General Fund Revenue Report - November 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

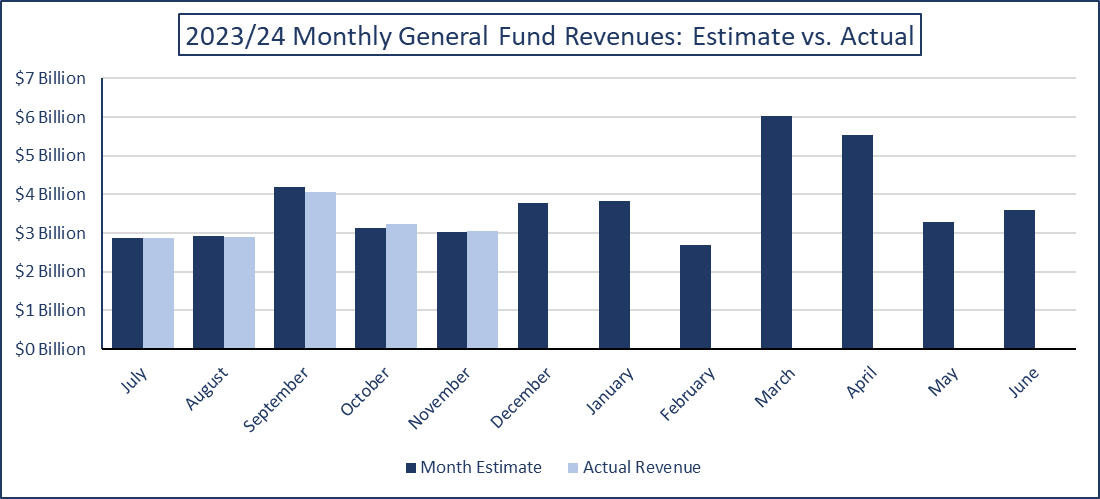

General Fund revenues in November were $46.4 million or 1.5% more than expected.

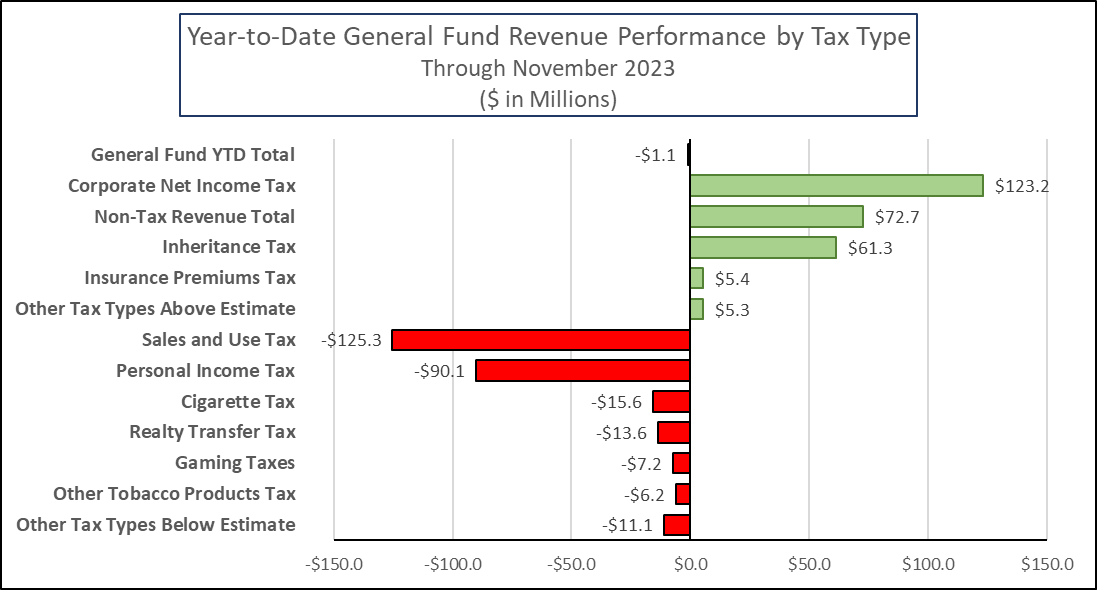

For the year-to-date, General Fund revenues are $1.1 million or 0.01% below estimate.

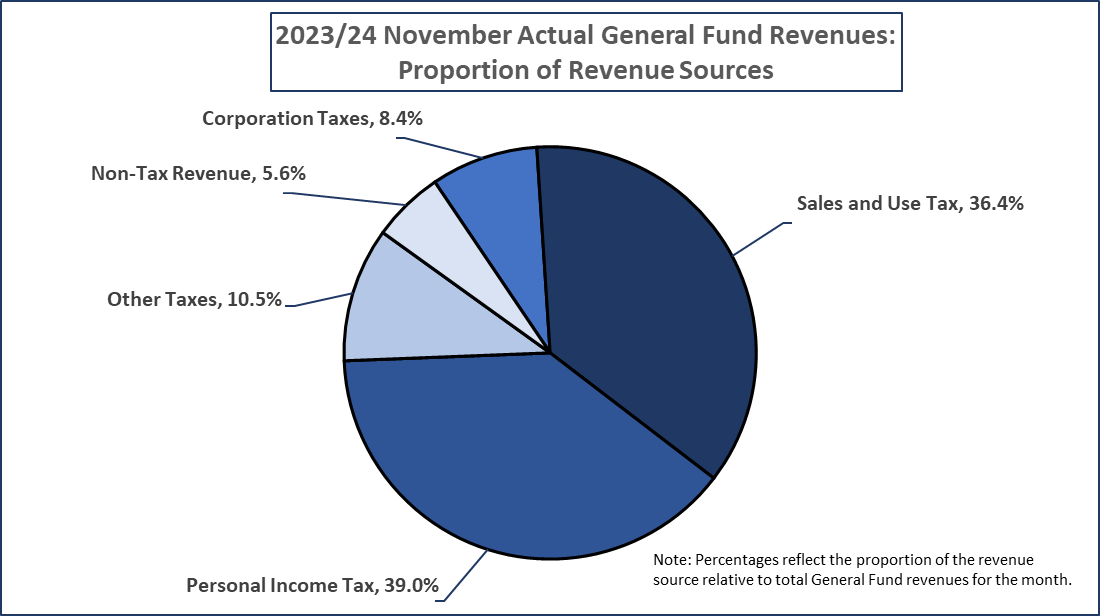

Corporate net income tax (CNIT) collections were $66.4 million or 35.2% higher than expected in November. For the fiscal year-to-date, CNIT is outperforming estimates by $123.2 million or 7.5%.

Non-tax revenue also finished the month higher than expected by $24.8 million or 16.8%. It should be noted that non-tax revenue collections this month were impacted by the first installment of the liquor store profit transfer being made by the Pennsylvania Liquor Control Board, totaling $100 million. This transfer was anticipated and therefore built into the November projections for non-tax revenue. The remainder of the profit transfer, expected to be $85.1 million, will be transferred to the General Fund later in the fiscal year.

Sales and use tax (SUT) revenue was $19.6 million or 1.7% lower than expected for the month. Collections from motor vehicle sales were $0.7 million or 0.7% higher than estimated, but collections from nonmotor vehicle sales were $20.3 million or 2.0% below estimate. For the year-to-date, SUT is $125.3 million or 2.0% under projections.

Similarly, personal income tax (PIT) revenue underperformed in November by $13.0 million or 1.1%. Although non-withholding payments were $8.7 million or 15.4% above estimate, withholding payments were $21.7 million or 1.9% less than projected. For the year-to-date, PIT is $90.1 million or 1.4% below estimate.

|

2023/24 General Fund Revenues ($ in Millions)

|

|

|

November 2023 Revenues

|

Year-to-Date Revenues

|

|

|

Month Estimate

|

Month Revenues

|

$ Difference

|

% Difference

|

YTD Estimate

|

YTD Revenues

|

$ Difference

|

% Difference

|

|

General Fund Total

|

$3,015.0

|

$3,061.4

|

$46.4

|

1.5%

|

$16,146.4

|

$16,145.3

|

($1.1)

|

-0.0%

|

|

Tax Revenue

|

$2,867.5

|

$2,889.1

|

$21.6

|

0.8%

|

$15,720.9

|

$15,647.1

|

($73.8)

|

-0.5%

|

|

Corporation Taxes:

|

|

Corporate Net Income Tax

|

$188.8

|

$255.2

|

$66.4

|

35.2%

|

$1,641.1

|

$1,764.3

|

$123.2

|

7.5%

|

|

Gross Receipts Tax

|

$2.9

|

$1.6

|

($1.3)

|

-44.9%

|

$16.2

|

$19.5

|

$3.3

|

20.6%

|

|

Public Utility Realty Tax

|

$0.0

|

$0.1

|

$0.1

|

0.0%

|

$1.2

|

$2.3

|

$1.1

|

92.2%

|

|

Insurance Premiums Taxes

|

$0.1

|

$0.6

|

$0.5

|

521.1%

|

$1.5

|

$6.9

|

$5.4

|

357.6%

|

|

Financial Institution Taxes

|

$1.4

|

($0.1)

|

($1.5)

|

-106.0%

|

$18.7

|

$19.5

|

$0.8

|

4.3%

|

|

Consumption Taxes:

|

|

Sales and Use Tax

|

$1,134.9

|

$1,115.3

|

($19.6)

|

-1.7%

|

$6,127.1

|

$6,001.8

|

($125.3)

|

-2.0%

|

|

Cigarette Tax

|

$78.4

|

$71.0

|

($7.4)

|

-9.4%

|

$339.8

|

$324.2

|

($15.6)

|

-4.6%

|

|

Other Tobacco Products Tax

|

$13.7

|

$12.4

|

($1.3)

|

-9.2%

|

$67.9

|

$61.7

|

($6.2)

|

-9.1%

|

|

Malt Beverage Tax

|

$1.8

|

$1.9

|

$0.1

|

5.1%

|

$10.0

|

$9.2

|

($0.8)

|

-8.2%

|

|

Liquor Tax

|

$40.9

|

$41.2

|

$0.3

|

0.7%

|

$188.4

|

$183.4

|

($5.0)

|

-2.7%

|

|

Other Taxes:

|

|

Personal Income Tax

|

$1,206.7

|

$1,193.7

|

($13.0)

|

-1.1%

|

$6,359.4

|

$6,269.3

|

($90.1)

|

-1.4%

|

|

Realty Transfer Tax

|

$48.0

|

$48.4

|

$0.4

|

0.8%

|

$221.7

|

$208.1

|

($13.6)

|

-6.1%

|

|

Inheritance Tax

|

$114.0

|

$113.9

|

($0.1)

|

-0.1%

|

$590.5

|

$651.8

|

$61.3

|

10.4%

|

|

Gaming Taxes

|

$35.2

|

$33.6

|

($1.6)

|

-4.6%

|

$146.4

|

$139.2

|

($7.2)

|

-4.9%

|

|

Minor and Repealed

|

$0.7

|

$0.2

|

($0.5)

|

-70.7%

|

($9.0)

|

($14.3)

|

($5.3)

|

-58.4%

|

|

Non-Tax Revenue

|

$147.5

|

$172.3

|

$24.8

|

16.8%

|

$425.5

|

$498.2

|

$72.7

|

17.1%

|