General Fund Revenue Update - November 2020

By Eric Dice , Assistant Executive Director | 5 years ago

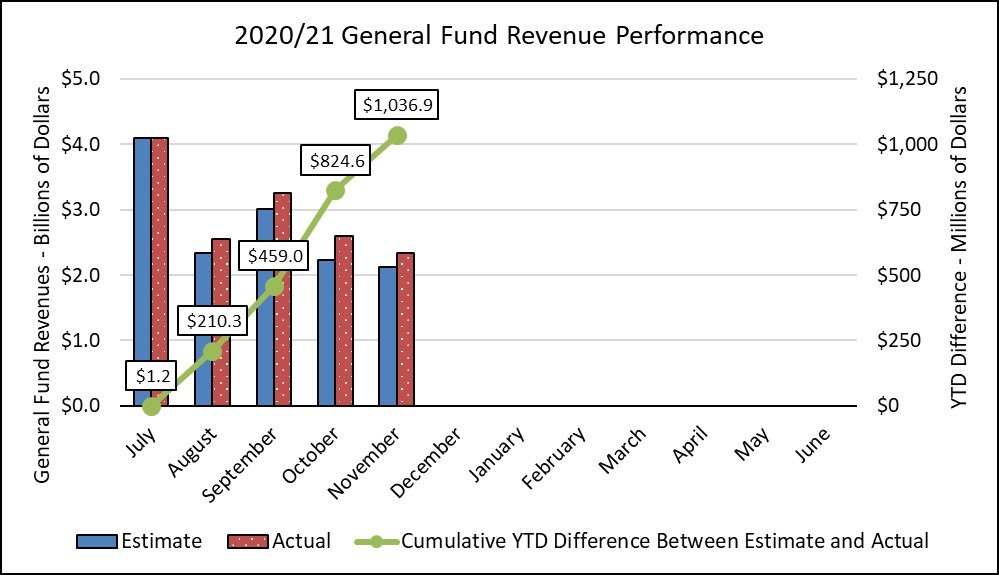

The General Assembly enacted a supplemental General Appropriations Act in November, providing additional appropriations through the end of the fiscal year for most agencies and programs. In part, the newly enacted budget is balanced by assuming that the General Fund will continue to exceed the official revenue estimate certified in May and finish the year $1.99 billion above that estimate. As has been the case so far in 2020/21, November’s revenues continued progress toward that goal.

General Fund revenues in November were higher than original projections by $212.3 million. Year-to-date, revenues are now $1.037 billion higher than expected in May. Some of the changes and transfers enacted as part of the budget are included with this total, affecting totals, and leading to certain results not anticipated by the monthly revenue distribution.

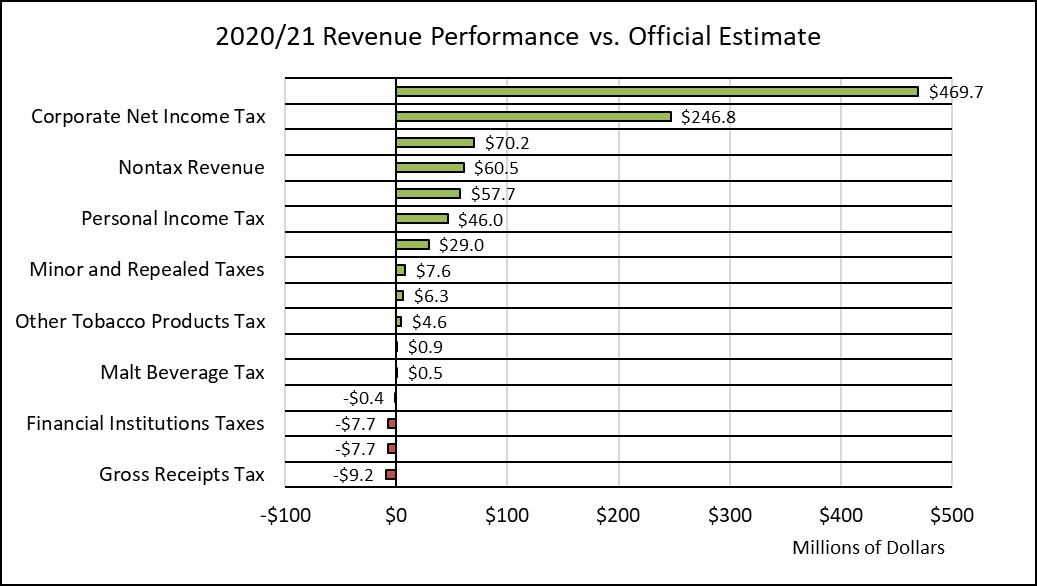

Sales tax collections finished the month $141.4 million ahead of estimate, or 16.8 percent. Non-motor collections were $86.4 million above estimate and motor vehicle sales tax collections were $54.9 million higher than expected.

Personal income tax collections were $139.5 million lower than the estimate due to a transfer of PIT revenues to the Property Tax Relief Fund in accordance with the Fiscal Code. Gross employer withholdings before the transfer were $76.9 million higher than estimate, but offset by the $200 million transfer out, leaving a net of $123.1 million below estimate, or 15.7 percent. Non-withheld collections were $16.5 million lower than expected, or 39.9 percent. Non-withheld PIT collections were not affected by transfers.

The corporate net income tax showed revenues $78.9 million higher than estimate, or 132.9 percent. Final payments were $62.7 million more than expected, and quarterly payments were $16.3 million above estimate.

Non-tax revenues were $92.3 million higher than expected. $100 million was deposited into the General Fund from the Rainy Day Fund, the first of several transfers from special funds authorized by the General Assembly that will occur during this fiscal year to help balance the budget. These transfers are one-time fixes that will not recur next year.

In a normal year, the official estimate certified by the Secretary of Revenue and the Secretary of the Budget is locked in and not adjusted during the year. Because of the special circumstances, the Fiscal Code amendments passed with the budget authorize the administration to formally reopen the official revenue estimate and recertify the new total, which will then become the new basis for the fully enacted budget. The Department of Revenue has not yet calculated a new monthly revenue distribution based on the updated estimate, but this should happen over the next month. This will affect the baseline for how revenues are reported, but the overall goal is the same – to inform how on-target the commonwealth towards maintaining a balanced budget.

For the month of November, total General Fund revenues were $212.3 million higher than expected, or 10.0 percent. Please note, these comparisons are against the official estimate certified in May, and do not reflect the updated monthly distribution for the revised revenue estimate.

- Corporate net income tax collections were $78.9 million higher than expected (132.9 percent)

- Sales and use tax collections were $141.4 million higher than expected (16.8 percent)

- Non-motor sales tax collections were $86.4 million more than estimate (11.3 percent)

- Motor vehicle sales tax collections were $54.9 million above projections (68.1 percent)

- Personal income tax revenues were $139.5 million less than the official estimate (16.9 percent), impacted by a $200 million transfer of PIT revenues to the Property Tax Relief Fund.

- Employer withholdings on wages and salaries were $123.1 million less than anticipated (15.7 percent)

- Quarterly estimated payments were $9.1 below estimate (44.4 percent)

- Final payments were $7.3 million less than projected (35.3 percent)

- Realty transfer tax collections were $14.9 million more than expected (37.1 percent)

- Inheritance tax collections were $6.4 million higher than anticipated (7.2 percent)

- Non-tax revenues were $92.3 million more than expected (83.4 percent), driven by a $100 million transfer to the General Fund from the Rainy Day Fund.

Through the first five months of the 2020/21 fiscal year, compared to the official estimate certified in May:

- Cumulative General Fund revenues are $1.037 billion higher than expected (7.5 percent)

- General Fund tax revenues are $976.3 million higher than projected (7.2 percent)

- Corporate net income tax revenues are $246.8 million more than expected (21.8 percent)

- Sales and use taxes are $469.7 million more than expected (9.6 percent)

- Personal income tax collections are $46.0 million higher than anticipated (0.7 percent), net of the $200 million transfer to the Property Tax Relief Fund

- Non-tax revenues are $60.5 million above the estimate (26.4 percent)

|

General Fund Revenues - Year-to-Date Performance vs Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

13,808.2

|

14,845.1

|

1,036.9

|

|

Tax Revenue Total

|

13,579.0

|

14,555.3

|

976.3

|

|

Corporation Taxes

|

1,172.6

|

1,404.6

|

232.0

|

|

Corporate Net Income Tax

|

1,130.6

|

1,377.4

|

246.8

|

|

Gross Receipts Tax

|

20.8

|

11.6

|

(9.2)

|

|

Utility Property Tax

|

1.2

|

2.1

|

0.9

|

|

Insurance Premiums Taxes

|

1.8

|

1.4

|

(0.4)

|

|

Financial Institutions Taxes

|

18.2

|

10.5

|

(7.7)

|

|

Consumption Taxes

|

5,537.3

|

6,071.1

|

533.8

|

|

Sales and Use Tax

|

4,886.5

|

5,356.2

|

469.7

|

|

Cigarette Tax

|

425.1

|

477.7

|

52.6

|

|

Other Tobacco Products

|

51.7

|

56.3

|

4.6

|

|

Malt Beverage Tax

|

10.0

|

10.5

|

0.5

|

|

Liquor Tax

|

164.0

|

170.3

|

6.3

|

|

Other Taxes

|

6,869.1

|

7,079.6

|

210.5

|

|

Personal Income Tax

|

6,184.1

|

6,230.1

|

46.0

|

|

Realty Transfer Tax

|

178.1

|

248.3

|

70.2

|

|

Inheritance Tax

|

442.5

|

500.2

|

57.7

|

|

Gaming

|

57.2

|

86.2

|

29.0

|

|

Minor and Repealed

|

7.2

|

14.8

|

7.6

|

|

Non-Tax Revenue

|

229.2

|

289.7

|

60.5

|

Note: These comparisons reflect the official estimate certified in May, and do not reflect the updated monthly distribution for the revised revenue estimate.

Graphs reflect comparison with the official estimate certified in May, not the forthcoming monthly distribution of the revised estimate.