General Fund Revenue Report - February 2024

By Brittany Van Strien , Budget Analyst | 2 years ago

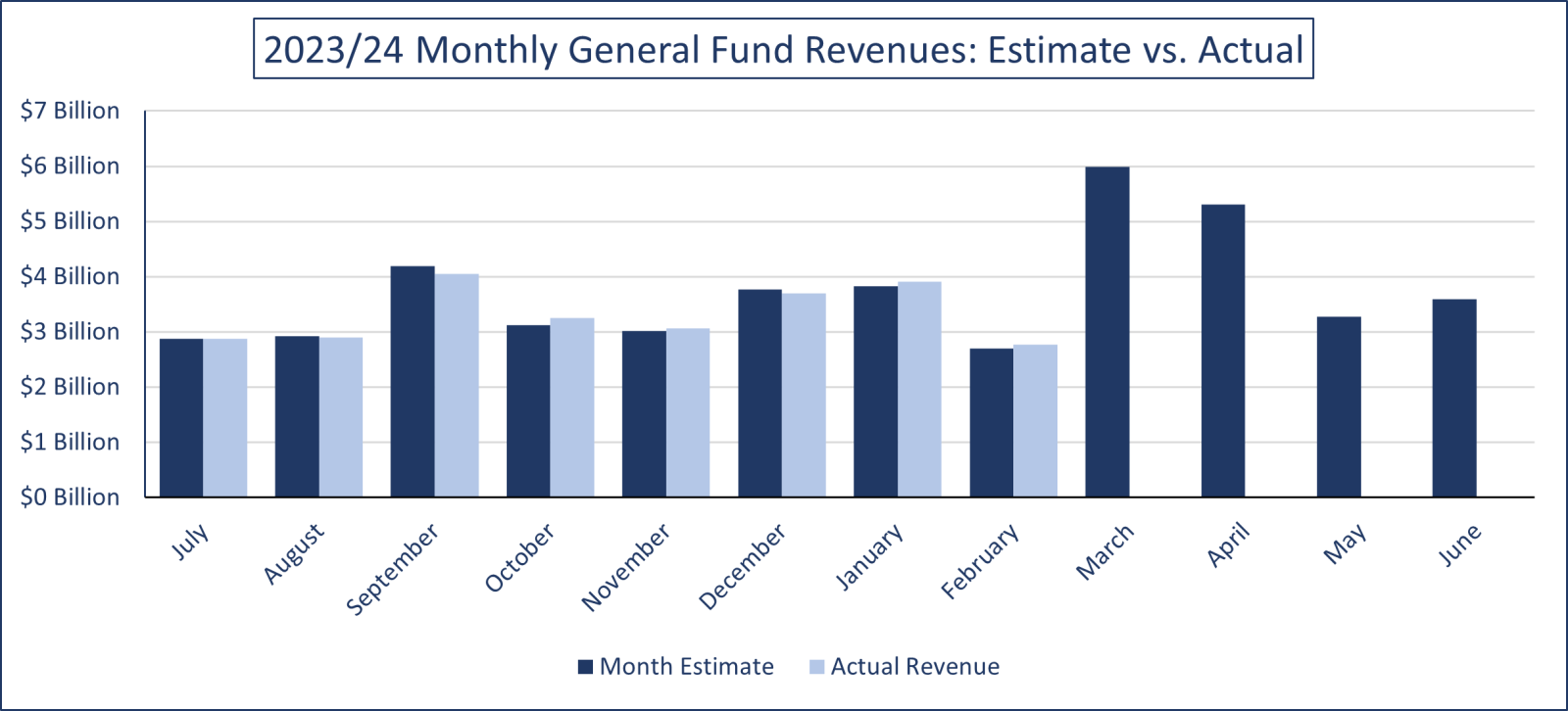

General Fund revenues in February were $69.5 million or 2.6% higher than expected.

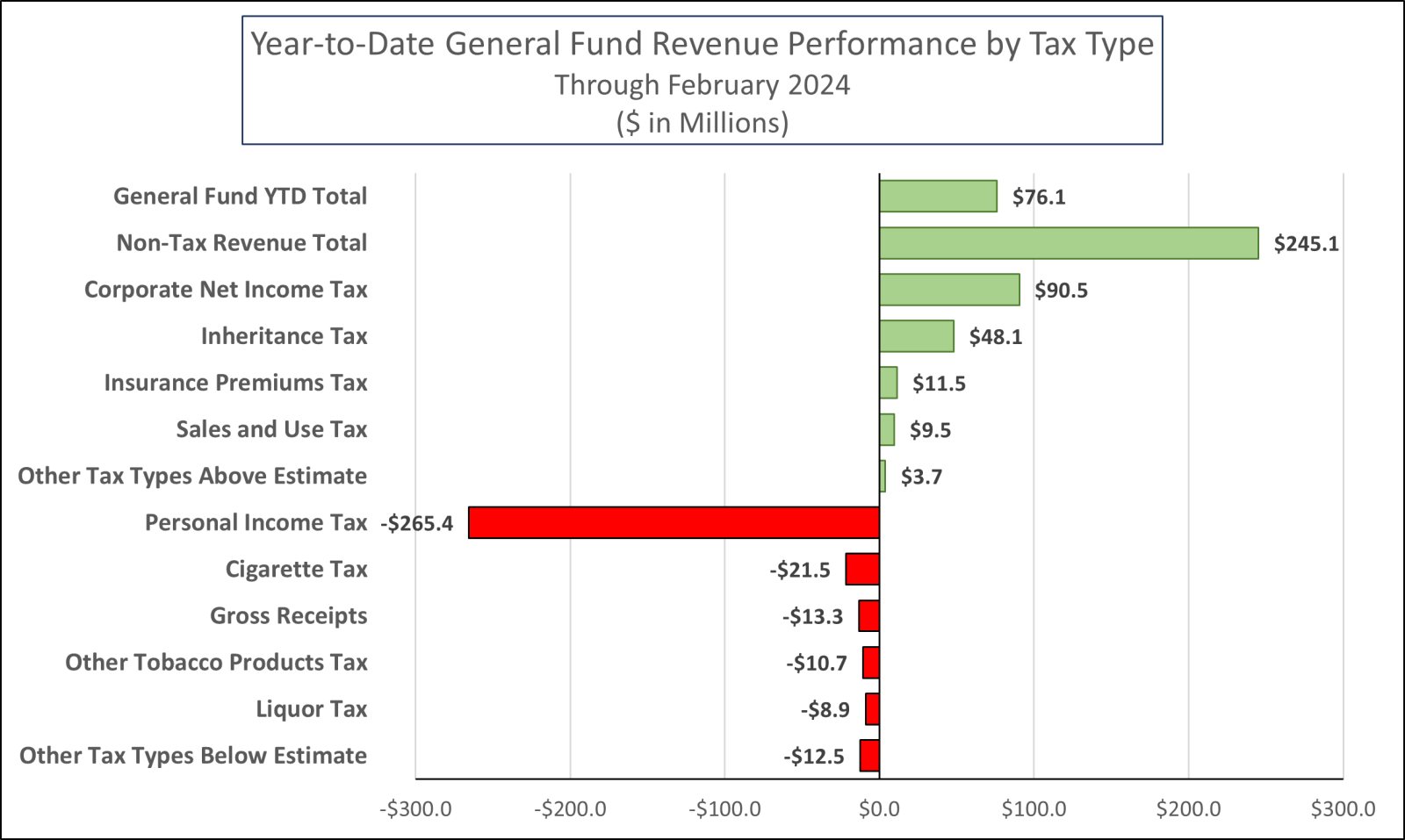

For the year-to-date, General Fund revenues are $76.1 million or 0.3% above estimate.

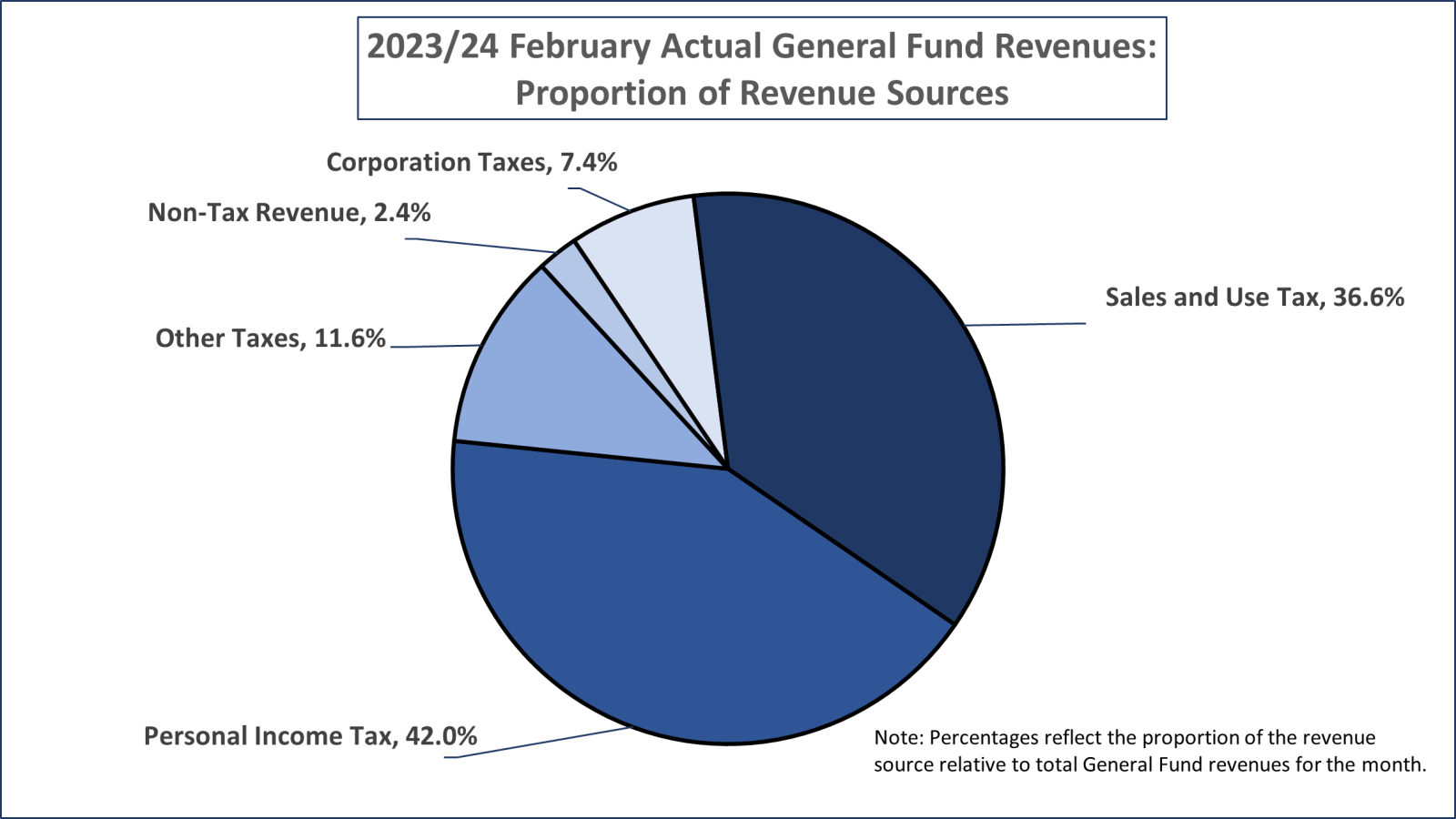

The story for the month is centered on the collection performances of Sales and Use Tax (SUT) and Personal Income Tax (PIT). SUT collections outperformed estimates in February by $36.7 million or 3.8%. This was largely impacted by nonmotor vehicle sales collections, which were $31.4 million or 3.5% higher than projected for the month. For the year-to-date, SUT collections are $9.5 million or 0.1% above estimate.

Similarly, PIT collections were $40.6 million or 3.6% over estimate in February. Collections from withholding payments were $12.4 million or 1.2% higher than estimated, and non-withholding payments were $28.1 million or 44.9% above projections. For the year-to-date, PIT collections are still underperforming expectations by $265.4 million or 2.5%.

Non-tax revenue was $29.1 million or 78.8% higher than expected in February. For the year-to-date, non-tax revenue is $245.1 million or 43.7% above estimate, largely influenced by higher-than-expected interest earnings.

Conversely, Corporate Net Income Tax (CNIT) collections finished the month $19.1 million or 12.1% under estimate. For the year-to-date, however, CNIT continues to outperform projections by $90.5 million or 3.1%.

|

2023/24 General Fund Revenues ($ in Millions)

|

|

|

February 2024 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$2,696.8

|

$2,766.3

|

$69.5

|

2.6%

|

$26,443.1

|

$26,519.2

|

$76.1

|

0.3%

|

|

Tax Revenue

|

$2,659.9

|

$2,700.3

|

$40.4

|

1.5%

|

$25,882.9

|

$25,713.9

|

($169.0)

|

-0.7%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$158.4

|

$139.3

|

($19.1)

|

-12.1%

|

$2,901.1

|

$2,991.6

|

$90.5

|

3.1%

|

|

Gross Receipts Tax

|

$34.6

|

$19.3

|

($15.3)

|

-44.1%

|

$60.9

|

$47.6

|

($13.3)

|

-21.8%

|

|

Public Utility Realty Tax

|

$0.0

|

$0.0*

|

$0.0

|

0.0%

|

$1.2

|

$2.4

|

$1.2

|

97.6%

|

|

Insurance Premiums Taxes

|

$45.6

|

$40.1

|

($5.5)

|

-12.0%

|

$99.1

|

$110.6

|

$11.5

|

11.6%

|

|

Financial Institution Taxes

|

$10.2

|

$7.2

|

($3.0)

|

-29.9%

|

$37.2

|

$36.2

|

($1.0)

|

-2.8%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$975.4

|

$1,012.1

|

$36.7

|

3.8%

|

$9,497.3

|

$9,506.8

|

$9.5

|

0.1%

|

|

Cigarette Tax

|

$68.4

|

$64.4

|

($4.0)

|

-5.9%

|

$525.1

|

$503.6

|

($21.5)

|

-4.1%

|

|

Other Tobacco Products Tax

|

$13.4

|

$12.4

|

($1.0)

|

-7.3%

|

$109.1

|

$98.4

|

($10.7)

|

-9.9%

|

|

Malt Beverage Tax

|

$1.4

|

$1.6

|

$0.2

|

13.6%

|

$14.6

|

$14.1

|

($0.5)

|

-3.5%

|

|

Liquor Tax

|

$33.6

|

$32.6

|

($1.0)

|

-3.0%

|

$311.1

|

$302.2

|

($8.9)

|

-2.9%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$1,122.2

|

$1,162.8

|

$40.6

|

3.6%

|

$10,804.7

|

$10,539.3

|

($265.4)

|

-2.5%

|

|

Realty Transfer Tax

|

$25.7

|

$37.6

|

$11.9

|

46.4%

|

$336.0

|

$338.6

|

$2.6

|

0.8%

|

|

Inheritance Tax

|

$141.2

|

$140.7

|

($0.5)

|

-0.4%

|

$967.2

|

$1,015.3

|

$48.1

|

5.0%

|

|

Gaming Taxes

|

$29.2

|

$30.0

|

$0.8

|

2.8%

|

$243.4

|

$240.4

|

($3.0)

|

-1.2%

|

|

Minor and Repealed

|

$0.6

|

$0.2

|

($0.4)

|

-59.0%

|

($25.1)

|

($33.0)

|

($7.9)

|

-31.6%

|

|

Non-Tax Revenue

|

$36.9

|

$66.0

|

$29.1

|

78.8%

|

$560.2

|

$805.3

|

$245.1

|

43.7%

|

|

*Note: Actual Public Utility Realty Tax collections in February were $41,663.

|