Adequacy and Equity

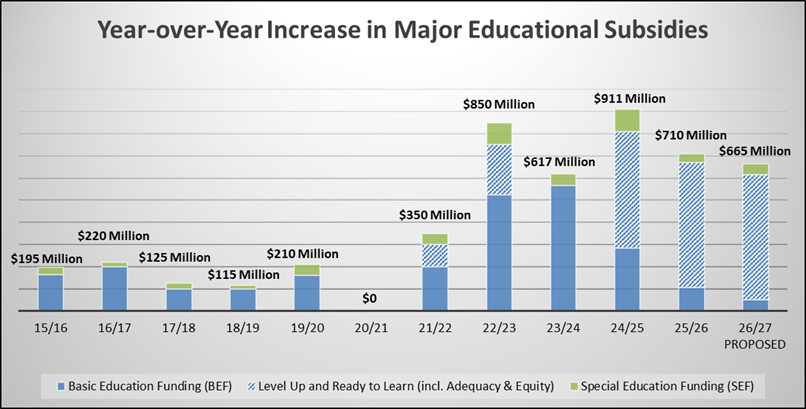

In response to William Penn S.D., the General Assembly passed a new adequacy formula as part of the 2024/25 budget package. Adequacy payments are made to underfunded school districts on top of their base Ready-to-Learn amount. A school district qualifies for adequacy funding if the district’s current expenditures (state, local, and federal funding) is less than its adequacy target expenditures (based on a successful schools model). Adequacy supplements increase year-over-year, meaning that a school district’s 2025/26 adequacy supplement is included in its base Ready-to-Learn Block Grant payment for the subsequent year.

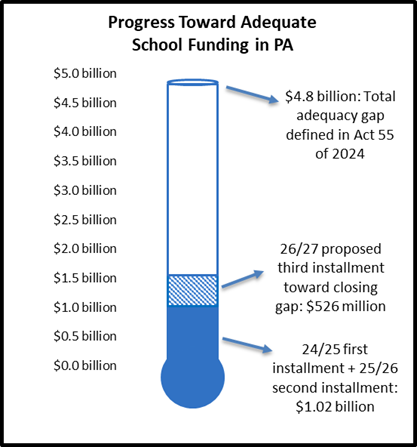

The governor’s 2026/27 proposal includes an additional $526.4 million for the third installment of adequacy funding. This is the same amount and same method as the second installment in 2025/26, and it maintains General Assembly's current nine-year timeline for fully funding the adequacy gap. Read more about the first two adequacy installments here.

Tax equity funding is for school districts with a “local tax effort” above the 90th percentile. With 500 school districts in the Commonwealth, the 90th percentile cutoff means the 50 highest taxing school districts. “Local tax effort” is calculated by dividing each district’s local taxes collected (e.g., real estate taxes and other local school taxes) by the sum of its total market value and total personal income. Like the first two tax equity installments, the governor’s 2026/27 proposal provides an additional $32.2 million for the third installment of tax equity funding. This investment would maintain General Assembly's current eight-year timeline for paying the tax equity gap.

The governor’s budget proposal calls for $75 million in additional cyber charter school savings to school districts by further aligning the statutorily set tuition rate calculation with the actual cost to educate a cyber student. The 2025/26 budget package included cyber charter tuition rate reforms which were estimated to save school districts at least $178 million statewide. The proposed additional reforms would build on the changes enacted under Act 27 of 2025 for an estimated two-year savings of $253 million.

The nonspecial education tuition rate is based upon the school district of residence’s selected expenditures per student. Selected expenditures are the total expenditures net of permitted deductions. It is the Committee’s understanding that the additional savings are achieved through two changes to the current nonspecial education tuition rate for cyber charter school tuition:

- Expanding the permitted deductions

- Last year’s budget added three new deductions for spending categories that don’t make sense to include:

- Tax assessment and collection services

- 60% of student activities

- 60% of operations and maintenance of plant services (facilities)

- The proposal increases the 60% amounts to 80% so school districts can write off more of those expenditures

- Incorporating an “excess spending factor” into the tuition rate calculation

- In the basic education funding formula, the excess spending factor compares a school district’s current expenditures to the statewide median. If you are above the median (higher spenders), you have an excess expenditure factor below one.

- For cyber charter school tuition rate calculations, multiplying a school district’s selected expenditures by its excess spending factor (maximum value of 1) effectively caps each school district’s cyber charter nonspecial tuition rate at the 50th percentile.

Gov. Shapiro’s 2026/27 budget proposal maintains $125 million in funding for the competitive Public School Facility Improvement Grant Program, administered by the Commonwealth Financing Authority (CFA). This program supports a broad range of projects such as roof or window repairs, HVAC needs, and plumbing systems.

In 2024/25 and 2025/26, the fiscal code required $25 million of the money provided for the Public School Facility Improvement Grant Program to be used for the Solar for Schools Grant Program. The governor’s 2026/27 budget proposal recommends continuing the $25 million investment in solar projects.

Notably, in the out years presented in the governor’s budget proposal, funding for the Public School Facility Improvement Grant Program is eliminated. The governor is proposing the Pennsylvania Program for Critical Infrastructure Investment, which would use bond proceeds to invest billions into infrastructure projects across the commonwealth, including school districts and local governments.

Although PlanCon, the state’s school facility reimbursement program for new buildings or major renovations, is not open for applications, the state is still paying the legacy costs of PlanCon 1.0, which has not accepted new projects since 2016. In 2019, the legislature enacted the PlanCon 2.0 recommendations of a bipartisan committee; however, no funding has been allocated to reopen PlanCon.

- Early childhood education

- $7.5 million or 2.3% increase ($334.3 million total) to Pre-K Counts and $2 million or 2.3% increase ($93 million total) to Head Start to help providers raise wages and stabilize the early educator workforce

- $51.2 million or 11.3% increase ($504.5 million total) for Early Intervention for 3-5 year olds

- Career and technical education

- $14.3 million or 10% increase ($158.5 million total) for the Career and Technical Education appropriation, which has multiple components:

- $4.3 million is the estimated amount needed to maintain the CTE subsidy

- $10 million to support high-quality STEM and computer science

- Maintains the $100 million allocation for School Safety – Physical and Mental Health

- Teacher workforce pipeline

- $2.5 million or 50% increase for teacher professional development programs for a total of $7.5 million in available funding in 2026/27

- $5 million or 17% increase for student teacher stipends for a total of $35 million in available grant funding in 2026/27 (note: this program is administered by PHEAA)

- Supplemental appropriations to increase 2025/26 funding amounts based upon updated projected need:

- $1.2 million (0.16%) increase for pupil transportation

- $7.5 million (1.1%) increase for school employees’ social security

- $7.1 million (9.3%) increase for school food services

State funding for Penn State University, University of Pittsburgh, and Temple University has remained level since fiscal year 2018/19. Last year, the Governor proposed new competitive funding for these three state-related institutions. While the 2025/26 budget package established the State-related University Performance Fund, the General Assembly did not transfer any money to the fund.

This year, the Governor proposes a $30 million transfer to the State-related University Performance Fund. Money in the fund would be distributed to state-related institutions utilizing performance-based metrics, as outlined the performance-based funding formula enacted under the 2025/26 budget package. Performance metrics in the formula include: 4-year graduation rate, 6-year graduation rate, 6-year graduation rate of Pell-grant recipients, and the high-demand degree rate.

Outside of the performance-based funding process, the budget proposal provides a 5% increase to Lincoln University and flat-funds the Pennsylvania College of Technology.

The governor’s 2025/26 budget proposes:

- $625.8 million ($5 million increase) for the Pennsylvania State System of Higher Education (PASSHE)

- The appropriation is level-funded this year, but $5 million would be newly available to the system due to the proposed discontinuation of a one-time payment made to Cheyney University in 2025/26 for an enhanced transfer and workforce development partnership with the Community College of Philadelphia.

- In 2025/26, due in part to level state funding, the PASSHE Board of Governors approved a 3.6% tuition increase after seven consecutive years of frozen tuition.

- Flat funding for Community Colleges for a total of $277.3 million

- Flat funding for the Community College Capital Fund

- Flat funding for Thaddeus Stevens College of Technology for a total of $23.6 million

PHEAA’s flagship program is the State Grant Program, which provides needs-based financial aid to Pennsylvania students that attend an approved postsecondary institution. The 2026/27 budget proposal includes a slight increase to maintain the maximum grant award level at $5,750.

The 2026/27 budget proposal also includes $32.5 million to level-fund the recently created Grow PA scholarship following last year’s 30% funding increase to the program. Grow PA provides $5,000 grants to in-state students earning degrees related to in-demand occupations. After graduation, Grow PA scholarship recipients must live and work in PA for one year for each grant award received or return the funds.

The Governor also proposed a $5 million increase for $35 million in total funding for student teacher stipends. Grant amounts are $10,000 for student teachers and $2,500 for cooperating mentor teachers.

| Student Teacher Support Program |

2024-25 |

Estimated

2025-26 |

| Appropriated Funds1 |

$30,000,000 |

$30,000,000 |

| Student Teacher Applicants |

4,222 |

3,578 |

| Selected Student Teacher Applicants |

2,164 |

2,348 |

| Estimated Award Volume to Student Teachers |

$21,640,000 |

$23,480,000 |

| Estimated Award Volume to Cooperating Teachers |

$5,410,000 |

$5,870,000 |

| Student Teachers that Did Not Receive an Award |

2,058 |

1,230 |

| 1The $10 million appropriated in 2023-24 and the $20 million appropriated in 2024-25 were combined and distributed in 2024-25 due to the delayed passage of Act 33 of 2023. |

| Notes: PHEAA has not implemented the $5,000 supplement for student teachers working in high vacancy schools. An equitable method for identifying schools that either attract few student teachers or have a high rate of open teaching positions is still being evaluated. Award volumes for 2024-25 are still be being reconciled, and award volumes for 2025-26 are estimated as of 12/9/25. It is anticipated that there will be more selected applicants for 2025-26 due to the availability of carryover funds from 2024-25 as the result of 2024-25 selected applicants being determined ineligible late in the award year. |

The 2026/27 budget proposal brings forward several budget changes and new initiatives. Those changes include a total increase of eight positions and affect the following areas:

- Commonwealth Office of Digital Experience - $14.56 million total

- Includes a $3.7 million initiative to support the commonwealth’s permitting activities across agencies

- Enhanced Enterprise Cybersecurity - $10 million total; new state appropriation

- In 2025/26, $10 million was transferred for Enhanced Enterprise Cybersecurity from Enterprise and Technology (funded via executive authorization)

- Office of the Budget - $27.5 million total

- Including a $380,000 initiative for capital investment in critical infrastructure

The 2026/27 budget proposal includes an overall supplemental increase to the General Fund request for FY 2025/26 for the Department of Human Services (DHS).

The proposed supplemental increase to DHS appropriations totals $410 million, with $391 million of this increase related to increased projections of utilization, caseloads and enrollments anticipated through June 2026 for the Medical Assistance managed care program.

This supplemental increase is offset by reductions in appropriations, including a $35.5 million supplemental decrease, resulting in a net increase of $374.5 million in General Fund appropriations for 2025/26.

The governor’s budget plan includes $21.9 billion ($1.3 billion or 6.6% increase) for FY 2026/27 for Human Services programs. This is an increase of $1.3 billion, or 6.6%, over 2025/26. The increase is driven primarily by the following categories:

- The impact of changes in federal funding,

- Costs to maintain the current programs, and

- Program initiatives.

American Rescue Plan Act Funding (ARPA) – Medical Assistance

The American Rescue Plan Act provided a temporary 10% additional Federal Medical Assistance Percentage (FMAP) for MA Home and Community-Based Services (HCBS) between April 1, 2021, and March 31, 2022. The federal government required that any state savings from the temporary FMAP increase must be used to implement programs that enhance, expand, or strengthen the HCBS services available under the MA program. This federal funding had to be spent by June 30, 2026. As a result, there is an increase of $17.8 million to General Funds to continue funding for initiatives that had been funded in full or in part through this federal funding.

Federal Medical Assistance Percentage (FMAP)

Under the formula in the Social Security Act, Pennsylvania’s regular FMAP will increase effective October 1, 2026, from 56.06% to 57.41%. As this increase takes effect on October 1, 2026, the governor’s executive budget uses a blended rate to account for the fact that the July to September 2026 quarter will have a lower FMAP. This blended rate will increase from 55.82% in FY 2025/26 to 57.07% in FY2026/27. State savings due to the higher regular FMAP are estimated to be $565.7 million.

Supplemental Nutrition Assistance Program (SNAP) Administrative Costs

The 2025/2026 House Resolution 1 of the 119th United States Congress (H.R. 1), known as the One Big Beautiful Bill Act (“OBBBA”), was signed into law on July 4, 2025. Based on the Act, the federal share of administrative costs associated with the Supplemental Nutrition Assistance Program (SNAP) will decrease from 50% to 25% effective October 1, 2026. This means that the state share of administrative costs will increase from 50% to 75%. The impact of decrease in federal share results in an increase to state General Funds of $87 million over the prior fiscal year.

Rural Health Transformation Plan Funding

The federal funding impact of changes to the Medical Assistance program are expected to have a significant impact on rural hospitals and health systems. H.R. 1 included $10 billion annually for the next five years ($50 billion total) to support health care in rural areas nationally. As was required by the federal government, Pennsylvania submitted a detailed Rural Health Transformation Plan (RHTP)[1] which was subsequently approved. In addition to approving the RHTP, Pennsylvania was awarded $193 million in federal funds for the first year of this Plan. This funding will be used to support the initiatives noted within the approved Plan.[2]

MA Managed Care Rates

The MA - Capitation appropriation provides funding for the MA managed care program for physical and behavioral health services, also known as the HealthChoices program. The 2026/27 proposed budget for this program assumes an increase in state General Funds of $566.1 million over FY 2025/26 for a total proposed appropriation of $4.4 billion. This increase includes $374.1 million for changes to the number of individuals that are eligible for the physical health and behavioral health MA managed care programs and changes to the rates paid by DHS to the participating MA managed care organizations.

The MA – Community HealthChoices appropriation provides funding to the MA managed care program that provides a wide array of services to low-income older adults, low-income individuals with qualifying disabilities, or individuals that are eligible for both Medicare and Medical Assistance programs. The 2026/27 proposed budget also includes an increase of $502.7 million over FY 2025/26 to continue the current program for a total proposed appropriation of $7.2 billion. This increase includes $754 million to continue the current program which includes changes to the number of individuals that are eligible for the program and for changes to the rates paid by DHS to the participating MA managed care organizations. The increase in enrollment and rates is partially offset by the increase in FMAP for this program.

Intellectual Disabilities – Community Waiver Program

The 2026/27 budget proposal includes a proposed appropriation of $2.8 billion, which includes an increase of $76.8 million over the prior fiscal year.

The governor’s proposed budget for 2026/27 includes several new initiatives for Human Services programs.

211 Communications

The proposed budget includes a $250,000 increase for 211 Communications for a total proposed appropriation of $1 million. This increase will provide funding for 211 Communication network to address the increased need for individuals to connect to available resources during their time of need.

Medical Assistance – Reentry

The budget proposes an increase to state General Funds for the MA – Fee-for-Service appropriation of $900,000 to provide Medical Assistance coverage for individuals that are expected to reenter the community after incarceration and to provide DHS with funds to provide these individuals with Medical Assistance services 90 days prior to the date of their release.

Medical Assistance – Housing

The 2026/27 budget proposes an increase to state General Funds for the MA – Fee-for-Service appropriation of $1 million to increase services under the Medical Assistance program that will connect eligible medically compromised individuals with stable housing and improve their overall health.

Medical Assistance – Food Insecurity

The governor’s proposed budget includes an increase to state General Funds for the MA – Fee-for-Service appropriation of $900,000 which will support the Food is Medicine initiative. This initiative will provide food and nutrition for certain eligible individuals experiencing food insecurity that also have diet sensitive medical conditions.

Medical Assistance - Long-Term Care Managed Care

The governor’s proposed budget includes an increase of $3.6 million in state General Funds to add 300 spots in the Living Independence for the Elderly (LIFE) program.

Mental Health Services

The governor’s budget proposes an increase of $7.3 million to maintain diversion and discharge programs for individuals with mental illness currently in the criminal justice system, an increase of $3.2 million to maintain expansion of community-based services from the prior fiscal year, and an increase of $5 million to maintain walk-in mental health crisis stabilization centers.

Mental Health - 988 Network Services & Additional Community Services

In addition to the county-based mental health services, the 2026/27 budget proposes an increase of $10 million over the prior year to provide support for the 988 network and an increase of $3.2 million to transition 40 individuals currently residing in the state psychiatric hospitals into the community.

ChildLine – Added Positions

The budget proposes an increase of $658,000 to the General Government Operations appropriation to add 20 new positions for staff of the ChildLine hotline. This hotline allows individuals to report concerns about a child’s safety and well-being.

Subsidized Child Care – Minimum Wage

The governor’s executive budget includes an increase of $2.7 million to provide an increase in the minimum wage for child care workers.

Child Care Recruitment and Retention

In addition to increasing the minimum wage for child care workers, the proposed 2026/27 budget includes an increase of $10 million for the Child Care Recruitment and Retention appropriation. This funding in this appropriations funds grants that provide retention and recruitment payments to eligible child care workers employed by licensed childcare centers that have an agreement to provide services to children in the commonwealth’s subsidized child care program.

The governor’s proposed 2026/27 budget includes $1.5 billion for County Child Welfare appropriation which is flat funded to the appropriated amount for FY 2025/26. In addition to state General Funds, the County Child Welfare program also receives appropriations from federal funds. The combined total state and federal appropriations total $2.1 billion.

The proposed budget includes slight decrease in funding for the Youth Development Institutions and Forestry Camps appropriation of $367,000 for a proposed appropriation of $145.6 million.

The governor’s executive budget maintains funding at the same overall level as the prior year for:

- MA – Hospital Burn Centers - $4.4 million

- MA – Obstetric and Neonatal Services - $10.7 million

- MA – Trauma Centers - $8.7 million

- MA – Academic Medical Centers - $24.7 million

- Community-Based Family Centers - $34.6 million

- Expanded Services for Women - $8.3 million

- Nurse Family Partnership - $13.9 million

- Domestic Violence - $23.1 million

- Rape Crisis - $12.2 million

- Human Services Development Fund - $13.5 million

- Legal Services - $6.7 million

- Homeless Assistance - $23.5 million

- Services for the Visionally Impaired - $4.7 million

The proposed budget reflects a transfer of $6.6 million in state General Funds from the MA – Physician Practice Plans appropriation to the MA – Capitation appropriation due to a change in the payment methodology.

The proposed budget does not include funding for the Health Program Assistance Services appropriation which is a decrease to state General Funds of $32.6 million.

The 2026/27 executive budget proposes $260.3 million, a $714,000 or 0.3% increase over the prior fiscal year, in state General Funds. The governor’s budget proposes to increase General Government Operations (GGO) by $3.4 million, or 10.5%, for a total of $35.4 million. This increase includes $2 million to maintain the Pennsylvania Immunization Electronic Registration System.

The governor’s budget proposes to increase Health Promotion and Disease Prevention appropriation by $2.5 million, or 50%, over fiscal year 2025/26, for a total of $7.5 million to expand support for maternal health programs. The governor’s budget continues to provide funding for menstrual hygiene products at no cost to students in schools.

The governor’s budget proposes to increase the following appropriations over FY 2025/26 to continue the current programs:

| ($ amounts in thousands) |

2025/26

Available |

2026/27

Budget |

$ Change Over 25/26 |

% Change Over 25/26 |

| Quality Assurance |

$ 31,663 |

$ 33,522 |

$ 1,859 |

6% |

| Health Innovation |

$ 798 |

$ 813 |

$ 15 |

2% |

| State Laboratory |

$ 5,935 |

$ 7,232 |

$ 1,297 |

22% |

| State Health Care Centers |

$ 32,957 |

$ 35,188 |

$ 2,231 |

7% |

| Sexually Transmitted Disease Screening and Treatment |

$ 1,822 |

$ 2,154 |

$ 332 |

18% |

| Achieving Better Care - MAP Administration |

$ 3,117 |

$ 3,148 |

$ 31 |

1% |

| Local Health Departments |

$ 35,854 |

$ 36,265 |

$ 411 |

1% |

| Tuberculosis Screening and Treatment |

$ 1,047 |

$ 1,084 |

$ 37 |

4% |

The governor’s executive budget proposes to eliminate the following appropriation:

- Bio-Technology Research ($11.3 million, program elimination)

The governor proposes level funding for the many disease-specific appropriations. The governor’s executive budget maintains funding at the same overall level as the prior year for:

- Primary Health Care Practitioner - $8.3 million

- Community-Based Health Center Subsidy - $2 million

- Newborn Screening - $7.3 million

- Cancer Screening Services - $2.6 million

- AIDS Programs and Special Pharmaceutical Services - $10.4 million

- Regional Cancer Institutes - $2 million

- School District Health Services - $37.6 million

- Local Health – Environmental - $2.7 million

- Maternal and Child Health Services - $1.4 million

- Diabetes programs - $112,000

- Renal Dialysis - $6.7 million

- Services for Children with Special Needs - $1.7 million

- Adult Cystic Fibrosis and Other Chronic Respiratory Illness - $795,000

- Cooley’s Anemia - $106,000

- Hemophilia - $1 million

- Lupus - $106,000

- Sickle Cell - $1.3 million

- Lyme Disease - $3.2 million

- Regional Poison Control Centers - $742,000

- Trauma Prevention - $488,000

- Epilepsy Support Services - $583,000

- Tourette’s Syndrome - $159,000

- Amyotrophic Lateral Sclerosis Support Services - $1.5 million

- Neurodegenerative Disease Research - $5 million

The 2026/27 executive budget proposes $48.4 million, $30,000 increase over the prior fiscal year, in state General Funds. Funding available for the Assistance to Drug and Alcohol appropriation is level funded to FY 2025/26 levels at $44.7 million.

- General Government Operations - $3.6 million

- Assistance to Drug and Alcohol Programs - $44.7 million

The 2026/27 executive budget proposal includes $20.9 million for the General Government Operations appropriation, which includes an increase of $3.4 million for the Department of Aging. This increase allows the Department of Aging to continue its efforts in improving its oversight of the local Area Agencies on Aging (AAA) using the new Comprehensive Agency Performance Evaluation (CAPE) tool. Results from CAPE are available on the Department’s website and allow the public to view the performance of their local AAA. Additionally, this increase includes $850,000 to expand evaluation and technical assistance to the AAA for CAPE assessment and monitoring, and $150,000 to modernize data collection and program performance for information reported by the AAAs.

The governor’s executive budget includes $6 million for the Aging Our Way, PA appropriation, which includes an increase of $3 million over FY 2025/26. This appropriation funds initiatives identified within the Aging Our Way, PA plan which proposed to transform the infrastructure and coordination of services for older adults in the commonwealth. This funding will be used by the Department of Aging to modernize PA Link, which serves as the commonwealth’s Aging and Disability Resource Center.

There is an increase in the transfer from Lottery Funds to the Pharmaceutical Assistance Fund of $5 million over the prior year for a total transfer of $155 million. This transfer of funds to the Pharmaceutical Assistance Fund is used for the Pharmaceutical Assistance Contract for the Elderly (PACE) and the PACE Needs Enhancement Tier (PACENET) programs.

There is a proposed increase of $707,000 for the PENNCARE appropriation over FY 2025/26 for a total proposed appropriation of $299.3 million for continuation of the current PENNCARE program. The PENNCARE appropriation funds the OPTIONS program, which provides home and community-based services to qualified older adults so that they can continue to live in their homes.

Finally, the 2026/27 budget proposes a decrease to Lottery Funds of $15 million for the MA-Community HealthChoices appropriation, and $7.2 million for Property Tax and Rent Assistance appropriations. Resulting in an overall decrease to the Lottery Funds of $10.1 million over 2025/26.

| 2026/27 Proposed Lottery Fund Expenditures for Senior Programs |

| ($ amounts in millions) |

| Agency / Expenditure |

Available |

Exec Budget |

Exec Budget less Avail |

| 2025/26 |

2026/27 |

$ Chng |

% Chng |

| Department of Aging |

|

|

|

|

| General Gov't Operations |

$ 17,546.0 |

$ 20,930.0 |

$ 3,384.0 |

19.3% |

| PENNCARE |

$ 298,555.0 |

$ 299,262.0 |

$ 707.0 |

0.2% |

| Aging Our Way, PA |

$ 2,950.0 |

$ 5,950.0 |

$ 3,000.0 |

101.7% |

| Transfer to Pharmaceutical Assistance Fund |

$ 150,000.0 |

$ 155,000.0 |

$ 5,000.0 |

3.3% |

| Pre-Admission Assessment |

$ 8,750.0 |

$ 8,750.0 |

$ - |

0.0% |

| Caregiver Support |

$ 12,103.0 |

$ 12,103.0 |

$ - |

0.0% |

| Grants for Senior Centers |

$ 3,000.0 |

$ 3,000.0 |

$ - |

0.0% |

| Alzheimer's Outreach |

$ 0.3 |

$ 0.3 |

$ - |

0.0% |

| Dept of Human Services |

|

|

|

|

| Medical Assistance - Community HealthChoices |

$ 454,966.0 |

$ 440,000.0 |

$ (14,966.0) |

-3.3% |

| Medical Assistance - Transportation Services |

$ 4,000.0 |

$ 4,000.0 |

$ - |

0.0% |

| Department of Revenue |

|

|

|

|

| Property Tax and Rent Assistance |

$ 323,700.0 |

$ 316,500.0 |

$ (7,200.0) |

-2.2% |

| Department of Transportation |

|

|

|

|

| Transfer to Public Transportation Trust Fund |

$ 95,907.0 |

$ 95,907.0 |

$ - |

0% |

| Older Pennsylvanians Shared Rides |

$ 75,000.0 |

$ 75,000.0 |

$ - |

0% |

| Total Expenditures |

$ 1,446,477.3 |

$ 1,436,402.3 |

$ (10,075.0) |

-0.7% |

| ($ amounts in thousands) |

2025/26 |

2026/27 |

$ Change |

% Change |

| Attorney General |

$ 151,349 |

$ 171,509 |

$ 20,160 |

13.3% |

| Auditor General |

$ 46,694 |

$ 47,613 |

$ 919 |

2.0% |

| Treasury (excl. debt service costs) |

$ 57,806 |

$ 59,248 |

$ 1,442 |

2.5% |

Within the Office of Attorney General (OAG), state General Government Operations funding would increase by $1.2 million, or 2.0 percent, to $58.9 million.

| Proposed Office of Attorney General Appropriation Changes |

| ($ amounts in thousands) |

2025/26 |

2026/27 |

$ Change |

% Change |

| General Government Operations |

$ 57,759 |

$ 58,914 |

$ 1,155 |

2.0% |

| Drug Law Enforcement |

$ 62,066 |

$ 63,307 |

$ 1,241 |

2.0% |

| Supplemental Law Enforcement Support |

|

$ 15,233 |

$ 15,233 |

- |

| Joint Local-State Firearm Task Force |

$ 13,969 |

$ 14,367 |

$ 398 |

2.8% |

| Child Predator Interception |

$ 7,184 |

$ 7,887 |

$ 703 |

9.8% |

| Tobacco Law Enforcement |

$ 1,746 |

$ 2,162 |

$ 416 |

23.8% |

| School Safety |

$ 2,640 |

$ 2,639 |

$ (1) |

0.0% |

| Human Trafficking Enforcement and Prevention |

$ 1,750 |

$ 2,377 |

$ 627 |

35.8% |

| Organized Retail Theft Prevention |

$ 2,720 |

$ 3,108 |

$ 388 |

14.3% |

New for 2026/27 is a proposed Supplemental Law Enforcement Support appropriation of $15.2 million. The purpose of this new appropriation is to replace non-recurring revenues for the OAG.

The executive budget proposes increasing the Drug Law Enforcement appropriation by $1.2 million, or 2.0 percent, to $63.3 million. Funding for the Joint Local-State Firearm Task Force, a collaborative effort program to reduce gun crime in Philadelphia and Pittsburgh, would see its appropriation increase by $398,000, or 2.8 percent, to $14.4 million. The Child Predator Interception and Human Trafficking Enforcement and Prevention appropriations were both increased by $703,000 (9.8 percent) and $627,000 (35.8 percent) respectively. The budget also increased funding for the Organized Retail Theft Prevention appropriation by $388,000 (14.3 percent). The Tobacco Law Enforcement appropriation was increased by $416,000 or 23.8 percent. These increases were all cost-to-carry increases to continue the current programs.

The School Safety appropriation, which provides for the Safe2Say Something program, was essentially flat-funded.

The executive budget decreases net state funding to the Department of Military and Veterans Affairs by $11.8 million, or 5.4%, to a total of $205.3 million. The $15.7 million proposed decrease in state funding for the six veterans’ homes run by the department is possible due to increases in Federal funding. Funding for the department’s General Government Operations is increased by $2.2 million to $41.2 million.

The governor’s executive budget also proposes increasing funding for Armory Maintenance and Repair by $720,000 to continue the current program while ensuring continued solvency in the State Treasury Armory Fund.

The budget also includes small increases for the Keystone State ChalleNGe Academy ($214,000 or 8.4%), Education of Veterans Children ($50,000 or 13.3%), the Amputee and Paralyzed Veterans Pension ($465,000 or 10.2%), Civil Air Patrol ($20,000 or 20%), Veterans Outreach Services ($99,000 or 2.1%), and the Special State Duty appropriation ($130,000 or 185.7%).

The budget proposes a supplemental appropriation for the Education of Veterans Children appropriation for fiscal year 2024/25 of $25,000. This appropriation provides an educational gratuity not to exceed $500 per semester to children of veterans who are 100% disabled.

The 2026/27 executive budget proposal reduces state General Fund spending in the Department of Community and Economic Development (DCED) from $514.2 million to $277.8 million. This is largely done through the elimination of appropriations that are negotiated through the budget process.

The FY 2026/27 budget proposes a $1 million increase to PA First, DCED’s comprehensive program aimed at job creation and retention, to continue providing adaptive equipment and opportunities for children with special needs as well as an additional $9 million increase to provide further financial assistance to increase economic investment.

Previously funded within PA First, the budget proposes to make the Workforce and Economic Development Network (WEDnetPA) program its own appropriation. In addition to breaking out the $10 million for WEDnetPA, a $2.5 million increase is proposed to increase assistance to employers for incumbent worker training.

| |

2025/261 |

Proposed

2026/272 |

YOY Change |

| PA First |

$28,000,000 |

$38,000,000 |

$10,000,000 |

36% |

| WEDnetPA |

$10,000,000 |

$12,500,000 |

$2,500,000 |

25% |

| PA First + WEDnetPA Total: |

$38,000,000 |

$50,500,000 |

$12,500,000 |

33% |

| 1 $38 million total appropriated as one appropriation under "Pennsylvania First" |

| 2 $50.5 million proposed as two appropriations: "Pennsylvania First" and "Workforce and Economic Development Network" |

The executive budget includes a $2 million increase for the Foundations in Industry appropriation for a total proposed appropriation of $5 million which will support internships at Pennsylvania companies. It also includes a $35.735 million appropriation for PA SITES debt service, which is an increase of $15.377 million over FY 2025/26.

Multiple appropriations receive increases to continue current operations. These increases include $464,000 for a total of $9.32 million for BusinessPA, $211,000 for a total of $20.211 million for Main Street Matters, $51,000 for a total of $20.051 million for Historically Disadvantaged Business Assistance, $160,000 for a total of $4.984 million for the Office of Open Records and $471,000 for a total of $6.04 million for the Center for Local Government Services.

The 2026/27 executive budget proposal increases state General Fund spending in the Department of State (DOS) from $43.163 million to $44.434 million. This includes a $1.4 million initiative to increase voter education and direct outreach, as well as a $1.3 million increase associated with advertising and publishing proposed constitutional amendments.

These increases are offset by decreases in DOS’ General Government Operations appropriation, as well as in Lobbying Disclosure, County Election Expenses, the Statewide Uniform Registry of Electors, and Election Code Debt Service.

The governor’s budget proposes $3.4 billion of state general fund dollars for the Department of Corrections, an increase of $142.5 million, or 4.4% over 2025/26. The General Government Operations appropriation increased by $1 million, or 2.4% to continue current programming.

| Major Department of Corrections Appropriations |

| ($ amounts in thousands) |

2025/26 |

2026/27 |

$ Change |

% Change |

| General Government Operations |

$ 41,769 |

$ 42,764 |

$ 995 |

2.4% |

| Medical Care |

$ 409,089 |

$ 448,432 |

$ 39,343 |

9.6% |

| Correctional Education and Training |

$ 50,999 |

$ 52,510 |

$ 1,511 |

3.0% |

| State Correctional Institutions |

$ 2,513,629 |

$ 2,616,893 |

$ 103,264 |

4.1% |

| State Field Supervision |

$ 191,325 |

$ 188,218 |

$ (3,107) |

-1.6% |

| Pennsylvania Parole Board |

$ 13,598 |

$ 14,442 |

$ 844 |

6.2% |

| Sexual Offenders Assessment Board |

$ 8,621 |

$ 8,364 |

$ (257) |

-3.0% |

| Board of Pardons |

$ 3,122 |

$ 2,823 |

$ (299) |

-9.6% |

| Office of Victim Advocate |

$ 4,049 |

$ 4,280 |

$ 231 |

5.7% |

The executive budget proposal contains a net $103.3 million increase for the Department of Corrections’ largest appropriation, State Correctional Institutions (SCIs). The 4.1% increase would increase the appropriation to $2.6 billion for 2026/27. Included in this increase is $10.2 million to replace federal funding received in 2025/26 for COVID-19 response and $195 million to continue current programming. The closures of SCI Rockview, the Quehanna Boot Camp, and two community corrections centers resulted in anticipated savings of $102 million in 2026/27.

The Medical Care and Correctional Education and Training appropriations were also increased in the executive budget by $39.3 million (9.6%) and $1.5 million (3.0%) respectively. The Office of Victim Advocate received a $231,000 or 5.7% increase. The executive budget proposed decreases in the appropriations for State Field Supervision ($3.1 million or 1.6%), the Sexual Offenders Assessment Board ($257,000 or 3%), and the Board of Pardons ($299,000 or 9.6%).

The budget also proposes changing the Rockview Farm Program executive authorization to the DOC Farm Program.

The governor’s budget proposal provides $1.82 billion for the Pennsylvania State Police (PSP), a $118.5 million, or 6.6% increase from 2025/26. Most of this increase is to continue the current programs of the state police, including a $102 million increase for their General Government Operations, a $6.3 million increase for the Law Enforcement Information Technology appropriation, and a $2.6 million increase for the Patrol Vehicles appropriation. Recent increases in the Patrol Vehicle appropriation have allowed the PSP to reduce the number of vehicles in their fleet that are over 100,000 miles by 40%. The budget also includes $2.3 million for adult use cannabis enforcement and expungement, funded by the proposed Adult Use Cannabis Tax.

The executive budget proposes a pause in what has been a multi-year effort to reduce the reliance of the PSP on the Motor License Fund (MLF). This budget sets expenditures to the PSP from the MLF at $250 million, the same as fiscal years 2024/25 and 2025/26. The entirety of the $250 million is for general government operations (GGO) of the state police, which continue to be funded by the General Fund and the Motor License Fund.

The governor’s executive budget includes $16.2 million for four new cadet classes with the goal of hiring and training 380 new state troopers and calls for the complete elimination of the current statutory cap which limits the number of PSP troopers.

The 2026/27 budget proposes a $4.3 million appropriation to supplement the gun check fees which are used to support the Pennsylvania Instant Check System (PICS).

The governor’s executive budget proposal provides $41 million in state General Funds for the Pennsylvania Emergency Management Agency (PEMA) and Office of the State Fire Commissioner. This is a $9.1 million, or 29% increase from the prior fiscal year.

The budget proposal increases PEMA’s General Government Operations funding by $2.1 million, or 13%, over FY 2025/26 to continue the current program and maintains $4.8 million in General Government Operations funding for the Office of the State Fire Commissioner.

The budget proposal includes an increase of $10 million for Disaster Relief and an increase of $3 million for the Hazard Mitigation appropriations which represent the state match needed to support federally funded projects. Both appropriations were not funded in the 2025/26 budget.

Funding is maintained at the same level as the prior year for following appropriations:

- State Disaster Assistance - $5 million

- Red Cross Extended Care Program - $350,000

- Search and Rescue - $250,000

- Firefighters Memorial Flags - $10,000

The proposed budget eliminates the Urban Search and Rescue appropriation which results in a decrease to state General Funds of $6 million from the prior year.

The 2026/27 executive budget proposes spending an additional $30 million to provide supplemental grants to Fire Companies. This increase would be funded by the Property Tax Relief Fund and not by state General Funds. Additionally, the proposed budget includes $377.8 million for Emergency Services Grants which is funded by the 911 Fund. This is a $7.4 million decrease over the prior fiscal year.

The governor’s executive budget proposes $26.6 million for the General Government Operations (GGO) of the Pennsylvania Commission on Crime and Delinquency (PCCD), a $1.3 million or 5.1% increase to continue current programming.

The governor's budget proposal appropriates $57.2 million for a new appropriation, County Probation and Reentry Services, to consolidate multiple county-based funding streams for parole, adult probation, re-entry, and jail-based medication treatment. In 2025/26, County probation is currently supported through the Improvement of Adult Probation Services and Intermediate Punishment Treatment appropriations ($16.2 million and $18.2 million respectively) and disbursements from the Justice Reinvestment (JRI) Fund ($22.6 million) for a total of $56.9 million. The proposed County Probation and Reentry Services appropriation combines the Improvement of Adult Probation Services and Intermediate Punishment Treatment Programs appropriations and the JRI County Probation Grant funding stream which statutorily ended in 2025/26.

Justice Reinvestment Initiative savings (Acts 114 and 115 of 2019), which funded the County Probation Grants, were generated by implementing short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations and are used to fund county probation grants. Deposits and disbursements began in 2021/22 based on a percentage of program savings generated in the prior year and continued through 2025/26. The executive budget proposes to continue funding these grants from the General Fund.

Act 44 of 2018 established the School Safety and Security Committee for the administration of the School Safety and Security Grant Program. Act 33 of 2023 transferred the administration of the Targeted School Safety Grants for Nonpublic Schools and School Entities Program to PCCD. The executive budget proposes a $111 million transfer into the School Safety and Security Fund, which includes $100 million appropriated under the Dept. of Education and $11 million appropriated to PCCD (decreased from $20.7 million in 2025/26) for Targeted School Safety Grants for Nonpublic Schools and School Entities.

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in 2026/27.

The executive budget provides $68.4 million for Violence Intervention and Prevention grants to support community-led gun violence prevention efforts and the Building Opportunity through Out of School Time (BOOST) program, a $6.2 million increase from 2025/26. $1 million of the increase is meant to expand the BOOST program for a total of $12.5 million. The BOOST program received $11.5 million in 2025/26. The remaining $5.2 million is for additional support for community-led gun violence prevention efforts, for a total of $55.7 million.

Using funds generated by the legalization of adult use cannabis, the budget proposes to invest $10 million in restorative justice initiatives.

The budget continues the $10 million transfer to the Nonprofit Security Grant Fund and the $7.5 million in funding for indigent defense. Indigent defense was first funded in Pennsylvania in the 2023/24 budget at $7.5 million. Funding for indigent defense will continue to flow through PCCD and the Criminal Justice Advisory Committee.

The governor’s executive budget proposes a $370,000 increase for the Juvenile Court Judges’ Commission (JCJC). The JCJC is responsible for advising juvenile court judges regarding the development and improvement of juvenile probation services throughout the commonwealth.

The governor’s executive budget provides $500.2 million from the state General Fund for the Judiciary, a 10.3 percent or $46.7 million cost-to-carry increase from 2025/26.

The budget proposes a permanent suspension of the Unified Judiciary System transfer to the School Safety and Security Fund from the Judicial Computer System.

The 2026/27 executive budget proposes a reduction in state General Fund spending of $3.4 million or 1.4% to $249.9 million down from $253.4 million. This proposal strengthens the Department’s capacity while simultaneously supporting the agricultural community and addressing food insecurity. Specifically, the 2026/27 budget maintains the significant increases made to the Farmer’s Market Food Coupons ($9.57 million total) and for the State Food Purchase Program ($30.68 million total) during the prior fiscal year.

The 2026/27 budget proposal includes a number of initiatives:

- Agricultural Preparedness and Response

- Total appropriation of $11 million, or a $2 million increase, to increase testing capacity in western Pennsylvania

- Agricultural Innovation Development

- Increase of $9 million for a total appropriation of $19 million

- $7 million for increased support and attraction of innovative agricultural businesses

- The program helps farmers and other agriculture businesses implement new agricultural technologies, conservation, and renewable energy innovations – expanding their potential to generate profits, enrich soil and water resources, and produce energy on the farm.

- $2 million for a county-based digester pilot program

Lastly, the 2026/27 budget proposal includes a transfer from the General Fund to the Race Horse Development Trust Fund to provide funding for the Animal Health and Diagnostic Commission ($5.35 million), Payments to Pennsylvania Fairs ($4 million), and the Pennsylvania Veterinary Lab ($5.3 million).

The 2026/27 executive budget proposal includes an increase in state General Fund spending of $56.1 million or 44.3% to $182.8 million up from $126.7 million in 2025/26. Nearly all of the increase is a result of changes within the agency’s three major appropriations: General Government Operations, State Parks Operations, and State Forest Operations. Funding in FY 2025/26 relied heavily on available revenues in the Oil and Gas Lease Fund (OGLF). Because most OGLF resources were exhausted in the enacted budget, there is an increased reliance on the General Fund for these appropriations. In this fiscal year, the Oil and Gas Lease Fund use decreases to $89 million from $130.1 million in 2025/26. When combined, GF and OGLF support for DCNR’s three major appropriations is increased by $14.4 million or 6.1% over 2025/26.

The General Fund changes include:

- General Government Operations - $30.75 million total

- $6.8 million or 28.5% increase

- State Parks Operations – $76.9 million total

- $25.67 million or 50.1% increase

- Includes the addition of 4 new positions

- State Forest Operations - $55.7 million total

- $23.06 million or 70.7% increase

| 2026/27 DCNR Major Appropriations Summary |

| General Fund and Oil & Gas Lease Fund Comparison |

| ($ amounts in thousands) |

| Approp/FY |

Available |

Exec Budget |

Exec Budget less Avail |

| 2025/26 |

2026/27 |

$ Chng |

% Chng |

| General Gov't Operations (GGO) |

| GF |

$ 23,927 |

$ 30,755 |

$ 6,828 |

28.5% |

| OGLF |

$ 32,943 |

$ 28,500 |

$ (4,443) |

-13.5% |

| GGO Subtotal |

$ 56,870 |

$ 59,255 |

$ 2,385 |

4.2% |

| State Parks Operations (SPO) |

| GF |

$ 51,236 |

$ 76,909 |

$ 25,673 |

50.1% |

| OGLF |

$ 52,068 |

$ 32,000 |

$ (20,068) |

-38.5% |

| SPO Subtotal |

$ 103,304 |

$ 108,909 |

$ 5,605 |

5.4% |

| State Forests Operations (SFO) |

| GF |

$ 32,639 |

$ 55,708 |

$ 23,069 |

70.7% |

| OGLF |

$ 45,145 |

$ 28,500 |

$ (16,645) |

-36.9% |

| SFO Subtotal |

$ 77,784 |

$ 84,208 |

$ 6,424 |

8.3% |

| General Fund Subtotal |

$ 107,802 |

$ 163,372 |

$ 55,570 |

51.5% |

| Oil & Gas Lease Fund Subtotal |

$ 130,156 |

$ 89,000 |

$ (41,156) |

-31.6% |

| Total |

$ 237,958 |

$ 252,372 |

$ 14,414 |

6.1% |

The governor’s 2026/27 budget proposes $294.06 million in state General Fund spending, an increase of $44.4 million or 17.8% over 2025/26. Proposed changes within the agency’s major appropriations include:

- General Government Operations – $32.77 million total

- $850,000 increase or 2.6%

- Environmental Program Management - $48.01 million total

- $2.53 million increase or 5.5%

- Environmental Protection Operations – $137.78 million total

Notably, this budget proposal invests $37.5 million in funding to improve our waters, help with oversight of the Oil & Gas Program, clean up hazardous sites, and support our conservation districts. More specifically:

- Chesapeake Bay Agricultural Resource Abatement - $6.39 million total

- Transfer to Well Plugging Account - $19.03 million total

- $16.03 million increase or 534%

- Transfer to Hazardous Sites Clean Fund - $20 million total, no transfer in 2025/26

- Transfer to Conservation District Fund - $8.49 million total

The 2026/27 executive budget proposal includes $8.08 billion in state funds for the Pennsylvania Department of Transportation (PennDOT), reflecting a decrease of $513.2 million (5.9%) from the prior year. PennDOT finances its operations primarily through four funds—the Motor License Fund (MLF), Public Transportation Trust Fund (PTTF), Public Transportation Assistance Fund (PTAF), and the Multimodal Transportation Fund.

The decrease is not the result of a single programmatic cut. To identify the drivers of this decline, it is necessary to examine changes in the agency’s largest funding categories, including the Highway and Bridge Improvement Program (Highway and Bridge construction), State Highway Maintenance, the Local Highway and Bridge Maintenance, Mass Transit Grants Program, and the Multimodal program.

- Highway and Bridge Improvement Program - $3.59 billion total (state/federal)

- State Highway and Bridge Improvement - $1.4 billion or $191.7 million decrease (11.8%)

- Federal Construction - $2.15 billion or $893,000 increase

- State Highway Maintenance - $1.98 billion in total or $960,000 increase

- Local Highway and Bridge Maintenance - $797.4 million in total or $14.88 million decrease (1.8%)

- Mass Transit Grants - $2.99 billion in total or $302.6 million decrease (9.18%)

- Multimodal Transportation - $233.09 million in total or $17.5 million decrease (7%)

Available funds in the Motor License Fund, the Public Transportation Trust Fund, and the Public Transportation Assistance Fund fluctuate as revenues are received, projects are completed, and new projects are started. As a result, cash flow availability dictates what can be spent at the time the executive budget is introduced and changes to the aforementioned programs are anticipated prior to finalizing the 2026/27 budget.

| 2026/27 PENNDOT EXECUTIVE BUDGET STATE FUNDS |

| ($ amounts in thousands) |

| ROADS & BRIDGES |

| |

Available |

Exec Budget |

Exec Budget less Avail |

| Area |

2025/26 |

2026/27 |

$ Chng |

% Chng |

| HWY CONSTRUCTION |

$ 1,360,294 |

$ 1,168,953 |

$ (191,341) |

-14.1% |

| BRIDGES |

$ 265,346 |

$ 264,910 |

$ (436) |

-0.2% |

| HWY & BRIDGE IMPROVEMENT |

$ 1,625,640 |

$ 1,433,863 |

$ (191,777) |

-11.8% |

| STATE HIGHWAY MAINTENANCE TOTAL |

$ 1,983,826 |

$ 1,984,786 |

$ 960 |

0.0% |

| LOCAL HIGHWAY & BRIDGE TOTAL |

$ 812,337 |

$ 797,451 |

$ (14,886) |

-1.8% |

| ROADS & BRIDGES |

$ 4,421,803 |

$ 4,216,100 |

$ (205,703) |

-4.65% |

| MASS TRASIT GRANTS |

$ 3,297,433 |

$ 2,994,832 |

$ (302,601) |

-9.18% |

| MULTIMODAL TRASNPORTATION |

$ 250,651 |

$ 233,097 |

$ (17,554) |

-7.00% |

| OTHER |

$ 631,266 |

$ 643,909 |

$ 12,643 |

2.00% |

| TOTAL STATE FUNDS |

$ 8,601,153 |

$ 8,087,938 |

$ (513,215) |

-5.97% |

The 2026/27 budget proposal includes an increase in the transfer of Sales & Use Tax (SUT) by 1.75% for a total transfer of 6.15% to the Public Transportation Trust Fund for FY 2027/28. Under current law (Act 89 of 2013), the transfer of SUT revenues deposited into the Public Transportation Trust Fund (PTTF) include two components:

- 4.4% transfer from SUT related to non-motor vehicle transactions; and

- 3.28% transfer from SUT related to motor vehicle transactions;

Based on current SUT estimates, the 2027/28 increase in the transfer of SUT to PTTF is projected to be $319.6 million.

The governor’s 2026/27 proposal included three initiatives in the Dept. of Labor and Industry:

- $1 million increase ($49.7 million total) for the Transfer to the Vocational Rehabilitation Fund

- $3.5 million increase ($6.3 million total) for Industry Partnerships

- $3.5 million increase – doubling last year’s investment -- for Schools-to-Work to grow partnerships between career and technical education students and employers through apprenticeships, workplace visits, and internships

The budget also calls for the department to retain more inspection fees to support elevator safety work.

The governor’s executive budget provides $60 million for the Historical and Museum Commission. $26.5 million of this amount is from the state General Fund. The executive budget proposal includes $24.5 million for General Government Operations, a 3.4%, or $865,000 decrease from 2025/26. The budget proposal includes a $1.9 million 2025/26 supplemental appropriation for the Historic Site Development executive authorization from the Keystone Recreation, Park, and Conservation Fund. The budget also includes a $2 million reduction in Cultural and Historical Support grants, which would bring total grant funding to $2 million, in line with the amount appropriated in FY 2023/24.

Though the Pennsylvania Housing Finance Agency (PHFA) does not receive a direct appropriation through the executive budget, the agency is the recipient of taxpayer dollars. The PHFA administers the Housing Affordability and Rehabilitation Enhancement Fund (PHARE). The PHARE program provides funding for affordable housing and receives an annual $5 million transfer from the Unconventional Gas Well Fund in addition to a transfer from the Realty Transfer Tax (RTT) based on the amount of RTT received annually.

The Tax Code for FY 2024/25 increased the transfer caps from the RTT to PHARE as follows:

- For FY 2025/26, a cap of $80 million

- For FY 2026/27, a cap of $90 million

- For FY 2027/28 and each fiscal year thereafter, a cap of $100 million

The 2026/27 executive budget utilizes funds from the Inflation Reduction Act (IRA), however it’s worth noting that the Trump Administration has frozen a number of programs and funding from the Act. In response to the freeze, there is currently ongoing litigation filed by the Shapiro Administration. The goal of the litigation is to unlock federal funds previously appropriated by Congress for Pennsylvania. The chart that follows highlights the projected IRA utilization in 2026/27.

| Inflation Reduction Act (IRA) |

| ($ amounts in millions) |

| Area |

Available |

Available |

| 2025/26 |

2026/27 |

| Community and Economic Development |

|

|

| IRA-Industrial Decarbonization |

$ 10.0 |

$ 10.0 |

| Environmental Protection |

|

|

| IRA-Solar for All |

$ 166.1 |

$ 166.1 |

| IRA-Coastal Zone Management |

$ 0.4 |

$ 0.4 |

| IRA-Energy Performance-Homes Program |

$ 135.0 |

$ 135.0 |

| IRA-Energy Performance-Electric Appliance |

$ 140.0 |

$ 140.0 |

| IRA-Clean Air Act Grant |

$ 30.3 |

$ 30.3 |

| IRA-DOE-Planning Grants and Other Capacity Bldg |

$ 71.0 |

$ 71.0 |

| IRA-EPA-Planning Grants and Other Capacity Bldg |

$ 520.0 |

$ 520.0 |

| IRA-EPA-Green Bank and Energy Financing Initiatives |

$ 100.0 |

$ 100.0 |

| IRA-DOE-Clean Energy Demonstration Projects |

$ 150.0 |

$ 150.0 |

| IRA-Transmission Siting and Economic Development Program |

$ 50.0 |

$ 50.0 |

| IRA-Assistance for Latest and Zero Building Energy Code |

$ 16.0 |

$ 16.0 |

| Public Utility Commission |

|

|

| IRA-Transmission Siting Program |

$ 2.5 |

$ - |

| Total IRA Utilization |

$ 1,391.3 |

$ 1,388.8 |

| Infrastructure Investment and Jobs Act (IIJA) |

| ($ amounts in millions) |

| Area |

Available |

Exec Budget |

| 2025/26 |

2026/27 |

| Executive Offices |

|

|

| IIJA-State Digital Equity |

$ 5.0 |

$ - |

| IIJA- State Cybersecurity |

$ 0.9 |

$ - |

| Community and Economic Development |

|

|

| IIJA-DOE-Weatherization Admin |

$ 12.0 |

$ 12.0 |

| IIJA-DOE-Weatherization Program |

$ 150.0 |

$ 150.0 |

| IIJA-Broadband Equity, Access, and Deployment |

$ 1,160.0 |

$ 1,000.0 |

| IIJA-State Digital Equity Capacity |

$ 50.0 |

$ 50.0 |

| IIJA-EPA Brownfields Revolving Loan Fund |

$ 10.0 |

$ 10.0 |

| Conservation and Natural Resources |

|

|

| IIJA-Community Wildfire Defense Grant Program |

$ 0.9 |

$ 0.9 |

| IIJA-Forest Fire Protection and Control |

$ 0.8 |

$ 2.1 |

| IIJA-Forest Management and Processing |

$ 34.0 |

$ 34.0 |

| IIJA-Aid to Volunteer Fire Companies |

$ 1.8 |

$ 1.8 |

| IIJA-Forest Insect and Disease Control |

$ 1.4 |

$ 1.4 |

| IIJA-Spring Garden Dam Removal |

$ 0.8 |

$ 0.8 |

| Emergency Management Agency |

|

|

| IIJA-State and Local Cybersecurity |

$ 21.0 |

$ 16.0 |

| Environmental Protection |

|

|

| IIJA-DOE-Energy Programs |

$ 22.3 |

$ 22.3 |

| IIJA-Orphan Well Plugging |

$ 175.0 |

$ 195.0 |

| IIJA-Energy Efficiency and Conservation |

$ 4.0 |

$ 4.0 |

| IIJA-Assistance for Small and Disadvantaged Communities |

$ 103.2 |

$ 103.2 |

| IIJA-Electric Grid Resilience |

$ 269.3 |

$ 269.3 |

| IIJA-Chesapeake Bay |

$ 15.9 |

$ 15.9 |

| IIJA-Brownfields |

$ 6.0 |

$ 6.0 |

| IIJA-Water Quality Management Planning Grants |

$ 2.0 |

$ 2.0 |

| IIJA-USDA Good Neighbor Authority |

$ 18.5 |

$ 18.5 |

| IIJA-National Dam Safety Program |

$ 0.6 |

$ 0.6 |

| IIJA-Coastal Zone Management |

$ 8.5 |

$ 8.5 |

| IIJA-Methane Emissions Reduction Grants |

$ 20.0 |

$ 20.0 |

| IIJA-Energy Efficiency Revolving Loan Fund |

$ 3.7 |

$ 3.7 |

| IIJA-Resilient and Efficient Codes Implementation |

$ 6.0 |

$ 6.0 |

| IIJA-Energy Auditor Training Grant |

$ 2.0 |

$ 2.0 |

| IIJA-Solid Waste Infrastructure for Recycling |

$ 1.1 |

$ 1.1 |

| IIJA-Environmental Justice Programs |

$ 10.0 |

$ - |

| IIJA-DOE-Clean Energy Demonstration Projects |

$ 150.0 |

$ 150.0 |

| IIJA-Advanced Energy Manufacturing |

$ 50.0 |

$ 50.0 |

| IIJA-Hydroelectricity Development Programs |

$ 25.0 |

$ 25.0 |

| IIJA-2 Percent Drinking Water Set Asides Offset |

$ 6.5 |

$ 6.5 |

| IIJA-10 Percent Drinking Water Set Asides Offset |

$ 7.4 |

$ 8.4 |

| IIJA-15 Percent Drinking Water Set Asides Offset |

$ 1.9 |

$ 1.9 |

| IIJA–DW Set-Aside Emerging Contam. Small or Disadvantage |

$ 2.8 |

$ 2.8 |

| IIJA-Abandoned Mine Reclamation |

$ 715.0 |

$ 715.0 |

| IIJA-STREAM Act Set-Aside |

$ 18.7 |

$ 19.5 |

| Fish and Boat Commission |

|

|

| IIJA-Delaware River Basin Conservation |

$ 0.8 |

$ 0.8 |

| Human Services |

|

|

| IIJA-State Digital Equity |

$ 1.0 |

$ - |

| Infrastructure Investment Authority |

|

|

| IIJA-Drinking Water Projects Revolving Loan Fund |

$ 500.0 |

$ 500.0 |

| IIJA-Loan Program Administration |

$ 15.5 |

$ 15.5 |

| IIJA-Technical Assistance to Small Systems |

$ 6.5 |

$ 6.5 |

| IIJA-Assistance to State Programs |

$ 7.4 |

$ 8.4 |

| IIJA-Local Assistance and Source Water Pollution |

$ 1.9 |

$ 1.9 |

| IIJA-Emerging Contaminants in Small or Disadvantaged Comm |

$ 75.1 |

$ 112.1 |

| IIJA-Sewage Projects Revolving Loan Fund |

$ 325.0 |

$ 350.0 |

| Labor and Industry |

|

|

| IIJA-State Digital Equity |

$ 0.7 |

$ - |

| State Police |

|

|

| IIJA-Motor Carrier Safety-General Fund |

$ 8.5 |

$ 9.5 |

| IIJA-Cybersecurity |

$ 0.6 |

$ 0.7 |

| Transportation |

|

|

| IIJA-Highway and Safety Capital Projects |

$ 858.8 |

$ - |

| Total IIJA Authorizations |

$ 4,895.2 |

$ 3,941.1 |