General Fund Revenue Report - May 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

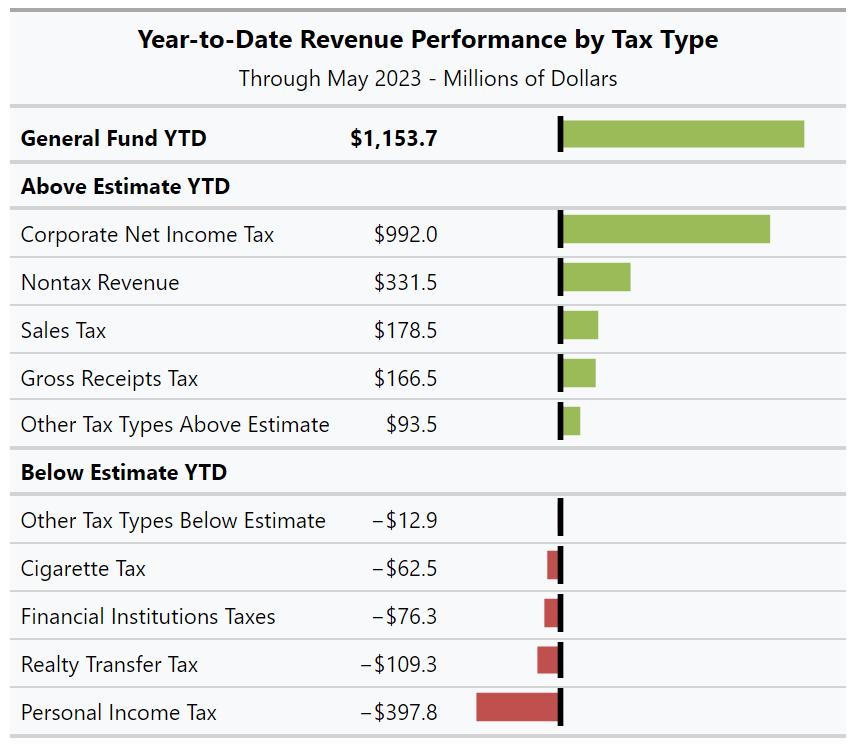

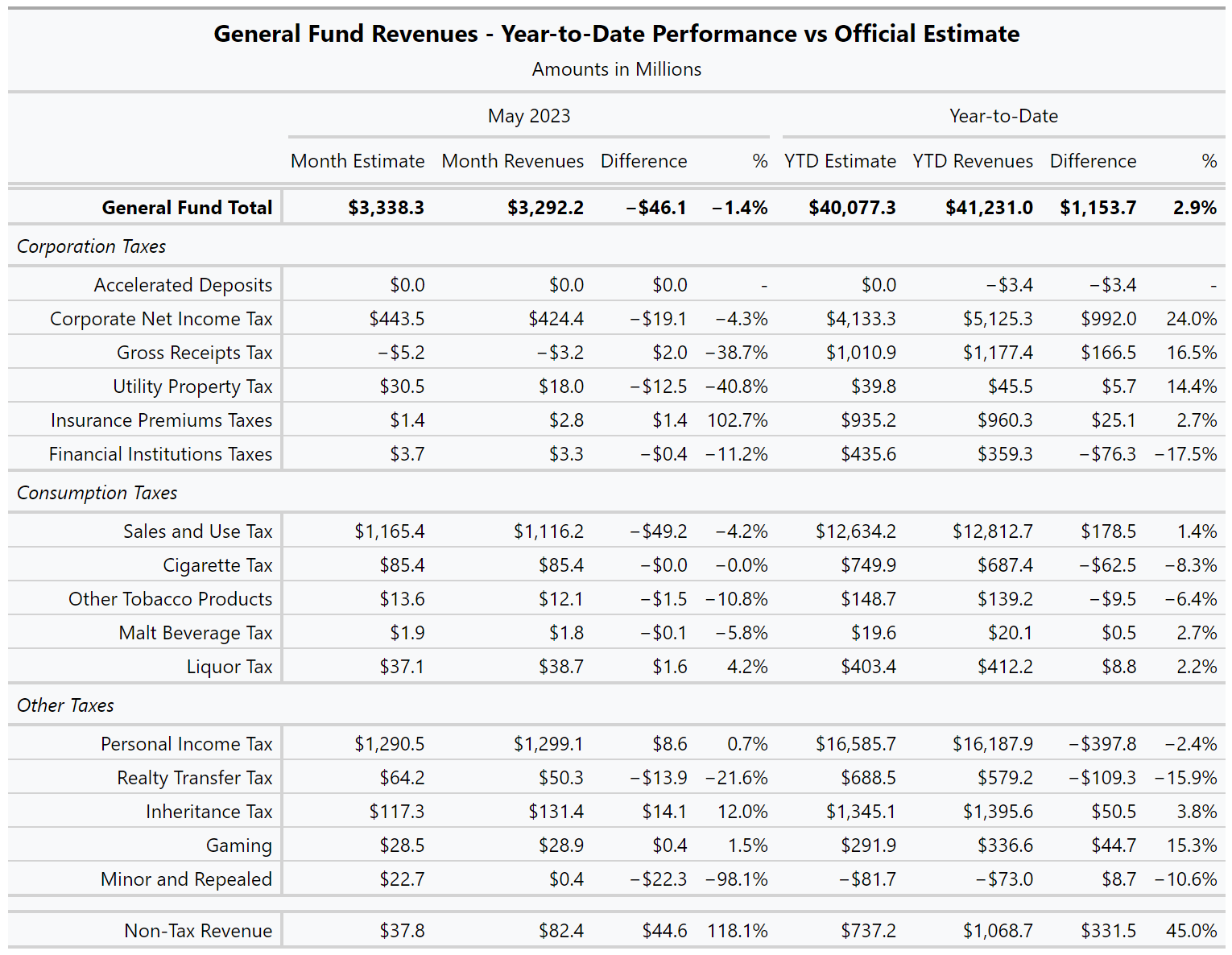

General Fund revenues were $46.1 million or 1.4% lower than expected in May.

For the year to date, total General Fund revenues are still above estimate by $1.2 billion or 2.9%.

Corporate net income tax revenue was $19.1 million or 4.3% under estimate for the month. Remittance of annual payments for corporate taxpayers are typically spread across April and May, and corporate taxpayers that operate on a calendar year basis were required to file their annual returns by May 15. Although May final annual payments were lower than expected, April’s collections exceeded the official estimate. Year to date, total CNIT revenue is $992.0 million or 24.0% ahead of estimate.

Sales and use tax revenue underperformed for the month by $49.2 million or 4.2%. Although motor vehicle collections were $10.2 million or 8.4% higher than the estimate, non-motor vehicle collections for the month were $59.4 million or 5.7% less than expected. Overall annual sales tax revenue is still outperforming estimates by $178.5 million or 1.4% for the fiscal year to date.

Both the personal income tax and inheritance tax were higher than projections for the month – personal income tax revenue finished $8.6 million or 0.7% above estimate and inheritance tax revenue was $14.1 million or 12.0% more than expected.