General Fund Revenue Update - April 2021

By Eric Dice , Assistant Executive Director | 4 years ago

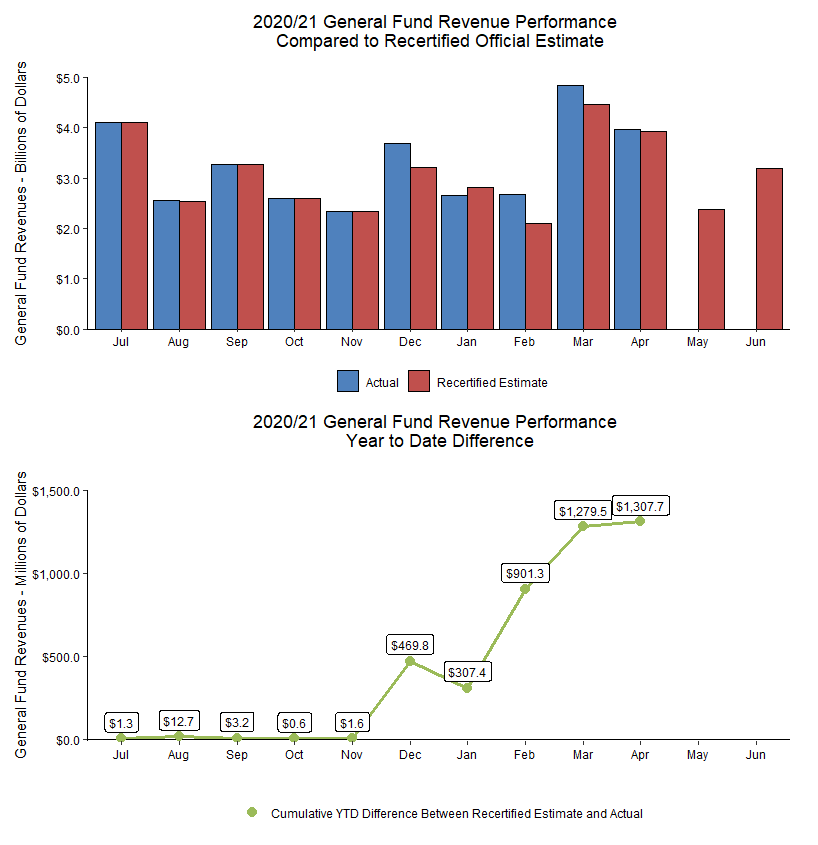

Although April’s General Fund revenues were only $28.2 million higher than the revised official estimate, collections were exceptionally strong in many tax types and would have significantly exceeded the monthly estimate, but for the delay of the personal income tax filing deadline until next month. Through 10 months of the fiscal year, the General Fund sits $1.308 billion higher than the revised official estimate.

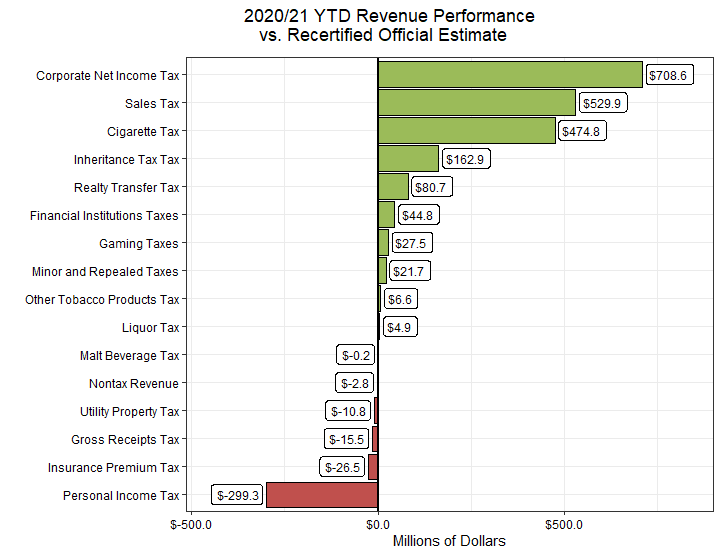

Sales and use tax collections were extremely strong in April, beating expectations by $273.1 million, or 29.6 percent. Both motor vehicle and non-motor vehicle collections performed well. Motor vehicle collections were $53.9 million higher than expected (41.6 percent), while non-motor collections were $219.2 million above estimate (27.6 percent). Other consumption-based taxes similarly beat expectations by healthy margins, reflecting growing consumer spending and the support to consumers and families provided by recent acts of Congress.

Corporate net income tax payments were $235.4 million higher than expected, or 96.9 percent. Final payments were almost double the amount assumed in the official estimate this month. There’s a chance that some taxpayers have remitted payment earlier than expected, but the size of the payments received so far tends to suggest that this tax type will remain strong through the end of the fiscal year.

The personal income tax finished $571.8 million below estimate, or 24.9 percent. The primary reason for the PIT shortfall was the delay of the filing deadline until May 17. So, while PIT final payments (normally at their peak in April) were $531.3 million lower than expected, or 51.7 percent, most of that shift will be recovered in May when taxpayers remit their returns.

PIT withholdings on wages and salaries were $15.3 million lower than expected, or 1.7 percent. Quarterly estimated payments, which have a major due date in April, were $25.2 million lower than expected, or 6.8 percent.

As was the case last month, inheritance tax collections were significantly elevated in April, exceeding estimate by $57.2 million, or 64.8 percent. Other tax types exceeding estimate included the realty transfer tax by $12.0 million or 29.6 percent, and gaming taxes paid into the General Fund, which were $13.5 million above estimate or 88.0 percent.

Looking ahead, PIT revenues bear watching in May, to see how much of the timing shift is recovered. Also, of interest is whether other recurring sources, like the sales tax that are running ahead of estimate, continue their pace. The Independent Fiscal Office is scheduled to release its preliminary revenue estimate for the next fiscal year in late May.

For April:

-

Total General Fund collections were $28.2 million higher than expected (0.7 percent)

-

General Fund tax revenues were $68.0 million higher than anticipated (1.9 percent)

-

The corporate net income tax was $235.4 higher than expected (96.9 percent)

-

Sales and use tax collections exceeded projections by $273.1 million (29.6 percent)

-

Cigarette tax collections were $21.5 million higher than expected (57.8 percent)

-

Personal income tax collections were $571.8 million lower than expected (24.9 percent)

-

Employer withholdings on wages and salaries were $15.3 million less than anticipated (1.7 percent)

-

Final annual payments were $531.3 million below estimate (51.7 percent)

-

Quarterly estimated payments were $25.2 million less than expected (6.8 percent)

-

Realty transfer tax revenues were $12.0 million above estimate (29.6 percent)

-

Inheritance tax collections were $57.2 million higher than estimated (64.8 percent)

-

Non-tax revenues were $39.9 million below the official estimate (15.0 percent)

For the 2020/21 fiscal year to date:

-

Cumulative General Fund revenues are $1.308 billion higher than expected (4.2 percent)

-

General Fund tax revenue are $1.311 billion higher than projected (4.3 percent)

-

Corporate net income tax revenues are $708.6 million more than expected (27.4 percent)

-

Sales and use taxes are $529.9 million more than expected (5.3 percent)

-

Personal income tax collections are $299.3 million less than anticipated (2.3 percent), not adjusting for the delay in the PIT due date that has pushed some revenue into May.

-

Non-tax revenues are $2.8 million below the estimate (0.3 percent)

|

General Fund Revenues - Year-to-Date Performance vs Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

31,368.7

|

32,676.4

|

1,307.7

|

|

Tax Revenue Total

|

30,314.2

|

31,624.7

|

1,310.5

|

|

Corporation Taxes

|

4,460.7

|

5,189.1

|

728.4

|

|

Corporate Net Income Tax

|

2,586.1

|

3,294.7

|

708.6

|

|

Gross Receipts Tax

|

1,005.9

|

990.4

|

(15.5)

|

|

Utility Property Tax

|

22.8

|

12.0

|

(10.8)

|

|

Insurance Premiums Taxes

|

483.1

|

456.6

|

(26.5)

|

|

Financial Institutions Taxes

|

362.8

|

407.6

|

44.8

|

|

Consumption Taxes

|

11,142.6

|

11,731.0

|

588.4

|

|

Sales and Use Tax

|

9,948.6

|

10,478.5

|

529.9

|

|

Cigarette Tax

|

729.7

|

776.9

|

47.2

|

|

Other Tobacco Products

|

104.6

|

111.2

|

6.6

|

|

Malt Beverage Tax

|

19.3

|

19.1

|

(0.2)

|

|

Liquor Tax

|

340.4

|

345.3

|

4.9

|

|

Other Taxes

|

14,710.9

|

14,704.6

|

(6.3)

|

|

Personal Income Tax

|

13,231.3

|

12,932.0

|

(299.3)

|

|

Realty Transfer Tax

|

437.5

|

518.2

|

80.7

|

|

Inheritance Tax

|

945.7

|

1,108.6

|

162.9

|

|

Gaming

|

168.4

|

195.9

|

27.5

|

|

Minor and Repealed

|

(72.0)

|

(50.3)

|

21.7

|

|

Non-Tax Revenue

|

1,054.5

|

1,051.7

|

(2.8)

|