General Fund Revenue Report - March 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

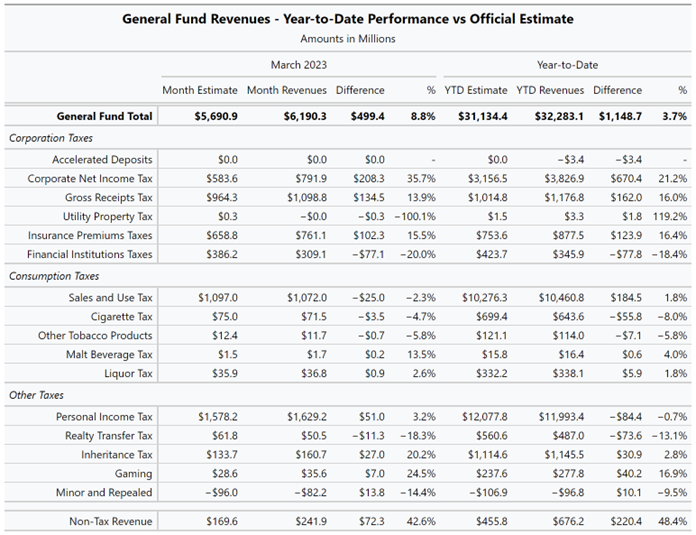

General Fund revenues were $499.4 million or 8.8% higher than expected in March.

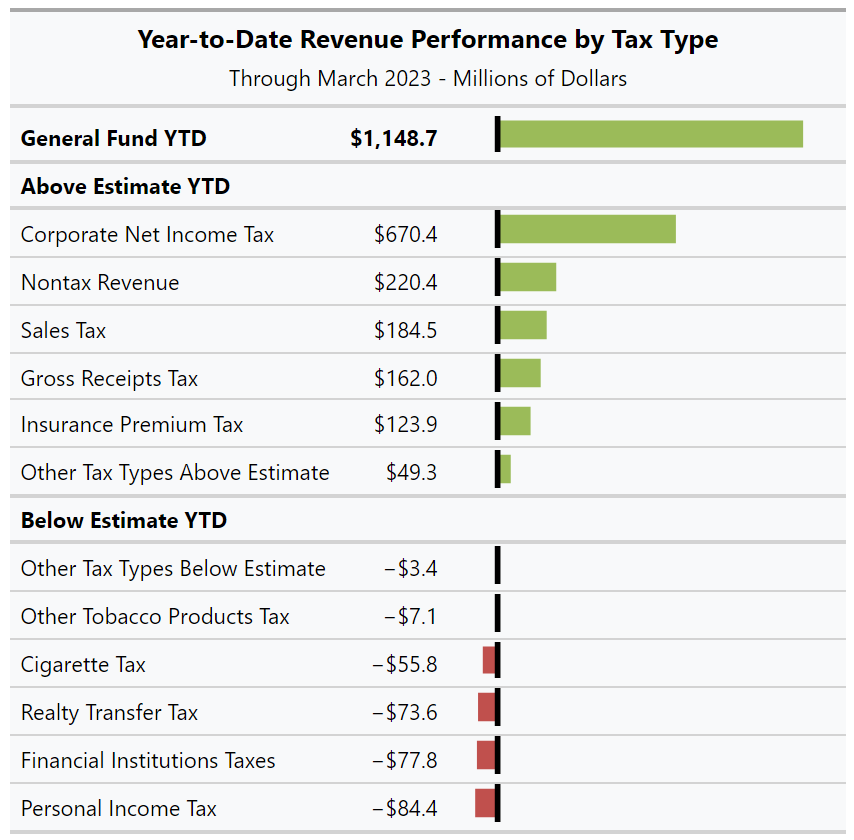

For the year to date, total General Fund revenues are $1.15 billion or 3.7% above estimate.

March is typically the largest revenue month due to multiple due dates for business taxes. Many corporate net income taxpayers pay their first quarterly estimated payment in March. Other special business taxes are almost entirely paid in March. These taxes were the main source of strength compared with the official revenue estimate this month.

The corporate net income tax outperformed the official estimate in March by $208.3 million or 35.7%. Similarly, the gross receipts tax and the insurance premiums tax collections both exceeded projections; GRT revenues were $134.5 million above estimate (13.9%) and insurance premiums taxes were $102.3 million higher than expected (15.5%).

Taxes on financial institutions were lower than projected in March by $77.1 million or 20.0%, due in large part to the underperformance of the bank shares tax.

The personal income tax was higher than expected in March by $51.0 million, or 3.2%. The sales and use tax came in $25.0 million below estimate, or 2.3%. Year to date, however, the sales and use tax continues to outperform the official estimate by $184.5 million, or 1.8%.

Looking ahead, the deadline to file annual tax returns for individuals is April 18. Final PIT payments remitted by Pennsylvanians with their tax returns will be a major revenue driver for the personal income tax this month. The first quarterly estimated payments for personal income tax are also due in April.

The House Appropriations Committee will continue to hold budget hearings on Governor Shapiro’s budget proposal through April 14. The Department of Revenue is scheduled to testify before the committee on April 12.