General Fund Revenue Update - June 2021

By Eric Dice , Assistant Executive Director | 4 years ago

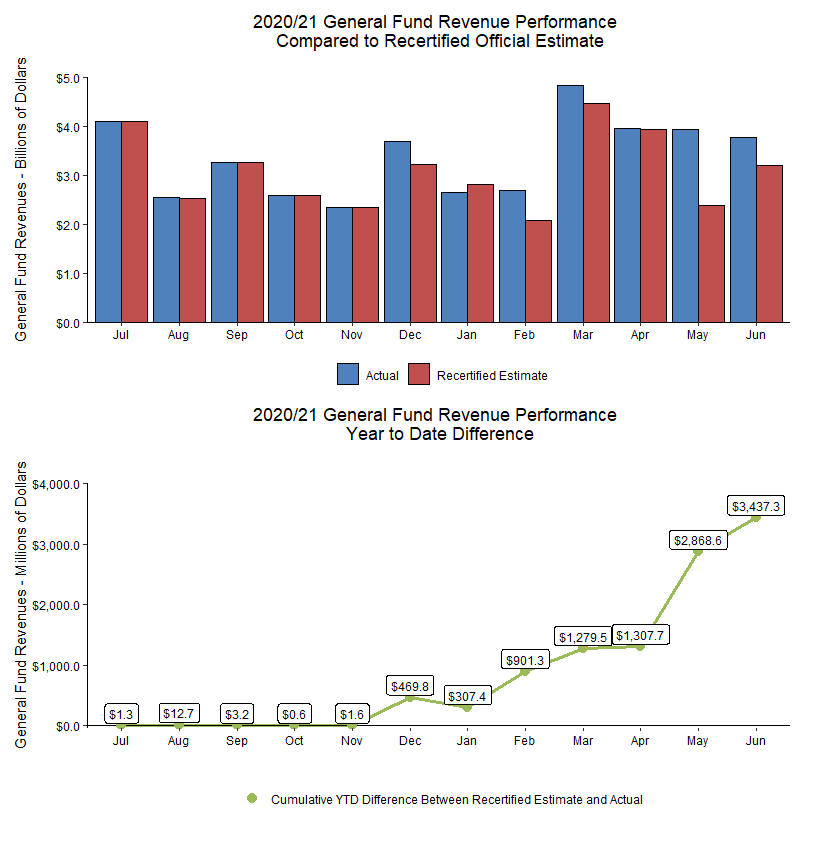

The tumultuous 2020/21 fiscal year came to an end on June 30, closing a year that saw incredible uncertainty as Pennsylvania emerged from the pandemic, unprecedented federal support, two budgets, large changes in taxpayer behavior, and ultimately, a large revenue surplus.

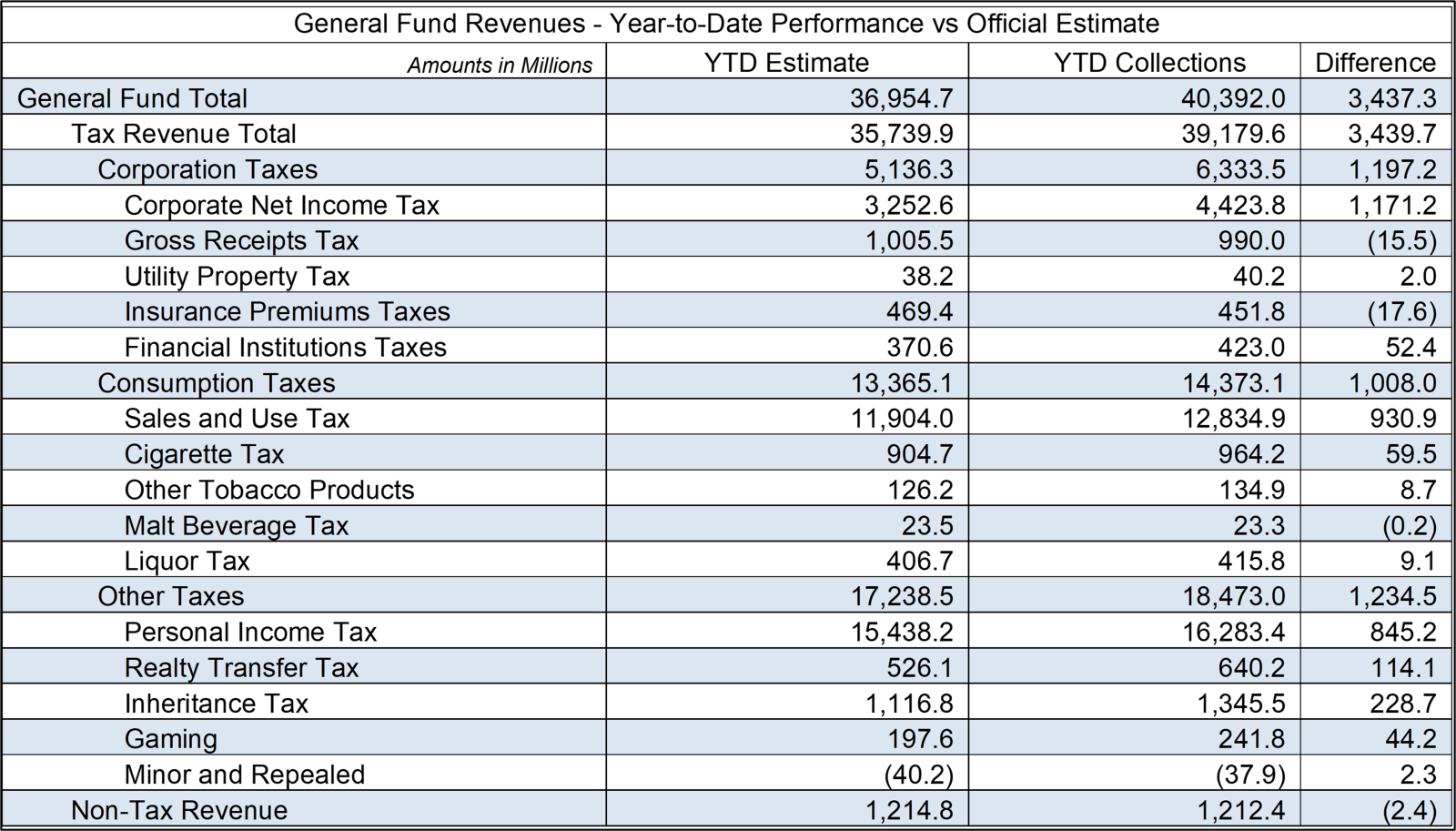

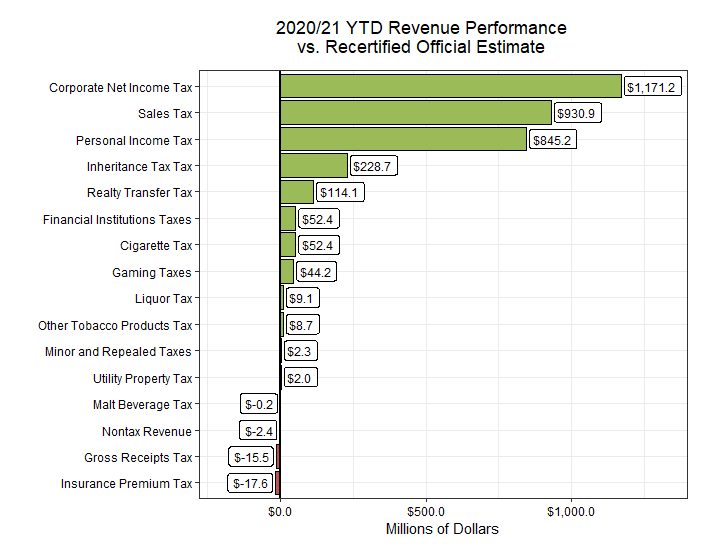

General Fund revenues finished the fiscal year $3.4 billion ahead of the official revenue estimate. Revenues outperformed estimate in almost all tax types and were significantly ahead of estimate in the three major taxes. The corporate net income tax led the way, finishing $1.17 billion ahead of estimate. Sales and use taxes were $930.9 million higher than projected, while the personal income tax exceeded expectations by $845.2 million.

The large surplus on the revenue side of the budget is a primary factor that led to a multi-billion transfer to the Rainy Day Fund, offset in part by additional costs that were addressed through supplemental appropriations on the spending side. The Fiscal Code required that 100% of the budgetary surplus for the General Fund after accounting for changes in revenues and expenditures be transferred to the Rainy Day Fund. This amount has not yet been certified by the Secretary of the Budget, but a preliminarily estimate is that it will be around $2.6 billion.

For June:

- Total General Fund collections were $568.7 million higher than expected (17.8 percent)

- General Fund tax revenues were $613.9 million higher than anticipated (20.1 percent)

- The corporate net income tax was $296.9 million higher than expected (71.6 percent)

- Quarterly estimated payments were $272.5 million above estimate

- Final payments were $23.6 million above estimate

- Sales and use tax collections exceeded projections by $189.2 million (18.7 percent)

- Non-motor collections were $167.8 million higher than projected (19.7 percent)

- Motor vehicle collections were $21.4 million above estimate (13.3 percent)

- Personal income tax collections were $97.5 million higher than the official estimate (7.3 percent)

- Employer withholdings on wages and salaries were $43.0 million more than anticipated (7.3 percent)

- Quarterly estimated payments were $15.7 million more than expected (4.4 percent)

- Final annual payments were $38.8 million higher than projected (143.7 percent)

- Realty transfer tax revenues were $18.6 million above estimate (40.1 percent)

- Inheritance tax collections were $12.2 million higher than estimated (13.8 percent)

- Non-tax revenues were $45.2 million below the official estimate (30.5 percent)

For the 2020/21 fiscal year in total:

- Cumulative General Fund revenues were $3.44 billion higher than expected (9.3 percent)

- General Fund tax revenues were $3.44 billion higher than projected (9.6 percent)

- Corporate net income tax revenues are $1.17 billion more than expected (36.0 percent)

- Sales and use taxes are $930.9 million more than expected (7.8 percent)

- Personal income tax collections are $845.2 million higher than anticipated (5.5 percent)

- Non-tax revenues are $2.4 million below the estimate (0.2 percent)