General Fund Revenue Update - May 2021

By Eric Dice , Assistant Executive Director | 4 years ago

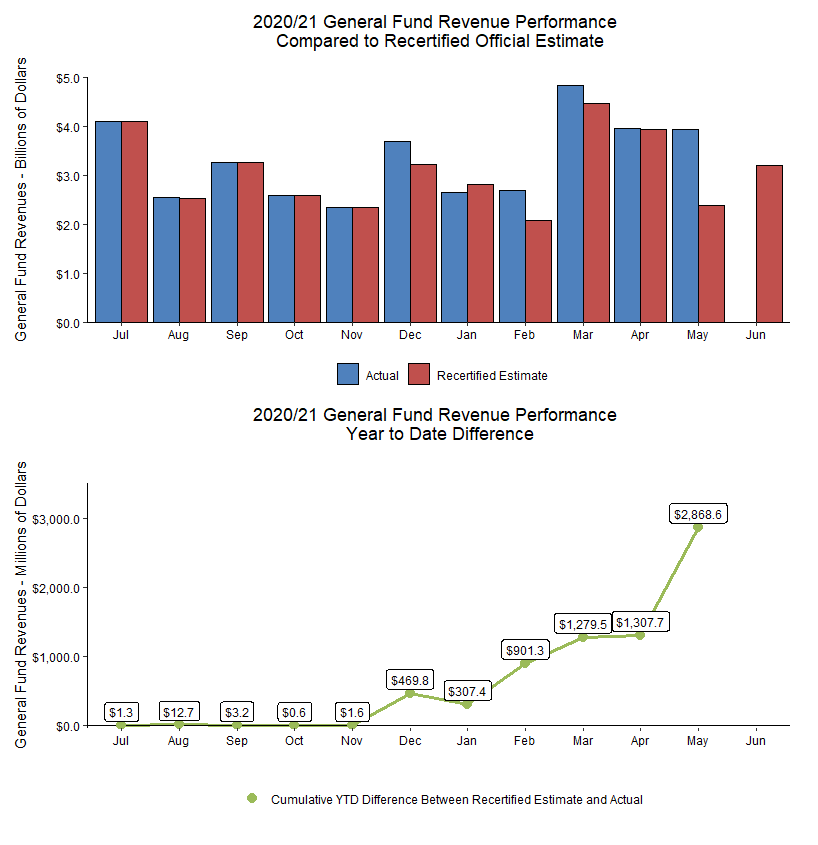

After the change to the tax due date last month, which partially obscured some of the positive revenue trends, the delayed revenues arrived in May to great effect. General Fund revenues were $1.56 billion ahead of estimate, bringing the year-to-date total to $2.87 billion above the recertified amount assumed when the budget was concluded in November 2020.

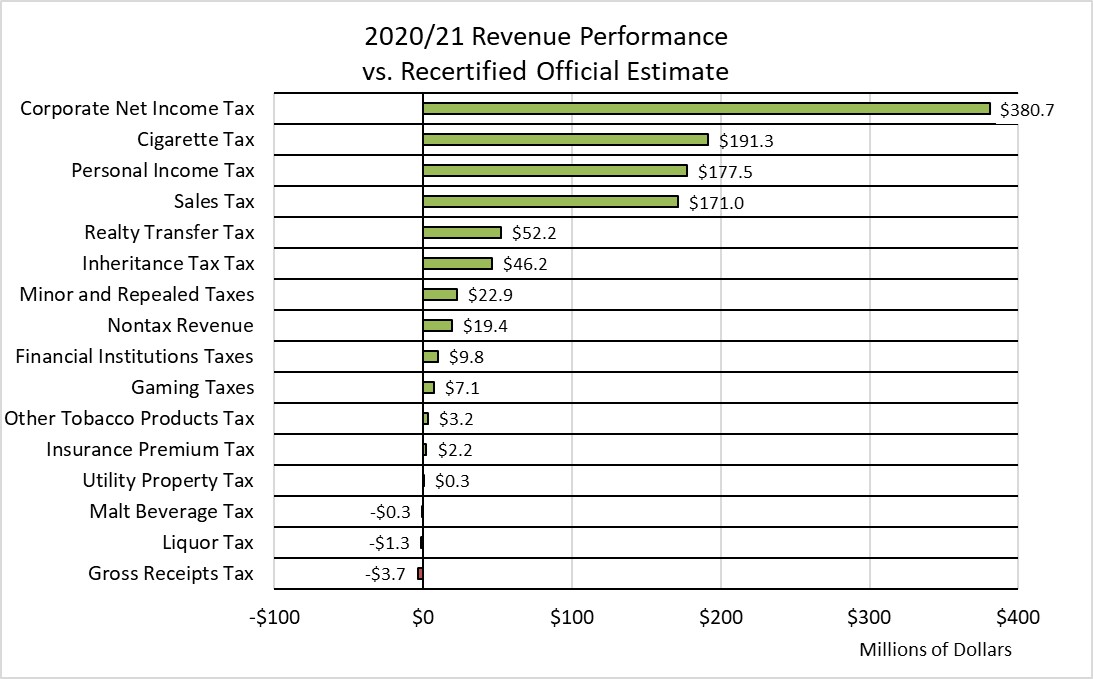

Sixty-nine percent of the revenues above estimate this past month can be attributed to final payments from the personal income tax and the corporate net income tax. The personal income tax final payments largely reflect the timing shift. Corporate net income tax final payments, however, were well above estimate in both April and May and sit $469.0 million above estimate for the year in total. Many large businesses seem to have fared better than expected over the last year, which could be a source of this revenue strength. The Independent Fiscal Office, in its preliminary revenue forecast release last week, posited that another factor might be a change in taxpayer behavior to hedge against potential corporation tax increases at the federal level.

As has been the case for several months, sales tax revenue continues to strongly surpass expectations. May collections for non-motor sales taxes were $172.4 million above estimate, bringing the year-to-date total to $647.2 million better than expected. Motor vehicle sales taxes were $39.4 million above estimate, pushing the total to $94.5 million above estimate.

The realty transfer tax continues to perform above estimate, finishing $14.8 million higher, as did the inheritance tax, which brought in $53.5 million more than expected last month.

Looking ahead, the 2020/21 fiscal year will end on June 30. General Fund revenues have been the subject of so much uncertainty and an unprecedented amount of swings in due dates, collection patterns, changing estimates and the underlying economic conditions. In the end, revenues should finish the fiscal year more than $3 billion above the official estimate.

Along with the substantial federal support provided to Pennsylvania, the unexpected turnaround from initial projections over the last year to a revenue surplus presents policymakers with an altogether different budget challenge than the one they might have expected a few months ago. Some one-time revenues, budgetary offsets and the impact of heavy federal economic support will not be available or phase out in the next fiscal year, and the commonwealth continues to rely on enhanced federal support for the Medical Assistance budget. But revenues have improved to a point where the commonwealth can focus not on cuts, but how best to invest both state resources and federal funds available under the American Rescue Plan to position itself for the future.

For May:

- Total General Fund collections were $1.56 billion higher than expected (65.4 percent), in large part due to changes in the personal income tax filing deadline to match the Federal deadline

- General Fund tax revenues were $1.52 billion higher than anticipated (63.8 percent)

- The corporate net income tax was $165.6 million higher than expected (65.7 percent)

- Sales and use tax collections exceeded projections by $211.8 million (22.5 percent)

- Non-motor collections were $172.4 million higher than projected (21.0 percent)

- Motor vehicle collections were $39.4 million above estimate (32.6 percent)

- Cigarette tax collections were $12.4 million higher than expected (15.0 percent)

- Personal income tax collections were $1.05 billion higher than the official estimate (119.9 percent)

- Employer withholdings on wages and salaries were $32.4 million more than anticipated (4.0 percent)

- Final annual payments were $933.4 million above estimate (2,721 percent, reflecting the change to the due date that caused revenue to be shifted from April to May.

- Quarterly estimated payments were $81.2 million more than expected (394.1 percent)

- Realty transfer tax revenues were $14.8 million above estimate (35.1 percent)

- Inheritance tax collections were $53.5 million higher than estimated (64.9 percent)

- Non-tax revenues were $45.6 million above the official estimate (377.1 percent)

For the 2020/21 fiscal year to date:

- Cumulative General Fund revenues are $2.87 billion higher than expected (8.5 percent)

- General Fund tax revenue are $2.83 billion higher than projected (8.6 percent)

- Corporate net income tax revenues are $874.2 million more than expected (30.8 percent)

- Sales and use taxes are $741.7 million more than expected (6.8 percent)

- Personal income tax collections are $747.7 million higher than anticipated (5.3 percent)

- Non-tax revenues are $42.8 million above the estimate (4.0 percent)

| General Fund Revenues - Year-to-Date Performance vs Official Estimate |

| Amounts in Millions |

YTD Estimate |

YTD Collections |

Difference |

| General Fund Total |

33,755.0 |

36,623.6 |

2,868.6 |

| Tax Revenue Total |

32,688.4 |

35,514.2 |

2,825.8 |

| Corporation Taxes |

4,727.1 |

5,619.3 |

892.2 |

| Corporate Net Income Tax |

2,838.0 |

3,712.2 |

874.2 |

| Gross Receipts Tax |

1,002.8 |

987.7 |

(15.1) |

| Utility Property Tax |

38.1 |

40.0 |

1.9 |

| Insurance Premiums Taxes |

484.7 |

457.9 |

(26.8) |

| Financial Institutions Taxes |

363.5 |

414.2 |

50.7 |

| Consumption Taxes |

12,215.8 |

13,031.2 |

815.4 |

| Sales and Use Tax |

10,891.9 |

11,633.6 |

741.7 |

| Cigarette Tax |

812.6 |

872.3 |

59.7 |

| Other Tobacco Products |

115.0 |

123.2 |

8.2 |

| Malt Beverage Tax |

21.3 |

21.2 |

(0.1) |

| Liquor Tax |

375.0 |

381.0 |

6.0 |

| Other Taxes |

15,745.5 |

16,863.7 |

1,118.2 |

| Personal Income Tax |

14,104.7 |

14,852.4 |

747.7 |

| Realty Transfer Tax |

479.6 |

575.1 |

95.5 |

| Inheritance Tax |

1,028.2 |

1,244.7 |

216.5 |

| Gaming |

183.0 |

217.1 |

34.1 |

| Minor and Repealed |

(50.0) |

(25.5) |

24.5 |

| Non-Tax Revenue |

1,066.6 |

1,109.4 |

42.8 |