2022/23 Executive Budget Briefing

By House Appropriations Committee Staff , | 4 years ago

Gov. Wolf’s final budget proposal arrives in a complex time for the commonwealth.

The pandemic continues to affect the lives of Pennsylvanians, impacting their health, the health of their loved ones, their job prospects, the care and education available for their children, and their access to goods and services in the economy.

The tug-of-war between countervailing trends in the commonwealth’s budget reflects this underlying dynamic.

- The economic recovery has fueled General Fund revenues that continue to exceed estimate by billions of dollars, but the disruption of the pandemic has shown widespread need and increased costs.

- Increased federal match for health care costs paid by the commonwealth continues to reduce state costs during the federal public health emergency, but the end of the emergency will swing the burden rapidly back to the General Fund.

- Billions in flexible federal funds remain available to help address needs, but they are finite in both amount and the time they are available.

- Reserves in the Rainy Day Fund and the projected ending balance for the General Fund are higher than they have ever been, but they were built up with the help of limited duration support from Congress, not over time by a state budget that is structurally in balance.

Paradoxically, while the commonwealth finally has the resources and the budgetary breathing room to address many of its budgetary challenges, the scope of these problems has increased and uncertainty about the future remains.

The 2022/23 executive budget approaches the coming fiscal year by choosing opportunity over a passive status quo. The budget proposal:

- Invests the remaining American Rescue Plan State Fiscal Recovery Funds to help Pennsylvanians affected by the pandemic rather than holding them in reserve

- Reduces the corporate net income tax from 9.99 percent to 7.99 percent on January 1, 2023, while strengthening add-back provisions that improve tax fairness

- Increases the minimum wage to $12/hour on July 1, 2022, with a path to $15/hour

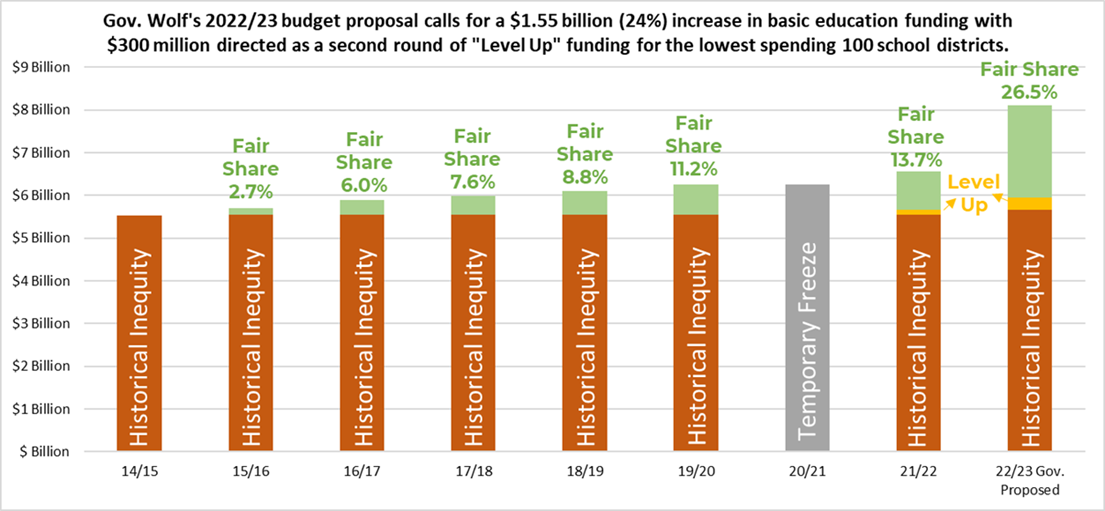

- Provides an additional $1.25 billion for basic education funding through the fair funding formula, $300 million in Level Up funding for the 100 most underfunded districts, and $200 million in special education funding

- Invests $70 million in early childhood education; maintains federal investments in childcare rates, copay reductions, and incentives for non-traditional care hours; and provides $15 million to expand evidence-based home visiting and family support services to an additional 3,800 Pennsylvania families

- Accelerates the phase-down of state police funding out of the Motor License Fund to free up more resources for roads and bridges in concert with the federal Infrastructure Investment and Jobs Act

- Increases funding for Medical Assistance programs to cover the sunset of enhanced federal match

- Does not increase taxes to achieve these goals and keeps the Rainy Day Fund intact.

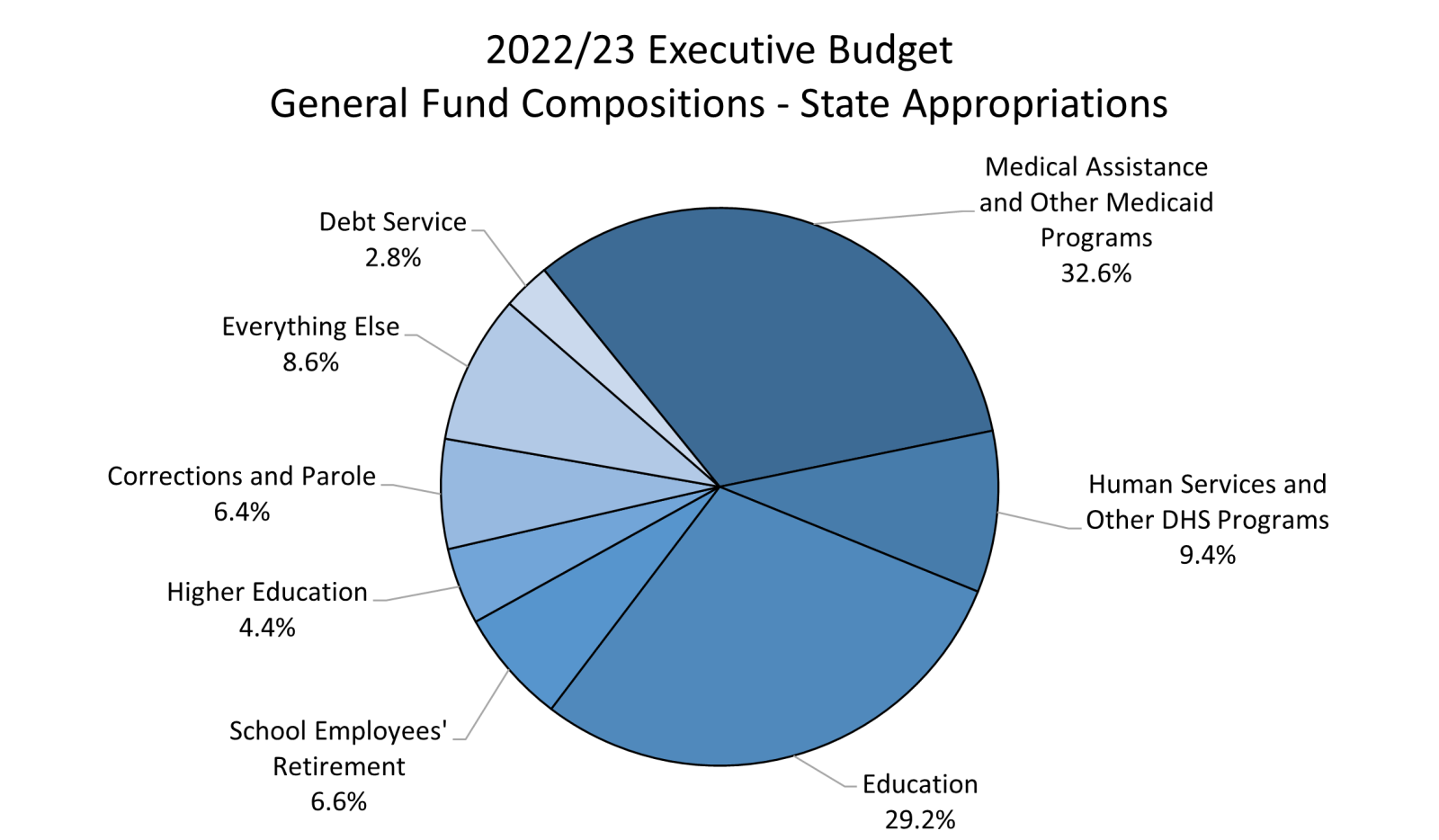

While the General Fund is the focus of legislative budget balancing, it is important to understand the scope of the total operating budget for the commonwealth. The total 2022/23 proposed operating budget including federal and other special funds is $109.3 billion, a decrease of $6.0 billion, or 5.2 percent, from 2021/22. The total operating budget consists of:

- $43.7 billion in state General Fund expenditures, an increase of $6.2 billion, or 16.6 percent,

- $3.0 billion in Motor License Fund expenditures, an increase of $165.6 million, or 5.8 percent,

- $2.0 billion in Lottery Fund expenditures, an increase of $3.3 million, or 0.2 percent,

- $41.4 billion in federal expenditures, a decrease of $13.1 billion, or 24.0 percent, and

- $19.2 billion in other special fund expenditures, augmentations and restricted accounts, an increase of $662,484, or 3.6 percent.

Although proposed total General Fund expenditures, including federal funds, show a large decrease, this is due to the one-time federal COVID relief funding received in 2021/22.

The executive budget proposal projects that General Fund revenues will finish 2021/22 $2.4 billion higher than the official estimate certified in July 2021. Corporate net income tax revenues are expected to perform well above estimate with $755.8 million in additional revenue. Sales tax is expected to generate $881.6 million more than estimate, and personal income tax is expected to generate $566.9 million more than the official estimate.

Through January 2021, year-to-date revenues were $1.85 billion ahead of the official estimate. The Independent Fiscal Office provided a revenue estimate in their Mid-Year Update on January 31, 2021, which projects 2021/22 revenues finishing the year at $2.79 billion above the official estimate.

The governor’s proposed 2022/23 revenue estimates show an increase in base tax revenue growth of $769.7 million, or 1.9 percent, from $40.4 billion to $41.2 billion (after adjusting for $43.9 million in net tax revenue modifications). Total General Fund revenues are estimated to decline by $3.0 billion, or 7.3 percent, from $45.0 billion to $41.9 billion. The sharp decline in total revenues is due to federal State Fiscal Recovery revenue replacement funds of $3.8 billion, which were used in 2021/22 and booked as non-tax revenues.

The governor’s proposal invests in businesses and aims to make Pennsylvania more competitive by lowering the Corporate Net Income Tax (CNIT) rate to 7.99 percent for tax years beginning on or after January 1, 2023. The governor proposes further reductions to 6.99 percent in 2026, 5.99 percent in 2027 and ultimately 4.99 percent.

As a way of improving the CNIT base, the governor proposes to strengthen current addback provisions by codifying economic nexus rules and adopting market sourcing for intangibles. These were recommendations from the 2004 Business Tax Reform Commission Report.

- Economic nexus – taxing phantom holding companies (i.e., Delaware holding companies) as having economic nexus in the commonwealth.

- Market based sourcing – encourages growth of service industries by apportioning sales of particular services based on the destination of the customer instead of the state where the largest share of the costs are incurred to produce the service.

Corporate Net Income Proposed Modifications

($ in thousands) |

| |

2022/23 |

2023/24 |

2024/25 |

2025/26 |

2026/27 |

| Proposed Rate |

7.99% |

7.99% |

7.99% |

6.99% |

5.99% |

| Net Fiscal Impact |

-$79,400 |

-$140,900 |

-$140,800 |

-$270,500 |

-$645,100 |

Estimates provided by the Administration

Table games taxes have been deposited into the General Fund since they were enacted in 2010. Current law stipulates that if the balance in the Rainy Day Fund exceeds $750 million on the last day of the fiscal year, then table games tax revenue would switch and instead be deposited into the Property Tax Relief Fund after that time. The deposit of $2.6 billion into the Rainy Day Fund in September 2021 triggers this change. The governor proposes to continue depositing table games taxes into the General Fund. This would require a statutory change by the General Assembly and would result in an additional $133.5 million to the General Fund as compared to current law.

The budget proposes four transfers in and out of the General Fund for different purposes:

- From the General Fund to the Tobacco Settlement Fund, $115.3 million from cigarette tax revenues to replace monies deducted from the Master Settlement Agreement to pay debt service associated with the Tobacco Settlement bonds.

- From the General Fund to the Environmental Stewardship Fund, $13.8 million from personal income tax revenues for Growing Greener debt service payments.

- From the General Fund to the School Safety and Security Fund, $45 million from personal income tax revenues for grants.

- From the Medical Marijuana Program Fund to the General Fund, the unexpended fund balance of $36.6 million in the fund to offset Department of Health operations as currently required in statute.

The net effect of all proposed revenue modifications (CNIT rate and base change, deposit of table games taxes and transfers) on the 2022/23 General Fund budget is a revenue reduction of $81.9 million.

Minimum Wage – The governor proposes a minimum wage increase from $7.25 per hour to $12.00 per hour, including tipped workers, effective July 1, 2022. The plan would then increase the minimum wage by $0.50 per hour each year thereafter until reaching $15.00 per hour in 2028. This proposal is estimated to generate $74.6 million in combined personal income and sales and use tax revenue in 2022/23.

As part of the American Rescue Plan, the commonwealth received $7.291 billion in flexible State Fiscal Recovery Funds to help respond to the pandemic in the spring of 2021. Over the last year, the General Assembly has appropriated $5.1 billion of these funds for several purposes shown in the table below. The initial allocations were included in the 2021/22 budget and most recently in Act 2 of 2022, which provided another $225 million to support the hospital and health care provider workforces, as well as provide student loan relief incentives for nurses.

The predominant use of the State Fiscal Recovery Fund so far is a $3.84 billion transfer to the General Fund to bolster and replace revenues. Not all of that transfer is necessary to balance the 2021/22 budget, so excess funds will be carried forward to future fiscal years like other revenues when a surplus exists.

On top of the transfer, the 2021/22 budget implementation language in the Fiscal Code (Act 24 of 2021) provided that any unappropriated amounts State Fiscal Recovery Funds at the end of the fiscal year will be transferred to the General Fund as revenue replacement.

Gov. Wolf’s budget proposes to change direction and use the remaining State Fiscal Recovery Funds to help Pennsylvanians rather than let the funds be transferred to the General Fund to sit in reserve. Highlights from his plan include:

- $500 million for the PA Opportunity Program to provide grants to families

- $450 million for Growing Greener III, spread across the Departments of Agriculture, Conservation and Natural Resources (DCNR), and Environmental Protection (DEP)

- $225 million for statewide small business assistance to help Pennsylvania businesses who continue to be impacted by the pandemic

- $150 million in additional support to the Pennsylvania State System of Higher Education (PASSHE)

- $112 million for the Nellie Bly Tuition Program proposal, which would fund the program in concert with a transfer from the Pennsylvania Race Horse Development Trust Fund. The budget anticipates using ARP funds for the Nellie Bly program each year for the next three fiscal years.

- $35 million for health care worker student loan forgiveness

- $250 million for long-term living programs workforce recruitment and retention and workforce development initiatives

- $40 million to support and expand behavioral health programs

- $204 million to enhance the Property Tax/Rent Rebate benefit by making a one-time double rebate payment to eligible individuals.

|

State Fiscal Recovery Fund – Current Appropriations and Executive Budget Recommendations

($ amounts in thousands)

|

|

Agency

|

Appropriation

|

2021/22

|

2022/23

|

2023/24

|

2024/25

|

Total

|

|

Treasury

|

PA Opportunity Program

|

|

500,000

|

|

|

500,000

|

|

Executive Offices

|

Transfer to the General Fund

|

3,841,000

|

|

|

|

3,841,000

|

| |

Transfer to EMS Operating Fund

|

5,000

|

|

|

|

5,000

|

| |

Pandemic Response1

|

372,000

|

|

|

|

372,000

|

|

Growing Greener III Proposal

|

|

|

|

|

|

|

Agriculture

|

Agriculture Conservation

|

|

135,058

|

|

|

135,058

|

|

DEP

|

Watershed and Wetland Restoration

|

|

180,077

|

|

|

180,077

|

|

DCNR

|

State & Local Parks and Forest Facility Restoration

|

|

135,058

|

|

|

135,058

|

|

|

|

|

|

|

|

|

|

DCED

|

Statewide Small Business Assistance Program

|

|

225,000

|

|

|

225,000

|

|

PHFA

|

Construction Cost Relief

|

50,000

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

Education

|

Nellie Bly Tuition Program

|

|

111,913

|

111,622

|

109,801

|

333,336

|

|

PASSHE

|

State System of Higher Education

|

50,000

|

150,000

|

|

|

200,000

|

|

PHEAA

|

Student Loan Relief for Nurses

|

15,000

|

|

|

|

15,000

|

| |

Health Care Worker Student Loan Forgiveness

|

|

35,000

|

|

|

35,000

|

|

Human Services

|

Long Term Living Programs

|

282,000

|

250,000

|

|

|

532,000

|

| |

Behavioral Health

|

|

40,000

|

|

|

40,000

|

|

|

Healthcare Workforce Assistance

|

110,000

|

|

|

|

110,000

|

|

|

Hospital Workforce Assistance

|

100,000

|

|

|

|

100,000

|

|

Revenue

|

Property Tax Rent Rebates

|

|

203,800

|

|

|

203,800

|

|

Transportation

|

Highway and Safety Capital Projects2

|

279,000

|

|

|

|

279,000

|

| |

Total

|

5,104,000

|

1,965,906

|

111,622

|

109,801

|

7,291,329

|

1. Includes subgrants to other agencies

2. Now using State Fiscal Recovery Funds, instead of Coronavirus Capital Project Funds, based on updated federal guidance

Last year’s budget transferred $2.6 billion into the Rainy Day Fund, bringing the balance to over $2.8 billion. The current reserves in the fund far exceed the $755 million that the fund held in 2008/09 entering the Great Recession and the $343 million on hand entering the pandemic. The governor’s proposal includes no new transfers into the Rainy Day Fund in the upcoming fiscal year. At the current amount, plus interest, the fund is estimated to be at almost $2.9 billion in 2022/23. This represents 7.1 percent of expenditures, or almost 26 days of reserves. This is competitive with other states and considered a healthy amount, as noted by a Pew report, the median of all states’ reserves in 2021 was 28.5 days or 7.8 percent of expenditures. The governor’s proposal to leave an ending balance of almost $3.4 billion in the General Fund would roll over to the next year to address the structural deficit.

The governor’s proposal would increase the total authorized complement by a net 602 full-time equivalents, from 78,807 to 79,409. The most significant increases in proposed personnel are 292 new positions for Veterans Homes. The current filled complement has decreased by 1,199, from 72,865 to 71,666, since January 2021. Total filled positions have decreased by 1,544 since 2017.

Total property tax relief available to homeowners has remained the same each year for more than a decade since it was first available, and this budget assumes homeowners will again receive the same amount of relief in 2022/23. Gaming activity has been robust this year, especially with increased internet gaming and sports betting, and gaming revenues have reached record high levels. The governor proposes to maintain current levels of property tax relief, while increasing the Property Tax Relief Reserve Account from $6.2 million to $150 million. This would still leave several hundred million remaining in the fund; however, the Secretary of the Budget is charged with certifying an amount that will provide for stability to provide consistent payments in the future.

The governor’s plan for a portion of American Rescue Plan dollars is to double the Property Tax Rent Rebate Program distribution for 2022/23 with an additional distribution of $203.8 million. This is proposed as a one-time bonus just for 2022/23. The number of senior citizens receiving Property Tax Rent Rebate continues to decline each year since there are no inflationary adjustments to income caps in statute. These distributions are taken off the top of the fund, so there is enough money available; however, fewer people qualify each year as they earn more income and exceed the income limit. The amount required from the Lottery Fund is expected to decline by $30.8 million, from $234.6 million in 2021/22 to $203.8 million in 2022/23.

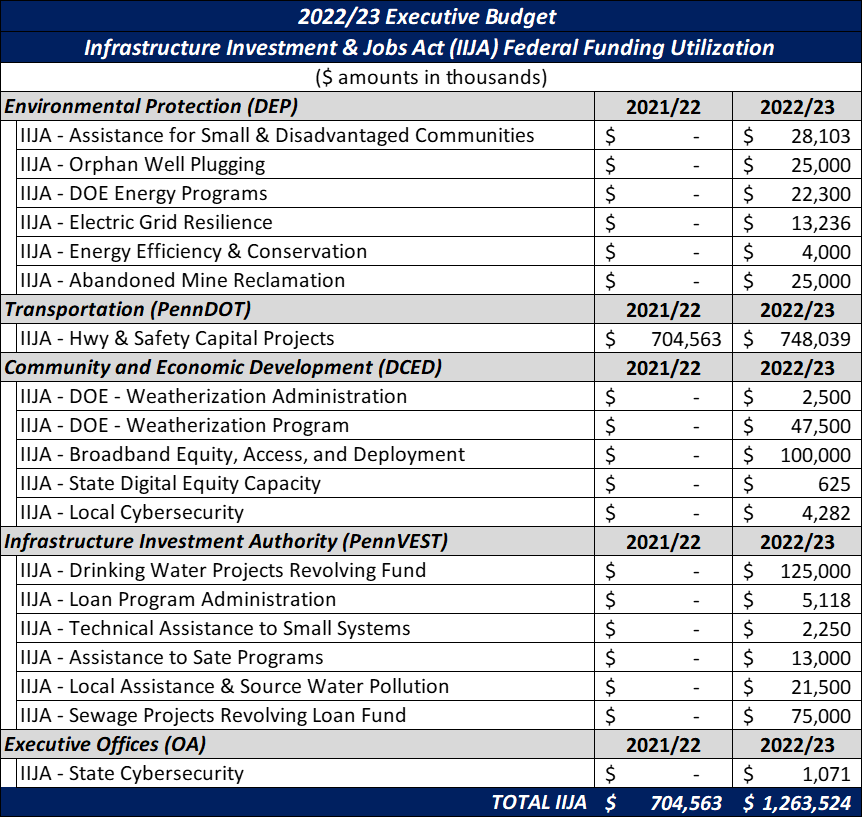

The governor’s budget proposal starts to appropriate funding allocated to the commonwealth by the federal Infrastructure Investment and Jobs Act. The legislation is one of the largest and most comprehensive infrastructure investments in history. This law provides for investments in core areas including transportation, environmental remediation and conservation, clean water, broadband, and cyber security. The following table provides a bird's eye view of the appropriations requested for this federal funding.

A net reduction is proposed to the enacted 2021/22 General Fund appropriations in the amount of $1.11 billion. Of this amount, $51.5 million is a reduction in the Treasury Department for debt service. The other major component is availability of federal Medicaid funding tied to the COVID-19 public health emergency outlined in more detail later. Finally, additional funds are requested in the Department of Education for costs associated with school district social security payments and Chartered Schools for the Deaf and Blind.

- $1.55 billion (23.6 percent) total increase in Basic Education Funding (BEF) for school districts

- $1.25 billion is added to the fair funding formula distribution and $300 million is distributed among “Level Up” school districts (the 100 lowest spending districts on a per weighted student basis)

- The 2021/22 budget included $100 million for the inaugural Level Up investment, which becomes part of each school district’s guaranteed base amount in 2022/23 and beyond

- The proposed total 2022/23 BEF is $8.1 billion

- $5.66 billion base (70 percent of total)

- $2.15 billion distributed through the BEF fair funding formula (26.5 percent of total)

- $300 million for Level Up school districts (3.7 percent of total)

- $200 million (16.2 percent) increase in Special Education Funding (SEF)

- $6.1 million (6.2 percent) increase in the Career and Technical Education subsidy

- Early Childhood Education

- $60 million (24.8 percent) increase for Pre-K Counts

- Includes a proposed rate increase

- $10,000 for full-time slots ($1,250 increase per slot)

- $5,000 for part-time slots ($625 increase per slot)

- Allows for 2,308 (8.2 percent) additional slots

- $10 million (14.5 percent) increase for Head Start Supplemental Assistance

- No additional seats assumed; increase is to meet growing costs

- State funding for early childhood education has more than doubled under Gov. Wolf’s leadership.

- Increases the statutory minimum teacher salary from $18,500 to $45,000

- Reduces the nation-leading 20 percent administrative cost allowance for scholarship granting organizations in the education tax credit programs to 5 percent so more donations go toward student scholarships

- Charter school funding reform that will save school districts an estimated $373 million per year

- $500,000 or 4 percent increase for Adult and Family Literacy programs

The basic education funding (BEF) appropriation is PA’s general and largest education subsidy, accounting for just over half of the funds the state sends its 500 school districts. Since 2019/20, in a House Republican-insisted move that reduces transparency, social security reimbursement payments have been included in the overall BEF appropriation.

Basic Education Funding (BEF) Appropriation

in thousands |

Actual

FY18-19 |

Actual

FY19-20 |

Actual

FY20-21 |

Revised

FY21-22 |

Proposed

FY22-23 |

22-23 Proposed

less

21-22 Revised |

| Basic Education Funding |

$6,095,079 |

$6,742,838 |

$6,794,489 |

$7,074,736 |

$8,645,605 |

$1,570,869 |

22.2% |

| BEF Portion |

$6,095,079 |

$6,255,079 |

$6,255,079 |

$6,555,079 |

$8,105,079 |

$1,550,000 |

23.6% |

| Social Security Portion |

$0 |

$487,759 |

$539,410 |

$519,657 |

$540,526 |

$20,869 |

4.0% |

| Note for Social Security Portion: 2021/22 includes a recommended $7.963 million supplemental appropriation; 2020/21 current year costs were $501.8 million (the amount shown included $37.6 million to cover shortfalls from prior years) |

How BEF is distributed is just as important as how much is appropriated. Since 2015/16, school districts have been guaranteed their 2014/15 levels of funding as a secure “base” amount, while new funding added to the BEF appropriation has been distributed using the bipartisan fair funding formula’s annually updated factors (e.g., student counts, poverty, income, spending levels, local tax collections, etc.). The inclusion of a new “Level Up” investment for the 100 lowest spending school districts in the 2021/22 budget was a first-step recognition of the inequities and inadequacy present in Pennsylvania’s overall funding system.

Under the fair funding formula, each school district receives the same amount of funding per weighted and adjusted student. Therefore, as more funding is distributed using the fair funding formula, the financial importance of the formula’s weights and adjustment factors grows. A substantial increase in formula funds, as is the case in the proposed 2022/23 budget, will further expose some of the volatility in the formula’s factors. This will be something to monitor this year and evaluate when the Basic Education Funding Commission reconvenes July 1, 2022. The final formula factors for the 2022/23 distribution will not be available until later this spring when the Department of Education (PDE) publishes the latest student count and financial data and the Census releases its median household income and poverty metrics.

Out of PA’s 500 school districts, 410 (82 percent) have adopted a resolution calling for charter school funding reform.

Gov. Wolf’s proposed budget answers the call by once again proposing bipartisan (see HB272) and data-driven reforms that are estimated to save school districts $373 million annually.

- $174 million in savings realized by applying the fair funding formula for special education to the way school districts pay brick and mortar charter schools. This bipartisan formula uses actual student counts instead of outdated assumptions and reimburses based upon the level of need rather than an inflated average. The formula already applies to the way the state pays school districts.

- $199 million in savings generated by instituting a $9,800 statewide cyber charter tuition rate for non-special education. The current non-special education rates range between $8,306 and $36,204 per student depending on the school district’s spending levels. However, Intermediate Units typically charge only $5,400 per student for their cyber programs. The special education rate for cyber charter students would apply the special education funding fair formula to the statewide cyber rate.

The executive budget proposes an additional $75 million for the Pennsylvania State System of Higher Education (PASSHE). This meets the system’s base operating appropriations request, which is critical to the health of all system universities and for the success of the system redesign effort to integrate Clarion, Edinboro and California into the new Pennsylvania Western University and Lock Haven, Mansfield and Bloomsburg into a new northeast university.

On top of the primary operating appropriation, the budget proposes to provide $150 million in federal American Rescue Plan State Fiscal Recovery Funds to PASSHE in 2022/23. When combined with the $50 million that the General Assembly appropriated in 2021/22, this would fulfill the commitment to provide $200 million in ARP funds to PASSHE over three years.

Once again, the governor proposes to create the Nellie Bly Scholarship. As proposed in previous years, the scholarship would provide need-based aid to full time students for tuition, fees, housing, books and other expenses. This year’s proposal still contains a post-graduation residency requirement where the student must agree to stay in Pennsylvania the same number of years that he or she received the grant, or the grant will convert to a loan. However, there are several key differences compared to prior versions of the proposal:

- This year, the scholarship would be open to both PASSHE students and community college students. Previous versions were limited just to PASSHE students

- The funding source changed to include $112 million from the ARP State Fiscal Recovery Fund, and $88 million from the PA Race Horse Development Trust Fund, totaling $200 million in resources for the program. The Race Horse Development Trust Fund was the sole proposed funding source in prior iterations. The budget plans to use ARP funds to support the program for the next three fiscal years in roughly the same proportion. Afterwards, the General Fund replaces the federal funds, while we assume the Race Horse Development Fund share continues (though this is ambiguous).

- Priority fields for the scholarship have broadened to more high-need sectors, including health care, education, and public service.

Other public institutions of higher education generally receive a 5 percent increase in the governor’s budget. This includes the four state-related universities (Lincoln University, Temple University, the University of Pittsburgh, and Penn State University), the Pennsylvania College of Technology and Thaddeus Stevens College of Technology. The appropriation for community college capital support also increases by 5 percent.

The budget eliminates funding for the Northern Pennsylvania Regional College.

For private colleges and universities that receive institutional assistance grants through PHEAA, the budget recommends a 2.5 percent increase.

The PHEAA State Grant Program that provides need-based aid to Pennsylvania students attending undergraduate programs longer than two years in length receives a $39.6 million increase, or 12.8 percent. This meets the PHEAA Board’s request, which PHEAA projects will be enough to maintain the current maximum grant of $5,000 (the highest amount in the program’s history)

Funding for the Ready to Succeed Scholarship increases by $10.8 million to a total of $16.4 million. This amount will help provide additional partially-merit based aid for students from families with incomes less than $110,000 per year. The program has been consistently oversubscribed since its inception. Similarly, the Targeted Industry Cluster Program (PA-TIP) receives an additional $2.4 million to serve more students who enroll in shorter programs in high-priority fields.

The Cheyney Keystone Academy is proposed to receive an additional $1.5 million. The Bond-Hill Scholarships did not receive an increase in the executive budget.

The governor’s budget includes $1 million for the Hunger-Free Campus Initiative, a new grant program to help fight food insecurity at colleges and universities.

The budget also increases funding for the It’s On Us grant program by $500,000 for a total of $1.5 million. The program provides funding to colleges and universities to help reduce sexual violence, including awareness, prevention, and reporting.

The proposed budget would once again fully fund the actuarially required contributions to the Public School Employees’ Retirement System and the State Employees’ Retirement System. For the sixth consecutive year, this budget would fully fund the pension systems after more than a decade of systematic underfunding. Approximately 75 percent of the employer contributions go toward the large unfunded liabilities, which accrued due to unfunded benefit increases, poor investment returns, and failure to make actuarially required payments.

State contributions to PSERS are made in an appropriation under the Department of Education budget, while contributions to SERS are contained within various personnel appropriations throughout agency budgets. The governor’s budget would appropriate $2.9 billion for contributions to PSERS, an increase of $167 million. Estimated contributions to SERS would total $2.35 billion, approximately 40 percent of which would come from the General Fund.

Pennsylvania offers health insurance to some retired employees based on years of service and service class. One of those plans is known as Retired Employees Health Plan (REHP), and benefits are administered by the Pennsylvania Employees Benefit Trust Fund (PEBTF). The commonwealth has largely paid these costs on a pay-as-you-go basis as part of agency payroll costs, but recognizing the long-term nature of the liability, the fund started to build up assets to pay future costs.

As part of the 2020/21 enacted budget, contribution rates were temporarily reduced as a cost savings measure. Now, the contribution rates are returning to normal to ensure the REHP obligations can continue to be met. Costs are reflected in various personnel-bearing appropriations throughout agency budgets. Staff estimates the total increased costs in the budget in 2022/23 to be $221.3 million across all funds and sources, with $102.5 million of that total included within state General Fund appropriations.

The executive budget proposes over $18.34 billion in state General Funds for the Department of Human Services (DHS). This proposed increase of $3.28 billion is based on assumed net reductions of $1.08 billion to the 2021/22 enacted budget.

The governor’s proposed budget includes an overall negative supplemental General Fund request for 2021/22 for DHS of $1.08 billion. This the net effect of reduced need of $1.25 billion due to the availability of federal Medicaid funds and additional needs of $167 million due to changes in cost and utilization.

The Families First Coronavirus Response Act provides an additional 6.2 percent Federal Medical Assistance Percentage (FMAP) to states on many eligible Medicaid costs. The enhanced FMAP is available through the end of the quarter that contains the end of the federal public health emergency. The enacted 2021/22 budget assumed the enhanced FMAP would be available through December 31, 2021. Currently, the federal public health emergency is set to expire in April 2022 unless extended again or terminated early. Absent additional federal action, Pennsylvania would be eligible for the enhanced FMAP through June 30, 2022. Staff estimate this comprises $1.25 billion in reduced 2021/22 General Fund need at DHS.

As a condition of receiving enhanced FMAP, states may not terminate Medical Assistance (MA) eligibility, except in rare cases, for the duration of the public health emergency. Although DHS estimates who will present for services and the cost of providing those services, uncertainty of program costs and enrollment related to the COVID-19 pandemic have made projections difficult. Therefore, staff estimates DHS needs $167 million in supplemental funding to finish out the current fiscal year.

The American Rescue Plan Act (ARPA) allowed states to claim an additional 10 percent FMAP on eligible home and community-based services (HCBS) if those funds were reinvested in ways that enhance, expand, or strengthen HCBS in the state and may not supplant state funds for HCBS services. The additional 10 percent FMAP can be earned from April 1, 2021, to March 31, 2022, and may be used through March 31, 2024. Several executive authorizations (EAs) have been issued for planned uses of those funds and the EAs are reflected in the governor’s budget.

Major factors driving the proposed 2022/23 DHS General Fund budget increase of $3.28 billion from revised 2021/22 estimates largely fall in four areas: cost of current programs; federal matching; initiatives; and the impact of one-time adjustments.

Under the federal public health emergency, DHS is prevented from terminating MA enrollment, except in specific cases, such as death or a move out of state. DHS projects decreased enrollment in 2022/23 due to the assumed end of the public health emergency. The monthly average number MA participants are expected to decrease by 170,000 enrollees, or 4.9 percent. Some of those participants are expected to transition to state-based exchange coverage through Pennie and others to the Children’s Health Insurance Program (CHIP). Therefore, CHIP average monthly enrollment is projected to increase by 26,000, or 16.2 percent.

Investments using enhanced HCBS FMAP that are maintained, such as provider rate increases, will eventually need to switch to General Funds as the enhanced HCBS FMAP funds earned are depleted over time. Additional detail of how much of the DHS cost to maintain current programs is due to maintaining these investments will be analyzed as part of detailed hearing materials.

As mentioned previously, the governor’s executive budget assumes availability of 6.2 percent enhanced FMAP sunsets on June 30, 2022. The availability of the enhanced FMAP reduced General Fund need for the programs for the duration of the public health emergency. Once the end of the quarter that contains the end of the public health emergency arrives, those costs will revert back to the General Fund. DHS estimates that $2.2 billion in General Funds will be needed in 2022/23 to account for the sunset.

In addition, the federal government projects the standard FMAP for Pennsylvania will decrease effective October 1, 2022 from 52.68 percent to 52.00 percent. Therefore, the state fiscal year blended rate will drop from 52.56 percent in 2021/22 to 52.17 percent in 2022/23. This will increase the need for General Funds by $165.4 million.

Gov. Wolf’s executive budget proposes an increase to Pennsylvania’s minimum wage to $12 per hour, effective July 1, 2021, with annual increases of 50 cents each year until the minimum wage becomes $15 per hour. The higher minimum wage is expected to reduce costs in DHS as children transition from MA to CHIP at a higher FMAP or adults transition to the state-based healthcare exchange, Pennie, to purchase coverage.

The increased minimum wage proposed in the budget will also increase costs for DHS in the County Child Welfare program related to counties’ rates of pay of children and youth caseworkers, as well as provider rates in the field of childcare where providers are currently unable to pay $12 per hour. The net impact of the initiative is estimated to save DHS $2.6 million. Like last year, no cost impacts have been included for additional fields such as direct care workers, direct support professionals, or certified nurse aides. Investments made with enhanced HCBS FMAP may have eliminated a prior cost impact or delayed a cost impact to a future year. Assumptions of both cost and savings will be further evaluated in the department's hearing materials.

Gov. Wolf is also seeking $148 million in General Funds for the following initiatives:

- Increasing the monthly Supplemental Nutrition Assistance Program (SNAP) benefit from $20 to $35 for 75,000 to 95,000 seniors and individuals with disabilities - $14.3 million

- Increasing the personal care home state supplement from $439.30 per month to $1,351.80 per month - $50 million

- Investing in critical county behavioral health services - $36.7 million

- Serving an additional 832 individuals with intellectual disabilities and autism currently waiting for services - $18.8 million

- 732 to be served in the Community Living Waiver

- 100 to be served in the Consolidated Waiver

- Assumes continued transition of high school graduates into the Person and Family Directed Services waiver through existing capacity

- Establishing capacity to serve individuals leaving correctional facilities with complex medical or behavioral health needs - $7.2 million

- Facilitating community placements of individuals residing in intermediate care facilities – $1 million

- Implementing additional evidence-based home visiting and family support services to 3,800 additional families - $15 million

- Supporting court appointed volunteer advocacy - $1.8 million

- Discharging 20 individuals from state hospitals through the Community Hospital Integration Project Program (CHIPP) - $1.25 million

- Implementing a home and community-based services model called “Agency with Choice,” which preserves the ability for participants to choose their worker while allowing workers to obtain the support of an agency - $280,000

- Adding 30 staff to support increased regulatory, licensing, budgeting, and administrative workloads - $1.4 million

- Creating a 4 staff child welfare crisis response team - $291,000

In addition to the above initiatives, Gov. Wolf also highlights funding for the following items:

- Increasing MA rates for skilled nursing facilities effective January 2023 - $91.25 million state ($190.1 million total)

- Extending postpartum coverage for birthing parents eligible for MA to 12 months - $8 million

- Supporting Medical Assistance for Workers with Disabilities (MAWD) - Workers with Job Success - $10.5 million

- Recruiting and retaining behavioral health providers - $75 million in federal funds

- Continuing childcare rate increase effective January 1, 2022 - $77.7 million

- Providing incentives for provision of childcare during nontraditional hours - $6.1 million

- Continuing three percent rate increase for early intervention providers – no estimate provided

The executive budget reflects the impacts of 2021/22 one-time costs and one-time carry forward of prior year costs of $523 million that are not anticipated to recur in 2022/23. Additionally, the proposed budget eliminates $71.2 million in 2021/22 special initiatives for nursing facilities, hospitals, medical schools, autism service providers, and local level organizations.

The governor’s budget assumes the reauthorization of the nursing home assessment program scheduled to sunset June 30, 2022. State revenues of $394.6 million are currently generated from this provider assessment. The net benefit to the state is in excess of $170 million and the nursing home provider community benefits from increased resources for MA reimbursements. Reauthorization of the assessment will require legislative action.

The governor’s executive budget proposes $226.2 million in General Funds to the Department of Health, a 7.8 percent increase above enacted 2021/22 appropriation levels. Costs to maintain operations in the department account for $7.2 million of the proposed increase while the annualization of the two new County and Municipal Health Departments (CMHDs) in Delaware and Lackawanna Counties accounts for $1.5 million in year-over-year growth.

The governor proposes several public health related initiatives in the department as well:

- Support CMHDs at the $6 per capita maximum amount permitted by statute – $7.2 million

- Invest in innovative gene and immunotherapy research to develop targeted cancer therapies - $5 million

- Enhance the commonwealth’s public health workforce, including the capacity of the state laboratory - $4 million

The governor proposes level funding to most disease-specific appropriations that are often candidates for reduction due to lack of commonwealth resources. However, the governor does propose eliminating funding to the bio-technology research appropriation, which was enacted at $8.55 million in 2021/22.

Act 42 of 2019 created the Pennsylvania Health Insurance Exchange Authority to develop and operate a state-based exchange (SBE) for the purchase of medical and dental insurance by Pennsylvanians. This new SBE, “Pennie,” replaced the use of the federal exchange, HealthCare.gov, for individuals to purchase insurance. The act also established assessments on insurers, or exchange user fees, currently set at 3 percent of premiums. Exchange fees collected in excess of PHIEA costs are to be invested in a reinsurance program, reducing the cost of purchasing healthcare. The governor’s budget estimates $20 million in excess exchange fees will be collected and distributed to insurers. In addition, $120 million is estimated in federal pass-through reinsurance funds, for a total reinsurance program of $140 million in 2022/23.

The governor proposes spending $345.5 million from the Tobacco Settlement Fund (TSF) in 2022/23 using the same allocation formula from the current year’s Fiscal Code (Act 24 of 2021). The allocation formula maintained in Act 24 is as follows:

- 4.5 percent for tobacco use prevention and cessation activities,

- 13.6 percent for health and related research,

- 8.18 percent for hospital uncompensated care,

- 30 percent for Medicaid benefits for workers with disabilities, and

43.72 percent for health-related purposes.

| Tobacco Settlement Fund |

| ($ amounts in millions) |

| |

|

|

|

| |

2020/21 |

2021/22 |

2022/23 |

| Health Related Program |

Actual |

Available |

Budget |

| Tobacco Use Prevention and Cessation |

16.3 |

16.0 |

15.5 |

| Health and Related Research (CURE) |

49.3 |

48.4 |

47.0 |

| Hospital Uncompensated Care |

29.6 |

29.1 |

28.3 |

| Medical Assistance for Workers with Disabilities |

108.7 |

106.7 |

103.7 |

| Health Related Purposes: |

|

|

|

| Life Sciences Greenhouses |

3.0 |

3.0 |

3.0 |

| Community HealthChoices |

155.4 |

152.5 |

148.1 |

| Total |

$ 362.4 |

$ 355.6 |

$ 345.5 |

Act 24 also included a new sub-allocation of funds for the portion of TSF allocated to health and related research. The 30 percent portion of the health and related research allocation that previously was determined by the Secretary of Health in conjunction with the Health Research Advisory Committee was changed to require $1 million be dedicated to spinal cord injury research and remaining funds be divided into 75 percent for pediatric cancer research and 25 percent for bio-technology research capital and equipment grants.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the master settlement agreement. In 2022/23, the debt service payments on those bonds will total $115.3 million. However, Act 24 of 2021 mandated that sufficient revenues be transferred from General Fund tax collections to the TSF in order to completely offset those debt service costs. The governor’s budget fully reflects this transfer.

Gov. Wolf is proposing an investment of $1.17 billion from the Lottery Fund in 2022/23 for programs that benefit Pennsylvania’s seniors. This is $25 million less than the investments in 2021/22 primarily due to reduced payment assumptions for the Property Tax and Rent Assistance program. Eligibility criteria for the program is static; therefore, fewer and fewer people are eligible each year. However, Gov. Wolf proposes to use $203.8 million of American Rescue Plan Act funds to provide a one-time double payment to those that qualify.

| Lottery Fund Expenditures for Senior Programs |

| ($ amounts in thousands) |

| |

2020/21 |

2021/22 |

2022/23 |

| Agency/Appropriation |

Actual |

Available |

Budget |

| Department of Aging: |

| PENNCARE |

$285,726 |

$281,993 |

$282,848 |

| Transfer to Pharmaceutical Assistance Fund1 |

$155,000 |

$130,000 |

$135,000 |

| Pre-Admission Assessment |

$8,750 |

$8,750 |

$8,750 |

| Caregiver Support |

$12,103 |

$12,103 |

$12,103 |

| Grants to Senior Centers |

$2,000 |

$2,000 |

$2,000 |

| Alzheimer's Outreach |

$250 |

$250 |

$250 |

| Department of Human Services: |

| Medical Assistance - Community HealthChoices |

$438,966 |

$348,966 |

$348,966 |

| Medical Assistance - Transportation Services |

$3,500 |

$3,500 |

$3,500 |

| Department of Revenue: |

| Property Tax and Rent Assistance2,3,4 |

$0 |

$234,600 |

$203,800 |

| Department of Transportation: |

| Transfer to Public Transportation Trust Fund3 |

$95,907 |

$95,907 |

$95,907 |

| Older Pennsylvanians Shared Rides3 |

$75,000 |

$75,000 |

$75,000 |

| TOTAL LOTTERY FUNDS |

$1,077,202 |

$1,193,069 |

$1,168,124 |

| 1 Includes 2021/22 recommended appropriation reduction of $25,000,000 |

| 2 Act 20 of 2020 authoriized the early payment of property tax and rent relief from July 2020 to the prior fiscal year |

|

|

| 3 Executive Authorization |

| 4 Does not include proposed one-time double payment of $203,800,000 using American Rescue Plan Act funds |

The governor proposes a negative appropriation adjustment to the 2021/22 Pharmaceutical Assistance Fund Transfer of $25 million due to excess balances in the Pharmaceutical Assistance Fund.

The proposed budget includes an investment of $667,000 in the Department of Aging for new staff positions to strengthen older adult protective services. These additional eight staff would provide more oversight and quality assurance to protect older Pennsylvanians.

The executive budget revises Lottery Fund net collection estimates for 2021/22 down by $50 million, or 2.5 percent, from last year. The Department of Revenue believes the pandemic played a significant role in 2020/21 being a record setting year and does not anticipate that to continue as strong in 2021/22. For the first six months of the year, scratch offs are slightly underperforming, and they are the largest source of revenue for the Lottery Fund. However, sales in other areas such as Fast Play, draw games, and monitor games are exceeding estimates, helping to make up the difference.

After projections for a sluggish current year, the executive budget assumes growth in future years starting with a 7.3 percent increase in net collections in 2022/23 compared to 2021/22. The proposed budget would also maintain the practice of reserving $75 million each year. After accounting for reserves, the Lottery Fund is projected to end 2021/22 with an ending balance of $158.6 million and end 2022/23 with an ending balance of $268 million.

The governor’s budget would increase funding across the three row offices but includes no major new initiatives. Within the Office of Attorney General, funding for Drug Law Enforcement would increase by $4.5 million, or 9.2 percent, to just under $54 million. The Joint State-Local Firearm Taskforce, a collaborative effort program to reduce gun crime in Philadelphia, would see its appropriation increase by 8.3 percent, or $590,000, to $7.7 million.

The proposed increase to the Auditor General’s budget includes no appropriation for a Bureau of Election Audits

| ($ amounts in thousands) |

2021-22 |

2022-23 |

Dollar Increase |

Percent Increase |

| Attorney General |

129,087 |

140,228 |

11,141 |

8.60% |

| Auditor General |

40,609 |

43,969 |

3,360 |

8.30% |

| Treasury (ex. debt costs) |

46,968 |

49,240 |

2,272 |

4.80% |

The governor’s budget proposal increases total funding for the Department of Military and Veterans by $42.2 million, or 26.3 percent, to $207.7 million. Much of this increase would be directed toward the commonwealth’s six veterans’ homes, which received an additional $36.6 million – an increase of 33.2 percent. Approximately $31 million of this increase would replace federal funds from COVID-19 relief measures or be used to comply with new regulatory requirements.

Funding for general government operations would increase by 11.5 percent, or $3 million. The governor would dedicate $1 million of this increase to new initiatives for veterans and members of the Pennsylvania National Guard, including $445,000 for suicide prevention. The governor would also increase funding to the Keystone State ChalleNGe Academy by $275,000.

Gov. Wolf’s 2022/23 budget proposal for the Department of Community and Economic Development (DCED) is $154.06 million, absent appropriations typically added back during budget deliberations.

With respect to investment in innovation in the commonwealth, the governor’s budget proposes a 124.1 percent increase, or an additional $18 million transfer, to the Ben Franklin Technology Development Authority (BFTDA) to support technology, innovation, and business startups. Similarly, the budget proposes a $2.35 million investment in Invent Penn State, which would support entrepreneurs and foster cross-sector collaborations in Pennsylvania.

The governor’s proposed budget includes increases in economic development initiatives. Specifically, the proposal incorporates a $1.5 million increase in funding for the Partnerships for Regional Economic Performance (PREP) and for Manufacturing PA. This 15.2 percent increase in PREP funding would support competitive grants to organizations to foster partnerships with institutions of higher education, while the 12.5 percent increase in Manufacturing PA funding would support competitive grants to Industrial Resource Centers for innovative service delivery.

Lastly, Gov. Wolf proposes restoring $1.5 million in funding for public television services, which was eliminated in the enacted 2021/22 budget. This appropriation would support programmatic and promotional costs for public television services. The 2022/23 budget proposal also includes an 11 percent increase in the general government operations appropriation to continue current programming, along with funding an additional 9 positions for the Office of Broadband Initiatives to administratively support the state’s recently created Broadband Development Authority.

The governor’s budget proposal for the Department of State provides for an increase of 16.3 percent, or $5.925 million, in state funding when compared to 2021/22. The primary contributor is the proposed 158.3 percent, or $9.2 million, increase in the general government operations appropriation. These increases consist of the following proposals: $2 million for a voter outreach campaign, $3.6 million for an increase in complement of twenty-two staff to modernize and improve Pennsylvania’s elections, and $2.5 million needed to maintain the current operations of the department.

The proposed increases in general government operations are partially offset by a $2.9 million reduction for the nonrecurring, decennial publishing of the state and federal reapportionment maps appropriated in the 2021/22 budget.

The Department of Corrections continues to be the third largest department in the state budget after human services and education. This budget proposes $2.8 billion in state general funds for the Department of Corrections, an increase of 108.5 million, or 4.1 percent, from 2021/22.

| Major Department of Corrections Appropriations |

| ($ amounts in thousands) |

2021/22 |

2022/23 |

Change |

Percent Change |

| GGO |

$ 42,268 |

$ 40,154 |

$ (2,114) |

-5.0% |

| State Correctional Institutions |

$ 2,083,044 |

$ 2,165,745 |

$ 82,701 |

4.0% |

| Medical Care |

$ 331,486 |

$ 340,279 |

$ 8,793 |

2.7% |

| Pennsylvania Parole Board |

$ 12,121 |

$ 12,965 |

$ 844 |

7.0% |

| State Field Supervision1 |

$ 151,403 |

$ 160,596 |

$ 9,193 |

6.1% |

| 1Includes requested $5 million supplemental appropriation for 2021/22 |

Act 59 of 2021 finalized the consolidation of the Department of Corrections and the Board of Probation and Parole. The budget proposal includes a requested $5 million supplemental appropriation for State Field Supervision in 2021/22 and proposes an increase in funding of $9.2 million, or 6.1 percent, for 2022/23.

The budget proposes to move the Office of Victim Advocate back to its own appropriation. The office has been funded out of General Government Operations since 2019/20. $3.2 million is recommended for the office.

The Board of Pardons was transferred from the Office of the Lieutenant Governor by Act 59 of 2021. $2.3 million is recommended for the board for 2022/23, a $164,000 increase over 2021/22.

The governor’s budget proposal provides $1.51 billion for Pennsylvania State Police (PSP), a $130.5 million, or 9.4 percent, increase from 2021/22.

PSP draws funding from the General Fund, Motor License Fund (MLF), and other smaller funds. Appropriations from the MLF to PSP are restricted by a statutory cap-- $641.4 million in 2022/23-- that decreases by approximately $32 million annually until it reaches $500 million in 2027/28. The governor’s budget proposal accelerates this multi-year effort to shift away from reliance on the Motor License Fund and decreases overall Pennsylvania State Police budget reliance on the Motor License Fund to $500 million. This transition was expedited due to state match requirements for federal transportation and infrastructure funding and the need to assure state match availability. The proposal includes a $141 million increase of state General Funds to the PSP to fill the gap left by the shift away from the MLF.

The budget does not propose any municipal police fees, which previously had been proposed since 2016/17 to help pay for state police costs.

The proposed budget would invest in two additional cadet classes in 2022/23, with a goal of graduating approximately 200 new troopers.

The proposal includes $7.7 million for technology to increase public and law enforcement officer safety. This includes funding for mobile video recorders and body worn cameras.

In 2022/23, Gov. Wolf proposes a $1.6 million appropriation increase to support the Pennsylvania Instant Check System (PIC) gun check system. PICS is also funded by a restricted account, although the account’s revenue is less than half the annual cost of the program. The increase in General Government Operations provides for an additional 32 staff for firearm purchase instant background checks.

The budget proposes a $1.5 million increase for General Government Operations within the Pennsylvania Emergency Management Agency and a $251,000 increase for the Office of the State Fire Commissioner.

The governor’s budget proposal includes $5 million for Disaster Relief and $20 million for Hazard Mitigation. These funds are for non-recurring costs related to disaster relief and hazard mitigation, which can vary substantially year-to-year.

The budget provides $10 million for State Disaster Assistance, a new initiative to provide disaster assistance to individuals. This would include improving access to safe, secure, and weathertight homes.

The governor’s budget proposes a $2.9 increase for General Government Operation for the Pennsylvania Commission on Crime and Delinquency (PCCD). Of that amount, $1 million would support the reintegration of women following incarceration by providing reentry services at the local level. Another $1 million would be used to provide legal representation for indigent defendants.

Grants to support county probation are level funded in this proposal. This is the eleventh year at the current funding level of $16.2 million.

Acts 114 and 115 of 2019, also known as JRI 2, shifted $16.2 million from the Department of Corrections to PCCD for the improvement of Adult Probation Services. Additional funds were deposited into the Justice Reinvestment Fund beginning in 2021/22 based on a percentage of program savings generated in the year prior to the deposits. Savings were generated by implementing short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations. These savings will be used to fund county probation grants.

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in 2022/23.

Act 44 of 2018 established the School Safety and Security Committee for the administration of the School Safety and Security Grant Program. Grant funding is used by schools to supplement existing spending on safety and security. For 2022/23, the budget proposes replacing the $15 million annual transfer from the Unified Judicial System with a $45 million transfer from the personal income tax.

The executive budget provides $35 million for Violence Intervention and Prevention grants, a $5 million increase from 2021/22. The additional $5 million will support community-led gun violence prevention efforts. It also provides for a $10 million transfer to the Nonprofit Security Grant Fund.

The governor’s budget proposes a $616,000 increase for the Juvenile Court Judges’ Commission. Within this increase, $425,000 is dedicated to staffing and resources to provide additional technical assistance to county juvenile probation offices and improve consistency between counties. The remainder of the increase is to continue the current program ($125,000) and to replace a nonrecurring benefits cost reduction ($66,000).

The Judiciary has been essentially flat funded for several fiscal years. The governor’s budget proposes increases to several appropriations to continue current operations. The net effect of these changes is an increase in state General Fund expenditures from $356 million in 2021/22 to $392 million in 2022/23, a $36 million, or 10.1 percent, increase.

| Proposed Judiciary Appropriation Increases |

| ($ amounts in thousands) |

2021/22 |

2022/23 |

Change |

Percent Change |

| Supreme Court |

$ 17,150 |

$ 18,649 |

$ 1,499 |

8.7% |

| Judicial Center Operations |

$ 814 |

$ 1,105 |

$ 291 |

35.7% |

| District Court Administrators |

$ 19,657 |

$ 21,994 |

$ 2,337 |

11.9% |

| Court Administrator |

$ 11,577 |

$ 12,290 |

$ 713 |

6.2% |

| Superior Court |

$ 32,377 |

$ 36,625 |

$ 4,248 |

13.1% |

| Commonwealth Court |

$ 21,192 |

$ 23,536 |

$ 2,344 |

11.1% |

| Court of Common Pleas |

$ 117,739 |

$ 130,270 |

$ 12,531 |

10.6% |

| Senior Judges |

$ 4,004 |

$ 4,291 |

$ 287 |

7.2% |

| Judicial Education |

$ 1,247 |

$ 1,899 |

$ 652 |

52.3% |

| Magisterial District Judges |

$ 82,802 |

$ 92,186 |

$ 9,384 |

11.3% |

| Magisterial District Judge Education |

$ 744 |

$ 1,020 |

$ 276 |

37.1% |

| Municipal Court |

$ 7,794 |

$ 9,122 |

$ 1,328 |

17.0% |

| Judicial Conduct Board |

$ 2,505 |

$ 2,555 |

$ 50 |

2.0% |

| Court of Judicial Discipline |

$ 606 |

$ 618 |

$ 12 |

2.0% |

In recent years, the General Assembly reallocated multiple revenue streams to support school facility safety efforts. One such transfer affecting the judicial branch is an ongoing $15 million redirect of fee revenue from the Judicial Computer Center Augmentation Account to the School Safety and Security Fund. Last fiscal year, the fiscal code (Act 24 of 2021) temporarily paused this transfer, out of concerns that the loss of resources would cause a shutdown for one of the judiciary’s key computer systems, the Common Pleas Case Management System. For 2022/23, the budget proposes to replace this fee transfer entirely and instead dedicate $45 million from the personal income tax to the School Safety and Security Fund.

The executive budget provides $625 million for the department’s overall budget. Specifically, the General Fund state budget proposal of $188.217 million represents a $12.36 million increase, or 7 percent. Furthermore, the General Fund’s federal funding proposal provides $233.96 million, equating to a $125.84 million increase. The significant increase in federal funds is driven by a $135.05 million increase for COVID State Fiscal Recovery (SFR) related to Agriculture Preservation. Governor Wolf proposes funding for the Growing Greener III program specifically related to the Agricultural Conservation Assistance and Excellence Programs. The increase in federal funding is offset by COVID – Emergency Food Assistance and COVID – Epidemiology & Lab Surveillance/Response funding that is available in 2021/22, but not for 2022/23.

Additionally, the executive budget delivers additional funding for the administration of Pennsylvania’s Dog Law. The proposal allocates supplemental funding of $1.34 million for 2021/22 and an additional $3 million for 2022/23. The additional need for support is due to lack of an increase to dog licensing fees since 1982.

The department’s budget proposal funds three initiatives through existing line items:

- $3.5 million increase in Agricultural Preparedness & Response to monitor and respond to invasive species

- $2.75 million increase in Transfer to Agricultural College Land Scrip Fund

- $1.59 million increase in University of Pennsylvania – Center for Infectious Disease

Lastly, the budget delivers a $2 million increase for the Pennsylvania Agricultural Surplus System (PASS) within the State Food Purchase Program to further address food insecurity and deliver more access to healthy meals.

The governor’s executive budget provides a significant infusion of resources to the Department of Conservation and Natural Resources (DCNR) with a total proposal of $637.74 million. Within the budget’s framework, the state General Fund proposal of $168.47 million represents a 21.2 percent increase, or $29.42 million, compared to 2021/22. Similarly, the federal General Fund proposal includes a significant increase conditioned on the infusion of COVID-19 State Fiscal Recovery (SFR) State/Local Parks & Forest Facility Restoration funds, as part of the investment in the Growing Greener III program.

Much of the department’s state General Fund increase is a function of the added support to DCNR’s major appropriations: General Government Operations and State Parks/Forests Operations. Personnel increases to those appropriations of $2.5 million, will fund 31 new positions to the department for management of outdoor recreation and state park/forest operations. Part of the additional funding is provided by increased utilization of the Oil & Gas Lease Fund, to the tune of $5 million.

The governor’s 2022/23 budget proposal not only prioritizes environmental investment, but also capitalizes on the passage of the Infrastructure Investment and Jobs Act (IIJA). The executive budget allocates $214.11 million for the state General Fund, an increase of 24.8 percent or $42.48 million. A considerable share of the proposed increase is related to the Department of Environmental Protection (DEP)’s major appropriations:

- General Government Operations - $3.17 million (includes $2.34 million for state match of IIJA funds)

- Environmental Program Management - $8.13 million (includes $5 million for additional staff)

- Environmental Protection Operations - $19.07 million

The executive budget supports 41 new positions within Environmental Program Management for clean water, waterways, and wetlands management to help facilitate the investment of federal funds.

Furthermore, this proposal includes a significant increase in the use of federal funds. Those funds are utilized to support the Growing Greener III program proposal, in the amount of $180.07 million from COVID - State Fiscal Recovery (SFR) Watershed & Wetland Restoration. The budget proposal also makes use of IIJA funding across several areas.

| DEP Executive Budget Utilization of IIJA |

| ($ amounts in thousands) |

| Infrastructure Investment & Jobs Act (IIJA) |

2022/23 |

| IIJA - Assistance for Small & Disadvantaged Communities |

$ 28,103 |

| IIJA - Orphan Well Plugging |

$ 25,000 |

| IIJA - DOE Energy Programs |

$ 22,300 |

| IIJA - Electric Grid Resilience |

$ 13,236 |

| IIJA - Energy Efficiency & Conservation |

$ 4,000 |

| IIJA - Abandoned Mine Reclamation |

$ 25,000 |

|

|

|

|

|

$ 117,639 |

Lastly, unlike the 2021/22 budget proposal, Governor Wolf’s budget funds Water Commissions at their fair share for 2022/23.

The budget proposal includes $6.89 billion in state funding for the department within the Motor License Fund, which represents a $80.47 million reduction, or 1.15 percent. Available for utilization, the budget proposal also includes federal funding form the Infrastructure Investment and Jobs Act (IIJA). To properly understand the contributing factors for this change, we must examine the different programs within the agency.

- Highway & Bridge Improvement (Hwy & Bridge Construction) - $2.54 billion state/federal combined

- State Highway & Bridge Construction – $1.34 billion

- Federal Construction – $2.02 billion

- Non-Stimulus or IIJA funding – $1.25 billion

- IIJA funding - $748.03 million

- proposal also includes supplement funding of $704.56 million for 2021/22

- State Highway Maintenance - $1.74 billion

- Local Highway & Bridge Maintenance - $836.07 million

- Mass Transit Grants - $2.18 billion

| PENNDOT STATE FUNDS EXECUTIVE BUDGET COMPARISON |

| ROADS & BRIDGE |

| |

Available |

Exec Budget |

Exec Budget less Avail |

| Area |

2021/22 |

2022/23 |

$ Chng |

% Chng |

| HWY CONSTRUCTION |

$ 799,200 |

$ 1,083,902 |

$ 284,702 |

35.6% |

| BRIDGES |

$ 258,465 |

$ 263,018 |

$ 4,553 |

1.8% |

| HWY & BRIDGE IMPROVEMENT |

$ 1,057,665 |

$ 1,346,920 |

$ 289,255 |

27.3% |

| |

|

|

|

|

| STATE HIGHWAY MAINTENANCE TOTAL |

$ 1,695,168 |

$ 1,742,503 |

$ 47,335 |

2.8% |

| |

|

|

|

|

| LOCAL HIGHWAY & BRIDGE TOTAL |

$ 806,205 |

$ 836,075 |

$ 29,870 |

3.7% |

| ROADS & BRIDGE |

$ 3,559,038 |

$ 3,925,498 |

$ 366,460 |

10.30% |

| |

|

|

|

|

| MASS TRASIT GRANTS |

$ 2,621,628 |

$ 2,189,302 |

$(432,326) |

-16.49% |

| |

|

|

|

|

| MULTIMODAL TRASNPORTATION |

$ 192,548 |

$ 193,909 |

$ 1,361 |

0.71% |

| |

|

|

|

|

| OTHER |

$ 598,919 |

$ 582,945 |

$ (15,974) |

-2.67% |

| |

|

|

|

|

| TOTAL STATE FUNDS |

$ 6,972,133 |

$ 6,891,654 |

$ (80,479) |

-1.15% |

Lastly, the executive budget assumes the increase in the transfer of Motor Vehicle Sales and Use Tax, as provided for by Act 44/89, as a result of the reduction in the transfer from the Turnpike from $450 to $50 million. Statutorily, the Motor Vehicle Sales and Use Tax transfer, into the Public Transportation Trust Fund, increases by at least $450 million.

For the General Fund, the Department of Labor and Industry’s budget is status quo, except for a $4.2 million increase for general government operations. The bulk of this increase, $3.2 million, is designated to help build a longitudinal data system to track outcomes and information from childcare and early education through secondary and post-secondary education and subsequent employment. Building a longitudinal database linking education and workforce data can help policymakers make data-driven decisions that maximize effectiveness of state programs in these areas.