General Fund Revenue Report - April 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

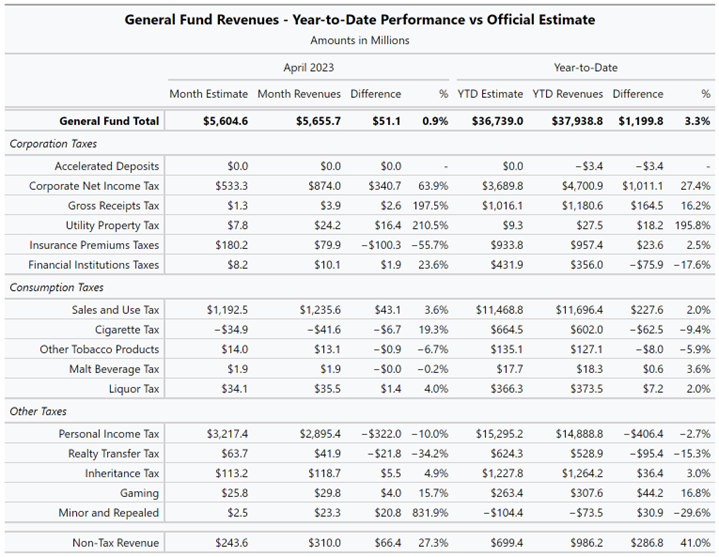

General Fund revenues were $51.1 million or 0.9% higher than expected in April.

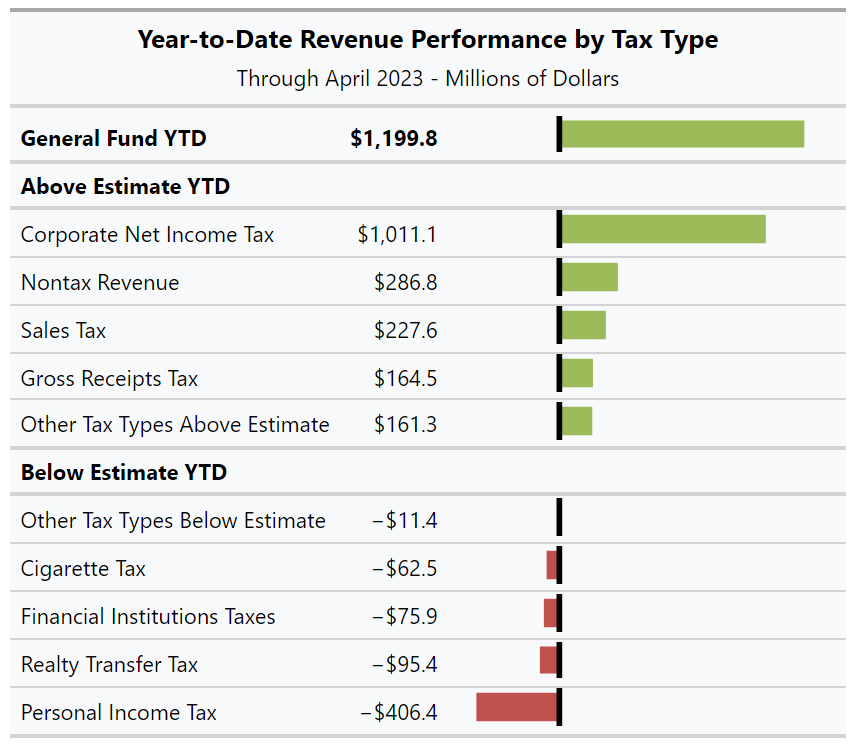

For the year to date, total General Fund revenues are $1.2 billion or 3.3% above estimate.

April is a significant month for personal income tax payments. For the month, overall personal income tax revenue finished $322 million under the projection. Although employer withholding payments outperformed the estimate by $16.1 million, individual estimated payments and annual payments were less than expected – individual estimated payments finished $186.4 million (29.1%) under the estimate and annual payments finished $151.7 million (9.5%) below projections.

The corporate net income tax again outperformed estimates for the month. For April, corporate net income tax revenue finished $340.7 million (63.9%) above estimate. Year to date, corporate net income tax revenue is $1.011 billion (27.4%) higher than the projection.

Sales and use tax revenue for the month rebounded slightly from March, finishing $43.1 million higher than estimated. Year to date, sales and use tax revenue is $227.6 million (2.0%) over estimate.

Realty transfer tax revenue finished the month $21.8 million (34.2%) less than expected, a consistent trend since the beginning of 2023. Year to date, realty transfer tax revenue for the General Fund is $95.4 million (15.3%) under estimate.