$ 174,615 |

7.5% |

| GGO |

$ 39,931 |

$ 40,784 |

$ 853 |

2.1% |

| State Field Supervision |

$ 180,548 |

$ 184,581 |

$ 4,033 |

2.2% |

| Pennsylvania Parole Board |

$ 12,967 |

$ 13,630 |

$ 663 |

5.1% |

| Sexual Offenders Assessment Board |

$ 7,349 |

$ 8,043 |

$ 694 |

9.4% |

| Board of Pardons |

$ 2,700 |

$ 2,885 |

$ 185 |

6.9% |

| Office of Victim Advocate |

$ 3,489 |

$ 4,547 |

$ 1,058 |

30.3% |

The medical care appropriation increase includes $29.6 million to continue providing Medication Assisted Treatment (MAT) to incarcerated individuals with Opioid Use Disorder (OUD).

The State Correctional Institutions appropriation includes $5 million to support efforts to reduce the use of Extended Restrictive Housing (EHR), formerly known as solitary confinement. The funding will support hiring thirty-five individuals to achieve this goal.

The General Government Operations appropriation includes $239,000 to fund a new initiative to support the mental health and wellness of corrections staff.

The $1.1 million increase in funding for the office of Victim Advocate offsets a reduction in federal funding for victim services and includes a $152,000 initiative to increase services for crime survivors.

The governor’s budget proposal provides $1.74 billion for the Pennsylvania State Police (PSP), a $109 million, or 6.7% increase from 2023/24.

The executive budget proposes to continue the multi-year effort to reduce the reliance of the PSP on the Motor License Fund (MLF). This budget proposal decreases expenditures to the PSP from the MLF to $250 million, a $125 million decrease from 2023/24. This decrease helps to assure state match requirements for federal transportation infrastructure funding. Further, the budget proposes to continue to reduce expenditures from the MLF by $125 million annually until support for the PSP by the MLF is eliminated in 2026/27. As part of the shift away from the MLF, the proposed budget completely transfers the following appropriations to the General Fund: Statewide Public Safety Radio System, Law Enforcement Information Technology, Municipal Police Training, Patrol Vehicles, Commercial Vehicle Inspections, and Municipal Police Training Grants.

New for 2024/25 is $2 million for the General Government Operations of the State Police for Adult Use Cannabis-Enforcement. The $2 million is from funds generated by the legalization of adult use cannabis.

The governor’s executive budget includes $16 million for 4 new cadet classes with the goal of hiring and training 432 new State Troopers.

The budget also provides $31 million for vehicle replacements and upgrades. This includes a $15 million initiative to maintain the PSP’s helicopter fleet, a $9 million initiative to replace fixed-wing aircraft, and $7 million initiative to improve the patrol vehicle replacement cycle and to replace additional high-mileage vehicles.

As part of the governor’s efforts to combat gun violence, the budget provides $1.5 million to hire nine additional civilian employees. The additional funding would provide for additional auditors to ensure problem firearms retailers in Pennsylvania comply with the law and would increase capacity for the PA Criminal Intelligence Center (PaCIC). The additional capacity will allow the PaCIC to expand social media monitoring efforts.

The 2024/25 budget proposes a $1.6 million appropriation increase to support the Pennsylvania Instant Check System (PICS).

The governor’s budget increases funding to the Pennsylvania Emergency Management Agency (PEMA) by $13.8 million to $40.4 million – an increase of 52.1%. The largest share of that increase is attributable to $10.8 million for state matching on federally funded disaster relief projects. Funding for state disaster assistance to individuals would be maintained at $5 million.

The budget proposal increases PEMA’s General Government Operations funding by $3.3 million, or 22.9%, including $2.7 million for a new initiative to enhance coordination with counties for disaster planning and management. This increase would support an additional 23 positions for emergency response and local support.

Spending for the Office of the State Fire Commissioner increases by $2.4 million to a total of $5.5 million, mostly to maintain current operations. The governor proposes doubling the size of the Fire and Emergency Medical Services Grant Program to a total of $60 million. The program, which is overseen by the State Fire Commissioner, distributes grants to volunteer or professional fire companies, EMS providers, and rescue squads. The grants may be used for equipment, facilities, training, debt reduction, and other purposes.

The governor’s budget proposes a $2.4 million increase for the General Government Operations of the Pennsylvania Commission on Crime and Delinquency (PCCD). $1 million of this increase is to establish the Office of Gun Violence Prevention and will fund two new positions.

Using funds generated by the legalization of adult use cannabis, the budget proposes to invest $5 million in restorative justice initiatives.

Act 44 of 2018 established the School Safety and Security Committee for the administration of the School Safety and Security Grant Program. Act 33 of 2023 transferred the administration of the Targeted School Safety Grants for Nonpublic Schools and School Entities Program to PCCD. The budget proposal provides $700,000 for the administration of program and provides for four new positions to administer the $11 million grant program.

To support the governor’s efforts to reduce gun violence in Pennsylvania, the executive budget also includes $37.5 million for Gun Violence Investigation and Prosecution grants. The purpose of the Gun Violence Investigation and Prosecution grant program is to make grants to county district attorneys' offices and local law enforcement agencies to investigate and prosecute firearms offenses and gun violence. The grant program was first funded in 2022/23 at $50 million using federal ARPA dollars and did not receive any funding in 2023/24.

The budget proposes a $4 million increase for the Improvement of Adult Probation Services. These grants are meant to support county probation and have been level funded for twelve years. County probation is also supported by the state through Intermediate Punishment Treatment programs, level funded for 2024/25 at $18.2 million and from the Justice Reinvestment Fund.

Acts 114 and 115 of 2019, also known as JRI 2, shifted Improvement of Adult Probation Services from the Department of Corrections to PCCD. Additional funds were deposited into the Justice Reinvestment Fund beginning in 2021/22 based on a percentage of program savings generated in the year prior to the deposits. Savings were generated by implementing short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations. These savings will be used to fund county probation grants. In 2024/25, the budget proposes $5.1 million for County Probation Grants funded by JRI 2 savings.

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in 2023/24.

The executive budget provides $77.5 million for Violence Intervention and Prevention grants to support community-led gun violence prevention efforts. This is a $37.5 million increase from 2023/24. New for 2024/25, and within the Violence Intervention and Prevention appropriation, are two new grant programs. The first is an $11 million program designed to provide resources for blight remediation, construction of parks, and improvement of shared spaces, such as parks, streets, and recreational areas, in communities most impacted by gun violence. The budget proposal also provides $11.5 million for after school programming. The goal of this grant program is to create a statewide Building Opportunity through Out of School Time (BOOST) program to positively impact communities, reduce community violence, and increase learning opportunities for young people.

The budget proposal also provides for a $10 million transfer to the Nonprofit Security Grant Fund, an increase of $5 million from 2023/24.

The proposed budget addresses concerns over adequate funding for the Victims Compensation fund by increasing funding by $5 million. The Victims Compensation Fund provides funding to victims of crime and the victim service community.

The budget proposal includes a $2.5 million increase in funding for indigent defense. Indigent defense was first funded in Pennsylvania in the 2023/24 budget at $7.5 million. Funding for indigent defense will flow through PCCD and the Criminal Justice Advisory Committee.

The governor’s budget proposes a $297,000 increase for the Juvenile Court Judges’ Commission (JCJC). The JCJC is responsible for advising juvenile court judges regarding the development and improvement of juvenile probation services throughout the commonwealth.

The governor’s executive budget provides $454 million from the state General Fund for the Judiciary, an 11.2% or $45.6 million increase from 2023/24. This calculation assumes $13.3 million in requested supplemental appropriations for 2023/24.

Included in this increase is a new $3.5 million initiative within the Unified Judicial System to improve capabilities and redundancies against cybersecurity and disaster threats.

The 2024/25 executive budget proposal increases state General Fund spending to $271.47 million from $207.37 million, or a 30.9% increase. It’s worth noting that the increase includes funding for the University of Pennsylvania’s Veterinary Activities in the amount of $31.66 million and the Center for Infectious Disease in the amount of $1.89 million. Neither appropriation was funded in the 2023/24 enacted budget.

Gov. Shapiro’s budget proposal takes bold steps to bolster the department and the agricultural community by incorporating a number of initiatives to advance Pennsylvania farmers. Specifically, the 2024/25 proposal includes the following initiatives:

- General Government Operations

- $130,000 to reduce food insecurity and increase access to healthy meals

- Assumes the addition of one position

- $235,000 to support the development and growth of the dairy industry

- Assumes the addition of one position

- $510,000 to migrate department applications to a cloud-based environment

- $655,000 to create a state program for agricultural seed certification and trade assistance

- Assumes the addition of five positions

- $1.2 million for implementation of new laboratory information management system

- Agricultural Preparedness and Response

- $145,000 for agricultural pest detection using canines

- Includes the addition of one position

- Agricultural Business and Workforce Development

- $5.6 million to increase participation in the Dairy Margin Coverage Protection Program

- Agricultural Innovation Development (new line item)

- $10.26 million to support and attract innovative agricultural businesses

- Assumes the addition of two positions

- Animal Health and Diagnostic Commission

- $5 million investment in new state laboratory in western Pennsylvania

- Transfer to Agricultural College Land Scrip Fund (Penn State Ag Extension)

- $2.88 million to invest in Higher Education and improve agricultural programs

This budget also takes steps to combat food insecurity with the addition of $3 million for programs that provide food resources to those in need. As part of the 2024/25 proposal, the executive budget creates new appropriations for the PA Agricultural Surplus System and the Senior Food Box, which were previously funded within the State Food Purchase Program (SFPP). Furthermore, the budget proposal continues funding of the Fresh Food Financing Initiative (FFFI) at $2 million.

The 2024/25 executive budget includes an increase of state funding for the department in the amount of $196.36 million from $152.12 million in the prior year. The increase represents a change of $44.24 million or 29%.

The lion’s share of the proposed increase is related to the agency’s major appropriations and the addition of 38 new positions.

The General Government Operations appropriation includes an increase of $8.27 million, or 28%, that incorporates the addition of five new positions, a $2 million initiative to consolidate systems and ensure continuity, and $669,000 to manage and improve state park/forest trails.

The State Parks Operations appropriation is increased by a total of $19.45 million or 32%. This increase is due to a decreased reliance on the Oil and Gas Lease Fund, a $1.93 million initiative to manage and improve trails across the state, and the addition of 11 new positions. As it relates to those new positions, six are to manage and improve state park/forest trails and five are to expand the capacity of the PA Outdoor Corps.

The executive budget proposal for State Forests Operations provides for an increase of $15 million that includes the addition of 22 new positions to manage and improve state park/forest trails.

Lastly, the 2024/25 executive budget provides for a significant decrease in the use of funds from the Oil and Gas Lease Fund (OGLF). Utilization of OGLF decreased by $128.79 million or 63.3%, mostly because of Natural Gas prices normalizing since the end of the pandemic.

Gov. Shapiro’s executive budget provides $245.02 million in General Fund state funding to the agency, which represents an increase of $39.2 million or 19.1% over 2023/24. Furthermore, the budget includes $2.72 billion in federal funding, which is an increase of $1.09 billion or 66.7% over the prior year. Those increases are due to new General Fund initiatives, the addition of 71 new positions, and utilization of federal resources, which were previously not available.

The 2024/25 budget proposal includes an increase of $12.96 million for the department’s General Government Operations appropriation. That encompasses a $7 million initiative to modernize and speed up permitting processes and $2.49 million for the Energy Programs Office. Additionally, the budget proposal includes adding 15 new positions within the office.

Next, the budget proposal provides a $2.79 million increase for Environmental Program Management appropriation to continue current operations, for a total of $42.51 million.

Similarly, the proposed budget includes a $10.05 million increase for Environmental Protection Operations appropriation, for a total of $126.5 million. The increase contains a $3.51 million initiative to modernize and speed up permitting, including the addition of 40 new positions. Furthermore, the budget provides an additional $1.5 million in resources for expanding PFAS (often referred to as forever chemicals) water testing capacity and the addition of two new related positions. Lastly, the 2024/25 proposal incorporates a $145,000 well plugging initiative and the addition of two new positions related to well plugging activities.

The Department of Environmental Protection (DEP) will receive a significantly higher amount of federal funding through the Infrastructure Investments and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). Of the total proposed federal dollars for DEP, $2.36 billion would come from those two laws. The executive budget includes the addition of 10 new positions, funded through federal funds, for the Energy Programs Office, well plugging activities, and increased air quality monitoring. Please refer to the sections in this document related to the two acts for specific dollar allocations.

The 2024/25 proposal also makes a transfer of $11 million from the General Fund to the Well Plugging Account to boost well plugging activities and provide matching funds for the utilization of federal dollars.

Lastly, Water Commissions funded within the agency are funded to their fair share, according to their interstate compact.

Transportation

The 2024/25 executive budget proposal includes $7.89 billion in state funding for the Department of Transportation within the Motor License Fund, which represents a $173.89 million reduction, or 2.16% decrease from 2023/24. There are several contributing factors for this change affecting multiple agency programs. To properly understand them, we need to examine the different programs that are affected:

- Highway & Bridge Improvement (Hwy & Bridge Construction) - $3.58 billion (state/federal combined)

- State Highway & Bridge Construction - $1.51 billion or $25.48 million decrease

- Federal Construction - $2.06 billion

- Hwy Research/Planning/Construction - $1.23 billion

- Infrastructure Investment and Jobs Act (IIJA) - $837.67 million

- State Highway Maintenance – $1.92 billion or $38.2 million increase

- Local Highway & Bridge Maintenance - $813.03 million or $20.9 million decrease

- Mass Transit Grants - $2.81 billion or $159.3 million decrease

| 2024/25 EXECUTIVE BUDGET PENNDOT STATE FUNDS |

| ($ amounts in thousands) |

| |

|

|

|

|

| ROADS & BRIDGES |

| |

Available |

Exec Budget |

Exec Budget less Avail |

| Area |

2023/24 |

2024/25 |

$ Chng |

% Chng |

| HWY CONSTRUCTION |

$ 1,274,606 |

$ 1,254,144 |

$ (20,462) |

-1.6% |

| BRIDGES |

$ 269,997 |

$ 264,972 |

$ (5,025) |

-1.86% |

| HWY & BRIDGE IMPROVEMENT |

$ 1,544,603 |

$ 1,519,116 |

$ (25,487) |

-1.7% |

| |

|

|

|

|

| STATE HIGHWAY MAINTENANCE TOTAL |

$ 1,883,899 |

$ 1,922,123 |

$ 38,224 |

2.0% |

| |

|

|

|

|

| LOCAL HIGHWAY & BRIDGE TOTAL |

$ 833,954 |

$ 813,039 |

$ (20,915) |

-2.5% |

| |

|

|

|

|

| ROADS & BRIDGES |

$ 4,262,456 |

$ 4,254,278 |

$ (8,178) |

-0.19% |

| |

|

|

|

|

| MASS TRASIT GRANTS |

$ 2,976,406 |

$ 2,817,080 |

$ (159,326) |

-5.35% |

| |

|

|

|

|

| MULTIMODAL TRASNPORTATION |

$ 228,661 |

$ 214,366 |

$ (14,295) |

-6.25% |

| |

|

|

|

|

| OTHER |

$ 599,660 |

$ 607,561 |

$ 7,901 |

1.32% |

| |

|

|

|

|

| TOTAL STATE FUNDS |

$ 8,067,183 |

$ 7,893,285 |

$ (173,898) |

-2.16% |

A major topic contained in the 2024/25 executive budget proposal is the increase of the transfer of Sales and Use Tax (SUT) related to Mass Transit. Under current law (Act 89 of 2013), the transfer of SUT revenues deposited into the Public Transportation Trust Fund (PTTF) include two components:

- 4.4% transfer from the Sales and Use Tax related to non-motor vehicles transactions; and

- A Motor Vehicle SUT transfer, currently around 3.28%, which is calculated as follows

- Motor Vehicle SUT times Ratio ($450 million divided by Motor Vehicle Sales and Use Tax receipts)

To support Mass Transit agencies, the governor proposes to increase the transfer from SUT on non-motor vehicle transactions by 1.75%, to a new total of 6.15%. Based on current SUT estimates, for 2024/25 that amount is approximately $282.8 million.

The executive budget increases overall state spending for the Department of Labor and Industry from $89.5 million to $98.8 million, an increase of 10.3%. Most of this increase makes important investments in the commonwealth’s workforce, including two new initiatives proposed by the governor.

A new Career Pathways program receives $2 million to create a digital one-stop-shop for information on education, training, and other career resources. Additionally, $2 million is allocated to help businesses transition to skills-based hiring practices based on skill and experience rather than on specific degree programs. The Industry Partnerships program budget is nearly doubled, increased by $2.2 million to a total of $5 million.

The Apprenticeship Training program is cut by $500,000 to $10 million.

The department’s General Government Operations increases by $2.2 million, $1.2 million of which funds an additional 12 positions for labor law compliance investigations. The governor also proposes raising the commonwealth’s minimum wage to $15 per hour.

The governor’s executive budget provides $58.2 million for the Historical and Museum Commission. Of this amount, $27.8 million is from the state General Fund. The executive budget includes $25.8 million for General Government Operations, a 15.2%, or $3.4 million increase over 2023/24. Included in this increase is $309,000 to increase access to programming at historic sites and museums and $212,000 to streamline environmental reviews affecting historic properties affecting Infrastructure Investment and Jobs Act (IIJA) projects.

Though the Pennsylvania Housing Finance Agency (PHFA) does not receive a direct appropriation through the executive budget, the agency is the recipient of taxpayer dollars. The PHFA administers the Housing Affordability and Rehabilitation Enhancement Fund (PHARE). The PHARE program provides funding for affordable housing and receives an annual $5 million transfer from the Unconventional Gas Well Fund in addition to a transfer from the Realty Transfer Tax (RTT) based on the amount of RTT received annually.

Currently, the RTT transfer is capped at $60 million, but the executive budget proposes increasing that cap to $70 million this budget year and increasing the cap by $10 million annually until it reaches $100 million in Fiscal Year 2027/28.

Gov. Shapiro’s budget proposal includes funding allocated to the commonwealth by the federal Infrastructure Investment and Jobs Act. The law provides for investments in core areas, including transportation, environmental remediation and conservation, clean water, broadband, and cyber security. The table on the following page summarizes IIJA appropriations recommended within the budget proposal.

| 2024/25 Executive Budget |

| Infrastructure Investment & Jobs Act (IIJA) Federal Funding Utilization |

| ($ amounts in millions) |

| Environmental Protection (DEP) |

2023/24 |

2024/25 |

| |

IIJA - Solid Waste Infrastructure for Recycling |

$ 1.1 |

$ 1.1 |

| |

IIJA - Assistance for Small & Disadvantaged Communities |

$ 103.2 |

$ 103.2 |

| |

IIJA - Orphan Well Plugging |

$ 105.0 |

$ 105.0 |

| |

IIJA - DOE Energy Programs |

$ 22.3 |

$ 22.3 |

| |

IIJA - Electric Grid Resilience |

$ 16.3 |

$ 269.3 |

| |

IIJA - Energy Efficiency & Conservation |

$ 4.0 |

$ 4.0 |

| |

IIJA - Chesapeake Bay |

$ 6.9 |

$ 6.9 |

| |

IIJA - Brownfields |

$ 4.0 |

$ 4.0 |

| |

IIJA - Water Quality Management Planning Grants |

$ 1.0 |

$ 1.0 |

| |

IIJA - USDA Good Neighbor Authority |

$ 2.0 |

$ 5.7 |

| |

IIJA - National Dam Safety Program |

$ 0.1 |

$ 0.1 |

| |

IIJA - NFWF America the Beautiful Challenge |

$ 7.5 |

$ 7.5 |

| |

IIJA - Coastal Zone Management |

$ 8.5 |

$ 8.5 |

| |

IIJA - Methane Emissions Reduction Grants |

$ 20.0 |

$ 20.0 |

| |

IIJA - Resilient and Efficient Codes Implementation |

$ 3.0 |

$ 3.0 |

| |

IIJA - Energy Auditor Training Grant |

$ 2.0 |

$ 2.0 |

| |

IIJA - Energy Efficiency Revolving Loan Fund |

$ 3.7 |

$ 3.7 |

| |

IIJA - Environmental Justice Programs |

$ 10.0 |

$ 10.0 |

| |

IIJA - DOE - Clean Energy Demonstration Projects |

$ 150.0 |

$ 150.0 |

| |

IIJA - Advanced Energy Manufacturing |

$ 50.0 |

$ 50.0 |

| |

IIJA - Hydroelectricity Development Programs |

$ 25.0 |

$ 25.0 |

| |

IIJA - Abandoned Mine Reclamation |

$ 469.9 |

$ 469.9 |

| |

IIJA - 10 Percent Dringking Water Set Asides Offset |

$ 7.4 |

$ 7.4 |

| |

IIJA - 2 Percent Dringking Water Set Asides Offset |

$ 6.5 |

$ 6.5 |

| |

IIJA - 15 Percent Dringking Water Set Asides Offset |

$ 1.9 |

$ 1.9 |

| |

IIJA - CWTP - Orphan Well Plugging |

$ 1.0 |

$ 1.0 |

| |

IIJA - CWTP - Abandoned Mine Reclamation |

$ 3.0 |

$ 3.0 |

| Transportation (PennDOT) |

2023/24 |

2024/25 |

| |

IIJA - Hwy & Safety Capital Projects |

$ 792.4 |

$ 837.6 |

| State Police (PSP) |

2023/24 |

2024/25 |

| |

IIJA - Motor Carrier Safety - General Fund |

$ - |

$ 8.5 |

| |

IIJA - Motor Carrier Safety - Motor License Fund |

$ 8.5 |

$ - |

| Labor and Industry (L & I) |

|

|

| |

IIJA - CWTP - Administration |

$ 0.03 |

$ 0.09 |

| Emergency Management Agency (PEMA) |

2023/24 |

2024/25 |

| |

IIJA - State and Local Cybersecurity |

$ 15.9 |

$ 25.0 |

| Community and Economic Development (DCED) |

2023/24 |

2024/25 |

| |

IIJA - DOE - Weatherization Administration |

$ 5.5 |

$ 5.5 |

| |

IIJA - DOE - Weatherization Program |

$ 80.0 |

$ 80.0 |

| |

IIJA - Broadband Equity, Access, and Deployment |

$ 330.0 |

$ 1,000.0 |

| |

IIJA - State Digital Equity Capacity |

$ 14.4 |

$ 40.0 |

| |

IIJA - EPA Brownfields Revolving Loan Fund |

$ - |

$ 10.0 |

| |

IIJA - CWTP - Weatherization Assistance Program |

$ - |

$ 0.8 |

| Infrastructure Investment Authority (PennVEST) |

2023/24 |

2024/25 |

| |

IIJA - Drinking Water Projects Revolving Fund |

$ 386.3 |

$ 500.0 |

| |

IIJA - Loan Program Administration |

$ 15.5 |

$ 15.5 |

| |

IIJA - Technical Assistance to Small Systems |

$ 6.5 |

$ 6.5 |

| |

IIJA - Assistance to State Programs |

$ 7.4 |

$ 7.4 |

| |

IIJA - Local Assistance & Source Water Pollution |

$ 1.9 |

$ 1.9 |

| |

IIJA - Sewage Projects Revolving Loan Fund |

$ 165.9 |

$ 250.0 |

| |

IIJA - CWTP - Drinking Water Projects Revolving Fund |

$ - |

$ 1.2 |

| |