General Fund Revenue Report - October 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

General Fund revenues in October were $119.8 million or 3.8% more than expected.

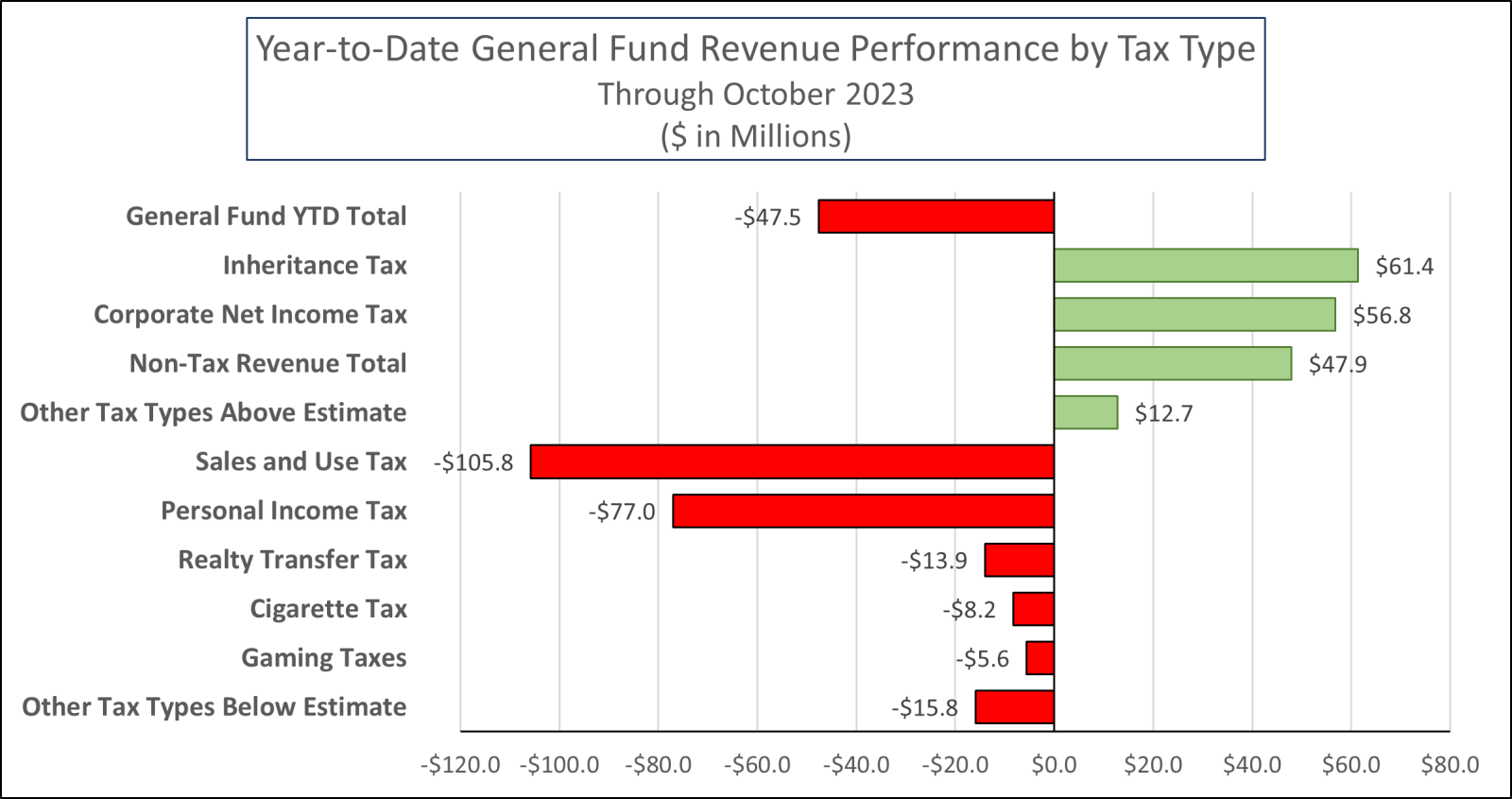

For the year-to-date, General Fund revenues are $47.5 million or 0.4% below estimate.

Corporate net income tax (CNIT) revenue for the month was $28.6 million or 15.3% above estimate. For the year-to-date, CNIT collections are exceeding projections by $56.8 million or 3.9%. Financial institutions taxes were also $6.1 million or 1,011.4% more than expected for the month due to higher than anticipated banks shares tax (BST) payments. Typically, almost all payments for the BST are made in March when they are annually due, so receiving large payments in October is considered unusual. Similarly, revenue from the insurance premiums tax, which also has a March due date for payments, was $5.2 million or 1,725.4% higher than expected in October.

Personal income tax (PIT) collections were $35.7 million or 2.8% over estimate for the month. Both withholding and nonwitholding payments exceeded projections by $25.8 million (2.5%) and $9.9 million (4.1%), respectively. For the year-to-date, PIT revenue is $77.0 million or 1.5% under estimate.

Inheritance tax revenue also outperformed projections for the month by $57.9 million or 51.1%.

Sales and use tax (SUT) revenue was $9.5 million or 0.7% less than estimated in October. Although collections from motor vehicle sales were $5.6 million or 4.7% higher than expected for the month, collections from nonmotor vehicle sales were $15.1 million or 1.3% under projections. For the year-to-date, SUT revenue is $105.8 million or 2.1% below estimate.

|

2023/24 General Fund Revenues ($ in Millions)

|

|

|

October 2023 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$3,126.5

|

$3,246.3

|

$119.8

|

3.8%

|

$13,131.4

|

$13,083.9

|

($47.5)

|

-0.4%

|

|

Tax Revenue

|

$3,064.3

|

$3,182.9

|

$118.6

|

3.9%

|

$12,853.4

|

$12,758.0

|

($95.4)

|

-0.7%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$186.6

|

$215.2

|

$28.6

|

15.3%

|

$1,452.3

|

$1,509.1

|

$56.8

|

3.9%

|

|

Gross Receipts Tax

|

$3.8

|

$1.1

|

($2.7)

|

-71.3%

|

$13.3

|

$17.9

|

$4.6

|

34.9%

|

|

Public Utility Realty Tax

|

$0.2

|

$0.0*

|

($0.2)

|

-82.4%

|

$1.2

|

$2.2

|

$1.0

|

80.5%

|

|

Insurance Premiums Taxes

|

$0.3

|

$5.5

|

$5.2

|

1,725.4%

|

$1.4

|

$6.2

|

$4.8

|

345.9%

|

|

Financial Institution Taxes

|

$0.6

|

$6.7

|

$6.1

|

1,011.4%

|

$17.3

|

$19.6

|

$2.3

|

13.2%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$1,285.5

|

$1,276.0

|

($9.5)

|

-0.7%

|

$4,992.2

|

$4,886.4

|

($105.8)

|

-2.1%

|

|

Cigarette Tax

|

$76.2

|

$77.1

|

$0.9

|

1.2%

|

$261.4

|

$253.2

|

($8.2)

|

-3.1%

|

|

Other Tobacco Products Tax

|

$14.1

|

$11.9

|

($2.2)

|

-15.9%

|

$54.2

|

$49.3

|

($4.9)

|

-9.0%

|

|

Malt Beverage Tax

|

$1.9

|

$1.6

|

($0.3)

|

-14.1%

|

$8.2

|

$7.3

|

($0.9)

|

-11.1%

|

|

Liquor Tax

|

$38.8

|

$36.5

|

($2.3)

|

-6.0%

|

$147.5

|

$142.2

|

($5.3)

|

-3.6%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$1,270.2

|

$1,305.9

|

$35.7

|

2.8%

|

$5,152.7

|

$5,075.7

|

($77.0)

|

-1.5%

|

|

Realty Transfer Tax

|

$50.6

|

$52.1

|

$1.5

|

3.1%

|

$173.7

|

$159.8

|

($13.9)

|

-8.0%

|

|

Inheritance Tax

|

$113.2

|

$171.1

|

$57.9

|

51.1%

|

$476.5

|

$537.9

|

$61.4

|

12.9%

|

|

Gaming Taxes

|

$29.4

|

$33.8

|

$4.4

|

15.1%

|

$111.2

|

$105.6

|

($5.6)

|

-5.0%

|

|

Minor and Repealed

|

($7.1)

|

($11.5)

|

($4.4)

|

-61.5%

|

($9.7)

|

($14.5)

|

($4.8)

|

-49.0%

|

|

Non-Tax Revenue

|

$62.2

|

$63.4

|

$1.2

|

1.9%

|

$278.0

|

$325.9

|

$47.9

|

17.2%

|

|

*Note: Actual Public Utility Realty Tax collections were $35,285 in October.

|