General Fund Revenue Update - August 2021

By Eric Dice , Assistant Executive Director | 4 years ago

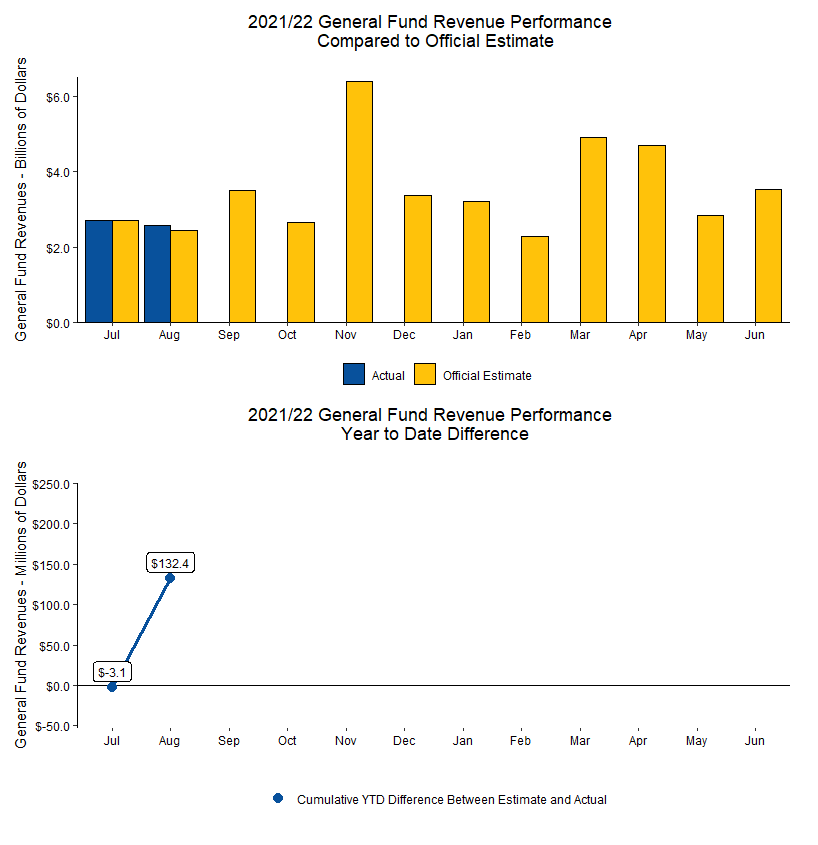

The General Fund is off to a good start for the 2021/22 fiscal year, with revenues in August $135.5 million ahead of the official estimate, or 5.6 percent. For the fiscal year to date, total revenues are $132.4 million higher than expected, or 2.6 percent.

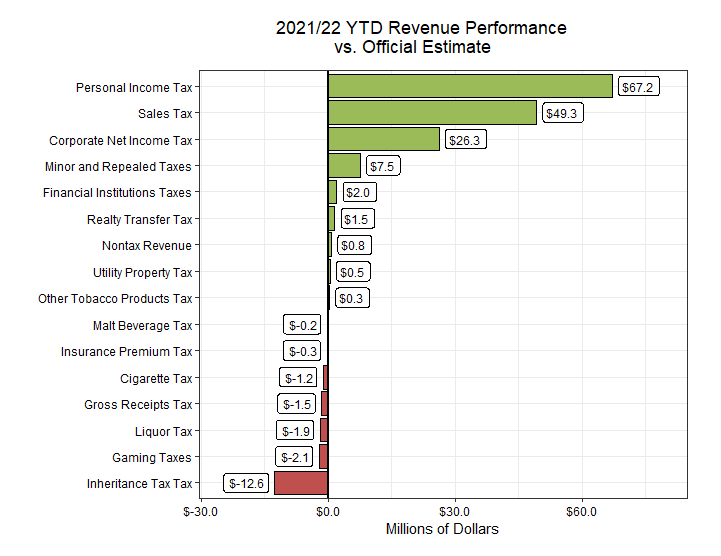

All three of the major tax types pitched in to the month’s surplus. Corporate net income tax revenues were $26.3 million ahead of estimate, sales and use tax collections were $49.3 million above projections, and the personal income tax brought in $67.1 million more than expected.

Looking ahead, September will bring the first quarterly estimated payments of the fiscal year for both the personal income tax and the corporate net income tax. Also worth tracking is the expiration of several pandemic-related unemployment benefits on September 4, and the impact of these supports not being available to Pennsylvania families experiencing unemployment.

Relatedly, the federal government announced that SNAP benefits will increase in October, both maintaining a current benefit that was scheduled to expire on September 30 and increasing the benefit further to help families struggling with food insecurity.

For August:

- Total General Fund collections were $135.5 million higher than expected (5.6 percent)

- General Fund tax revenues were $134.8 million higher than anticipated (5.6 percent)

- The corporate net income tax was $26.3 million higher than expected (33.0 percent)

- Sales and use tax collections exceeded projections by $49.3 million (4.6 percent)

- Non-motor collections were $54.6 million higher than projected (6.0 percent)

- Motor vehicle collections were $5.3 million below estimate (-3.4 percent)

- Personal income tax collections were $67.1 million higher than the official estimate (7.4 percent)

- Employer withholdings on wages and salaries were $55.1 million more than anticipated (6.5 percent)

- Non-withheld payments were $12.0 million above estimate (19.0 percent)

- Realty transfer tax revenues were $1.6 million above estimate (2.2 percent)

- Inheritance tax collections were $12.5 million lower than estimated (-10.2 percent)

- Non-tax revenues were $695,000 above the official estimate (3.9 percent percent)

For the 2021/22 fiscal year in total:

- Cumulative General Fund revenues were $132.4 million higher than expected (2.6 percent)

- General Fund tax revenues were $131.6 million higher than projected (2.6 percent)

- Corporate net income tax revenues are $26.3 million more than expected (10.5 percent)

- Sales and use taxes are $49.3 million more than expected (2.1 percent)

- Personal income tax collections are $67.2 million higher than anticipated (3.6 percent)

- Non-tax revenues are $800,000 above the estimate (1.7 percent)

| General Fund Revenues - Year-to-Date Performance vs Official Estimate |

| Through August 2021 |

| |

YTD Estimate |

YTD Revenues |

Difference |

| Corporation Taxes |

| Accelerated Deposits |

$0.0 |

−$3.2 |

−$3.2 |

| Corporate Net Income Tax |

$251.1 |

$277.4 |

$26.3 |

| Gross Receipts Tax |

$5.9 |

$4.4 |

−$1.5 |

| Utility Property Tax |

$0.4 |

$0.9 |

$0.5 |

| Insurance Premiums Taxes |

$19.8 |

$19.5 |

−$0.3 |

| Financial Institutions Taxes |

$1.6 |

$3.6 |

$2.0 |

| Subtotal - Corporation Taxes |

$278.8 |

$302.5 |

$23.7 |

| Consumption Taxes |

| Sales and Use Tax |

$2,297.9 |

$2,347.2 |

$49.3 |

| Cigarette Tax |

$145.5 |

$144.3 |

−$1.2 |

| Other Tobacco Products |

$24.7 |

$25.0 |

$0.3 |

| Malt Beverage Tax |

$4.3 |

$4.1 |

−$0.2 |

| Liquor Tax |

$71.6 |

$69.7 |

−$1.9 |

| Subtotal - Consumption Taxes |

$2,544.0 |

$2,590.3 |

$46.3 |

| Other Taxes |

| Personal Income Tax |

$1,870.8 |

$1,938.0 |

$67.2 |

| Realty Transfer Tax |

$104.8 |

$106.3 |

$1.5 |

| Inheritance Tax |

$239.8 |

$227.2 |

−$12.6 |

| Gaming |

$48.1 |

$46.0 |

−$2.1 |

| Minor and Repealed |

$9.9 |

$17.4 |

$7.5 |

| Subtotal - Other Taxes |

$2,273.4 |

$2,334.9 |

$61.5 |

| |

| Non-Tax Revenue |

$45.9 |

$46.7 |

$0.8 |

| General Fund Total |

$5,142.1 |

$5,274.5 |

$132.4 |