2020/21 Executive Budget Proposal Budget in Depth

By House Appropriations Committee Staff , | 6 years ago

On February 4, 2020, Governor Wolf presented his 2020/21 executive budget proposal to the General Assembly. This briefing provides an overview of that proposal and will be updated as the committee continues to review his request.

INTRODUCTION

In this budget, Governor Wolf addresses many serious issues plaguing the commonwealth, such as reducing gun violence, requiring that workers be paid a living wage, lessening the burden of student debt and ensuring our children attend schools that are free from environmental hazards, while presenting a balanced budget that relies on no broad based tax increases. The governor once again proposes to encourage fairness through business tax reform and require local support for State Police operations.

The 2020/21 executive budget proposal spends $36.056 billion, an increase of $1.46 billion, or 4.22 percent, over the current year, after considering the request of $588 million in supplemental funding for the current year.

The governor focuses on nine key themes in his 2020/21 proposed budget:

-

Investing in Our Kids,

-

Promoting Fairness, Equity and Quality in Our Public Education System,

-

Making College More Affordable,

-

Making Pennsylvania a Better Place for Workers and Businesses,

-

Keeping Pennsylvanians Safe,

-

Protecting the Most Vulnerable,

-

Investing in Our Environmental Protection and Restoration,

-

Repairing and Improving Our Infrastructure, and

-

Investing in the Arts.

Over the last five years, commendable progress has been made to address our structural budget deficit. The administration has worked tirelessly to streamline agency operations and reduce their expenses. The Rainy Day Fund has a balance of approximately $340 million. However, more work needs to be done. Recurring revenues continue to lag behind expenditures. The proposed budget relies on more than $1.5 billion in revenue or savings proposals that require legislative action with a very small ending balance. Additional investment in areas such as education, human services and the environment must be made to support the citizens of this commonwealth and improve their quality of life.

OVERVIEW

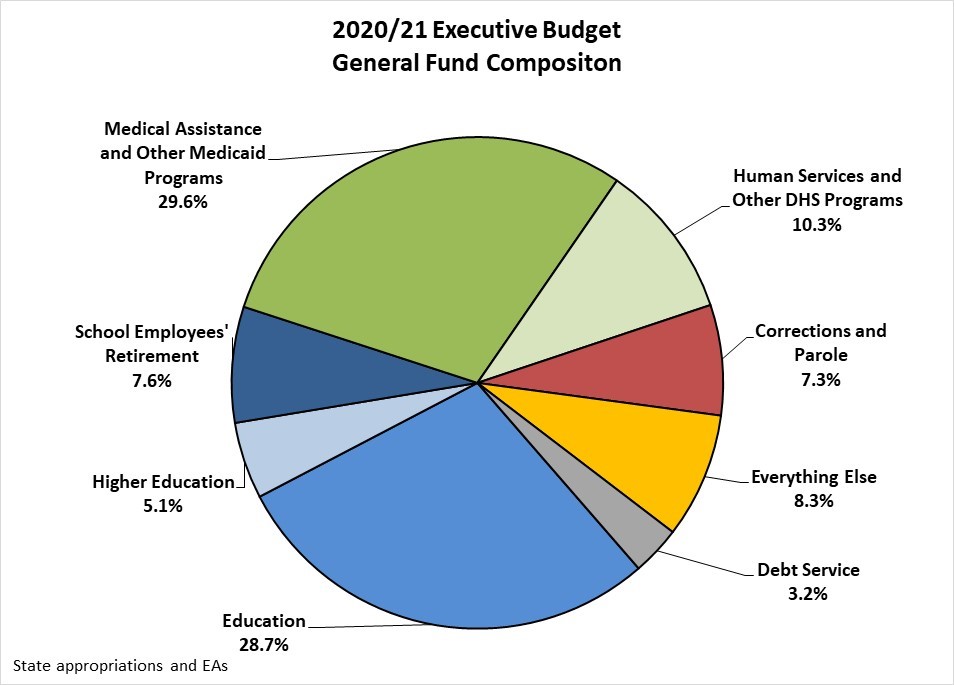

Combined Operating Budget

While the General Fund is the focus of legislative budget balancing, it is important to understand the scope of the total operating budget, which includes federal funds and other special funds. The total 2020/21 proposed operating budget for the commonwealth is $89.2 billion, an increase of $2.1 billion, or 2.4 percent, from 2019/20. The total operating budget consists of:

-

$36.1 billion in state General Fund expenditures, an increase of $1.46 billion, or 4.2 percent,

-

$2.9 billion in Motor License Fund expenditures, an increase of $74 million, or 2.6 percent,

-

$1.9 billion in Lottery Fund expenditures, an increase of $33 million, or 1.8 percent,

-

$30.8 billion in federal fund expenditures, an increase of $242 million, or 0.8 percent, and

General Fund Revenue

The governor’s budget proposal projects that General Fund revenues will finish the 2019/20 fiscal year $200 million higher than the official revenue estimate for a revised estimate of $35.7 billion. This change is primarily due to higher than expected escheats, personal income and sales taxes, the sum of which is partially offset by corporate net income taxes expected to be lower than the official estimate. Sales tax growth is partly attributable to continued phase-in of online marketplace requirements enacted in 2017. Corporate net income taxes tend to experience volatility, however the effects of timing shifts associated with the federal tax changes still impact the forecasting of this tax.

For 2020/21, the governor projects baseline General Fund revenue collections of $37.2 billion, which shows growth of $1.5 billion, or 3.9 percent.

The proposed budget includes several proposed tax changes (discussed below), new revenue expected from the minimum wage increase and the following transfers out of the General Fund, totaling $134.4 million:

-

Transfer to the Tobacco Settlement Fund of $115.3 million from cigarette tax revenue for the commonwealth’s Tobacco Settlement Fund debt service payments,

-

Transfer to the Commonwealth Financing Authority of $5.3 million from the sales and use tax for school construction (PlanCon) debt service payments,

-

Transfer to a restricted receipt account of $13.8 million from the personal income tax for Growing Greener debt service payments, which is currently an expenditure in the Environmental Stewardship Fund.

Note: The proposed redirection of $204.2 million from the Pennsylvania Race Horse Development Trust Fund to fund the Nellie Bly Tuition Program does not impact the General Fund. More details regarding this program are provided in the Higher Education section.

PRIOR YEAR TRANSFERS

In the 2019/20 proposed budget, Governor Wolf shifted $45 million of expenditures that support the operations of the Departments of Environmental Protection and Conservation and Natural Resources to the Recycling Fund, Environmental Stewardship Fund and Oil and Gas Lease Fund. The enacted budget assumed these transfers, but permitted the administration to transfer the funds from other sources. On November 9, 2019, the administration announced that the $45 million would instead come from the following funds:

-

Banking Fund: $21 million

-

Volunteer Companies Loan Fund: $5 million

-

Machinery and Equipment Loan Fund: $10 million

Proposed Tax Modifications

COMBINED REPORTING

Gov. Wolf’s proposes a corporate net income tax rate cut and implementation of mandatory combined reporting to improve the business climate and make it more competitive with surrounding states. Currently 28 states and the District of Columbia require combined reporting. As in four out of five of the governor’s previous budgets, the corporate net income tax base would be changed to require mandatory unitary combined reporting (often referred to as closing the Delaware loophole) for tax years beginning January 1, 2021.

To offset this change, he proposes lowering CNIT rates beginning Jan. 1, 2021 to 8.99 percent, with a gradual phase down to 5.99 percent by 2025. The governor’s proposal relies on $239.5 million in new revenue available to the General Fund in 2020/21 from these CNIT changes. The Department of Revenue recently testified that 7.76 percent is a revenue neutral CNIT rate in conjunction with combined reporting. Therefore, this proposal would eventually result in revenue losses in the out-years.

Although this proposal is the same as the governor proposed in the prior year, the 2019/20 budget did not rely on new revenue, mainly due to an increase in the net operating loss cap from 35 percent to 40 percent (beginning January 1, 2019), which was enacted as part of Act 43 of 2017.

MINIMUM WAGE

The governor’s proposal to increase the minimum wage is projected to generate $133.3 million in new personal income and sales tax revenue. Details of the minimum wage proposal are discussed later in this briefing.

Rainy Day Fund

Revenue shortfalls during the great recession depleted the Rainy Day Fund with a transfer of $755 million to balance the 2009/10 budget. Statute requires a transfer of 25 percent of the year-end surplus to the Rainy Day Fund. No substantial deposits were made for almost a decade until $22.4 million, or 50 percent, of the 2017/18 surplus was transferred. Last year, the General Assembly transferred 100 percent of the 2018/19 surplus, which was $316.9 million. The fund is expected to hold a balance of $341.3 million as of June 30, 2020.

The governor’s proposal, in line with current law, would transfer 25 percent of the 2019/20 and 2020/21 surpluses, or $1.1 million and $1.5 million, respectively.

Complement

The governor’s proposal would increase the total authorized complement by a net 46 full-time equivalents, from 77,917 to 77,963. The most significant increases in proposed personnel are 78 positions in the Department of Human Services for the vulnerable population initiative; 25 for air quality and Chesapeake Bay operations in Department of Environmental Protection; and 25 for park and forest operations in the Department of Conservation and Natural Resources. The current filled complement has increased by 620, from 72,835 to 73,455 since January 2019.

Property Tax Relief Fund

Based on current law, the governor’s budget estimates of the Property Tax Relief Fund indicate that homeowners can expect the same amount of property tax relief in 2020/21 as they received in each year prior. Total general property tax relief to homeowners is expected to remain constant at $595 million, which will result in average property tax relief of approximately $200 per homeowner. Total property tax relief distributions are expected to decrease from $766.8 million in 2019/20 to $739.2 million in 2020/21 due to static income cap thresholds in the Property Tax and Rent Rebate program, which result in fewer qualifying applicants each year due to inflation.

Although expanded gaming is expected to result in an additional $44.2 million transferred from the State Gaming Fund to the Property Tax Relief Fund, the governor’s proposal does not increase property tax relief distributions. This is most likely intended to add to the reserves with the goal of keeping property tax relief consistent in future years if or when gaming revenues might decline.

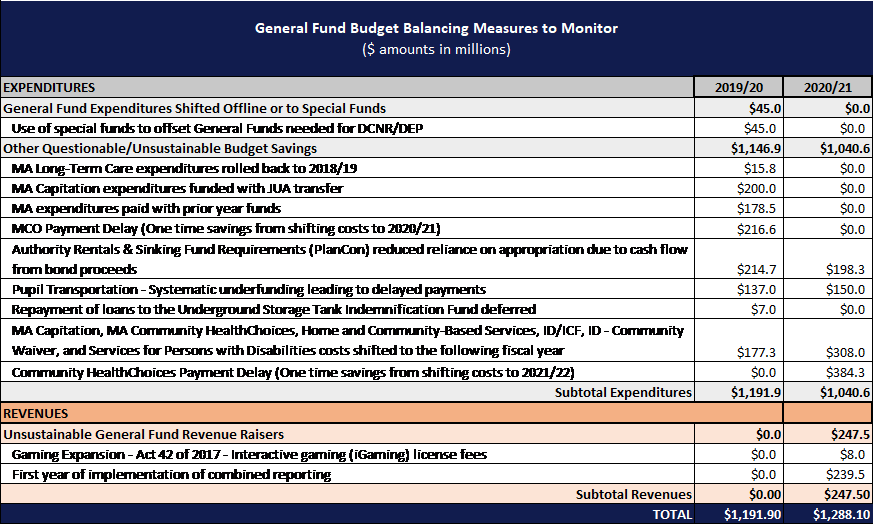

General Fund Budget Balancing Measures to Monitor

EDUCATION

Pre-K to 12

In the five budgets enacted under Gov. Wolf’s leadership, the Republican-controlled General Assembly has approved $1.08 billion, or 69 percent, of the $1.57 billion in increases requested by the governor for basic, special, and early childhood education. These increases helped deliver essential services, reduce inequities, and lessen the reliance on local property taxes.

Gov. Wolf’s 2020/21 budget proposal again calls for more spending in these core areas because there is overwhelming evidence that many school districts in the commonwealth are still struggling. A small sample:

-

The January 2020 PASBO/PASA School District Budget Report notes that the rising mandated costs of charter tuition, special education, and retirement contributions continue to dictate budget increases that are borne by local property taxpayers in the absence of additional state support.

-

PA’s overreliance on local funding sources enables PA’s wealthiest 100 school districts to spend $5,440, or 52 percent, more per weighted student than its poorest 100 school districts.

-

The Pre-K for PA Campaign’s new report reiterates the important impact high-quality early learning programs have on children’s social and learning skills, workforce readiness, and long-term economic mobility. Unfortunately, the report also shows that PA’s public investment ranks 19th out of the 28 states that fund high-quality pre-kindergarten programs. PA is currently only serving 44 percent of eligible children, and the campaign calls for a $243 million investment over the next three fiscal years.

The governor’s 2020/21 proposed budget renews the call for increasing the teacher minimum salary to $45,000 from the outdated statutory minimum of $18,500. Gov. Wolf is also proposing overdue charter funding reform (see section below for detail) as well as universal, free, full-day kindergarten (with flexibility for districts with capacity challenges).

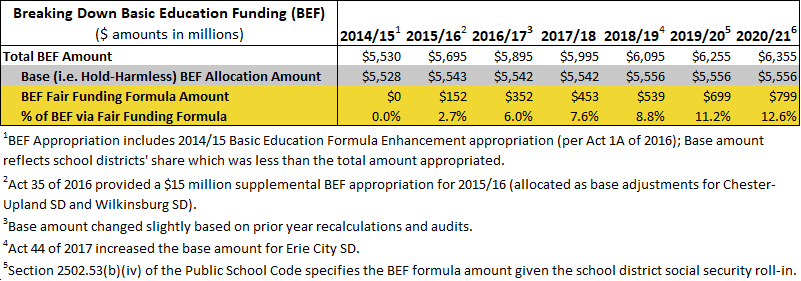

Basic Education

Gov. Wolf’s 2020/21 budget proposal includes a $100 million, or 1.6 percent, increase in basic education funding. New funding since 2014/15 is distributed using the fair funding formula. In 2020/21, 12.6 percent of all basic education funding will be distributed using the fair funding formula.

The school district portion of the school employees’ social security appropriation was combined with the basic education funding appropriation in 2019/20. The $114.6 million increase in the 2020/21 basic education funding appropriation reflects $14.6 million in additional social security costs and $100 million in increased basic education funding.

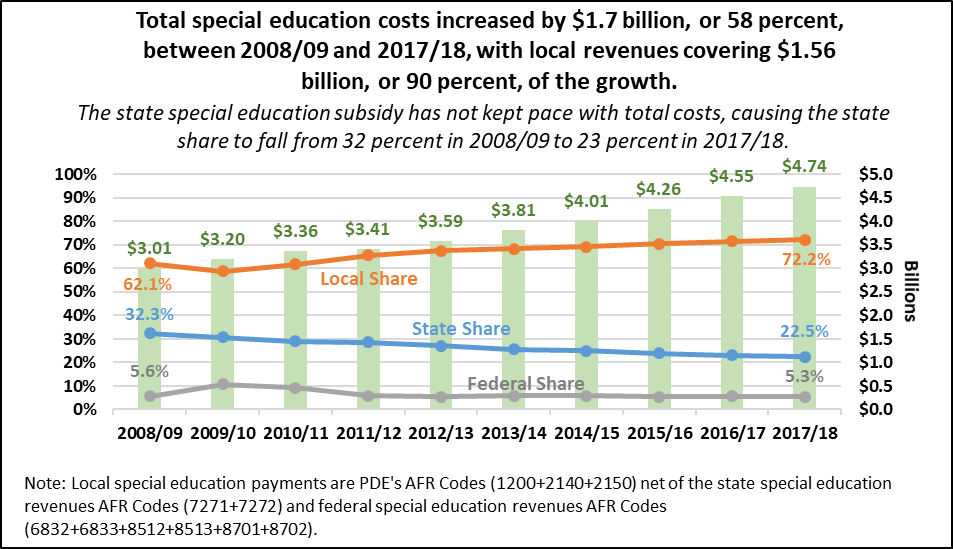

Special Education

Special education funding receives a $25 million, or 2.1 percent, increase in the 2020/21 budget proposal. Local special education costs have been rising so quickly -- driven by increased enrollments and outside placements -- that the $160 million, or 15.6 percent, in increased state support since 2014/15 has only stabilized the downward trend in the state’s share of special education spending.

New special education funds since 2013/14 have been distributed using the fair funding formula for special education, the implementation of which the reconstituted Special Education Funding Commission (SEFC) is evaluating ahead of an April 30, 2020 report deadline. In 2019/20, $150 million, or 13.6 percent, of the total sent to school districts was distributed through the fair formula for special education.

Charter School Reform

Gov. Wolf’s 2020/21 budget proposal recommends improving the transparency and accountability of charter schools. This includes rightsizing charter school tuition rates, which collectively would save school districts an estimated $280 million each year compared to current practice.

The largest component is a much-needed statutory change surrounding the charter school tuition rate for special education students. The current funding methodology has two enormous flaws. First, it does not account for the vast differences in the cost of special education services. In 2017/18, 90.7 percent of special education students cost less than $25,628 per student, 6.6 percent cost between $25,628 and $51,257 per student, and 2.7 percent cost more than $51,257 per student. By using an average cost, the current charter school special education tuition formula artificially drives up the per-student tuition rate for the vast majority of students.

Second, the per-student tuition calculation relies on the faulty assumption that 16 percent of each school district’s average daily membership are special education students. In reality, the median school district’s special education students make up 19.8 percent of the population. Dividing total special education spending by a lower (and incorrect) number yields a higher per-student cost that school districts have to pay to charter schools.

The bipartisan Special Education Funding Commission’s (SEFC) recommended formula, which Gov. Wolf supports in this budget proposal, addresses both of these flaws by using the actual count of special education students and funding those students based on tiers of cost. Applying the SEFC formula to brick and mortar charter schools accounts for $147 million of the projected savings.

Gov. Wolf’s policy proposal also calls for applying the SEFC formula to cyber special education students, as well as instituting a statewide tuition rate of $9,500 per student for non-special education students (the median rate was $10,926 in 2017/18). The estimated cyber-related savings from these measures are $133 million.

Early Childhood Education

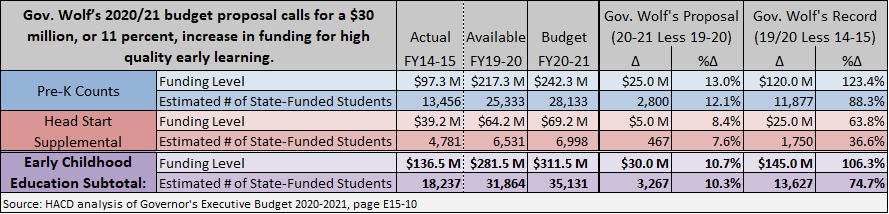

The 2020/21 budget proposal calls for a $30 million, or 11 percent, increase in funding for high quality early learning, which would add 3,267 state-funded slots to the 13,627 already funded under Gov. Wolf’s leadership.

School Construction

Gov. Wolf’s 2020/21 budget proposal calls for fixing Pennsylvania’s toxic schools by expanding the Redevelopment and Capital Assistance Program (RACP) to include $1 billion in grants to schools to remediate lead and asbestos.

The $10.5 million in the authority rentals and sinking fund requirements appropriation (funds the school construction reimbursement program known as PlanCon) reflects the annual costs of the charter school lease reimbursement program.

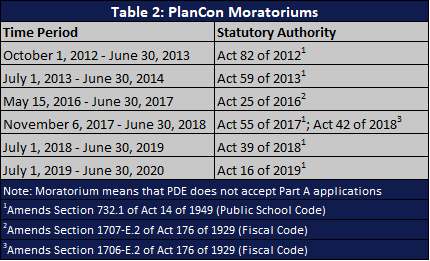

The current moratorium on new PlanCon applications extends to the end of 2019/20. Existing projects will continue to receive funding through bond proceeds authorized by Act 25 of 2016.

The PlanCon Advisory Committee’s recommendations for a new program are contained in Act 70 of 2019. Highlights include a streamlined administrative process, an incentive for high-performance building standards, a new maintenance reimbursement program, and an updated reimbursement funding formula. While the new program will take effect in 2020/21 in the absence of further statutory amendments, the governor’s budget proposal does not set aside any funding for it.

School Safety

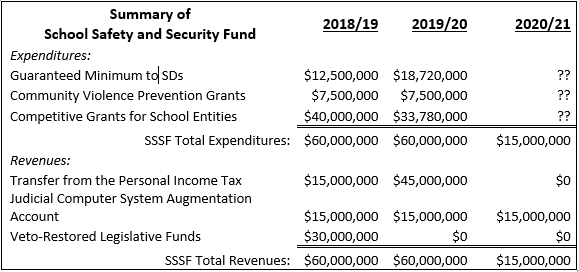

The 2020/21 budget proposal maintains the school safety grants through the Pennsylvania Department of Education’s (PDE) Office of Safe Schools, but reduces the grant funding available through the School Safety and Security Fund established two years ago.

The administration has indicated their intention to direct the $15 million proposed to fund mental health services and school counselors.

See the section on PCCD for information on how new proposed gun violence prevention and reduction grants may benefit school safety efforts.

HIGHER EDUCATION

Gov. Wolf’s budget proposal creates a new scholarship program for students at the Pennsylvania State System of Higher Education (PASSHE). The proposal redirects $204 million in Race Horse Development Fund proceeds currently used for horse racing purses to the Nellie Bly Tuition Program. This last-dollar, need-based program would support full-time PASSHE students to help cover tuition, room and board, books, supplies and other expenses. Recipients must commit to remain in Pennsylvania for the same number of years that they received the grant. If the recipient moves out of state before the terms are met, the grant will convert to a loan.

The governor proposes additional funding for students through the Pennsylvania Higher Education Assistance Agency (PHEAA). The budget invests an additional $30 million into the state grant program, which provides need-based aid to students attending college. While dependent on final board action, the budget assumes that PHEAA will also continue to contribute $30 million from their reserves and together this investment will increase grant amounts.

The 2020/21 budget proposal requests an additional $8.9 million for the Ready to Succeed Scholarship program, which provides merit-based aid to students from families with incomes less than $110,000 per year.

The budget proposal increases appropriations for the Bond-Hill scholarship by $1 million and the Cheyney Keystone Academy by $1.5 million. The Bond-Hill Scholarship supports exceptional graduates of the commonwealth’s two historically black universities, Lincoln University and Cheyney University, who go on to pursue certain graduate or professional degrees. The Cheyney Keystone Academy appropriation supports the honors program at Cheyney University. Institutional assistance grants, which support private colleges and universities that enroll needy students who receive PHEAA grants, are increased by 5 percent, or $1.3 million.

The budget proposal includes $12.95 million to support part of the first year costs of the PASSHE system redesign initiative. The system redesign aims to enable the PASSHE universities to collaborate more effectively, reduce costs and become more efficient. The additional funds included in the governor’s request will help PASSHE upgrade its system-wide enterprise software system and infrastructure, as well as transition all fourteen universities to a common student information system.

Other than the specific increase for PASSHE’s system redesign, operating support for public institutions remains flat-funded in the governor’s proposal.

PENSIONS

Gov. Wolf’s budget proposal fully funds the actuarial required contribution (ARC) for the State Employees’ Retirement System (SERS) and the Public School Employees’ Retirement System (PSERS) for the fourth consecutive year – and specifically for PSERS, this marks five consecutive years of full actuarial funding. After decades of systematic underfunding, this is a substantial achievement and reflects the ongoing commitment to ensure a secure retirement for all members of the commonwealth’s two largest public pension funds.

While pension costs continue to rise for SERS and PSERS, the magnitude of those increases has leveled off significantly, as the contribution collars imposed by Act 120 expired, and as the benefit reforms included in the act have reduced the normal cost, or the cost of current employee benefits, for employees hired after 2010.

More than 75 percent of contributions to the two systems go toward the unfunded liabilities accrued over the years, with the remainder covering the normal cost. Both systems are likely to experience the first reductions in their unfunded liabilities in more than a decade as a larger share of contributions go directly towards paying down the debt.

The required contribution for PSERS, which is appropriated under the Department of Education, increases from $2.63 billion to $2.75 billion – an increase of $119 million, or 4.5 percent. Employer contributions for SERS are not reported in a single specific appropriation, but rather are allocated to personnel costs across various agencies. Estimated total General Fund contributions for SERS in 2020/21 are $704 million, an increase of $15 million, or 2.2 percent.

Both SERS and PSERS continue to implement Act 5 of 2017, which established a new defined contribution component for employee retirement benefits. Appropriations for the defined contribution plans amount to $4.6 million and $1.1 million for SERS and PSERS, respectively.

MINIMUM WAGE

Gov. Wolf shares the House Democratic Caucus’s commitment to finally raising the minimum wage to help Pennsylvanians support themselves and their families. Providing a raise from the current federal minimum of $7.25/hour, which all surrounding states that share a border with Pennsylvania have already done, would also have a positive impact on the state’s overall economy by generating additional income, and therefore purchasing power, for Pennsylvania families.

In his budget, the governor calls on the General Assembly to increase Pennsylvania’s minimum wage to $15/hour. The plan would increase the wage to $12/hour, effective July 1, 2020, followed by annual 50 cent/hour increases until the minimum reaches $15/hour.

The executive budget proposal assumes that the first phase of the minimum wage increase will generate an additional $133.3 million in General Fund revenues, due to increased personal income tax and sales tax collections.

Human Services

The executive budget proposes over $14.3 billion in state General Funds for the Department of Human Services (DHS). This proposed increase of $1.17 billion from 2019/20 includes $493 million in net supplemental appropriation requests.

2019/20 SUPPLEMENTAL APPROPRIATIONS

The largest driver of the $493 million in supplemental requests is due to the underfunding of Medical Assistance – Capitation and Medical Assistance – Community HealthChoices appropriations in the enacted budget, estimated in July 2019 at $380 million. The proposed budget requests $374 million for these two appropriations.

The remaining significant drivers of the additional need are $90 million for Medical Assistance programs serving the elderly and persons with physical disabilities and $16 million for county early intervention programs experiencing significant increases in the number of children presenting for early intervention services.

2020/21 HIGHLIGHTS

Factors driving the proposed General Fund increase for DHS largely fall in four areas: replacing non-recurring 2019/20 adjustments; increasing program enrollments and costs; decreasing federal matching rates; and, initiatives.

REPLACING NON-RECURRING ADJUSTMENTS

The net impact in the 2020/21 budget for non-recurring cost and revenue shifting is $742 million. Specifically,

-

Net prior year costs shifted to 2020/21, including the additional delay in some managed care payments ($347 million)

-

Prior year funding used in 2019/20 that is not available again in 2020/21 ($178.5 million)

-

One-time transfer from the Pennsylvania Professional Liability Joint Underwriting Association (JUA) assumed in 2019/20 that will not recur in 2020/21 ($200 million)

-

Reduction in other sources of funds, including Tobacco Settlement Funds ($16.5 million)

INCREASING PROGRAM ENROLLMENTS AND COSTS

The executive budget assumes Medical Assistance (MA) participants remain mostly stable at 2,863,000 participants on average per month, an increase of only 2,850 individuals (or 0.1 percent) over the current year. Also expected to remain level is the number of adults qualifying for MA under Medicaid Expansion at approximately 759,000 individuals.

The governor’s proposed budget contains the final transitional impacts of the implementation of Community HealthChoices (CHC), the managed care program for Pennsylvanians dually eligible for Medicare and Medicaid and older Pennsylvanians and individuals with physical disabilities requiring long-term services and supports.? DHS has completed the three phases of CHC implementation: January 1, 2018, in southwest PA; January 1, 2019 in southeast PA; and, January 1, 2020 in the remainder of the state.? Nearly 145,000 people joined the program in Phase 3, bringing total CHC enrollments to approximately 360,000. As CHC expanded across the commonwealth, expenditures were transferred from other appropriations – namely Long Term Care, Home and Community-Based Services, Services to Persons with Disabilities, and Attendant Care -- to the Community HealthChoices appropriation to support MA recipients who transitioned into the program. ?The 2020/21 budget proposal reflects this restructuring of the department’s long-term living programs:

-

The CHC appropriation includes the shifting of fee-for-service nursing home costs as well as costs for the following waivers: Aging Waiver, Independence Waiver, and Attendant Care Waiver.

-

The Long-Term Care appropriation is renamed Medical Assistance – Long Term Living and will support services provided to MA recipients not in CHC managed care. In addition to nursing home care, the Long-Term Living appropriation will fund the two programs not transferred to CHC (OBRA Waiver and Act 150) as well as the claims run-out costs for the three waiver programs listed above.

-

Because their costs have been transferred, the following appropriations are eliminated: Home and Community-Based Services, Attendant Care, and Services for Persons with Disabilities.

Managed care rate increases are budgeted for Physical Health HealthChoices, Behavioral Health HealthChoices, and CHC. The proposed budget also includes increases to reimburse those managed care organizations that pay the Health Insurance Providers Fee established in the Affordable Care Act -- Congress suspended the fee for calendar year 2019, but it will resume in calendar year 2020. No other rate increases are outlined in the budget except those in the initiatives section that follows.

FEDERAL MEDICAID MATCHING

Decreasing federal Medicaid funds, due to reductions in the Federal Medical Assistance Program (FMAP) matching rate for Medicaid expenditures (including Medicaid Expansion) and Children’s Health Insurance Program (CHIP) costs accounts for $240 million of the proposed increase in state General Funds.

-

The Affordable Care Act outlines the gradual decrease of the FMAP available to the Medicaid Expansion population from 100 percent to 90 percent. The last FMAP decrease from 93 percent to 90 percent was effective January 1, 2020. The Governor’s proposed budget includes $166 million for the increased impact from a partial year in 2019/20 (for which only three months of managed care payments reflected the lower FMAP) to a full year in 2020/21.

-

The Affordable Care Act provided for a temporary increase in the CHIP FMAP of 23 percent. That rate began to phase out October 1, 2019 with an 11.5 percent reduction and will reduce again by 11.5 percent on October 1, 2020. This will require $55 million in state funds in 2020/21.

-

The federal government projects the standard FMAP for PA to decrease slightly October 1, 2020 from 52.25 percent to 52.18 percent. This will require $18.6 million in state funds.

INITIATIVES

Gov. Wolf’s executive budget continues to propose an increase to Pennsylvania’s minimum wage to $12 per hour effective July 1, 2020, with annual increases of $0.50 each year until the minimum wage becomes $15 per hour on July 1, 2026. The higher minimum wage is expected to reduce costs in DHS as individuals transition from Medicaid to CHIP at a higher FMAP or on to the healthcare exchange to purchase coverage. A higher minimum wage will also cost DHS in terms of increases in provider rates, as some providers of human services are currently unable to pay $12 per hour. Although the net cost impact of the minimum wage on DHS’s budget is $10.7 million, those costs will be more than offset by increases in the personal income tax and sales tax covered elsewhere in this document.

Gov. Wolf is also seeking $50 million in state General Funds for the following initiatives:

-

Provide home and community-based services to an additional 100 individuals on the emergency waitlist in the Consolidated Waiver and 732 individuals on the emergency waitlist in the Community Living Waiver. The proposed budget continues to assume high school graduates can be served in the Person/Family Directed Services waiver through attrition. The governor also outlines that up to 40 of the individuals within this initiative will be children with complex medical needs transitioning from congregate care settings. ($15 million)

-

Start-up funding to begin transitions from Polk and White Haven centers netted with state center savings due to reduced census ($8.2 million)

-

Develop a Health Services Initiative (HSI) through CHIP for lead remediation in low income family homes and to increase the number of EPA-certified individuals to perform remediation ($4 million)

-

Adjust the eligibility criteria for the Ventilator Dependent Resident Grant program to allow more providers to qualify ($1.4 million)

-

Enhance the training provided to direct care workers providing services to seniors and individuals with a physical disability receiving consumer directed services in the home and community-based setting ($1.2 million)

-

Discharge 20 current residents of state mental hospitals through the Community Hospital Integration Projects Program (CHIPP) ($1.3 million)

-

Provide increased funding to counties supporting individuals with intellectual disabilities and autism to enhance risk management and incident investigation resources ($4 million)

-

Increase early intervention administrative funding to counties to support the significant increases in the number of children presenting for services ($2.5 million)

-

Dedicate funding to increase access to reproductive health care services ($3 million).

-

Enhance DHS staffing to ensure timely inspections of facilities and monitor corrective measures taken by providers ($5.1 million)

-

Expand the provision of home visiting within the MA program and maintain home visiting services experiencing a loss of available federal funds ($2.4 million)

-

Expand the Legal Services program to allow additional low income Pennsylvanians to receive legal assistance ($1 million)

Additionally, the governor proposes federal funding to support the following initiatives:

-

Restructure child care copayments ($436,000)

-

Replace the current work expense reimbursement with a work expense deduction for all working Temporary Assistance to Needy Families (TANF) recipients ($23.4 million)

-

Integrate case management into the employment and training programs ($15 million)

TRANSFERS AND CUTS

The proposed budget includes a large transfer and cuts to help control growth in DHS. First, the Community HealthChoices program appears underfunded by several hundred million in 2020/21. A one-month cycle roll of May services costs (from payment in June to payment in July) is expected in the detailed hearing materials due from the administration in the next few weeks.

The executive budget also eliminates $65 million in 2019/20 legislative initiatives for nursing facilities, hospitals, medicals schools, autism service providers, and local level organizations.

OTHER ITEMS TO NOTE

Gov. Wolf’s 2020/21 budget proposal includes the following items of note:

-

Assumes the reauthorization of the Managed Care Organization (MCO) Assessment scheduled to sunset June 30, 2020. State revenues of $1.7 billion are estimated in 2020/21 from this provider assessment. The net benefit to the state is over $1 billion, which reduces state funds needed to support the MA program. The assessment will require Human Services Code language in order to be reauthorized and minimal other changes in the assessment structure are anticipated.

-

Medical Assistance – Transportation appropriation does not include any financial impacts of the broker model through June 30, 2020.

-

County Child Welfare appropriation includes an increase only to fund the cost of the minimum wage proposal. No increase related to the county needs based plan and budget is apparent --this will require closer review when hearing materials are provided by the administration.

-

Impact of 2019/20 initiatives for a full year in 2020/21 will require $17 million in state funds. Most of this need is related to the waitlist initiatives for individuals with intellectual disabilities.

-

Implementation of the MA program statewide preferred drug list (PDL) is estimated to generate $84 million in additional state fund rebates.

-

Children’s Health Insurance Administration appropriation is proposed for elimination. Personnel costs are being shifted to the County Administration – Statewide appropriation and other CHIP programmatic administrative costs are being shifted to the Children’s Health Insurance Program appropriation.

-

Intellectual Disabilities – Lansdowne Residential Services appropriation funds community participation services for select persons with intellectual disabilities in the Lansdowne area. The budget proposes a reduction in funding for this facility from $340,000 to $200,000.

Health

The governor’s 2020/21 budget proposal includes modest increases for programmatic and personnel cost increases in the Department of Health (DOH). The budget proposal maintains the restoration investments in the State Health Care Centers that began in 2018/19 and increased in 2019/20. In line with the enacted budget, the proposed budget maintains the assumption that revenues collected from increased birth and death certificate fees will be sufficient to fund the operations of Vital Statistics services. A placeholder general fund appropriation remains for $100,000.

The governor’s budget proposes an increase of $450,000 to the Primary Health Care Practitioner Program to increase the availability of health care providers, thereby increasing Pennsylvanians’ access to primary health care services. The 2020/21 budget also proposes $1.3 million in additional funds for a DOH-led study on fracking.

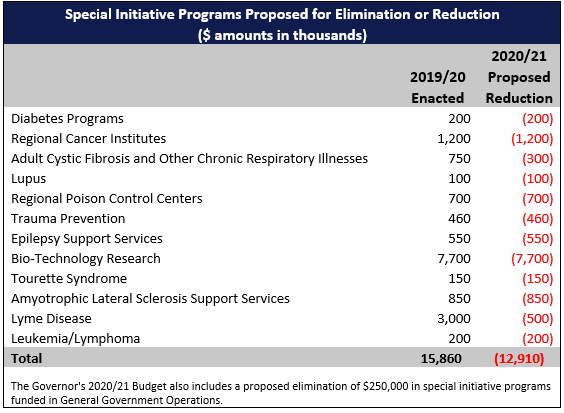

Gov. Wolf again proposes the elimination or reduction of numerous disease and research specific special initiatives, outlined in the following table.

HEALTH INSURANCE EXCHANGE AUTHORITY

Act 42 of 2019 created the Pennsylvania Health Insurance Exchange Authority to develop and operate a state-based exchange (SBE) for the purchase of medical and dental insurance by Pennsylvanians. The SBE will replace the use of the federal exchange, HealthCare.gov, for individuals to purchase insurance. The act also established the Pennsylvania Health Insurance Exchange Fund (PHIEF) to support the operations of the SBE through assessments on insurers, or exchange user fees. The exchange user fee is currently set at 0.5 percent of premiums. The governor’s budget assumes the exchange user fee rate will increase to 3.0 percent of premiums midway through 2020/21 when the SBE is implemented in calendar year 2021. The budget reflects the executive authorization of $3 million for general operations issued so far this fiscal year from the PHIEF. The budget also outlines anticipated PHIEF executive authorizations of $26 million in 2020/21 for the general operations of the authority.

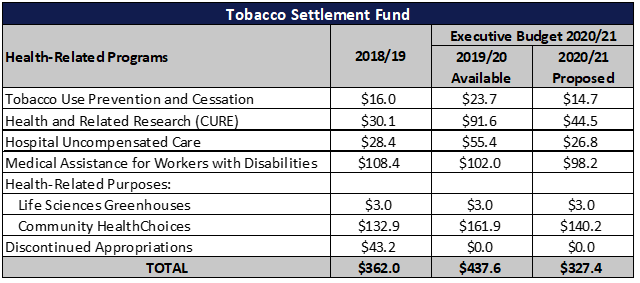

TOBACCO SETTLEMENT FUND

The governor proposes spending $327.5 million from the Tobacco Settlement Fund (TSF) in 2020/21 using the same allocation formula from the current year’s Fiscal Code (Act 20 of 2019). In 2019/20, the TSF received a one-time influx of revenue after the Attorney General settled outstanding lawsuits related to prior year payments under the Master Settlement Agreement (MSA), which in large part was used to offset human service spending. While appropriations from the TSF are reduced significantly from 2019/20 levels, they remain largely in line with spending in 2018/19 before the windfall.

The allocation formula established in Act 20 is as follows:

-

4.5 percent for tobacco use prevention and cessation programs,

-

13.6 percent for health and related research (CURE),

-

8.18 percent for hospital uncompensated care,

-

30 percent for Medicaid benefits for workers with disabilities, and

-

43.72 percent for health-related purposes in the General Fund budget. Within this allocation, the governor proposes flat-funding the life sciences greenhouses and directing the remainder to the Community HealthChoices program.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the MSA. In 2020/21, the debt service payments on those bonds will total $115.3 million. However, Act 20 of 2019 mandated that sufficient revenues are transferred from cigarette tax collections to the TSF in order to fully offset those debt service costs. The governor’s budget fully reflects this transfer.

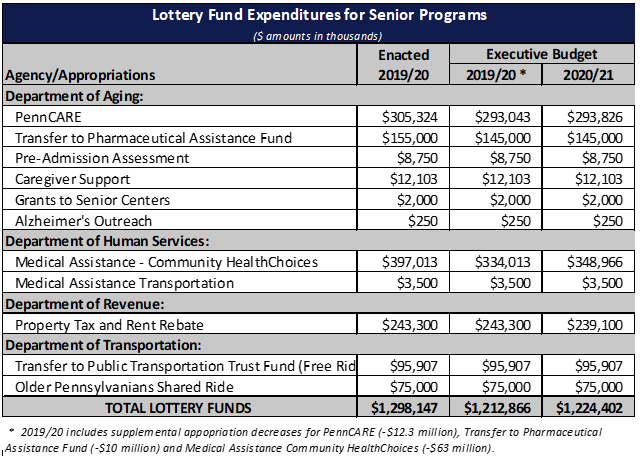

LOTTERY FUND

Gov. Wolf is proposing an investment of $1.2 billion from the Lottery Fund in 2020/21 for programs that benefit Pennsylvania’s seniors. This is $11.5 million more than the revised 2019/20 funding level, which includes significant supplemental appropriation decreases in order to keep spending in line with available lottery revenue.

Given the decline in ticket sales through the first half of the fiscal year, the Administration has reduced its 2019/20 estimate for net lottery collections (revenue deposited into the Lottery Fund after deducting from total ticket sales the commissions retained and prizes paid by local retailers). Declining revenue is due primarily to the lack of large multi-state jackpots, which has hurt Powerball and MegaMillions ticket sales.

The executive Budget presumes net lottery collections will rebound in 2020/21 and grow 3.9 percent over the revised 2019/20 estimate. At this time, the breakdown of projected revenue between traditional lottery games and the iLottery games that consumers play online is not known. The proposed budget would leave the Lottery Fund with positive ending balances of $4 million in 2019/20 and $4.7 million in 2020/21.

The table on the following page details spending for senior programs as originally enacted for 2019/20, with a comparison to the levels proposed in the executive budget.

The revised 2019/20 request is $85.3 million less than what was in the enacted budget. Most of the reduction is based on a shift of Medical Assistance Community HealthChoices expenditures from the Lottery Fund to the General Fund ($63 million). The budget also proposes reductions to PENNCARE ($12.3 million) and the Pharmaceutical Assistance Fund ($10 million).

For 2020/21, Gov. Wolf proposes $8.1 million in new funding for PENNCARE to reduce the waiting list for OPTIONS in-home services. Please note that this proposed increase in OPTIONS funding is being masked by a reduction in PENNCARE expenditures due to the transfer of attendant care waiver users to the Community HealthChoices program.

The proposed 2020/21 budget decreases funding for the property tax and rent rebate program by $4.2 million. This reduction is based on the Administration’s current estimates for participation in the program.

The governor is requesting nearly $349 million from the Lottery Fund for Community HealthChoices in 2020/21. This is about $15 million above the revised 2019/20 request.

ENVIRONMENTAL PROTECTION

Department of Environmental Protection’s total proposed budget of $825.3 million represents a $15.2 million, or 1.9 percent, increase over 2019/20.

Current year appropriations reflect the shift from the use of environmental special funds as proposed in the 2019/20 budget to other non-environmental special funds as permitted in the Fiscal Code. The 2020/21 budget then provides support for these expenditures from the General Fund. The department’s state General Fund proposal of $174.4 million is an increase of $36.6 million compared to 2019/20. The aforementioned shifts however, result in a proposed net General Fund increase of $3.03 million over 2019/20.

The governor proposes increases in department personnel and support for water commissions. The budget proposal includes 25 new positions. First, he allocates an additional $1.5 million for the Bureau of Air Quality, within the Environmental Protection Operations appropriation, to hire 15 new positions. In addition, $1 million would pay for 10 new positions dedicated to the implementation of Pennsylvania’s Phase 3 Chesapeake Bay Watershed Implementation Plan (Phase 3 WIP) within the Chesapeake Bay Agricultural Resource appropriation.

The governor’s executive budget also proposes an increase of $1-per-ton to the tipping fee on municipal landfills to support the Hazardous Sites Cleanup Fund (HSCF). Historically, the Capital Stock and Franchise Tax was the primary revenue source for the fund, but it was eliminated for tax years beginning in 2016. The proposed increase to the tipping fee is projected to generate an additional $22.6 million to provide solvency to the HSCF.

In line with the administration’s pipeline safety efforts, the executive budget also calls for action in establishing legislative authority related to pipeline safety proposals, including setback requirements. To safeguard the commonwealth’s citizens, the budget proposal also questions the lack of pipeline operator legislation, which would provide information and leak response advice to schools or childcare centers in close proximity to a pipeline. In addition, the budget proposal lays out the need for notification to residents and municipalities in advance of drilling by pipeline companies.

CONSERVATION AND NATURAL RESOURCES

The total proposed budget for the Department of Conservation and Natural Resources is $439.8 million, representing an increase of $3.4 million, or one percent, over 2019/20.

Current year appropriations reflect the shift from the use of environmental special funds as proposed in the 2019/20 budget to other non-environmental special funds as permitted in the Fiscal Code. The 2020/21 budget then provides support for these expenditures from the General Fund. The department’s state General Fund proposal of $145.8 million is an increase of $28.6 million over 2019/20. The use of non-environmental special funds in 2019/20 results in a net increase to General Fund spending of $17.27 million. Of that increase, $14.12 million is related to reduction in use of Oil & Gas Lease Fund.

The executive budget proposal invests $2.5 million for hiring 25 new positions. That includes a $1.66 million initiative for 17 ranger positions within State Park Operations and $835,000 initiative for 8 ranger positions within State Forest Operations.

Included as part of 2019/20 enacted budget, the $20 million reduction of the transfer from the Oil & Gas Lease Fund to the Marcellus Legacy Fund is also part of 2020/21 budget proposal. The executive budget also continues the use of personal income tax for the Growing Greener debt service payment within the Environmental Stewardship Fund.

AGRICULTURE

In total, the executive budget proposes $459.6 million for the Department of Agriculture, which is a reduction of $19.8 million, or 4.1 percent, from 2019/20. The Department’s state General Fund proposal of $166.9 million represents a $4.4 million reduction.

As part of an effort to address food insecurity, the Governor’s budget proposal provides a $1 million increase to Pennsylvania Agricultural Surplus System (PASS).

Similar to previous budgets, this proposal eliminates a number of appropriations, which are traditionally added back during budget negotiations.

Also part of the General Fund reduction are proposed eliminations of Livestock & Consumer Health Protection and Animal Health & Diagnostic Commission appropriations.

The executive budget proposal includes reductions in a number of line items within the Racing Fund. Reductions are based on two components: solvency concerns from the sunset of the drug testing transfer provision in Act 114 of 2016; and the proposal to eliminate the Pennsylvania Race Horse Development Trust Fund’s restricted revenue proceeds.

COMMUNITY AND ECONOMIC DEVELOPMENT

The governor’s $157.7 million budget proposal for the Department of Community and Economic Development (DCED) in most cases reflects cost-to-carry funding absent appropriations customarily added back during budget negotiations.

In addition, the governor’s proposed budget allocates $29 million to the Manufacturing PA appropriation, a $17 million increase compared to 2019/20. The proposed increase will support competitive grants to Industrial Resource Centers for innovative service delivery, as well as grants to Pennsylvania’s Regional Economic Performance organizations to promote partnerships with institutes of higher education. Similarly, Gov. Wolf proposes and additional $5 million, a 34.5 percent increase, to the Ben Franklin Technology Development Authority, which will provide funding and assistance to startup companies throughout the commonwealth.

Moreover, the governor’s budget proposal transfers $5.3 million to the Pennsylvania Economic Development Financing Authority (PEDFA), to pay the debt service on voting machine reimbursement bonds issued under the authority granted in Act 77 of 2019.

The governor’s budget proposes a $13.3 million decrease in funding for the “Marketing to Attract Tourism” appropriation. While a 76.5 percent decrease to this appropriation is notable, the department can utilize funds from the Tourism Promotion Restricted Fund, established under Act 109 of 2018 for the Marketing to Attract Tourism and Marketing to Attract Business programs.

Additionally, Gov. Wolf proposes a new $10 million WEDnetPA appropriation, which would be achieved by shifting their current $8 million in funding from the PA First appropriation and increasing overall funding to the program by $2 million. WEDnetPA provides funding to employers for incumbent workforce training.

In addition to the $8 million WEDnetPA funding shift, Gov. Wolf proposes an additional $12 million decrease in the PA First appropriation. Thus, the proposed budget allocates $12 million to PA First, a $20 million decrease compared to 2019/20.

Furthermore, the governor’s proposed budget establishes a new $2.35 million “Invent Penn State” appropriation. This initiative supports university, community and industry partnerships that focus on turning research into actual products and services.

Finally, Gov. Wolf proposes investing $5 million into the new State Facility Closure Transition Program to provide grants and loans to local municipalities impacted by the permanent closure of a state-operated or owned facility.

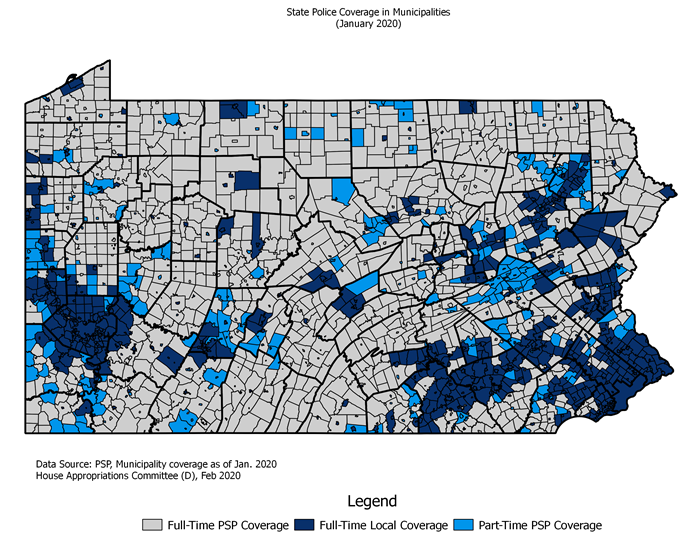

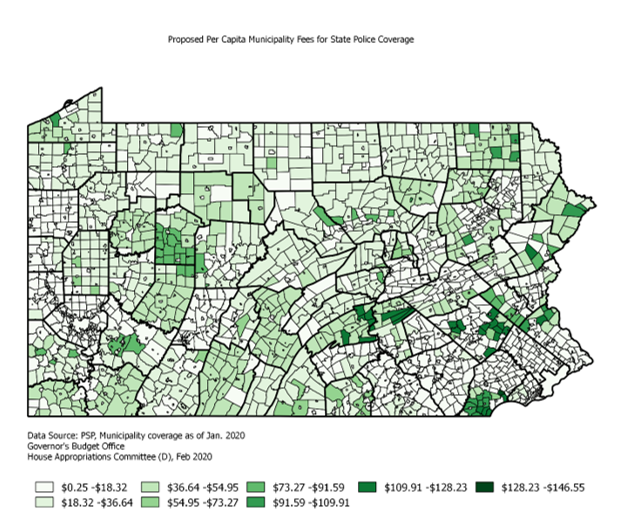

STATE POLICE

The governor’s budget proposal provides $1.38 billion for Pennsylvania State Police (PSP), a $45.3 million, or 3.4 percent, increase over 2019/20.

PSP draws funding from the General Fund, Motor License Fund (MLF), and other smaller funds. The budget proposal continues a multi-year effort to shift away from reliance on the Motor License Fund. Appropriations from the MLF to PSP are restricted by a statutory cap – $705.5 million in 2020/21 – that decreases by $32 million annually until it reaches $500 million in 2027/28.

The proposed budget achieves the required reduction in MLF spending, and decreases General Fund appropriations by $35.3 million, or 11.5 percent.

The budget proposal assumes a $135.9 million fee on all municipalities for their use of state police services. This fee is predicated on station coverage costs, which are driven by incidents and coverage area, and considers various factors, including population and income. It is further weighted for municipalities benefitting from full- or part-time services. Calculations of the per capita fee are estimated to range between $0.25 and $146.55.

The proposed budget would invest $13 million in four additional cadet classes in 2020/21. The four classes would maintain the police complement at full strength, despite expected retirements and turnover. By the end of 2020/21, the resulting graduates will increase the filled trooper complement level to the highest point in the history of the department.

The governor’s budget proposes a decrease of $2.5 million in funding for the statewide public radio system due to nonrecurring system implementation costs. A report by the Auditor General revealed that the P-25 radio system is scheduled to be completed in the summer of 2021, which is on time and within budget.

In 2020/21, Gov. Wolf proposes a $1.4 million appropriation to support the PICS gun checks system. PICS is also funded by a restricted account, although the account’s revenue is less than half the annual cost of the program.

CRIMINAL JUSTICE

Corrections continues as the third largest expenditure in the state budget after human services and education. This budget proposal includes $2.62 billion in funding for the Department of Criminal Justice, a decrease of $73 million, of 2.3%. Assumed in this decrease is the proposed closure of SCI Retreat, which would save the department approximately $43.9 million in the budget year.

The budget proposal assumes an $89.9 million supplemental appropriation in 2019/20 for inmate medical care ($14.9 million) and state correctional institutions ($75 million).

Beginning with Act 1A of 2017, funding for the Department of Corrections and the Pennsylvania Board of Probation and Parole has been appropriated jointly to the Department of Criminal Justice, reflecting ongoing efforts supported by Gov. Wolf to consolidate the two agencies.

Grants to support county probation are level funded in this proposal, but transferred to the Pennsylvania Commission on Crime and Delinquency, which would make this the ninth year at the current funding level of $16.2 million.

COMMISSION ON CRIME AND DELINQUENCY

The governor’s budget proposal calls for an $8.3 million increase to the Pennsylvania Commission on Crime and Delinquency (PCCD). This increase contains $6 million in additional funds for comprehensive gun violence prevention and reduction grants. These funds will be directed toward community programs that focus on implementing evidence-based strategies or promising practices recommended by the Special Council on Gun Violence. The budget also includes funding for a $1.3 million initiative to support court-appointed advocacy for children who have been victims of abuse or neglect through the CASA program.

Acts 114 and 115 of 2019, also known as JRI 2, shifted $16.2 million from the Department of Criminal Justice to PCCD for the improvement of adult probation services. Additional funds will be deposited into the Justice Reinvestment Fund beginning in 2021-22 based on a percentage of program savings generated in the year prior to the deposits. Savings will be generated by the implementation of short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations.

The governor’s budget shifts $379,000 from the Department of Education to PCCD to fund the Office of Safe Schools Advocate.

Support for grants to local criminal justice agencies and non-profits, including programs to divert low-level offenders from incarceration, support drug courts, and provide for victim services, are all level funded.

JUVENILE COURT JUDGES’ COMMISSION

The budget proposal increases funding for the Juvenile Court Judges’ Commission by $105,000, or 3.4 percent. Grants for juvenile probation services are maintained at $18.9 million.

PENNSYLVANIA EMERGENCY MANAGEMENT AGENCY

The budget proposal provides level funding for general operations and grant programs within the Pennsylvania Emergency Management Agency.

Non-recurring costs related to disaster relief and hazard mitigation, which vary substantially year-to-year, are returned to zero in the proposal.

The budget proposal increases emergency services grants (EA) for the 911 Fund by $26 million. These grants fund the implementation of a statewide 911 plan.

The budget proposal assumes a $600,000 supplemental appropriation for 2019/20 for hazardous materials planning and training.

JUDICIARY

The budget proposal provides level funding for almost all of the appropriations in the Judiciary. Funding for the Judicial Conduct Board funding is increased by $0.4 million. Funding streams for the judicial computer system and JNET are decreased by $11.4 million and $0.7 million, respectively.

Act 42 of 2018 (the Fiscal Code), established a recurring transfer of $15 million in fee revenue (which otherwise would be directed to the Judicial Computer System Augmentation Account) to the School Safety and Security Fund. 2020/21 will be the third year of the transfer.

OFFICE OF THE ATTORNEY GENERAL

The governor proposes significant funding increases for the Office of Attorney General. The proposal specifically requests additional resources to combat gun violence and drug-related crimes. Funding for the Joint Local-State Firearm Taskforce would see an increase of $4.1 million, or 60.9 percent, over 2019/20 to a total of $11.1 million. Spending on Drug Law Enforcement would increase by $3.6 million, or 7.3 percent, over 2019/20 to a total of $53.3 million.

TRANSPORTATION

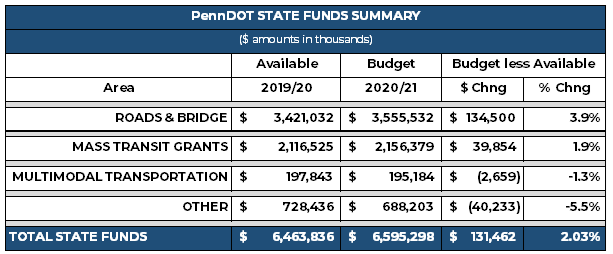

The 2020/21 executive budget proposal includes $6.59 billion in state funding for the Department of Transportation (PennDOT), representing an increase of $131.46 million or 2.03 percent over 2019/20. The proposed increase is primarily related to shifts in cash flow. As some projects are completed and new projects started, cash flow availability dictates what could be spent. Areas with increases include Roads & Bridge and Mass Transit, while offsetting decreases come from Multimodal Transportation and others.?

Notably, the Highway & Bridge Improvement proposal is $79.7 million higher than in 2019/20, representing a 7.4 percent increase.? Furthermore, proposals related to the Highway Maintenance and Local Highway & Bridge programs provide for an additional $54.7 million.? Lastly, there is an additional $39.8 million proposed for Mass Transit.

As the chart indicates, increases are offset by a $42.8 million decrease in a number of appropriations including Infrastructure Bank Loans and Proceeds from Bond Sales. The decrease from 2019/20 in Multimodal Transportation relates to administrative expenditures.

As we move forward, the executive budget proposal must consider options to replace the annual payments of $450 million from the Pennsylvania Turnpike Commission. These payments, which fund mass transit, will end in 2022.

DEPARTMENT OF STATE

The governor’s proposed budget for the Department of State provides for a $3.9 million increase in state funding, or an increase of 27.3 percent. A majority of this can be attributed to the proposed $1.57 million, or 36.4 percent, increase to the department’s General Government Operations appropriation, a portion of which will be used for election modernization. In an effort to modernize the commonwealth’s election infrastructure, the department obtained a $14 million federal grant in 2018 to alleviate the financial burden placed on counties. The Pennsylvania Economic Development Financing Authority (PEDFA) Board issued a $90 million bond, to provide additional funding to counties to help purchase new voting machines.

In addition, the governor’s budget proposal includes $2.4 million for upgrades to the Statewide Uniform Registry of Electors (SURE) system to replace the reduction in federal funds currently used to maintain the system.