General Fund Revenue Update - July 2020

By Eric Dice , Assistant Executive Director | 5 years ago

The month-by-month breakout of the official revenue estimate is typically not available for July each year. Just as well, because July’s General Fund revenue collections are unlike any month in recent history.

Key points for policymakers from complicated July collections include:

- Nothing we’ve seen in July so far alleviates the commonwealth’s budgetary challenges – the General Assembly still faces a multi-billion dollar crisis.

- The change in due dates and policies for many taxes to July shifted significant revenue from April, May, and June into this month.

- Due date shifts will continue to affect corporate net income tax collections in August when more shifted revenue is expected.

- The focus now shifts to the stability of recurring revenues and the ongoing impacts of the pandemic.

- What will the quarterly estimated payments for corporations and small businesses look like in September?

Gauging the shifts

To ease the impact of the pandemic, the General Assembly and the administration delayed due dates for many tax types to help provide temporary relief to taxpayers. This shift of revenue from April, May and June started to be received in July.

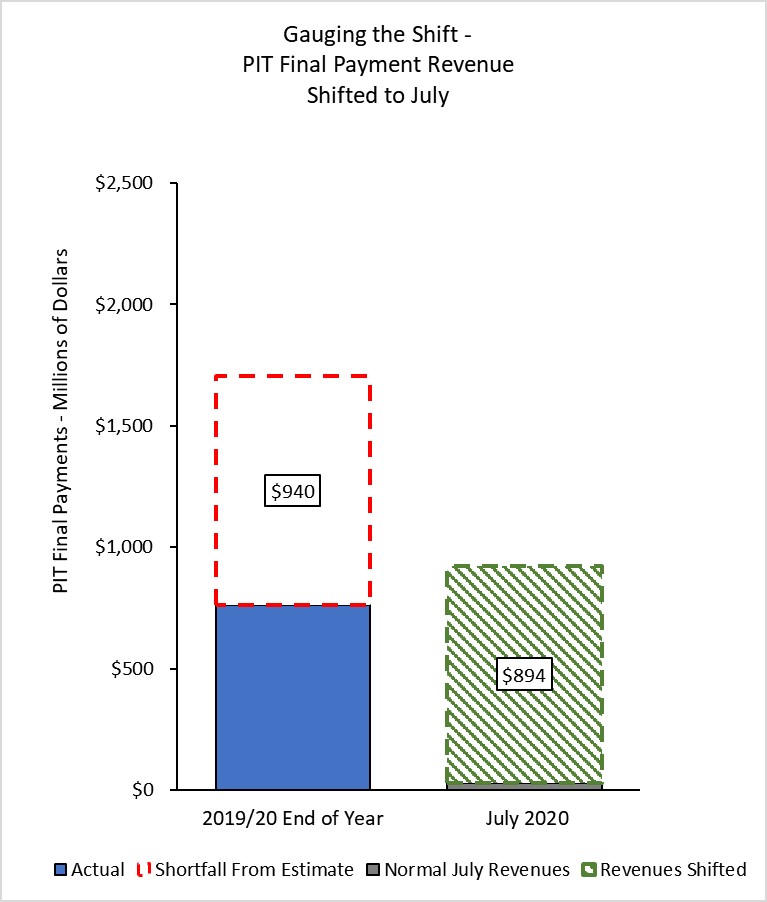

The personal income tax experienced the largest shift. Final annual payments largely paid in April were $940 million short of estimate at the end of 2019/20. PIT final payments received in July 2020 were $923 million (compared to just $29.5 million in July 2019). Assuming last year as a baseline, roughly 95 percent of the PIT final annual payment shortfall from last year was recovered in July.t;/span>

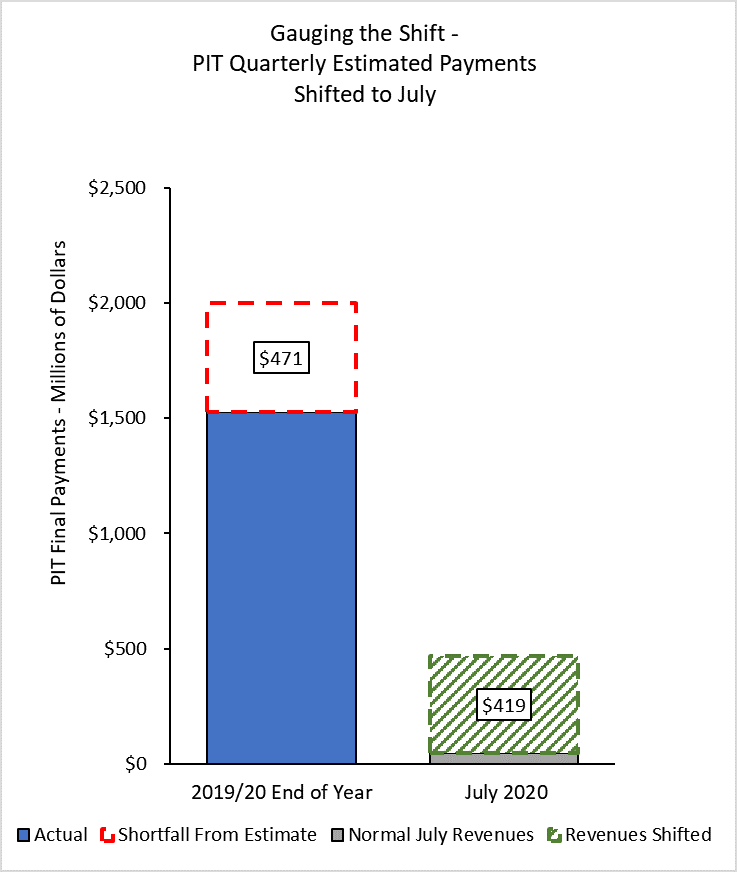

PIT quarterly estimated payments, usually paid in April and June, were also delayed. This tax type was $471 million short of estimate at the end of the fiscal year. July revenues for estimated payments were $467 million, also significantly higher than last year’s July collections of $41 million. Assuming last year’s collection as a baseline, about 89 percent of last fiscal year’s shortfall was recovered in July. However, estimated payments were ahead of estimate through March by about $25 million, meaning that the shortfall of the final quarter of 2019/20 was that much larger to net a $471 million difference from estimate at the end of the fiscal year.

Sales tax payments in July are affected by the resumption of accelerated prepayments. Businesses that normally had to remit prepayments had their requirement lifted for the last three months, and just remitted tax collected in the previous month.

The due date for corporate net income tax final payments was moved as well, though these businesses have until August for the revenues to remit payment. July collections for these payments were elevated and can be more fully analyzed next month.

Overall, the broad impact of due date extensions implemented by the General Assembly and the Department of Revenue unfolded in July about as expected. But, while unwinding the timing shifts creates a one-time increase in July revenue collections, the pandemic’s impact to recurring revenues will determine the scale of the commonwealth’s budgetary deficit.

Looking forward

Large uncertainty exists for how revenues will perform going forward.

First and foremost, we do not know how the virus will spread in Pennsylvania as we move into the fall. Second, timing shifts make it harder to discern the extent of the impact on economic activity. We will wait to see where sales tax collections start to settle and what happens in September when businesses start to remit estimated payments on their regular schedule.

|

Amounts in Millions

|

July 2020

Revenues

|

July 2019

Revenues

|

% Difference

|

|

General Fund Total

|

$4,103.9

|

$2,329.2

|

76.2%

|

|

Tax Revenue Total

|

$4,089.8

|

$2,295.2

|

78.2%

|

|

Corporation Taxes

|

$240.5

|

$116.9

|

105.7%

|

|

Accelerated Dep.

|

$1.3

|

$1.2

|

12.6%

|

|

Corporate Net Income

|

$236.7

|

$93.1

|

154.3%

|

|

Gross Receipts

|

$0.9

|

$4.3

|

-79.3%

|

|

Utility Property

|

$0.0

|

$0.4

|

-98.3%

|

|

Insurance Premium

|

$0.2

|

$17.5

|

-98.7%

|

|

Financial Institutions

|

$1.3

|

$0.4

|

201.4%

|

|

Consumption Taxes

|

$1,375.3

|

$1,019.8

|

34.9%

|

|

Sales and Use Tax

|

$1,255.7

|

$925.4

|

35.7%

|

|

Cigarette

|

$74.0

|

$50.8

|

45.8%

|

|

Other Tobacco Prod

|

$11.1

|

$10.9

|

1.1%

|

|

Malt Beverage

|

$2.0

|

$2.2

|

-6.9%

|

|

Liquor

|

$32.5

|

$30.5

|

6.5%

|

|

Other Taxes

|

$2,474.0

|

$1,158.5

|

113.6%

|

|

Personal Income

|

$2,312.5

|

$1,022.8

|

126.1%

|

|

Realty Transfer

|

$17.9

|

$21.1

|

-15.0%

|

|

Inheritance Tax

|

$118.4

|

$98.5

|

20.2%

|

|

Minor and Repealed

|

$12.7

|

$5.1

|

147.5%

|

|

Gaming

|

$12.6

|

$10.9

|

15.1%

|

|

Nontax Revenue Total

|

$14.1

|

$34.0

|

-58.4%

|