2023/24 Executive Budget Briefing

By House Appropriations Committee Staff , | 2 years ago

Gov. Shapiro’s 2023/24 executive budget presents a combined total operating budget of $117.5 billion, an increase of $4.2 billion or 3.7 percent across all funds and sources. The total operating budget consists of:

- $44.4 billion in state General Fund expenditures, an increase of $3.3 billion, or 8 percent, after adjusting for proposed supplemental appropriation changes that reduce current year state appropriations

- $45.8 billion in federal funds, a decrease of $1.1 billion or 2.3 percent

- $3.2 billion in Motor License Fund expenditures, an increase of $52.2 million or 1.7 percent

- $2.1 billion in Lottery Fund expenditures, a decrease of $32.7 million or 1.6 percent

- $22.1 billion in other special fund expenditures, augmentations and restricted accounts, an increase of $2.0 billion, or 9.9 percent

The executive budget proposal projects that 2022/23 General Fund revenues will finish $347.5 million higher than the official estimate certified in July 2022, for a total of $43.9 billion. Through the end of February, year-to-date total General Fund revenues were $649.2 million, or 2.6 percent, above estimate.

The General Assembly enacted reductions to the corporate net income tax rate in the 2022/23 budget package. Under current law, the tax rate decreased from 9.99 percent to 8.99 percent effective January 1, 2023, with gradual decreases to ultimately reach 4.99 percent by 2031. The 2023/24 budget does not propose any changes to this rate reduction schedule.

While 2023/24 base revenues are projected to increase by $454 million or 1.0 percent, the proposed tax and revenue modifications would reduce General Fund revenues year-over-year by $697.8 million, or 1.6 percent.

|

$ amounts in millions

|

2022/23

Available

|

2023/24

Budget

|

$

Change

|

%

Change

|

|

Revenue Estimate

|

43,579.7

|

44,381.5

|

|

|

|

Adjustment to Revenue Estimate

|

347.5

|

|

|

|

|

Revised Base Revenues

|

43,927.2

|

44,381.5

|

454.3

|

1.0%

|

|

Proposed Revenue Modifications

|

-

|

(1,152.1)

|

|

|

|

Revenues After Proposed Modifications

|

43,927.2

|

43,229.4

|

(697.8)

|

(1.6%)

|

The governor’s budget contains a new Individual Recruitment and Retention Tax Credit for workers in certain industries. Current Pennsylvania residents could qualify for a credit against the personal income tax of up to $2,500 per year for three years if they acquire a license or certification in the fields of nursing, teaching, or public policing. This proposal is estimated to increase refunds to Pennsylvania residents (i.e., reduce General Fund revenues) by $24.7 million in 2023/24.

The budget also proposes a new Adult Use Cannabis Tax at a rate of 20 percent of the wholesale price of products sold through the regulated framework of the production and sales system. This would require a statutory change to make adult use cannabis legal in the commonwealth before the tax could be implemented. The proposed budget assumes that sales would commence January 1, 2025, with initial revenues realized in 2024/25.

|

Fiscal Impact of Proposed

20% Adult Use Cannabis Tax ($ amounts in millions)

|

|

2023/24

|

2024/25

|

2025/26

|

2026/27

|

2027/28

|

|

-

|

$15.9

|

$64.1

|

$132.6

|

$188.8

|

The budget further proposes eliminating the Enhanced Revenue Collections Account (ERCA) and moving all proceeds from the account to the General Fund. ERCA was statutorily created in 2010 and is a restricted account to fund expanded tax return reviews, tax collections, and refund avoidance activities at the Department of Revenue, generating additional revenue. This change will incorporate these collection activities into the department’s general government operations appropriation. The budget assumes the change will result in $21.1 million in additional revenue for the General Fund.

The governor proposes to exclude mobile telecommunications services from the Gross Receipts and Sales and Use Taxes. These proposed exclusions would decrease 2023/24 General Fund revenues by $41.1 million and $20.9 million, respectively. Relatedly, the budget also proposes changes to the 911 surcharge on phone bills, which is discussed within the PEMA section of this briefing.

The governor proposes to increase the minimum wage from $7.25 per hour to $15.00 per hour effective January 1, 2024. No detail on the revenue impact of raising the minimum wage was included in the budget document.

The budget proposes four transfers affecting the General Fund.

- From the General Fund to a new Public Safety and Protection Fund to support State Police operations, a complete redirection of other tobacco products tax and liquor tax revenues and a $400 million transfer of motor vehicle sales and use tax revenues, resulting in a collective transfer of $1.02 billion to the new special fund. The budget also proposes to increase the amount of motor vehicle sales and use tax revenue transferred to the fund by $50 million in future years, growing the transfer to $600 million in 2027/28.

- From the General Fund to the Environmental Stewardship Fund, $10.5 million from personal income tax revenues for Growing Greener debt service payments.

- From the General Fund to the Tobacco Settlement Fund, $115.3 million from cigarette tax revenues to replace monies deducted from the Master Settlement Agreement to pay debt service associated with the Tobacco Settlement bonds.

- From the Medical Marijuana Program Fund to the General Fund, the unexpected fund balance of $31.9 million in the fund to offset Department of Health operations as required by law.

|

Proposed Tax and Revenue Modifications 2023/24 ($ amounts in millions)

|

|

|

Modification

|

Estimated 2023/24 Fiscal Impact

|

|

Tax Revenue

|

|

Exclusion of Mobile Telecommunications Services from Gross Receipts Tax

|

($41.1)

|

|

Exclusion of Mobile Telecommunications Services from Sales and Use Tax

|

($20.9)

|

|

Elimination of Enhanced Revenue Collections Account

|

$21.1

|

|

Transfer to Public Safety and Protection Fund

|

($1,017.3)

|

|

Transfer to Tobacco Settlement Fund

|

($115.3)

|

|

Transfer to Environmental Stewardship Fund

|

($10.5)

|

|

Adult Use Cannabis Tax

|

-

|

|

Nontax Revenue

|

|

Transfer from Medical Marijuana Program Fund

|

$31.9

|

|

Total Proposed Tax and Revenue Modifications

|

($1,152.10)

|

The budget proposes supplemental appropriations that reduce 2022/23 General Fund spending by a net $1.66 billion. Most of the reductions come from the savings generated by an extra two quarters of enhanced federal match for Medical Assistance programs that were not assumed at budget enactment in summer of 2022, but also reflect net changes from updated enrollment and utilization estimates. Increased supplemental appropriations are requested within the Department of Education for School Food Services and School Employees’ Social Security, reflecting updated cost estimates. After accounting for the net reduction from these supplemental appropriation changes, 2022/23 General Fund expenditures are $41.1 billion.

The updated 2022/23 revenue and spending estimates lead to a projected ending balance in the General Fund of $7.86 billion. The budget proposes to suspend the statutory transfer to the Rainy Day Fund and maintain this entire balance to start the 2023/24 fiscal year.

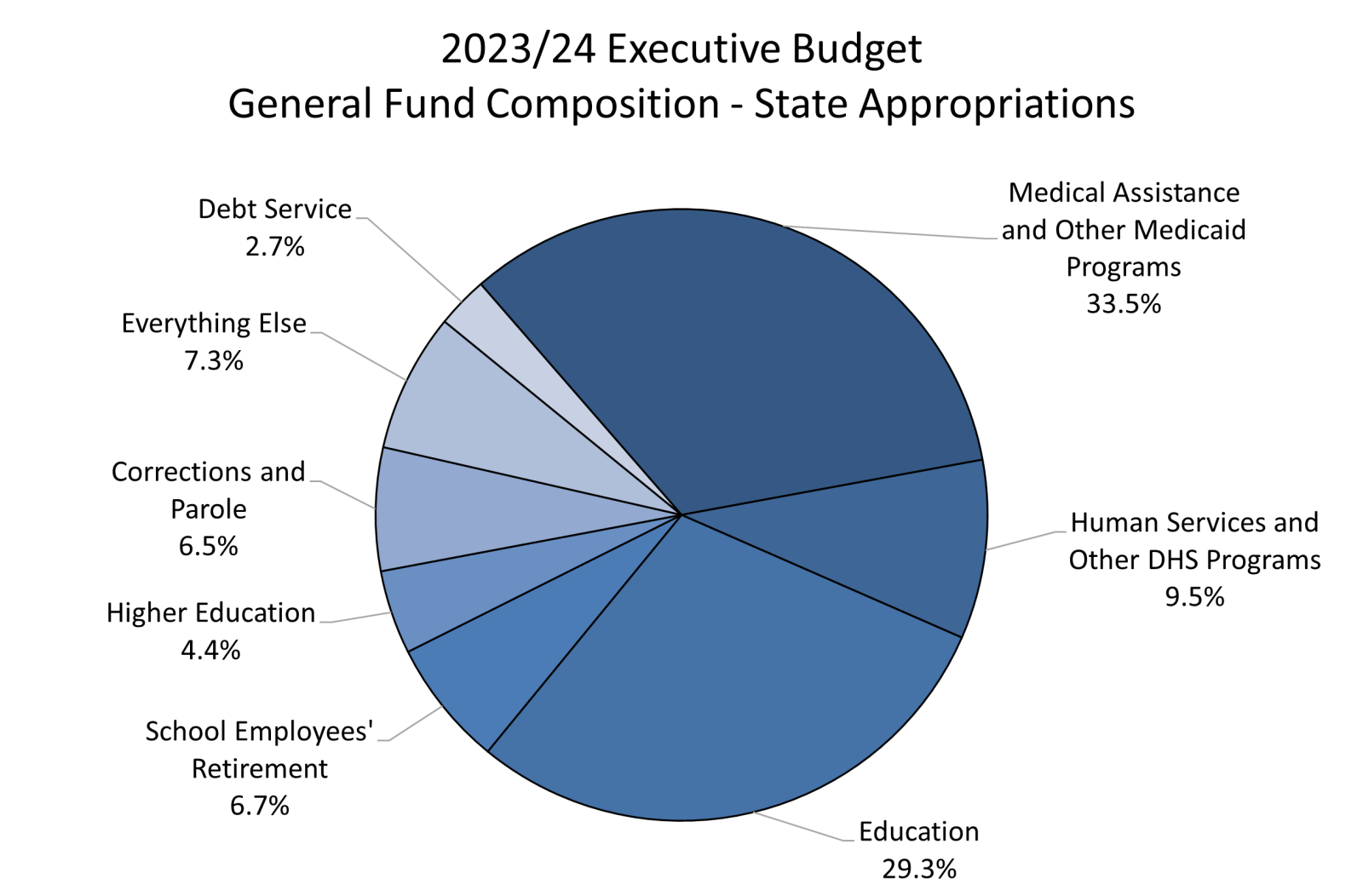

For 2023/24, the executive budget proposes $44.37 billion in General Fund expenditures, a $3.23 billion or 8.0 percent increase over 2022/23 after adjusting for recommended supplemental appropriations. Growth in total appropriations is driven by state cost increases in the Department of Human Services and increased education spending but offset by the transfer of State Police costs into the Public Safety and Protection Fund.

With the modest revenue estimates, proposed tax changes, recommended spending, shifts and refunds, General Fund expenditures exceed net revenues by $2.2 billion in the 2023/24 fiscal year, which requires the use of reserves, starting with the fund balance. The projected General Fund ending balance declines from $7.86 billion to $5.64 billion in 2023/24 and continues to drop each year. For the last two planning years, 2026/27 and 2027/28, the executive budget assumes that a transfer from the Rainy Day Fund to the General Fund will be necessary to pay for estimated expenditures.

Currently, the Rainy Day Fund has a balance of $5.05 billion.

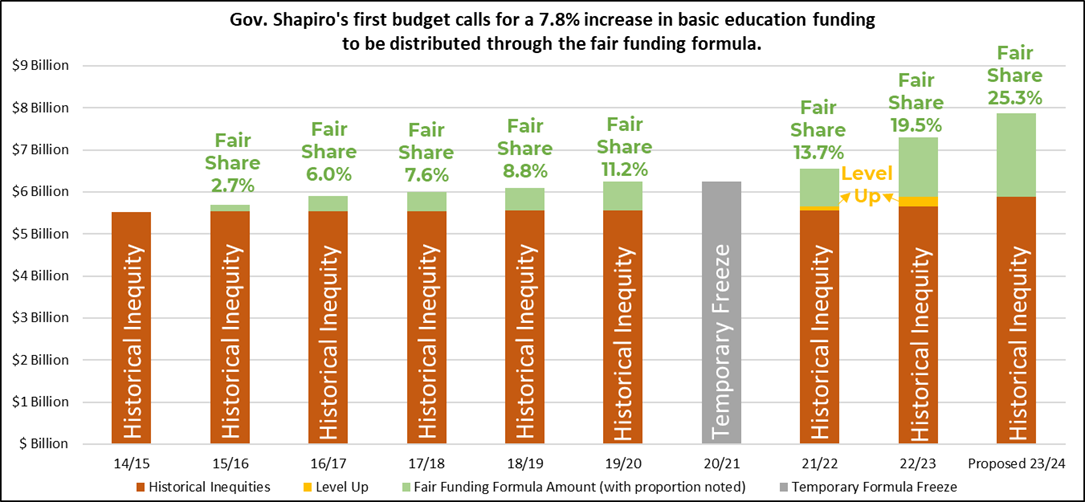

Gov. Shapiro’s first budget proposal includes new and increased education investments in what many will likely view as a first step in a multi-year effort to respond to the Commonwealth Court ruling declaring Pennsylvania’s public school funding system unconstitutional.

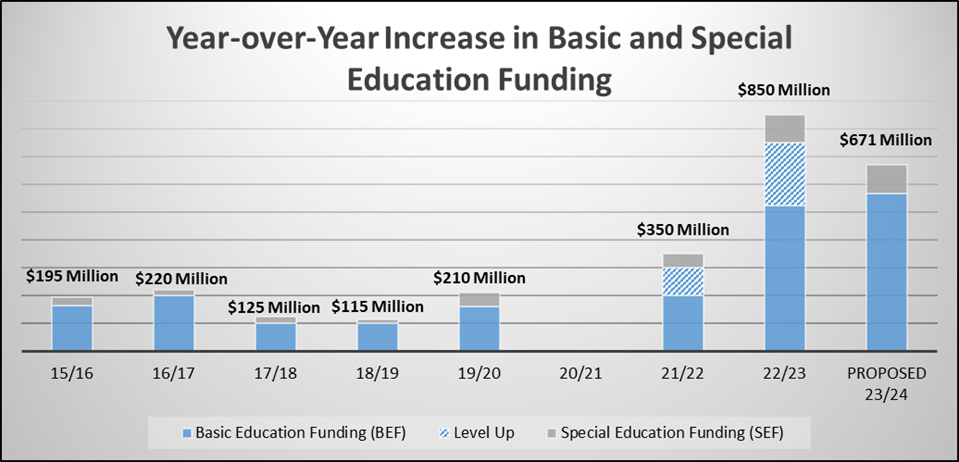

The 2023/24 proposed budget contains a $567 million, or 7.8 percent, increase for basic education funding (BEF) and a $104 million, or 7.8 percent, increase for special education funding (SEF). While this does not quite measure up to last year’s historic increase, it is a significant investment, especially relative to prior years. The budget materials note that future BEF and SEF investments are proposed to continue to grow with projected inflation rates.

The proposed budget does not include funding for a third round of “Level Up.”

- *New* $100 million state appropriation for school environmental repairs and improvements

- The budget materials call these matching grants; further proposed distribution details are unknown

- There has been no state school facility funding for new projects since the PlanCon moratorium in 2016

- *New* School Food Services initiative

- $38.5 million increase to both annualize Gov. Wolf’s 2022/23 universal free breakfast initiative and expand free lunch to students previously only eligible for reduced price lunches (estimated 22,000 students)

- Continued School Safety investments

- Maintains the $100 million Transfer to the School Safety and Security Fund for physical safety grants

- Creates a $100 million school-based mental health supports block grant (distribution unknown)

- This is a new structure for existing funds; the $100 million set aside within the Ready to Learn Block Grant for school safety mental health grants is discontinued

- $17.3 million, or 16 percent, increase in Career and Technical Education (CTE) programming

- $3.3 million, or 60 percent, more for equipment grants

- $3 million to cover enrollment growth and $4 million to increase the subsidy rate

- $5 million to develop additional CTE programs statewide

- $2 million for an initiative to bring more trade and industry professionals into the classroom

- $1 million increase within Adult and Family Literacy to make the high school equivalency exam free of charge

- *New* $4.2 million for a grant program for small, rural public library facilities improvements

- The Public Library Subsidy is flat funded after benefiting from an $11 million increase last year

- Pennsylvania Department of Education’s general government operations assumes $2.2 million for school audit costs and responsibilities

Gov. Shapiro proposes a $567 million, or 7.8 percent, increase in BEF for school districts.

The BEF appropriation is Pennsylvania’s largest education subsidy, accounting for a little over half of the funds the state sends to Pennsylvania’s 500 school districts. Since 2015/16, new funding has been distributed using the bipartisan fair funding formula, with the notable exception of the “Level Up” funding provided over the past two years to the lowest-spending 100 school districts.

Unfortunately, two technical nuances within the BEF appropriation make the year-over-year change difficult to follow. First, since 2019/20, in a House Republican-insisted move that reduces transparency, social security reimbursement payments have been included in the overall BEF appropriation.

Second, per Act 55 of 2022 (the omnibus 2022/23 School Code), the 2022/23 Level Up Supplement becomes part of the BEF base in 2023/24 and beyond. Therefore, while the Level Up Supplement does not receive new funding, the school districts that received funding in the previous two iterations will continue to receive those funds as part of their base BEF allocation.

For clarity, the table below shows the breakout within the BEF appropriation along with the corresponding Level Up Supplement appropriation.

Basic Education Funding (BEF)

$ amounts in thousands |

Actual

FY18-19 |

Actual

FY19-20 |

Actual

FY20-21 |

Actual

FY21-22 |

Available

FY22-23 |

Budget

FY23-24 |

Proposed Increase:

23-24 Budget

less

22-23 Available |

Last Year's Increase:

22-23 Available

less

21-22 Actual |

| Total BEF Appropriation |

$6,095,079 |

$6,742,838 |

$6,794,489 |

$7,082,304 |

$7,625,124 |

$8,421,751 |

$796,627 |

10.4% |

$542,820 |

7.7% |

| BEF Portion |

$6,095,079 |

$6,255,079 |

$6,255,079 |

$6,555,079 |

$7,080,079 |

$7,872,444 |

$792,365 |

11.2% |

$525,000 |

8.0% |

| Social Security Portion |

$0 |

$487,759 |

$539,410 |

$527,225 |

$545,045 |

$549,307 |

$4,262 |

0.8% |

$17,820 |

3.4% |

| Level Up Supplement |

$0 |

$0 |

$0 |

$0 |

$225,000 |

$0 |

-$225,000 |

-100.0% |

$225,000 |

|

| BEF Portion + Level Up |

$6,095,079 |

$6,255,079 |

$6,255,079 |

$6,555,079 |

$7,305,079 |

$7,872,444 |

$567,365 |

7.8% |

$750,000 |

11.4% |

Notes:

- BEF portion in 21/22 included $100 million for Level Up

- Social Security Portion in 2021/22 included a $15.5 million supplemental appropriation; 2020/21 current year costs were $501.8 million (the amount shown included $37.6 million to cover shortfalls from prior years) |

The proposed budget would fully fund the commonwealth’s share of the actuarially required contributions to the Public School Employees’ Retirement System. $2.971 billion is included within the budget for PSERS contributions, a $15 million reduction from 2022/23. The employer contribution rates for PSERS declined slightly for 2023/24 when approved by the board in December. About 80 percent of the employer contribution goes toward paying down the unfunded liability of the system.

The proposed 2023/24 budget increases funding for Early Intervention for 3 to 5 year olds by $10.4 million, or 3 percent. These resources will help serve an estimated 2,000 additional children, improving their well-being and very likely reducing future special education costs.

Gov. Shapiro’s budget calls on early childhood education providers to address staffing concerns by raising teacher wages to family-sustaining levels. To help support this effort, the budget proposal includes a $30 million, or 10 percent, increase for Pre-K Counts. The entirety of this increase would be used to raise the state-funded, full-time rate from $10,000 per seat to $11,000 for the 29,661 existing Pre-K Counts funded seats (half-time would get $5,500). Similarly, the $2.7 million, or 3 percent, increase for Head Start Supplemental Assistance would cover rising costs in the program.

Under Gov. Wolf’s 8 years of leadership, the General Assembly increased funding for Pre-K Counts (income up to 300 percent of poverty level to qualify) and Head Start Supplemental Assistance (income up to 100 percent of poverty level to qualify) by a combined $254 million, or 186 percent. This equated to an additional 17,998 seats and increased per-seat rates.

The governor’s budget proposes additional state funding for higher education, primarily in support of public colleges and universities.

The Pennsylvania State System of Higher Education (PASSHE) receives a $11.0 million increase, or 2.0 percent. The budget does not contain any additional direct appropriations to PASSHE for scholarship support. Similarly, the budget proposes a $5.1 million increase for community college operating funding, or 2.0 percent. Capital support for community colleges remains flat. Thaddeus Stevens College of Technology also receives a 2.0 percent increase, or $389,000.

The four state-related universities -- Lincoln University, Temple University, the University of Pittsburgh and Penn State University – each receive a 7.1 percent increase in state dollars for their educational appropriations. These universities were allocated one-time ARPA State Fiscal Recovery Fund dollars in the 2022/23 fiscal year and received level state funding. If these federal dollars are treated as part of the base funding, the overall increase for state-related universities is 2 percent.

The increases in state funding for the state-related universities are:

- Penn State University (including Penn College of Technology) - $19.1 million

- University of Pittsburgh (including rural education outreach) - $11.0 million

- Temple University - $11.2 million

- Lincoln University - $1.1 million.

PHEAA programs are all level funded within the budget.

The executive budget contains funding for two higher education-related initiatives.

- “It’s On Us” campus sexual assault prevention - $250,000 increase

- Parent Pathways - $1.66 million, to scale up a pilot program that provides support services to parents working on a postsecondary degree.

The governor’s executive budget proposes to redirect General Fund and Motor License Fund appropriations to newly created special fund for the Pennsylvania State Police, called the Public Safety and Protection Fund. The proposal would fund the Pennsylvania State Police at $1.6 billion for 2023/24, a $93.3 million or 6.2 percent increase over 2022/23.

Included in the transfer to the Public Safety and Protection Fund, for the purposes of supporting Pennsylvania State Police Operations, is the DNA detection program and associated fees as well as the funding for State Police enforcement of the Liquor Code.

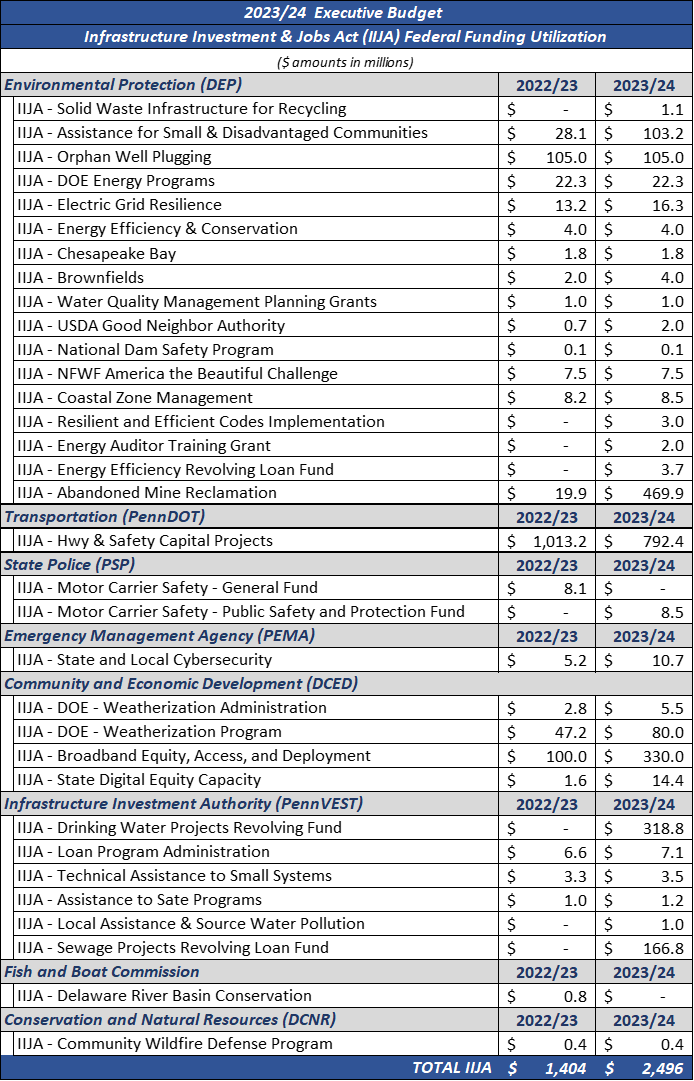

The state police budget would continue to rely on the Motor License Fund in 2023/24 with a $400 million transfer to the Public Safety and Security Fund. This is a $100 million decrease from 2022/23 when state police reliance on the Motor License Fund was decreased to $500 million. The budget proposes to reduce future transfers from the Motor License Fund to the PSP by $100 million each year until there is no further reliance in 2027/28. The governor’s executive budget forecasts that this will make an additional $1.5 billion available for road and bridge projects cumulatively over the next five years. These additional resources will help maximize the expected federal funding from the Infrastructure Investment and Jobs Act.

The governor’s executive budget includes $16.4 million for 4 new cadet classes with the goal of hiring and training 384 new troopers. This would bring the total number of troopers in Pennsylvania to the maximum amount allowed under current law.

The budget also provides $20.4 million for equipment replacements and upgrades. This includes $4.6 million to maintain the appropriate replacement cycle of the current aircraft fleet, $2.8 million to replace radio systems in fleet vehicles, and $13 million to reduce the average mileage of fleet vehicles and maintain the appropriate replacement cycle.

Pennsylvania Emergency Management Agency (PEMA)

The governor’s budget proposes to increase the current $1.65 surcharge collected by Wireless, Prepaid Wireless, VoIP, and Wireline service providers. The $1.65 surcharge is used to help fund and support Pennsylvania’s 911 system with a small portion used for PEMA’s administrative costs (2 percent). The current provision, set by Title 35, Chapter 53, will expire in January 2024.

The executive budget proposes to increase the surcharge to $2.03, with an expiration date in January 2029. Part of the surcharge increase will be offset by the proposed elimination of the gross receipts tax and sales and use tax on mobile phone services.

The proposal further expands the use of the proceeds from the surcharge to include funding for the 988 Suicide and Crisis Lifeline.

- 2.75 percent of the increased surcharge will be sent to the Department of Human Services to fund the 988 Suicide and Crisis Lifeline.

- 1.75 percent may be used by PEMA for administrative costs.

- The remaining proceeds will be available, as before, for approved county grants to support a statewide integrated 911 plan. The increased surcharge would provide $363.3 million for county grants, an increase of $27.6 million over 2022/23.

The budget includes a $2.5 million increase for General Government Operations (GGO) within the Pennsylvania Emergency Management Agency and a $232,000 increase for the Office of the State Fire Commissioner. $1 million of the increase in PEMA’s GGO is to repair and replace water pipes at the Commonwealth Resource Coordination Center to prevent future damage.

The budget provides $5 million for State Disaster Assistance to provide disaster assistance to individuals. This would include improving access to safe, secure, and weathertight homes.

The Property Tax/Rent Rebate Program currently provides property tax relief in the form of rebates to eligible Pennsylvania seniors, widows and widowers, and individuals with disabilities. The number of individuals qualifying for the program continues to steadily decline due to stagnant income eligibility requirements that have not been updated since 2006 and therefore do not keep up with cost-of-living adjustments and inflation. The amount of state funding required for the program has steadily declined, as fewer individuals qualify. The budget projects that the amount required from the Lottery Fund for the program will decline by $16.2 million, from $223.8 million in 2022/23 to $207.6 million in 2023/24.

The governor aims to address this problem by expanding the program to more Pennsylvanians. The budget proposes an increase to the income caps for homeowners and renters from $35,000 and $15,000, respectively, to $45,000 for both. The budget also proposes to grow the income thresholds with inflation beginning in claim year 2024. Moreover, the budget increases the maximum rebate from $650 to $1,000. The administration estimates that these adjustments to the Property Tax Rent Rebate Program will allow an additional 173,000 individuals to become eligible for the program and increase assistance to the 398,000 individuals that already qualify for the program. As such, the amount required from the Lottery Fund for the program is expected to increase beginning in 2024/25 to reflect projected increases in program participation.

Funding for the Property Tax Rent Rebate Program was bolstered in 2022/23 with the allocation of $140 million in State Fiscal Recovery Funds from the federal American Rescue Plan Act. This additional federal funding was used to provide one-time additional property tax rent rebate payments to Pennsylvanians who qualified for a regular rebate under the program. The governor’s proposed 2023/24 budget does not continue this additional rebate payment for the current claim year.

The governor’s budget proposes a $1.1 million increase for the General Government Operations of the Pennsylvania Commission on Crime and Delinquency (PCCD).

The budget proposes a $4 million increase for the Improvement of Adult Probation Services. These grants are meant to support county probation and have been level funded for eleven years. County probation is also supported by the state through Intermediate Punishment Treatment programs, level funded for 2023/24 at $18.2 million and from the Justice Reinvestment Fund.

Acts 114 and 115 of 2019, also known as JRI 2, shifted Improvement of Adult Probation Services from the Department of Corrections to PCCD. Additional funds were deposited into the Justice Reinvestment Fund beginning in 2021/22 based on a percentage of program savings generated in the year prior to the deposits. Savings were generated by implementing short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations. These savings will be used to fund county probation grants. In 2023/24, the budget proposes $1.5 million for County Probation Grants funded by JRI 2 savings.

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in 2023/24.

Act 44 of 2018 established the School Safety and Security Committee for the administration of the School Safety and Security Grant Program. The 2023/24 budget provides $100 million for the program. Grant funding is used by schools to supplement existing spending on safety and security. The budget proposes to move the $100 million for mental health grants to schools that was previously funded through PCCD to a new block grant program within the Department of Education. For 2023/24, the budget proposes replacing the $15 million annual transfer from the Unified Judicial System with a transfer from the Department of Education.

The executive budget provides $105 million for Violence Intervention and Prevention grants to support community-led gun violence prevention efforts. This is the same amount as in 2022/23, although $75 million in state funding is used to replace the nonrecurring $75 million in American Rescue Plan funds used in 2022/23. It also provides for a $5 million transfer to the Nonprofit Security Grant Fund.

The budget addresses concerns over adequate funding for the Victims Compensation fund by increasing funding by $3 million. The Victims Compensation Fund provides funding to victims of crime and the victim service community.

The budget also includes a $10 million initiative to fund indigent defense in Pennsylvania. Pennsylvania is one of only two states in the country that allocates no state funding for indigent defense. This results in wide disparities across counties in the quality of legal representation. The Criminal Justice Advisory Committee under PCCD would determine how to invest the $10 million under the proposal, with the end goal of ensuring that public defenders have the resources that they need to provide legal representation to defendants who cannot pay for it on their own.

The governor’s budget proposes $2.9 billion in state general funds for the Department of Corrections, an increase of $159.9 million, or 5.9 percent, from 2022/23.

| Major Department of Corrections Appropriations |

| ($ amounts in millions) |

2022/23 |

2023/24 |

$ Change |

% Change |

| Medical Care |

$338.2 |

$356.4 |

$18.3 |

5.4% |

| Correctional Education and Training |

$43.8 |

$47.0 |

$3.2 |

7.2% |

| State Correctional Institutions |

$2,127.2 |

$2,248.9 |

$121.7 |

5.7% |

| GGO |

$43.1 |

$41.4 |

-$1.7 |

-3.9% |

| State Field Supervision |

$158.1 |

$171.6 |

$13.5 |

8.5% |

| Pennsylvania Parole Board |

$12.8 |

$13.3 |

$0.5 |

4.0% |

| Sexual Offenders Assessment Board |

$6.9 |

$7.3 |

$0.4 |

6.0% |

| Board of Pardons |

$2.2 |

$2.7 |

$0.5 |

25.0% |

| Office of Victim Advocate |

$0.0 |

$3.5 |

$3.5 |

|

The budget proposes to move the Office of Victim Advocate back to its own appropriation. The office has been funded out of General Government Operations since 2019/20. $3.5 million is recommended for the office.

The State Correctional Institutions appropriation contains $355,000 for the creation of a new unit within the agency that will collaborate with the Secretary of the Board of Pardons. The three-person unit will review and revise documentation and process efficiencies with the goal of providing support to meritorious incarcerated persons and prioritizing applications for more successful outcomes.

The 2023/24 budget supports two new initiatives under State Field Supervision. The first is to provide an additional $1.5 million for body worn cameras for parole officers. The cameras should enable both safety and oversight improvements for the parole agents. The budget includes $359,000 to reduce recidivism by providing early services with social workers to parolees. The funding will support hiring three individuals who will engage in intense supervision efforts meant to deter violent behavior in reentrants.

The governor’s budget proposes more than $19 billion in state General Funds for the Department of Human Services (DHS). This year-over-year increase of $2.70 billion is heightened by the assumed supplemental net reductions of $1.65 billion to the 2022/23 enacted budget.

The governor’s proposed budget includes an overall negative supplemental General Fund request for 2022/23 for DHS of $1.7 billion. These adjustments reflect updated calculations of utilization, caseloads and enrollments and the impact of pandemic-related enhanced Federal Medical Assistance Percentage (FMAP) availability through the second half of the fiscal year. Under Families First Coronavirus Response Act (FFCRA), the federal government picked up an additional 6.2 percent of total Medicaid costs, lessening the state share. This temporary enhanced FMAP was tied to the federal Public Health Emergency (PHE) declaration and a moratorium on Medicaid eligibility redeterminations.

The 2022/23 budget enacted in July 2022 assumed the PHE would end in fall 2022 and the enhanced FMAP would expire December 31, 2022. Congress passed the Consolidated Appropriations Act for 2023 in late December 2022, which replaced the provisions of the FFCRA to provide more certainty for state budgeting. Now, the enhanced FMAP is no longer tied to the PHE and will phase down from 6.2 percent to 5 percent on April 1, 2023, and then continue to phase out during the remainder of calendar year 2023.

The supplemental negative adjustment largely reflects the two extra quarters of additional enhanced FMAP not assumed in the July 2022 enacted budget.

Major factors driving the proposed 2023/24 DHS General Fund budget increase of $2.7 billion from revised 2022/23 estimates largely fall in four areas: costs to maintain current programs, federal funding adjustments, initiatives, and the impact of one-time measures.

During the pandemic as a condition of receiving enhanced FMAP, states were not permitted to terminate Medical Assistance eligibility, except in specific cases such as death, a move out of state, or if a client voluntarily withdrew. With the phasing down of the enhanced federal match, eligibility redeterminations will occur over a 12-month period starting on April 1.

DHS projects enrollment will decrease as a result of eligibility redeterminations. Individuals no longer eligible for Medical Assistance, but are otherwise uninsured, will be referred to state-based exchange coverage through Pennie and/or transition to the Children’s Health Insurance Program (CHIP).

The assumed net state savings for 2023/24 due to redeterminations are $385 million

As mentioned previously, the governor’s budget proposal assumes the phase-out of the enhanced FMAP beginning on April 1, 2023 and ending on December 31, 2023. As the enhanced FMAP steps down, those costs will revert back to the General Fund. The cost of replacing these enhanced FMAP dollars with state dollars is $1.8 billion during 2023/24.

While enhanced FMAP reduction increases costs, they are partially offset by changes to Pennsylvania’s regular FMAP. Under the formula in the Social Security Act, Pennsylvania’s regular FMAP will increase effective October 1, 2023 from 52 percent to 54.12 percent. Therefore, the state fiscal year blended rate will increase from 52.17 percent in 2022/23 to 53.59 percent in 2023/24. State savings due to the higher base FMAP are estimated to be $437 million.

All told, nearly $1.4 billion in increased DHS costs for 2023/24 are attributable to various net FMAP changes.

The governor’s proposed budget includes several waiting list initiatives:

- $17.5 million for the intellectual disability waiting list.

- 750 additional people in the Community Living Waiver; and

- 100 additional people in the Consolidated Waiver Program

- $1.25 million to continue the annual transitions of 20 individuals currently residing in state hospitals to community services - the Community Hospital Integration Projects Program (CHIPP)

- Within the Department of Aging, $5 million for the Help at Home (OPTIONS) program for older Pennsylvanians, supported by the Lottery Fund.

To address food insecurity, the governor’s budget proposes to invest $16 million in state general funds to augment and enhance federal funding in the Supplemental Nutrition Assistance Program (SNAP). The estimated impact increases the minimum monthly benefit from $23 per month to $35 per month. The budget indicates a goal of targeting support to the elderly and individuals with disabilities. The budget also includes $1 million to improve IT systems to be able to provide these enhanced benefits.

The governor’s proposed budget includes a $20 million increase for county mental health funding to restore one-third of the base funding cuts made during the Corbett Administration in 2012/13.

$5 million is included for one-time build-out costs for the 988 National Suicide and Crisis Lifeline system. The budget recommends using a piece of the increased 911 surcharge to fund ongoing operations of the system through the 911 Fund.

The budget provides $4 million to expand diversion and discharge programs from DHS forensic units, assisting individuals with mental illness currently in the criminal justice system.

Within the Intellectual Disabilities Community Waiver Program, the budget contains $3.4 million to expand the Lifesharing Services, to include a day service rate. Also within the waiver program is $700,000 to add telemedicine health assessment and coordination as a service.

The governor’s executive budget proposes $231.8 million in General Funds to the Department of Health, a $7.6 million, or 3.4 percent, net increase above enacted 2022/23 appropriation levels.

The quality assurance program will receive a $4.36 million, or 17.2 percent, increase. The additional funding will support implementation of Act 128 of 2022 monitoring and regulatory compliance requirements for temporary health care staffing agencies and the Skilled Nursing Facility regulations taking effect. Eleven new positions are proposed in the budget for this program.

The governor’s executive budget adds a health promotion and disease prevention appropriation, which would provide $2.3 million in funding and four new positions to implement prevention strategies as part of his initiative to reduce maternal mortality and morbidity. It would also increase the local health-environmental appropriation by $6.6 million, or 244.8 percent, to support his initiative to help local health departments through full funding. The governor’s budget increases funding to state health care centers by $2.98 million, or 11.9 percent.

The budget proposes $250.7 million in state General Funds for the Department of Revenue. This is a $53.8 million, or 27.4 percent, increase for the department from 2022/23. The appropriation for General Government Operations represents a $37.2 million increase over the prior year. However, $30 million of the amount represents a simple shift in monies that has previously been appropriated to the department through the restricted Enhanced Revenue Collection Account (ERCA). The proposal to eliminate the ERCA in this budget funds these activities through General Government Operations instead.

The Department of Revenue continues to expand technological efforts to improve services and processes within the department. The budget proposes an appropriation of $22.1 million from the General Fund to the department for technology and process modernization. This $17.3 million increase in General Funds from 2022/23 would be used to complete system upgrades within the department.

Lottery Fund expenditures in support of senior programs total $1.18 billion in the 2023/24 executive budget, a total net decline of $5 million. While the budget includes new initiatives paid from the Lottery Fund, the overall decline in spending stems from the fixed eligibility criteria for the Property Tax Rent Rebate (PTRR) program. The governor’s proposed changes to PTRR do not impact the 2023/24 budget.

Within the Lottery Fund, the budget proposes a $10 million increase for PENNCARE under the Departing of Aging to support two initiatives: $5 million for Area Agencies on Aging (AAA) to recruit and retain staff serving older adults in their homes, and $5 million to remove 1,200 people from the OPTIONS waiting list, which provides services to seniors who are not eligible for Medical Assistance.

Grants to senior centers are proposed to increase by $1 million.

The governor’s budget would increase funding across the three row offices but includes no major new initiatives.

| ($ amounts in millions) |

2022/23 |

2023/24 |

$ Change |

% Change |

| Attorney General |

$121.2 |

$138.6 |

$17.4 |

14.4% |

| Auditor General |

$44.5 |

$45.4 |

$1.0 |

2.2% |

| Treasury (excl. debt service costs) |

$49.4 |

$51.4 |

$2.0 |

4.1% |

Within the Office of Attorney General, General Government Operations funding would increase by $7.7 million, or 15.4 percent. Funding for Drug Law Enforcement would increase by nearly $7 million, or 13.3 percent, to $59.3 million. The Joint State-Local Firearm Taskforce, a collaborative effort program to reduce gun crime in Philadelphia, would see its appropriation increase by 17.5 percent, or $1.3 million, to $8.9 million.

General obligation debt service costs under Treasury increase by $73 million, or 6.4 percent.

The governor’s budget proposal increases total state funding for the Department of Military and Veterans Affairs by $18.9 million, or 9.5 percent, to $216.7 million. Much of this increase would be directed toward the commonwealth’s six veterans’ homes, which received an additional $14 million – an increase of 9.9 percent. Approximately $1.3 million of this increase would replace federal funds from 2022/23 COVID-19 response measures. $1.2 million is designated for emergency repairs at the veterans’ homes.

Funding for general government operations would increase by 10.9 percent, or $3.2 million. The governor’s budget proposal would also increase funding to the Keystone State ChalleNGe Academy by $496,000 and funding for Veterans Outreach Services by $642,000. In addition to cost-to-carry ($338,000), the funds would allow for increased outreach services to assist veterans in accessing available benefits.

Gov. Shapiro’s executive budget proposal for the Department of Community and Economic Development (DCED) is $191.4 million, not including appropriations historically added back during budget negotiations. The governor’s budget for DCED includes investments in economic development initiatives to support businesses growth, workforce development, and local communities across Pennsylvania.

Specific to business growth, the 2023/24 budget proposes recapitalizing the Historically Disadvantaged Business Assistance grants with a $20 million investment using General Fund revenue. In the 2022/23 budget, $20 million in one-time, American Rescue Plan State Fiscal Recovery Funds were used to support this initiative. Additionally, Pennsylvania First, which is a grant program centered on job creation and retention, infrastructure projects, and labor force development, receives $33 million, a $13 million or 65 percent increase year over year.

For workforce development, Gov. Shapiro proposes a new $3 million initiative, Foundations in Industry, focused on increasing the number of apprenticeships and pre-apprenticeships across Pennsylvania. Also, the Manufacturing PA line-item supports a $1 million increase, or 8.3 percent, for the Manufacturing Innovation Program (MIP), which fosters collaboration between higher education, the state’s Industrial Resource Centers (IRCs), and DCED. Also, the governor proposes a new $2.9 million initiative supporting major economic development projects through the newly created Office of Transformation and Opportunity.

With respect to support for Pennsylvania’s municipalities and local communities, the 2023/24 budget includes the following investments:

- $1.5 million, or a 266.3 percent, increase for the Municipal Assistance Program to assist local governments with community planning and exploring shared service opportunities.

- $1.3 million, or a 52.8 percent, increase for the Strategic Management Planning Program and $2 million, or a 44.4 percent, increase in the transfer to the Municipalities Financial Recovery Revolving Aid Fund, both to provide financial assistance to local governments to avoid financial distress.

- $8.6 million additional investment in the Keystone Communities program which supports public-private partnerships across Pennsylvania.

Lastly, the governor proposes transferring $750,000 in support for the Appalachian Regional Commission from the Motor License Fund to the General Fund through DCED. In addition, the governor proposes restoring support for public television services across Pennsylvania at $875,000, which was last funded in the 2020/21 budget.

The governor’s executive budget proposes an increase of $2 million, or 5.8 percent, in state funding for the Department of State in the 2023/24 budget proposal. This year-over-year change is predominantly driven by the proposed increase in the general government operations line item. This appropriation is proposed at an increase of $5.3 million, or 86.7 percent, to support the costs to maintain the current levels of departmental programming ($3.3 million) and to support upgrades to the notaries application system ($1.8 million).

The increases in the budget proposal for the general government operations appropriation are in part offset by a decrease of $3.2 million for nonrecurring costs to advertise and publish proposed constitutional amendments.

Gov. Shapiro’s 2023/24 budget proposal provides $231.2 million for the department, representing a 2.1 percent increase over 2022/23. Highlights include:

- $7.26 million increase for General Government Operations (GGO)

- $2.5 million for technical and financial assistance within Farmland Preservation Program

- $1 million to create new Organic Center of Excellence

- Five new Full-time Equivalent positions for organic certification and farmland preservation

- $2 million for Fresh Food Financing Initiative

- Funding to promote investment in lower-income communities and food retailing businesses who are black/indigenous/people-of-color owned

- $500,000 increase for Agricultural Excellence

- For the creation of a Center for Plant Excellence, to enhance both supply chain and resources for our plant industries

- $500,000 increase for Agricultural Business and Workforce Investment

- $300,000 for PA Preferred support

- $200,000 for mental health services and resources for farmers

- $1.15 million increase to Transfer to Agricultural College Land Scrip Fund

- $671,00 increase for University of Pennsylvania

- $633,000 related to Veterinary Activities

- $38,000 related to Center for Infectious Disease

The governor’s budget proposes $165.48 million in General Fund spending for DCNR, representing an 8.9 percent increase over 2022/23. Highlights of his proposal include:

- $2.8 million initiative to bolster outdoor management, infrastructure updates, and safety including:

- $1.46 million within General Government Operations

- 10 new Full-time Equivalent positions

- $601,000 within State Park Operations

- Five new Full-time Equivalent positions

- $735,000 within State Forests Operations

- Six new Full-time Equivalent positions

- $56 million increase, within the Oil and Gas Lease Fund, for maintenance and improvement of state park and forest infrastructure

Gov. Shapiro’s 2023/24 budget proposal provides $199.58 million in General Fund spending, representing a 9 percent increase over 2022/23. Highlights include:

- $1.2 million increase for General Government Operations

- $2.3 million increase for Environmental Program Management, including:

- $537,000 boost to resources for permit processing and inspections

- Four new Full-time Equivalent positions

- $11.4 million increase for Environmental Protection Operations, including:

- $1.2 million boost to resources for permit processing and inspections

- 11 new Full-time Equivalent positions

- Water Commissions are funded to their Fair-Share

In 2021, the Independent Regulatory Review Commission adopted a CO2 Budget Trading Program for Pennsylvania to participate in the Regional Greenhouse Gas Initiative (RGGI). Gov. Shapiro’s budget proposal provides for implementation of the CO2 Budget Trading Program and utilization of such revenues within the Department of Environmental Protection, representing non-General Fund spending. The proposal includes $663 million of revenue receipts, be deposited into the Clean Air Fund, for investment in greenhouse gas abatement, energy efficiency, and clean/renewable energy programs.

- Complement changes within Clean Air Fund provide for the addition of:

- 15 new Full-time Equivalent positions for air quality monitoring

- 17 new Full-time Equivalent positions for implementation of the CO2 Budget Trading Program

Gov. Shapiro’s budget proposal includes funding allocated to the commonwealth by the federal Infrastructure Investment and Jobs Act. This legislation is one of the largest and most comprehensive infrastructure investments in history. The law provides for investments in core areas, including transportation, environmental remediation and conservation, clean water, broadband, and cyber security. The following table summarizes IIJA appropriations recommended within the budget.

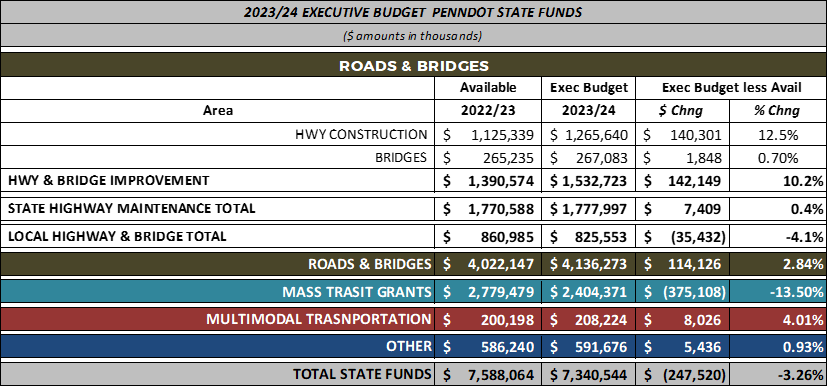

The governor’s budget proposal includes $7.34 billion in state funding for the Department of Transportation within the Motor License Fund, which represents a $247.5 million reduction, or 3.26 percent decrease, from 2022/23. To properly understand the contributing factors for this change, we must examine the different programs within the agency.

- Highway & Bridge Improvement (Hwy & Bridge Construction) - $3.6 billion (state/federal combined)

- State Highway & Bridge Construction - $1.53 billion

- Federal Construction - $2.06 billion

- Highway Research/Planning/Construction - $1.25 billion

- IIJA funding - $792.3 million

- State Highway Maintenance – $1.7 billion

- Local Highway & Bridge Maintenance – $825.5 million

- Mass Transit Grants - $2.4 billion

Workforce investment is emphasized within the governor’s budget proposal for the Department of Labor and Industry. An additional $3 million is invested in apprenticeship training, to help increase the number of registered apprenticeships and expand these opportunities to underserved populations and non-traditional occupations.

The governor’s budget proposal also invests $3.5 million from the General Fund for the Schools-to-Work program, a $1 million increase over the current funding through the Reemployment Fund. This program grows partnerships between career and technical education at schools and employers to provide additional opportunities for students.

The budget proposal increases funding for both assistive technology appropriations, providing an additional $250,000 for assistive technology financing, and a $400,000 increase for assistive technology demonstration and training.

The state-funded Centers for Independent Living would receive a $484,000 increase.

The New Choices/New Options program would be cut by $250,000.

The department’s general government operations appropriation includes $1.3 million to support eight new labor law compliance investigators.

Separately from the General Fund, the budget proposes 50 new positions within the Unemployment Compensation program to help reduce call wait times and improve operations. These positions are federally funded via the Administration Fund.

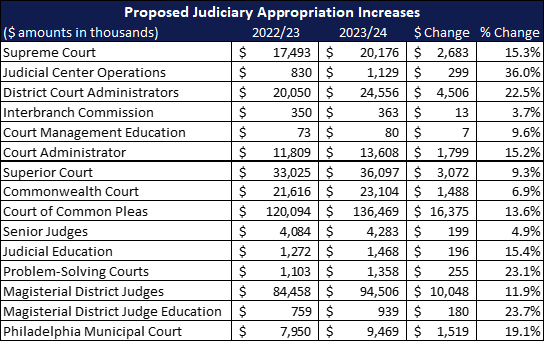

The governor’s budget proposes increases to several appropriations for the Judiciary to continue current operations. The net effect of these changes is an increase in state General Fund expenditures from $362.4 million in 2023/23 to $406.7 million in 2023/24, a $44.3 million, or 12.2 percent, increase.

Starting in 2018/19, the General Assembly reallocated multiple revenue streams to support school facility safety efforts. One such transfer affecting the judicial branch is an ongoing $15 million redirect of fee revenue from the Judicial Computer Center Augmentation Account to the School Safety and Security Fund. In 2021/22 and 2022/23, the fiscal code (Act 24 of 2021) temporarily paused this transfer, out of concerns that the loss of resources would cause a shutdown for one of the judiciary’s key computer systems, the Common Pleas Case Management System. For 2023/24, the budget proposes to completely fund the School Safety and Security Grant program with a $100 million transfer from an appropriation within the Department of Education.