2022/23 Budget-in-Depth

By House Appropriations Committee Staff , | 3 years ago

The 2022/23 budget package includes the following, which were all signed by the governor in July:

- General Appropriations (Act 1A/SB 1100)

- “Housekeeping” Appropriations (Acts 4A-12A/HBs 2653-2659; 2661, 2662)

- Non-Preferred Appropriations (Acts 2A and 3A/SBs 1105 and 1284)

- Fiscal Code (Act 54/HB 1421)

- Tax Code (Act 53/HB 1342)

- School Code (Act 55/HB 1642)

The General Assembly did not enact a capital budget for 2022/23, which is required to be annually enacted under the Pennsylvania Constitution. The commonwealth recently enacted a capital budget for 2021/22 at the end of May 2022.

A bill amending the Human Services Code impacting the budget was vetoed by the governor (Veto 6/HB 1420) on July 8, 2022. Parts of this bill were later amended into the final Fiscal Code bill.

Within the General Appropriations Act, the General Assembly appropriated $85.887 billion in state and federal funds for the 2022/23 fiscal year. These appropriations comprise the bulk of the commonwealth’s operating budget. They are joined by $438.3 million in state and federal appropriations within the separate appropriations bills for independent agencies and $630.6 million through the non-preferred appropriations acts. The balance of the operating budget for other special funds and restricted accounts is set by executive action, under authority granted by prior acts of the General Assembly directing the use of those funds.

The budget spends a total of $42.766 billion from the state General Fund. This is an increase of $3.4 billion or 8.7% over the prior fiscal year, after adjusting for supplemental appropriations.

The General Appropriations Act increases net spending authority for the 2021/22 fiscal year by $758.2 million. These supplemental appropriations, both increases and decreases, primarily affect five areas:

- Enhanced FMAP: Net decreases to state appropriations to account for additional federal funds received for Medical Assistance programs that were not anticipated when the 2021/22 budget was enacted. The extra federal enhanced match reduced the portion of costs paid with state funds.

- Cycle Rolls: Increased state appropriations to reverse changes to the payment schedule for managed care programs under the Department of Human Services, commonly called “cycle rolls.” The department will now be able to pay bills on a timelier schedule one month after coverage is provided.

- Loan Repayments: Repaying loans from the Workers’ Compensation Security Fund that were made to the General Fund in prior fiscal years.

- State Police Funding Shifts: Shifting more State Police costs into the General Fund and out of the Motor License Fund, freeing up resources for the repair and construction of roads and bridges.

- Other Budgetary Adjustments: Other net changes to appropriations to reflect budgetary changes that emerged during the fiscal year. Examples include a reduction to general obligation debt service due to the timing of bond issuances and a reduction to student transportation reimbursements, reflecting reduced student transportation costs for school districts and intermediate units over the last two years.

General Fund state spending for Medicaid programs continues to be impacted by the enhanced FMAP provided to states for the duration of the COVID-19 federal public health emergency. The increased match reduced state costs for these mandated expenses during the entirety of 2021/22.

For 2022/23 fiscal year, the budget assumes that enhanced FMAP will continue through the end of the 2022 calendar year. However, unlike the previous three fiscal years that used enhanced FMAP, the budget does not specifically appropriate the enhanced FMAP (or the adjustments needed for the extra quarters received in 2021/22.) Instead, it relies on the blanket authority provided to the governor by the General Assembly within the General Appropriations Act to adjust federal appropriations for COVID programs that are specifically tied to existing programs, like Medical Assistance.

Phasing out enhanced FMAP is an important factor driving part of the increase in total state appropriations for 2022/23. These increases do not reflect growth in the program but are purely a change in funding source. A year-over-year comparison with both state General Fund appropriations and enhanced FMAP helps illustrate this impact.

|

2022/23 Budget

Year-Over-Year Change Including Enhanced FMAP

|

|

$ amounts in billions

|

2021/22

Revised

|

2022/23

Budget

|

$

Change

|

%

Change

|

|

General Fund State Appropriations

|

$39.351

|

$42.766

|

$3.414

|

8.7%

|

|

Enhanced FMAP*

|

$2.479

|

$1.255

|

-$1.223

|

-49.4%

|

|

General Fund State + Enhanced FMAP

|

$41.830

|

$44.021

|

$2.191

|

5.2%

|

* Enhanced FMAP totals are staff estimates as of July 2022.

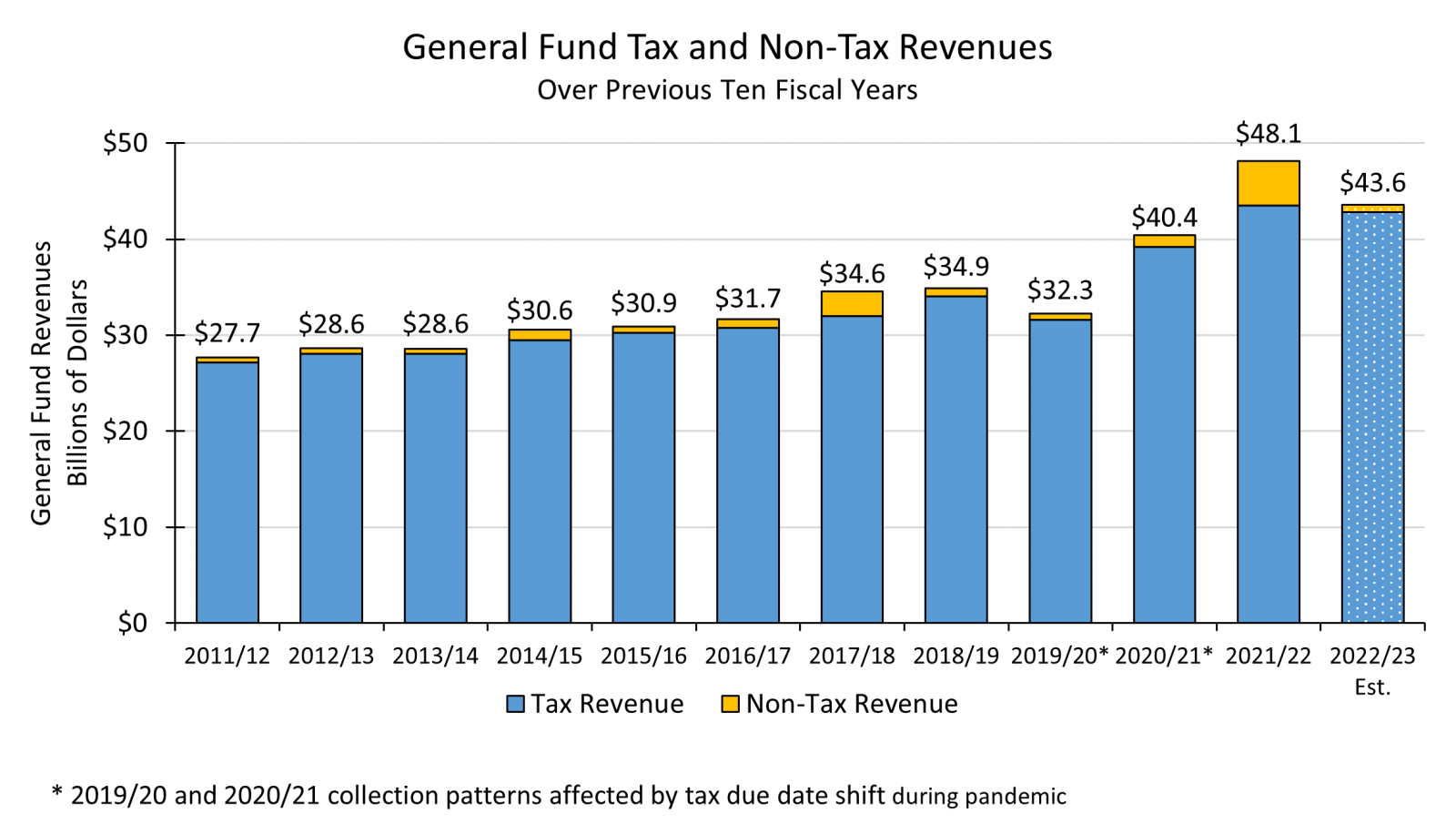

The foundation of the 2022/23 budget rests on the historic revenues collected in 2021/22. General Fund revenues the last fiscal year finished $5.6 billion, or 13.2%, above the official estimate, with total revenues of $48.13 billion.

After adjusting for non-recurring revenues, tax law changes, transfers, and increased tax credits, the 2022/23 official General Fund revenues estimate before refunds is $43.579 billion, a decrease of $4.56 billion.

Last year, the General Assembly transferred $3.84 billion in federal American Rescue Plan – State Fiscal Recovery Funds to the General Fund. This one-time transfer constituted 8.0% of total revenues collected during the fiscal year. In addition to the transfer, a significant, though indeterminate, amount of 2021/22’s revenue attributed to personal income tax on capital gains is expected to be nonrecurring next year. These large non-recurring revenues are a primary reason that total General Fund revenues for 2022/23 will decline year-over-year. Excluding the ARPA transfer, total General Fund revenues for 2022/23 decrease by $713.5 million, or 1.6%.

The Fiscal Code makes a transfer of $2.1 billion to the Budget Stabilization Reserve Fund, commonly called the Rainy Day Fund. The transfer will bring the total in the fund to $4.96 billion, representing 11.6% of expenditures, or 42.3 days of spending. The median amount of Rainy Day Funds among other states at the end of fiscal year 2021 was 9.4%, or 34.4 days of spending, according to data compiled by the Pew Charitable Trusts.

Current law requires 25% of the ending balance of the General Fund to be deposited into the Rainy Day Fund at the end of the fiscal year, though the General Assembly regularly modified that requirement in recent years. However, if the Rainy Day Fund balance is greater than 6% of actual revenues received for the fiscal year, the required transfer is reduced from 25% to 10% in recognition of the healthy balance. The Rainy Day Fund should be large enough to trigger that switch going forward, assuming the General Assembly does not enact changes requiring a different amount.

The governor’s executive budget proposed broadening the corporate net income tax (CNIT) base while gradually lowering the rate over eight years from 9.99 to 4.99 %. The proposed base-broadening consisted of three main parts – stronger addback provisions, market-based sourcing and economic nexus standards to bring in new taxpayers.

The enacted budget package incorporated a rate reduction and the market-based sourcing and nexus standards but did not include stronger addback provisions. The current 9.99% rate reduces to 8.99% beginning in 2023 and then reduces by a half a percentage point each year until it reaches 4.99% in 2031. These changes will help ensure that multi-state corporate groups are taxed on profits generated within the commonwealth leveling the playing field for corporations that operate primarily in Pennsylvania.

Market-based sourcing determines how much of a business’s income is apportioned to Pennsylvania. The new provisions apportion more income to Pennsylvania by including:

- Sales to PA for intangible property that is leased or licensed in this state or if there is a contract right or government license that authorizes business in this state,

- Sales of securities to customers in PA, or

- Interest and fees received from loans for real estate or personal property located in PA, or where the lender is in PA or for credit cards billed to an address in PA.

Economic nexus standards pull establish that a corporation has a substantial business presence, and must remit tax on their profits, because of:

- Leasing or licensing intangible property utilized in Pennsylvania,

- Engaging in transactions with customers in this state involving intangible property or loans, or

- Sales of intangible property utilized within Pennsylvania.

There is a rebuttable presumption that a corporation with $500,000 or more of sales sourced to Pennsylvania has substantial nexus without regard to physical presence in this state.

|

CNIT Net Fiscal Impact

($ amounts in millions)

|

|

2022/23

|

2023/24

|

2024/25

|

2025/26

|

2026/27

|

|

$ (126.60)

|

$ (305.30)

|

$ (408.10)

|

$ (585.20)

|

$ (774.10)

|

The net fiscal impact of the enacted CNIT changes is a larger tax cut than the governor proposed – especially in future years.

Taxpayers eligible for the federal Child and Dependent Care Tax Credit are automatically eligible for a new state Dependent and Child Care Tax Credit. Like the federal credit, this is a refundable credit for child and dependent care expenses necessary to allow the caregiver to work.

- The formula to calculate the tax credit is as follows:

Expenses x Income-based percentage x 30% = Tax Credit

- Expenses - Capped at $3,000 for one child and $6,000 for two or more children.

Income-based percentage – 35% for income of $15,000 or less; 20% for income of $42,000 or more; a sliding scale applies to income between that range as provided by Internal Revenue Code Section 21(2)(a). Federal eligibility is currently for income up to $438,000.The maximum credit at an income level of $15,000 is $315 for one child or dependent and $630 for two or more children. The maximum credit at an income level of $42,000 or more is $180 for one child and $360 for two or more children.

The Department of Revenue estimates that 221,000 families will benefit from the program with an average credit of $171 per year.

Two transfers of note impacting General Fund revenues are included in the Fiscal Code bill.

- $12.317 million from personal income tax revenues to the Environmental Stewardship Fund, similar to transfers in previous fiscal years.

- $45 million from personal income tax revenues to the Election Integrity Restricted Account. This program provides grants to counties through the Department of Community and Economic Development.

The American Rescue Plan Act provided a total of $7.291 billion to the commonwealth in State Fiscal Recovery Funds. States can use these funds to flexibly respond to the health, economic and budgetary impacts of the pandemic.

The General Assembly required all COVID-19 response funds from the federal government that were not required to augment specific programs or be driven out via formula to be spent only upon appropriation. Previously, the General Assembly directed $3.84 billion to the General Fund to replace lost revenues and used another $1.29 billion on a variety of programs to respond to the pandemic. Entering the 2022/23 budget, $2.16 billion remained available to spend.

The budget appropriated all remaining ARPA State Fiscal Recovery funds. The following table summarizes the plan, and specific uses of these funds across different departments are discussed through the agency sections of this document.

|

American Rescue Plan - State Fiscal Recovery Fund Appropriations

|

|

|

Amounts

in Millions

|

|

Total ARPA - State Fiscal Recovery Fund Allocation

|

$7,291.3

|

|

Transfer to General Fund - Revenue Replacement

|

$3,841.0

|

|

Appropriated previously by the General Assembly

|

$1,288.0

|

|

ARPA Funds Remaining

|

$2,162.3

|

|

|

|

|

New Appropriations:

|

|

|

Public Safety

|

|

|

PCCD - Local Law Enforcement Support

|

$135.0

|

|

PCCD - Gun Violence Investigation and Prosecution

|

$50.0

|

|

PCCD - Violence Intervention and Prevention

|

$75.0

|

|

|

|

|

Human Services

|

|

|

DHS - Child Care Stabilization

|

$90.0

|

|

DHS - Long Term Living Programs

|

$250.0

|

|

DHS - Mental Health Programs

|

$100.0

|

|

DHS - Low-Income Home Energy Assistance Program (LIHEAP)

|

$25.0

|

|

|

|

|

Environment

|

|

|

CFA - Water and Sewer Projects

|

$320.0

|

|

DCNR - State Parks and Outdoor Recreation Program

|

$100.0

|

|

DEP - Transfer to Clean Streams Fund

|

$220.0

|

|

|

|

|

Education

|

|

|

PASSHE Universities

|

$125.0

|

|

PHEAA - Student Loan Relief for Nurses Program

|

$35.0

|

|

|

|

|

Housing

|

|

|

PHFA - Development Cost Relief Program

|

$150.0

|

|

PHFA - Affordable Housing Construction

|

$100.0

|

|

DCED - Whole Home Repairs Program

|

$125.0

|

|

|

|

|

Other

|

|

|

Transfer to UC Trust Fund

|

$42.3

|

|

Exec. Offices - Pandemic Response

|

$40.0

|

|

DCED - Historically Disadvantaged Business Assistance

|

$20.0

|

|

CFA - Cultural and Museum Preservation Grant Program

|

$15.0

|

|

Health - Biotechnology Research

|

$5.0

|

|

Property Tax/Rent Rebate

|

$140.0

|

|

Subtotal - New Appropriations

|

$2,162.3

|

|

|

|

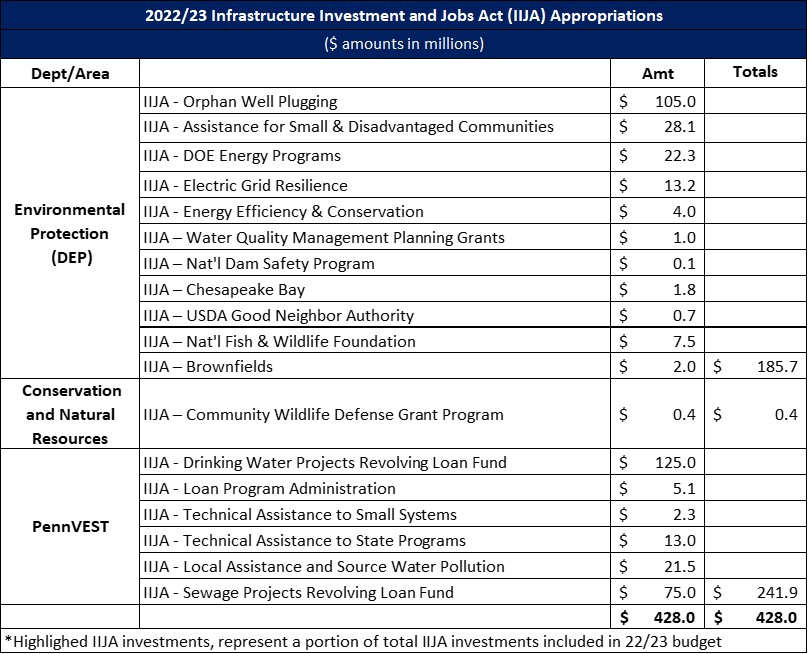

The 2022/23 budget appropriates $1.34 billion in IIJA funding, divided into two broad categories:

- Funding for Environmental priorities $427.9 million, within DEP, DCNR, and PennVEST.

- Funding for Other Infrastructure - $913.1 million, within Executive Offices, PennDOT, DCED, and PSP.

| 2022/23 Infrastructure Investment and Jobs Act (IIJA) Appropriations |

| ($ amounts in millions) |

| Dept/Area |

|

Amt |

Totals |

Environmental Protection

(DEP) |

IIJA - Orphan Well Plugging |

$ 105.0 |

|

| IIJA - Assistance for Small & Disadvantaged Communities |

$ 28.1 |

|

| IIJA - DOE Energy Programs |

$ 22.3 |

|

| IIJA - Electric Grid Resilience |

$ 13.2 |

|

| IIJA - Energy Efficiency & Conservation |

$ 4.0 |

|

| IIJA – Water Quality Management Planning Grants |

$ 1.0 |

|

| IIJA – Nat'l Dam Safety Program |

$ 0.1 |

|

| IIJA – Chesapeake Bay |

$ 1.8 |

|

| IIJA – USDA Good Neighbor Authority |

$ 0.7 |

|

| IIJA – Nat'l Fish & Wildlife Foundation |

$ 7.5 |

|

| IIJA – Brownfields |

$ 2.0 |

$ 185.7 |

| Conservation and Natural Resources (DCNR) |

IIJA – Community Wildlife Defense Grant Program |

$ 0.4 |

$ 0.4 |

| PennVEST |

IIJA - Drinking Water Projects Revolving Loan Fund |

$ 125.0 |

|

| IIJA - Loan Program Administration |

$ 5.1 |

|

| IIJA - Technical Assistance to Small Systems |

$ 2.3 |

|

| IIJA - Technical Assistance to State Programs |

$ 13.0 |

|

| IIJA - Local Assistance and Source Water Pollution |

$ 21.5 |

|

| IIJA - Sewage Projects Revolving Loan Fund |

$ 75.0 |

$ 241.9 |

| Exec Offices |

IIJA - State Cyber Security |

$ 1.1 |

$ 1.1 |

| PennDOT |

IIJA - Highway & Safety Capital Projects* |

$ 748.0 |

$ 748.0 |

| Community and Economic Development (DCED) |

IIJA - Weatherization Administration |

$ 2.8 |

|

| IIJA - Broadband Equity Access and Development |

$ 100.0 |

|

| IIJA - State Digital Equity Capacity |

$ 1.6 |

|

| IIJA - Local Cyber Security |

$ 4.3 |

|

| IIJA - DOE Weatherization Program |

$ 47.2 |

$ 155.9 |

| State Police (PSP) |

IIJA - Motor Carrier Safety |

$ 8.1 |

$ 8.1 |

|

|

$ 1,341.1 |

$ 1,341.1 |

| *IIJA funds within PennDOT are utilized within Highway Maintenance appropriation and State Bridge EA, to directly offset state expenditure |

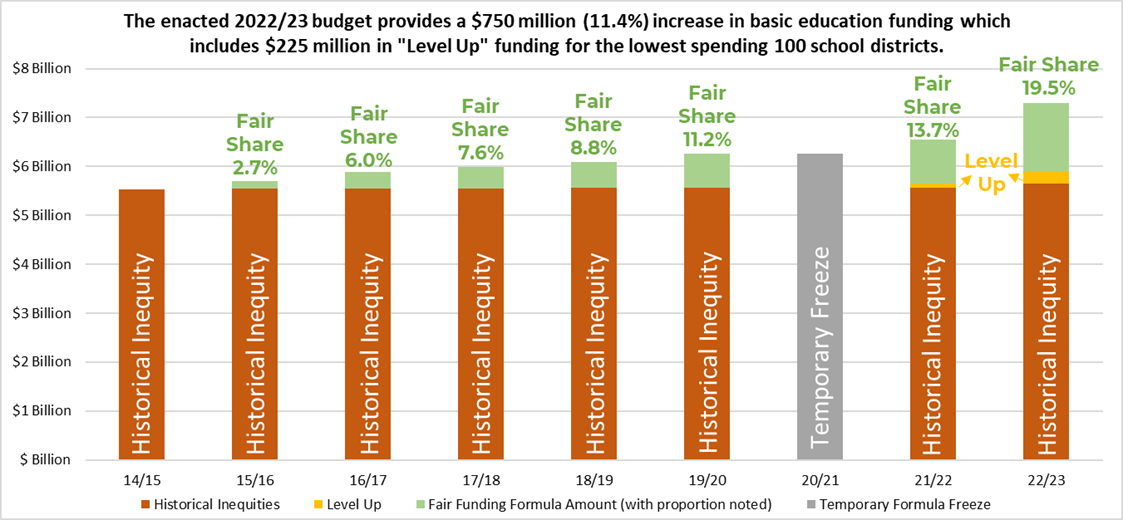

Basic education funding (BEF) is the largest state education subsidy, representing just over half of all funds the state provides to school districts each year.

The 2022/23 budget increased the BEF fair funding formula distribution by $525 million and added another $225 million through Level Up for the 100 neediest schools. This $750 million or 11.4% increase is more than the increases included in the previous five budgets combined.

The estimated distribution by school district is available here. The median increase across all school districts is 7.4%, and 25 Level Up school districts will receive an increase above 20%.

In 2021/22, Level Up was a $100 million component of the BEF appropriation. In 2022/23, there is a separate $225 million appropriation for Level Up, but although appropriated separately, the Level Up funding still becomes part of a school district’s recurring base BEF amount going forward.

The BEF appropriation includes both the basic education subsidy and the state’s contributions to school districts for school employees’ social security.

|

Basic Education Funding (BEF) Appropriation

$ amounts in thousands

|

Actual

FY18-19

|

Actual

FY19-20

|

Actual

FY20-21

|

Revised

FY21-22

|

Budget

FY22-23

|

22/23 Budget

less

21/22 Revised

|

|

Basic Education Funding

|

$6,095,079

|

$6,742,838

|

$6,794,489

|

$7,082,304

|

$7,625,124

|

$542,820

|

7.7%

|

|

BEF Portion

|

$6,095,079

|

$6,255,079

|

$6,255,079

|

$6,555,079

|

$7,080,079

|

$525,000

|

8.0%

|

|

Social Security Portion

|

$0

|

$487,759

|

$539,410

|

$527,225

|

$545,045

|

$17,820

|

3.4%

|

|

Note for Social Security Portion: 2021/22 includes a $15.5 million supplemental appropriation; 2020/21 current year costs were $501.8 million (the amount shown included $37.6 million to cover shortfalls from prior years)

|

For the 2022/23 Ready to Learn Block Grant, the School Code amendments specify each school entity will receive the same amount it received during the 2021/22 fiscal year (see PDE’s estimated 22-23 RTL distribution). This formula encumbers $269.5 million, and there is a $100 million transfer from the Ready to Learn Block Grant appropriation to the School Safety and Security Fund for mental health grants.

The 2022/23 budget contains a $100 million, or 8.1%, increase in Special Education Funding (SEF). Since 2014/15, SEF payments to school districts have been distributed through the fair funding formula recommended by the bipartisan Special Education Funding Commission (SEFC). The formula uses local wealth factors and a weighted special education student count based upon three tiers of student need to determine the distribution of funds. In 2022/23, 23% of special education funding will go through this fair funding formula, while the pre-2014/15 share (77%) remains subject to hold-harmless. In other words, the 2013/14 allocation is locked-in and only the new funding added since 2014/15 is dynamic and based upon the most up-to-date student counts and wealth factors.

The 2022/23 School Code amendments codified all but one of the December 2021 recommendations of the reconstituted SEFC, and these changes are in effect for the 2022/23 fiscal year. The recommendations included using updated weights between the three tiers of need to reflect a more recent survey of school district costs, locking-in the data prior to the start of the year to enhance the predictability of the distribution, requiring more data transparency, and collecting additional data on the lowest cost students.

The only recommendation not enacted concerned increasing the share (currently one percent) of the total special education funding appropriation designated for the Contingency Fund, which makes extra state funding support available for individual students costing more than $75,000. The recommendations included prioritizing any increase in the Contingency Fund for school districts with both high-cost students and smaller overall budgets.

Special education services are consistently identified as a top cost-driver for school districts. A recent report found that the state’s share of special education funding declined from about 33% of costs to 22% over the last decade.

The enacted budget provides a $60 million, or 25%, increase for Pre-K Counts. About two-thirds of this increase will support the higher grant rate enacted in the Fiscal Code amendments (a 14% increase; from $8,750 to $10,000 for a full-time slot). The remaining funding is estimated to support an additional 2,300 seats. New funding for Pre-K Counts slots is awarded on a competitive basis.

The 2022/23 budget also includes a $19 million increase for Head Start Supplemental Assistance to meet the growing costs of the program with no new seats anticipated.

Early Intervention (ages 3-5) receives a $10 million, or 3%, increase.

The enacted budget increases the Career and Technical Education subsidy by $6 million, or 8.4%, for a total of $78.9 million. About $67.3 million will go to Career and Technology Centers, while school districts and charter schools with qualifying programs will receive $11.1 million and $560,000, respectively.

The total 2022/23 Career and Technical Education appropriation is $105.1 million, and in addition to the subsidy and PA Smart grants, it regularly includes funding for personnel and curriculum development, economic development initiatives, licensed practical nursing programs, adult career and technical education, and competitive equipment grants.

The 2022/23 budget provides $7 million for the Dual Enrollment grants program, which was last funded in 2010/11 at $7 million. These funds reimburse school entities that cover the approved costs for a secondary student to concurrently enroll in postsecondary courses. The student receives both post-secondary and secondary credit for completed classes, which makes higher education more affordable and exposes the student to post-secondary pathways.

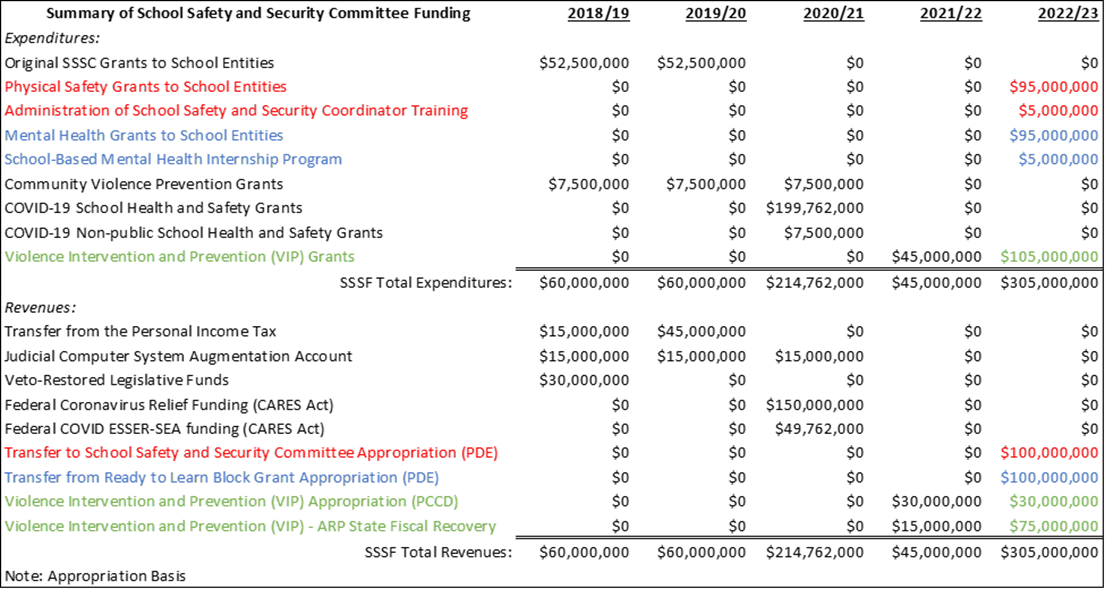

The 2022/23 budget includes $200 million for physical and mental health safety in schools.

- A new $100 million appropriation in PDE is for physical safety

- $95 million for physical safety grants to school entities (formula driven, not competitive)

- $100,000 for each school district, plus $15 per student

- $70,000 for each charter school, Intermediate Unit, and Area Career and Technical Center

- $5 million for the School Safety and Security Committee (SSSC) to develop and provide training to school safety and security coordinators

- At least 4% ($200,000) of these funds will be used to support the Safe2Say program

- $100 million of the increase in the Ready to Learn Block Grant is for mental health support

- $95 million for mental health grants to school entities (formula driven, not competitive)

- $100,000 for each school district, plus $15 per student

- $70,000 for each charter school, Intermediate Unit, and Area Career and Technical Center

- $5 million for the new School-Based Mental Health Internship Program under PHEAA

- Grants for Commonwealth residents working in internships in educational specialist preparation programs at Pennsylvania school entities

- Grant recipients must agree to work in a school entity in Pennsylvania as a school nurse, school psychologist, school counselor or school social worker for a minimum of three years following the completion of their program

- PHEAA will determine the amount of the grant awards

Estimates by school district and details about the uses of these funds are available here.

Since its inception in 2018, the SSSC’s funding amounts, sources, and uses have varied from year to year. The pandemic necessitated a focus on health and safety, and the influx of federal ARP ESSER funding for schools justified a funding holiday in 2021/22. The 2022/23 funding brings a dedicated focus to the mental health side of school safety, and it emphasizes using the funds to meet the baseline physical safety and mental health supports identified by the SSSC.

In addition to funding for schools, the SSSC provides resources for organizations focused on community violence prevention (see PCCD section for more information).

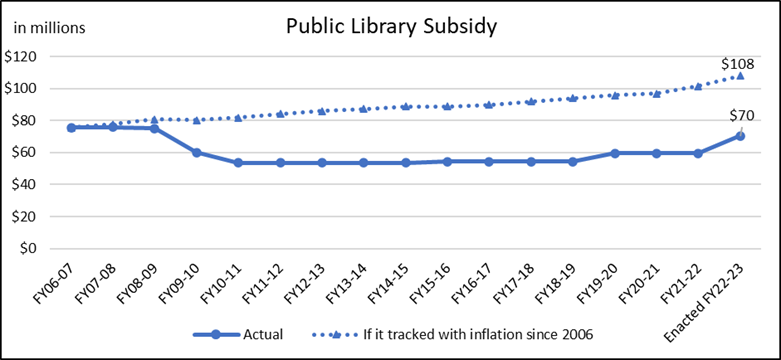

The 2022/23 budget provides the Public Library Subsidy with an $11 million, or 18.5%, increase. This funding brings support for libraries close to the 2006/07 funding level in nominal terms, but library support lags well behind its inflation-adjusted total from 2006/07.

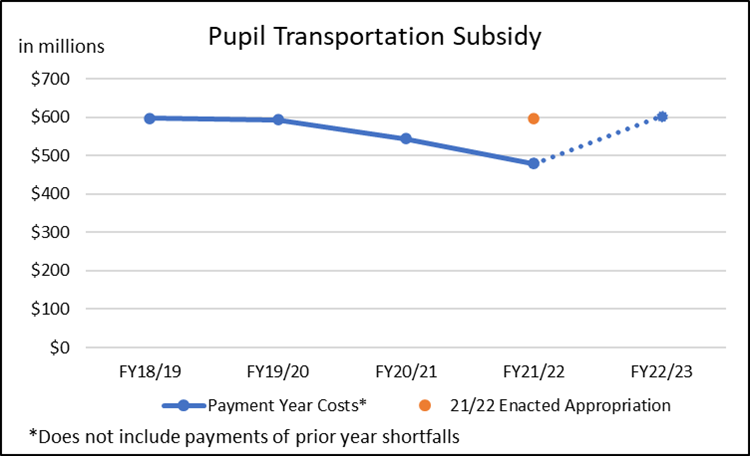

The past few years have seen uncertainty in the state’s pupil transportation subsidy stemming from the disruptions to in-person learning. In November 2020, the legislature passed Act 136, which offered level pupil transportation funding for any school entity that continued to make payments to bus transportation contractors. The goal of this incentive was to provide some stability to the bus transportation sector, but the unknown cost of this new variable also created more unpredictability in the amount needed in the state pupil transportation subsidy.

The state’s pupil transportation subsidy reimburses Intermediate Units based upon current year transportation activity and school districts for prior year activity. The transportation data submitted by school entities for the reimbursement calculation show a pandemic related decline in fiscal years 2020/21 and 2021/22. For 2021/22, the legislature appropriated $597 million, which was in line with pre-pandemic numbers. However, the final reimbursements came to $479 million, allowing the General Assembly to make a downward adjustment of $118 million to the 2021/22 appropriation. The 2022/23 enacted budget provides $603 million for pupil transportation.

The School Code amendments included in the 2022/23 budget package increased the educational tax credits by $125 million, or 45%.

There are four types of organizations under the educational tax credit article in the Public School Code:

- Scholarship Organizations – benefit tuition-paying students (i.e., private school students)

- Pre-K Scholarship Organizations – benefit public and private pre-k students

- Educational Improvement Organizations – benefit innovative education programs (e.g., programs offered by libraries, museums, civic clubs, community centers, public or private schools, etc.)

- Opportunity Scholarship Organizations - benefit students residing in the attendance area of a low-achieving (bottom 15% of achievement) school; award goes toward school-based fees for private or public school

The supplemental scholarship for students attending economically disadvantaged schools was added in 2019/20, and it piggybacks off an existing scholarship organization.

Between 2015/16 and 2021/22, the Scholarship Organization cap increased by $115 million or 192%, while the caps for the other three organizations remained the same. Breaking this trend, the 2022/23 budget increased the cap for each program.

|

Educational Tax Credits Summary

|

2021/22 Cap

|

2022/23 Cap

|

Year over Year Change

|

|

Scholarship Organizations

|

$175,000,000

|

$263,000,000

|

$88,000,000

|

50%

|

|

Earmarked for Economically Disadvantaged Scholarships

|

$0

|

$12,000,000

|

$12,000,000

|

|

|

Educational Improvement Organizations

|

$37,500,000

|

$44,500,000

|

$7,000,000

|

19%

|

|

Pre-Kindergarten Scholarship Organizations

|

$12,500,000

|

$20,500,000

|

$8,000,000

|

64%

|

|

Educational Improvement Tax Credit (EITC) Total:

|

$225,000,000

|

$340,000,000

|

$115,000,000

|

51%

|

|

Opportunity Scholarship Organizations

|

$50,000,000

|

$65,000,000

|

$15,000,000

|

30%

|

|

Earmarked for Economically Disadvantaged Scholarships

|

$5,000,000

|

$0

|

-$5,000,000

|

-100%

|

|

Opportunity Scholarship Tax Credit (OSTC) Total:

|

$55,000,000

|

$65,000,000

|

$10,000,000

|

18%

|

|

Educational Tax Credits Total:

|

$280,000,000

|

$405,000,000

|

$125,000,000

|

45%

|

However, a new transparency measure was applied only to the scholarship organization that administers the supplemental awards for students attending economically disadvantaged schools. This organization must additionally report the scholarship awards by family household income and the school that the student attended in the year prior to receiving the scholarship award.

Scholarship Organizations and Pre-Kindergarten Scholarship Organizations are still only required to report the total number and amount of scholarships awarded. This limited data collection means “key data necessary to thoroughly evaluate the program are not available,” (p. 30) as noted by the Independent Fiscal Office (IFO) in its January 2022 Performance-Based Budget report on Pennsylvania’s educational tax credits. The IFO recommended robust data collection across all the organization types.

The School Code amendments also expanded the number of schools that qualify as economically disadvantaged for the purposes of the supplemental scholarships for students who attend those schools.

The 2022/23 budget did not include the charter school funding reforms proposed by the governor and contained in House Bill 272. These reforms would save school districts an estimated $373 million each year by using a data-driven and need-based charter school tuition calculation rather than continuing to use the outdated assumption model from 1997.

The School Code amendments also abolish the charter school regulations approved by a 3-2 vote in March 2022 by the Independent Regulatory Review Commission. The charter school regulations, which had not yet gone into effect, reinforced strong financial accounting and ethical governing practices, including requiring charter school board members to recuse themselves from votes presenting a conflict of interest and to file statements of financial interest. The regulations also provided clarification and transparency regarding charter schools’ payment processes, application information, relationships with education management service providers, and enrollment policies.

The School Code amendments considered part of the 2022/23 budget package contained a greater number of non-funding-related policy provisions compared to previous years. Following is an overview of the more substantial K-12 policy changes not already mentioned:

- “2030 Commission”

- A large Commission tasked with issuing a report on long-term educational and workforce goals to the General Assembly (originally SR144)

- Educational and Professional Development Online Course Initiative

- Requires PDE to host a catalog of online school courses and professional development courses (originally HB1330)

- Per the Fiscal Code amendments, PDE’s general government operations appropriation includes $1.5 million to implement this initiative

- Home Education Program

- Beginning with 2023/24, the school district of residence shall develop policies and procedures to permit a child who is enrolled in a home education program to:

- participate on the same basis as other students in any cocurricular activity

- participate in academic courses equaling up to at least one quarter of the school day

- Originally HB1041

- Lunch Shaming

- Increases the “alternative meal” outstanding lunch debt threshold from $50 to $75

- Changes the “may” to a “shall” in regard to a school having to offer families assistance with applying for participation in the school food programs

- Clarifying that a board of school directors cannot have a policy requiring a student or staff to discard a school meal after it was served to the student

- Extended enrollment for special education students

- Allows special education students who turned 21 years old in 2021/22 to elect to return for another year. Due to aging out, these students, whose transition services were disrupted by the pandemic, did not get the true option year afforded by Act 66 of 2021.

- School safety training

- Additional training requirements for school employees

- Drug and Alcohol Recovery High School

- Makes the program permanent by removing the pilot status

- Talent Recruitment

- Establishes the Talent Recruitment Grant Program (no funding source identified) to provide grants to institutions of higher education to cover the tuition or fees of secondary students or implement programs that will increase the education workforce (originally SB99)

- Requires PDE to designate a Chief Talent Officer who is responsible for coordinating recruitment and retention efforts in the education workforce, including increasing participation in education-related jobs by people in communities that have low participation in the education workforce.

- Requires PDE to annually collect and publicly post information about the demographics of educators and administrators throughout the educator pipeline process

Pennsylvania State System of Higher Education (PASSHE)

The Pennsylvania State System of Higher Education received a $75 million increase, or 15.7%. This meets the system and governor’s request and is critical to the health of the state universities, including the two new integrated universities, Commonwealth University and Pennsylvania Western University.

The Board of Governors adopted a new distribution formula this year, which will be used to drive out the state appropriation to the universities. The formula is 25% based on core operations costs common to all universities of all sizes, and 75% based on enrollment. The enrollment portion prioritizes Pell-eligible students, under-represented groups, student progress toward degree attainment and the program level of the student.

The budget also appropriates $125 million of ARPA State Fiscal Recovery Funds to the system. In accordance with the Fiscal Code, the two integrated universities will share $34.3 million, as determined by the Board of Governors. Cheyney University will receive $7.4 million, and the remaining universities will split $83.3 million, allocated proportionally based on the average of full-time enrollment over the last two years.

2022/23 PASSHE Appropriations

Anticipated Distribution |

| University |

2021/22

State |

2022/23

State |

$

Change |

%

Change |

ARPA |

2022/23

State + ARPA |

| Cheyney |

$13.32 |

$19.38 |

$6.05 |

45.4% |

$7.37 |

$26.75 |

| Commonwealth |

$80.52 |

$84.64 |

$4.12 |

5.1% |

$17.15 |

$101.78 |

| East Stroudsburg |

$29.08 |

$39.61 |

$10.52 |

36.2% |

$7.37 |

$46.98 |

| Indiana |

$53.88 |

$56.90 |

$3.02 |

5.6% |

$12.27 |

$69.16 |

| Kutztown |

$37.20 |

$46.43 |

$9.23 |

24.8% |

$10.49 |

$56.92 |

| Millersville |

$35.71 |

$42.03 |

$6.32 |

17.7% |

$9.14 |

$51.17 |

| Pennsylvania Western |

$87.07 |

$87.30 |

$0.23 |

0.3% |

$17.15 |

$104.45 |

| Shippensburg |

$31.16 |

$37.52 |

$6.36 |

20.4% |

$7.79 |

$45.31 |

| Slippery Rock |

$41.54 |

$51.26 |

$9.72 |

23.4% |

$12.40 |

$63.66 |

| West Chester |

$62.26 |

$81.43 |

$19.17 |

30.8% |

$23.88 |

$105.30 |

| |

|

|

|

|

|

|

Chancellor's Office and

Other Systemwide Initiatives |

$5.72 |

$5.98 |

$0.26 |

4.5% |

$0.00 |

$5.98 |

| Total |

$477.47 |

$552.47 |

$75.00 |

15.7% |

$125.00 |

$677.47 |

| $ amounts in millions |

|

|

|

|

|

|

| Commonwealth University formerly Bloomsburg, Lock Haven and Mansfield |

|

|

| Pennsylvania Western University formerly California, Clarion and Edinboro Universities |

|

Community Colleges

The primary operating appropriation that supports Pennsylvania’s 15 community colleges received an $11.3 million increase, or 4.6% to a total of $256.5 million. Part of the increase is used to annualize funding for the new Erie Community College, which started operating last year. The remaining funds are driven out proportionally according to each college’s share of full-time equivalent enrollment, according to the formula enacted with this year’s School Code amendments.

|

Community College Operating Appropriation Distribution

|

|

College

|

2022/23 Allocation

|

Increase

|

% Change

|

|

Allegheny

|

$37,612,993

|

$1,256,415

|

3.5%

|

|

Beaver

|

$5,116,763

|

$173,605

|

3.5%

|

|

Bucks

|

$21,136,018

|

$883,289

|

4.4%

|

|

Butler

|

$8,883,469

|

$303,779

|

3.5%

|

|

Delaware

|

$20,296,850

|

$846,012

|

4.3%

|

|

Erie

|

$2,900,000

|

$1,515,000

|

109.4%

|

|

Harrisburg

|

$35,616,392

|

$1,388,246

|

4.1%

|

|

Lehigh Carbon

|

$14,564,918

|

$607,676

|

4.4%

|

|

Luzerne

|

$12,933,123

|

$406,971

|

3.2%

|

|

Montgomery

|

$20,882,974

|

$891,573

|

4.5%

|

|

Northampton

|

$17,736,367

|

$786,606

|

4.6%

|

|

PA Highlands

|

$3,078,846

|

$158,576

|

5.4%

|

|

Philadelphia

|

$33,527,111

|

$1,239,848

|

3.8%

|

|

Reading

|

$9,281,188

|

$388,392

|

4.4%

|

|

Westmoreland

|

$12,942,988

|

$424,012

|

3.4%

|

|

Total

|

$ 256,510,000

|

$ 11,270,000

|

4.6%

|

In addition to the operating appropriation, community colleges received increased capital support, with a $2.1 million, of 4%, increase to that appropriation.

State-Related Universities

The four state-related universities – Lincoln University, the University of Pittsburgh, Temple University and Penn State University – receive their funding outside of the General Appropriations Act due to special provisions under the Pennsylvania Constitution. In most previous years, the General Assembly appropriated money to each university in a separate bill. This year, the legislature combined all of the appropriations together into one bill, the State-Related University Nonpreferred Appropriation Act of 2022.

The state-related universities received flat funding for each of their state appropriations for educational support under the bill. However, from the ARPA funding appropriated for Pandemic Response, the universities will receive a supplement equal to a 5% increase over the state amounts appropriated in 2021/22 as proposed by the governor.

In addition to the education appropriations shown here, Penn State received a $2.75 million, or 5%, increase for its agriculture programs under the Transfer to Ag Land Scrip Fund, in the Department of Agriculture’s budget within the General Appropriations Act.

|

2022/23 State-Related University Funding

($ amounts in millions)

|

|

University

|

2021/22

State

|

2022/23

State

|

2022/23

ARPA

Supplement

|

2022/23

Total

|

$

Change

|

%

Change

|

|

Penn State - General Support

|

$242.10

|

$242.10

|

$12.11

|

$254.20

|

$12.11

|

5.0%

|

|

Pennsylvania College of Technology

|

$26.74

|

$26.74

|

$1.34

|

$28.07

|

$1.34

|

5.0%

|

|

Pennsylvania State University Total

|

$268.83

|

$268.83

|

$13.44

|

$282.27

|

$13.44

|

5.0%

|

|

|

|

|

|

|

|

|

|

Pitt - General Support

|

$151.51

|

$151.51

|

$7.58

|

$159.08

|

$7.57

|

5.0%

|

|

Pitt - Rural Education Outreach

|

$3.35

|

$3.35

|

$0.17

|

$3.51

|

$0.17

|

5.0%

|

|

University of Pittsburgh Total

|

$154.85

|

$154.85

|

$7.74

|

$162.60

|

$7.74

|

5.0%

|

|

|

|

|

|

|

|

|

|

Temple - General Support

|

$158.21

|

$158.21

|

$7.91

|

$166.12

|

$7.91

|

5.0%

|

|

|

|

|

|

|

|

|

|

Lincoln - General Support

|

$15.17

|

$15.17

|

$0.76

|

$15.92

|

$0.76

|

5.0%

|

The Thaddeus Stevens College of Technology received a $748,000, or 4%, increase in the budget. Similarly, the Northern Pennsylvania Regional College also received a 4%, or $280,000, increase.

Most of the programs under PHEAA received an increase in the budget.

The agency’s flagship program, the State Grant Program, received a $20.6 million, or 6.6%, increase. Based on the formula adopted by the PHEAA Board in April and current enrollment trends, the increased resources should be sufficient to provide additional aid and provide around 108,000 Pennsylvania students with a state grant in the coming academic year.

Under the board-adopted formula, the maximum state grant award will increase to $5,750, composed of a $5,000 base award (same as 2021/22 amount) and an addition $750 “pandemic inflation adjustment,” as termed by PHEAA. While the board did not choose to fully incorporate the increase into the program, the additional inflation component is functionally the same for the student.

Funding for the Ready to Succeed Scholarship more than tripled to a total of $23.9 million – an $18.4 million increase. This year’s School Code implementation language increased the household income limit from $110,000 to $126,000 per year. PHEAA estimates that the income limit expansion will extend awards to an additional 3,900 students, and the extra funding will be sufficient to increase the maximum award under the program to $2,500, a $500 increase.

The PA Targeted Industry Scholarship Program, or PA-TIP, increased by $2.4 million, or 37.3%. This increase should be sufficient to fully fund the program’s anticipated demand for this year.

The budget provides an additional $2.6 million for the Act 101 program, bringing the program up to $5 million in total funding. This increase more than doubles funding for the program, which provides grants to institutions to help ensure student success though advising, tutoring, counselling, enrichment, and other supports.

Cheyney Keystone Academy funding increased by $480,000, or 13.7%.

On the federal side, the budget appropriates $35 million of ARPA funds for a third round of funding for the Student Loan Relief for Nurses program. Under current program guidelines, an eligible Pennsylvania nurse can receive up to $2,500/year in loan relief for three years, with a maximum benefit of $7,500. This new funding will provide relief to more than 4,600 additional nurses.

PHEAA will administer a new $5 million program created in the budget, the School-Based Mental Health Internship Program. The funding is found within the Ready to Learn Block Grant under the Department of Education and is a component of the mental health funding within the school safety and security package outlined under the School Code bill.

The new program will provide grants to commonwealth residents working in internships in educational specialist preparation programs at a Pennsylvania school entity, including school nurses, psychologists, counselors, or social workers. Recipients must agree to work in these roles for a minimum of three years following completion of their programs.

The budget contains $1 million for the Hunger-Free Campus Initiative and a $250,000 increase for sexual assault prevention on campus. Both appropriations support grants to institutions through the Department of Education.

The enacted budget includes funding to annualize reimbursements to the new Delaware County Health Department and provides half year funding for the new Lackawanna County Health Department. In addition, funding is included to increase maximum reimbursements to local health departments. Reimbursements will still be limited to the lessor of 50% of costs or $6 per capita. Historically, average per capita reimbursements were approximately $4.66 per capita. Assuming every local health department maximizes their reimbursement, per capita payments are estimated to be $5.38 with the funding increase.

Increased funding of $2.5 million for the Primary Health Care Practitioner appropriation was enacted, bringing the total appropriation to $7.1 million. The Fiscal Code directs $1.4 million additional to be invested in loan repayments, $442,000 additional to be invested in a residency program, and $558,000 to be distributed proportionately to the remaining four grantees. The unallocated $149,000 increase is assumed to be for department administrative costs related to the program.

Most disease-specific appropriations received funding increases. The appropriation for Amyotrophic Lateral Sclerosis (ALS) Support Services received an increase of $651,000, or 77%. State funding for Bio-Technology Research was restored and increased to $10.6 million. Several remaining disease-specific appropriations received a 6% increase in funding, including Diabetes Programs, Renal Dialysis, Adult Cystic Fibrosis and Other Chronic Respiratory Illnesses, Cooley’s Anemia, Hemophilia, Lupus, Sickle Cell, Regional Poison Control Centers, Trauma Prevention, Epilepsy Support Services, Tourette Syndrome, Lyme Disease, and Leukemia/Lymphoma.

Administrative funding to the Department of Health is $8.5 million less than levels requested by the governor, but still $2.6 million, or 2.9%, greater than 2021/22.

General Funds to the Department of Drug and Alcohol Programs (DDAP) were enacted $41,000 less than amounts requested by the governor, but still $196,000 more than in 2021/22. Funding for Assistance to Drug and Alcohol Programs was held flat at $44.7 million. The appropriation for General Government Operations was enacted at $3.2 million, a 6.5% increase over 2021/22.

Funds appropriated to DDAP from the Opioid Settlement Restricted Account increased from $5 million in 2021/22 to $22.5 million in 2022/23 to reflect anticipated receipt of the first installments of the Johnson & Johnson and distributors settlement. These funds will be used to support opioid rescue, treatment, and prevention efforts in accordance with the settlement agreements.

The final enacted budget appropriates $18 billion in state General Funds to the Department of Human Services (DHS). This represents a $1.5 billion, or 9.3% increase, over 2021/22.

The federal government, as part of COVID relief to states, provides an additional 6.2% federal medical assistance percentage (FMAP) match on eligible Medicaid costs, reducing state funds needed in the programs. The enhanced FMAP is available through the end of the quarter that contains the end of the federal public health emergency (PHE). The federal PHE currently ends mid-July 2022; however, the federal Department of Health and Human Services has committed to provide states with 60 days' notice prior to the planned end of the PHE.

The enacted 2021/22 budget assumed the 6.2% enhanced FMAP was available through December 2021. The governor’s proposed budget assumed enhanced FMAP would be available through the first quarter of 2022/23. However, due to the likely additional extension in mid-July (that was realized July 15, 2022), the enacted 2022/23 budget assumes the enhanced FMAP is available through December 2022. The result from the change in assumptions is reductions to 2021/22 state appropriations to reflect six months of additional enhanced FMAP and enacted 2022/23 appropriations less than those proposed by the governor to reflect the assumed receipt of an additional quarter of enhanced FMAP.

Funding for administrative appropriations in the department were enacted $31 million less than amounts requested by the governor, but $6.1 million, or 1%, greater than in 2021/22.

The planned Human Services Code (HB 1420) was ultimately vetoed by Governor Wolf. However, several provisions were incorporated into the Fiscal Code. Those provisions are noted throughout the remainder of this section.

After several years of relatively flat Medical Assistance (MA) enrollment, as of May 2022, MA enrollment has grown 22.5% since February 2020. Enrollment changes can be seen across the various categories of eligibility, but growth is most pronounced in the Medicaid Expansion eligibility group. States are prohibited from terminating Medicaid eligibility for the duration of the PHE in exchange for the 6.2% enhanced FMAP, except in specific cases, contributing significantly to the increased enrollment. As the PHE gets extended, any estimated savings assumed by the governor in 2022/23 related to the redeterminations of eligibility are reduced and will be realized primarily in 2023/24 and beyond now that the PHE has been extended again through mid-October 2022.

The Fiscal Code included a rate increase for ambulance providers effective January 1, 2023, which impacts multiple appropriations including Capitation, Fee-for-Service, and Community HealthChoices (CHC). The minimum rate for basic life support increases from $180 to $325 per loaded trip and the rate for advanced life support increases from $300 to $400 per loaded trip. In addition, the minimum reimbursement for mileage increases from $2 per loaded mile to $4 per loaded mile for trips over 20 loaded miles.

Supplemental funding of $1.1 billion was appropriated to the 2021/22 Capitation appropriation to reverse the end of fiscal year payment delays, referred to as “cycle rolls,” which have been implemented progressively over time in both the Physical Health HealthChoices and Behavioral Health HealthChoices programs. For the last several years, funding was appropriated in a manner that required payment for April, May, and June coverage in July. The supplemental funding will allow DHS to pay for all managed care services the month following coverage.

The budget fully restores funding for hospitals and medical centers in the Physician Practice Plans and Academic Medical Centers appropriations in line with historical funding amounts. Meanwhile, funding is held flat for burn centers, trauma centers, critical access hospitals, and obstetric and neonatal units after consideration of the enhanced FMAP, as proposed by the governor.

The enacted budget also includes $22.9 million to provide reimbursements to CHIP contractors who experienced losses from families’ inability to pay CHIP premiums from March 2020 to July 2022 due the pandemic.

Enrollment in CHC continues to steadily grow. As of April 2022, there were 397,230 individuals enrolled in CHC, an increase of 3.5% over April 2021. Growth from April 2020 to April 2021 was nearly 5%. Funding for continued enrollment growth is included in the enacted budget.

In addition, funding is included in both CHC and Long-Term Living to support a 17.5% MA rate increase to nursing facilities effective January 1, 2023. This rate increase will annualize to $294 million in state funds, or approximately $613 million with FMAP, and will assist nursing facilities in meeting new staffing requirements. Finally, $399 million supplemental funding was provided to the 2021/22 CHC appropriation to reverse the delay in payment of May coverage to July. All payments for CHC coverage will now be made in the month following coverage.

Enrollment in the Living Independence for the Elderly (LIFE) program has grown 1% between May 2021 and May 2022. In additional to funding for normal program growth, the 2022/23 budget includes funding for a LIFE rate increase of 3% effective January 1, 2023.

The Fiscal Code reauthorized the nursing facility assessment and extended use of a revenue adjustment neutrality factor through 2026. Additionally, the Fiscal Code included payment requirements of CHC managed care organizations to pay no less than the fee-for-service rate for nursing facilities between January 1, 2023 and December 31, 2025.

Finally, the Fiscal Code includes requirements of county and nonpublic nursing facilities to demonstrate that at least 70% of costs are for resident care or other resident-related costs between January 1, 2023 and December 31, 2025. A facility that does not meet the 70% requirement may be penalized based on the differential between their actual calculated percentage and 70%, up to five percent. Any penalties imposed will be deposited into a new Nursing Facility Quality Improvement Fund, which may be used by DHS to administer and enforce the new requirement as well as provide funding for nursing facility quality improvement.

Long-term living programs will receive $250 million in one-time ARPA funding. This includes:

- $131 million for county and nonpublic nursing facilities,

- $75 million for personal assistance service providers,

- $26.8 million for personal care homes and assisted living facilities,

- $7 million for adult day providers,

- $535,000 for residential habilitation providers,

- $4.3 million for high MA ventilator/tracheostomy providers, and

- $5.4 million for LIFE providers.

The governor proposed several state funded initiatives related to mental health including discharging 20 state hospital residents to the community through the Community Hospital Integration Projects Program (CHIPP), $7.2 million to create capacity for hard to place individuals released from state prisons and $36.7 million for a partial restoration of the 2012 10% human services cuts. We estimate that sufficient funding is provided for the CHIPP initiative and at least $15 million may be available to partially restore county mental health funding cuts from 2012.

In addition, $100 million in ARPA funds was allocated for mental health programs. Under the Fiscal Code, DHS is not authorized to expend these funds until the General Assembly passes enabling legislation. To inform the legislature’s future action, the Fiscal Code establishes a new Commission for Adult Mental Health within DHS to be comprised of 24 individuals from various state agencies or areas of specialty, as well as legislative appointees. The commission is to issue a report of recommended funding allocations in the following areas:

- Delivery of services by telemedicine

- Behavioral health rates, network adequacy, and mental health payment parity

- Workforce development and retention

- Expansion of certified peer support specialist services and peer-run services

- Development and provision of crisis services

- Integration of behavioral health and substance use disorder treatment

- Cultural competencies when providing behavioral health care

- Impact of social determinants of health on behavioral health

- Intersection of behavioral health and the criminal justice system

- Integrating care that can deliver timely psychiatric care in a primary care setting

The enacted budget includes $18.8 million requested by the governor to serve 832 individuals with ID or autism waiting for services. The initiative will serve 100 individuals in the Consolidated Waiver (uncapped waiver that includes residential services) and 732 individuals in the Community Living Waiver ($85,000 annual cap and no residential services). The enacted budget also contains sufficient funding to serve special education graduates in the Person and Family Directed Support Waiver ($41,000 annual cap and no residential services) through attrition.

The governor also requested $74.8 million additional funding in the spring to delay the reinstatement of the prudent payment policy – the commonwealth policy to pay claims as close to 30 days from receipt as possible – that was suspended at the beginning of the COVID pandemic. Reinstatement was originally proposed to occur in 2022/23 but is now not planned to be reinstated before 2023/24.

State funding for state centers for individuals with ID increased $17.5 million, or 17.3%. The Fiscal Code established a new restricted account to receive proceeds from the sale of state centers for individuals with ID and any year-over-year decreases in the appropriation for state centers. Money in the account is appropriated to DHS to provide home and community-based services, including workforce capacity, to provide housing supports for individuals with ID and to serve individuals on the emergency ID waiting list.

The significant increase in evidence-based home visiting programs proposed by Gov. Wolf was included in the enacted budget. An additional $15 million, or 77%, increase was included in the Community Based Family Centers appropriation. This funding is estimated to benefit 3,800 additional families when combined with federal home visiting funds. In addition, a $1 million increase has been enacted for Nurse Family Partnership.

The legislature also provided, for the first time, funding to ease the childcare cliff, or the dramatic loss of benefits as household income increases. In the Child Care Services appropriation, $25 million is included to support families who would otherwise lose childcare subsidies upon exceeding the program income limit of 235% of the federal poverty income guidelines (FPIG), so long as the household income does not exceed 300% of the FPIG. DHS is to determine copayment amounts for families between 235% and 300% of FPIG in a way that supports economic self-sufficiency and publish copayment schedules in the PA Bulletin.

The Fiscal Code overrides several current childcare regulations (that are linked to DOH regulations) requiring parents to secure doctors’ notes for children to return to childcare in the cases of COVID-19. The regulations remain in place for other DOH determined reportable diseases but will no longer apply to COVID-19.

The enacted budget includes $90 million in ARPA funding for qualified childcare providers for the recruitment and retention of qualified staff. Qualified providers are those licensed under state regulations as childcare centers, group childcare homes, or family childcare homes, as well as relative providers exempt from licensing requirements. Qualified staff include those involved in direct supervision of children or environmental services; specifically excluded are executives, contracted staff, administrators, administrative support staff, and owners. The department must begin accepting applications no later than January 1, 2023 and are to continue accepting applications until all funds are exhausted or the deadline to spend ARPA funds has been reached. Several conditions apply in order to be eligible for a maximum payment of $2,500 per eligible staff member.

Although Gov. Wolf proposed more, $19 million is included in the enacted budget to increase the state supplemental assistance payment by $200 per month for eligible individuals residing in personal care homes or domiciliary care homes. The state contribution for personal care homes will increase from $439.30 to $639.30, or a 46% increase. The state contribution for domiciliary care homes will increase from $434.30 to $634.30, or a 46% increase.

The County Child Welfare appropriation was funded as requested by the governor, less the two proposed initiatives and after adjustments for enhanced FMAP assumptions. State funding for youth development institutions and forestry camps was held flat.

Similar to the disease-specific appropriations in DOH, the appropriation for breast cancer screening services also received a 6% increase of $105,000.

Two programs received supplemental funding for 2021/22. The 2-1-1 system received a one-time prior year increase of $4 million to be used for infrastructure enhancements to the system. Grantees receiving blind and visual services funding received $600,000 additional collectively for 2021/22. The additional $600,000 was also maintained in 2022/23.

Finally, $25 million in ARPA funds were allocated to the Low-Income Home Energy Assistance Program (LIHEAP). These funds may only be expended provided that all other federal funds received for LIHEAP are used first, except funds permitted to be carried over to the following fiscal year under federal law. The ARPA funds also may not be used prior to notification from the Budget Secretary that all non-ARPA LIHEAP funds have been committed or expended.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the Tobacco Master Settlement Agreement (MSA). The act established procedures for the resulting debt payments, which allowed for repayment either from MSA revenues or from general tax revenues.

The Fiscal Code continues the requirement that MSA revenues sufficient to make annual debt service payments must be deposited into the debt service account established by Act 43. Debt service payments will total $115 million in 2022/23, representing nearly one-third of expected MSA revenues for the fiscal year. However, the Fiscal Code also continues to require revenues equal to the debt service amount to be transferred from cigarette tax collections and deposited into the Tobacco Settlement Fund (TSF). Consequently, the TSF is again held harmless for debt service costs in 2022/23.

The Fiscal Code also outlines how funds are to be distributed. Allocations from 2021/22 are maintained in 2022/23.

- Tobacco Use Prevention and Cessation – 4.5%

- Health and Related Research – 12.6%

- 70% to National Institute of Health grantees, formula-based

- 30% remainder

- $1 million for spinal cord injury research

- Remainder

- 75% for pediatric cancer research

- 25% for capital and equipment grants to entities engaging in biotechnology research

- Health and Related Research (National Cancer Institute grantees, formula-based) - 1%

- Uncompensated Care – 8.18%

- Medical Assistance for Workers with Disabilities (MAWD) – 30%

- To be appropriated for other health-related purposes – 43.72%

The General Appropriations Act included the appropriations for the other health related purposes of $3 million for Life Sciences Greenhouse in the Department of Community and Economic Development and $156.6 million for Community HealthChoices in the Department of Human Services.

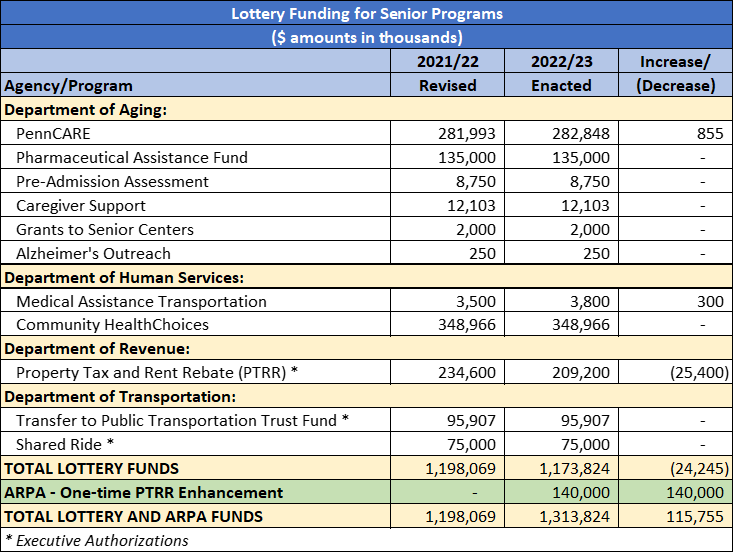

The Lottery Fund includes $1.17 billion for senior programs in 2022/23. The table below details Lottery Fund programmatic funding by agency and program.

The decrease in funding for Lottery Fund Property Tax and Rent Rebate (PTRR) is due to the decreased estimated number of individuals qualifying for the program as the income levels for the program are not indexed. The General Appropriations Act also included a one-time supplement to the PTRR payment using ARPA funds. The one-time additional funds will be issued in an amount equal to 70% of the amount received by the claimant for calendar year 2021.

Funding for programs administered by the Departments of Aging and Human Services are appropriated from the Lottery Fund as part of the General Appropriations Act. Programs administered by the Departments of Revenue and Transportation receive their funding through executive authorizations.

This budget demonstrated continuing commitment to fully fund the pension obligations of the commonwealth. The actuarially determined contributions to the Public School Employees’ Retirement System (PSERS) and the State Employees’ Retirement System (SERS) were paid in full for the eighth and seventh consecutive years, respectively.

PSERS’ employer contributions are divided, with approximately half coming from the local school district and the other half coming from the commonwealth. The appropriation for the commonwealth share is contained within the budget for the Department of Education. For the 2022/23 fiscal year, this appropriation increased by $239 million, or 8.7%, to a total of $2.986 billion. While the employer contribution rate increased slightly over the prior fiscal year, this increase was largely driven by stronger than expected growth in the total payroll of the school districts participating in PSERS.

Employer contributions to SERS are contained within the personnel costs of the various offices and agencies which participate in the system. As such, there is no single appropriation for the commonwealth’s total employer contributions for SERS. The General Fund is the source for approximately 40% of total SERS contributions, with 52% coming from different special or federal funds and the remaining 8% coming from nonstate participants in the system. Total final contributions will depend on exact employer payrolls over the course of the year but are forecast at approximately $2.27 billion across all funds.

Appropriations to fund the staff and operations of PSERS and SERS are made in two of the “housekeeping” appropriations acts that are passed each year as part of the combined budget package. For the 2022/23 fiscal year, Act 8A appropriated funds to PSERS while Act 9A appropriated funds for SERS. Act 8A appropriated $55.5 million for administration of the PSERS defined benefit plan and $949,000 for administration of its defined contribution plan, an increase of $3.2 million and a decrease of $6,000, respectively. Act 9A appropriated $34.0 million for the SERS defined benefit plan and $4.4 million for its defined contribution plan -- increases of $979,000 and $33,000, respectively.

The Department of Labor and Industry’s general government operations appropriation increased by 2.9%, while the Bureau of Occupational and Industrial Safety and the Office of Vocational Rehabilitation received flat funding.

Several smaller programs received increases:

- Centers for Independent Living: $200,000 increase

- Assistive Technology Financing: $250,000 increase

- New Choices/New Options: $250,000 increase

The General Assembly also appropriated federal ARPA funds to bolster the Unemployment Compensation Trust Fund. The budget includes $42.3 million to help repay any outstanding federal loans that trigger an increase in federal unemployment tax rates.

The Pennsylvania Historical and Museum Commission’s enacted budget for 2022/23 is similar to its 2021/22 budget. The cultural and historical support appropriation, which funds grants and subsidies across the commonwealth, is flat-funded year-over-year at $2 million. The general government operations funding, which supports the functioning of the Commission throughout the fiscal year, was increased by $614,000, or 2.9%.

The 2022/23 budget for the Department of State includes a few changes from the prior fiscal year’s enacted budget. The lobbying disclosure appropriation received an increase of $429,000, or 150%, to assist in replacing and upgrading the current technology system. Similarly, the PA Licensure System (PALS), utilized for applying for and renewing Pennsylvania’s professional licenses, received $5 million from the Professional Licensure Augmentation restricted account to support the replacement of the current system.

Additionally, the DOS budget eliminates $2.4 million in non-recurring costs to publish state and federal reapportionment maps, which are only needed every ten years after the decennial census. Lastly, the general government operations appropriation received a $290,000 year-over-year increase, or 5%, to assist in the continuation of current programming levels.

Community and Economic Development

The Department of Community and Economic Development’s 2022/23 budget includes a significant 63.3% year-over-year increase from the 2021/22 enacted budget, comprised of current programming increases along with new initiatives being created within the department. The below chart highlights many of DCED’s notable budgetary changes:

| DCED Appropriation |

FY 2021/22 |

FY 2022/23 |

$ Change |

% Change |

| General Government Operations |

$ 21,032 |

$ 30,747 |

$ 9,715 |

46.2% |

| Office of Open Records |

$ 3,299 |

$ 3,627 |

$ 328 |

9.9% |

| Transfer to Ben Franklin Technology Development Authority Fund |

$ 14,500 |

$ 17,000 |

$ 2,500 |

17.2% |

| Invent Penn State |

$ - |

$ 2,350 |

$ 2,350 |

100.0% |

| Partnerships for Regional Economic Performance |

$ 9,880 |

$ 10,880 |

$ 1,000 |

10.1% |

| Tourism - Accredited Zoos |

$ 800 |

$ 1,000 |

$ 200 |

25.0% |

| Infrastructure Technical Assistance |

$ 2,000 |

$ 2,500 |

$ 500 |

25.0% |

| ($ amounts in thousands) |

The general government operations appropriation was increased by 46.2%, or $9.7 million. Also, the Office of Open Records received a 9.9% increase to address the higher volume for right-to-know requests in recent years.

Moreover, the Ben Franklin Technology Development Authority (BFTDA) assists small and medium sized technology, research, and start-up companies to do applied research and development projects and to develop and introduce new products and processes. The funding transferred to the BFTDA was increased by $2.5 million, or 17.2%, in the enacted 2022/23 budget. Also, the new $2.35 million Invent Penn State appropriation will support university, community and industry entrepreneurial collaborations at the various campus locations across the state.

DCED also received ARPA State and Fiscal Recovery Funds in the 2022/23 budget, which included funding for housing and historically disadvantages businesses to be administer by the department.

- $125 million was appropriated to support the newly created Whole-Home Repairs Program. The purpose of this housing initiative is to provide grants or forgivable loans to low-income homeowners or landlords renting to low-income tenants to address habitability concerns, energy or water efficiency improvements, or accessibility for individuals with disabilities.

- $20 million in ARPA funds was appropriated to DCED for historically disadvantaged business assistance. Historically disadvantaged businesses are at least 51% owned and operated by persons who are Black, Hispanic, Native American, Asian American, or Pacific Islander.

Lastly, the Election Integrity Grant Program was established under DCED. This program provides $45 million annually in election support to counties. The grant funding is allocated proportionally based upon a county’s voter registration total as a percentage of the total number of registered voters across the commonwealth eligible to vote in the primary election. The funding can be utilized for the following purposes:

- Payment of staff needed to pre-canvass and canvass mail-in ballots and absentee ballots

- Physical security and transparency costs for centralized pre-canvassing and canvassing

- Post-election reporting procedures

- The printing of ballots

- Training costs for district election officials

- Payment of staff at polling places on election day

- Secure preparation, transportation, storage and management of voting apparatuses, tabulation equipment and required polling place materials

- Costs of county board of election duties related to the processing of voter registration applications

This funding is conditional on the prohibition of third-party funding of elections, counties beginning pre-canvassing at 7AM on election day until each ballot has been pre-canvassed, counties beginning canvassing at 8PM on election day until each ballot has been canvassed, and that the required post-election reporting obligations are fulfilled.

The 2022/23 budget appropriates ARPA State and Local Recovery Funds to the Department of Community and Economic Development for transfer to the Commonwealth Financing Authority. These transfers include funding for water and sewer projects, as well as grant support for cultural and museum preservation.

Water and sewer projects under the Commonwealth Financing Authority received $320 million in the enacted budget. The $320 million is comprised of $214.4 million for the H2O PA Program and $105.6 million for the PA Small Water and Sewer Program.

- $214.4 million for CFA’s H2O PA Program – provides for single-year or multi-year grants to municipalities or municipal authorities to assist with the construction of drinking water, sanitary sewer and storm sewer projects. The parameters of the grant include a minimum award of $500,000 and a maximum award of $20,000,000 for any project.

- $105.6 million for CFA’s PA Small Water and Sewer Program – supports small water, sewer, storm sewer, and flood control infrastructure projects. Eligible initiatives include those that can assist with the construction, improvement, expansion, or rehabilitation or repair of a water supply system, sanitary sewer system, storm sewer system, or flood control projects. The parameters of the grant include a minimum award of $30,000 and a maximum award of $500,000 for any project.

The 2022/23 budget also transferred $15 million to the CFA to create a Cultural and Museum Preservation Grant Program. The CFA will determine eligibility requirements, allowable uses of grant funds, and the minimum grant award amount permitted for the Cultural and Museum Preservation Grant Program. Eligible applicants include nonprofit arts and culture organizations, local arts and culture districts, and arts and culture professionals.

The 2022/23 budget appropriates $250 million in ARPA State Fiscal Recovery Funds to the Pennsylvania Housing Finance Agency for two specific housing initiatives: Development Cost Relief Program and Housing Options Grant Program.

- The newly created Development Cost Relief Program, which is similar to the previously enacted program under PHFA called the Construction Cost Relief Program (CCRP), received $150 million in the 2022/23 budget. This program supports already applied for or currently underway Low-Income Housing Tax Credit (LIHTC) construction projects. The Development Cost Relief Program addresses increased costs from supply chain challenges as well as losses in equity investments resulting from the COVID-19 pandemic. Program applicants needs to demonstrate increased expenses and the necessity of supplemental funding to complete the development project. Projects that received funds under the Construction Costs Relief Program are not precluded from also receiving funding from this program.