General Fund Revenue Update - March 2021

By Eric Dice , Assistant Executive Director | 4 years ago

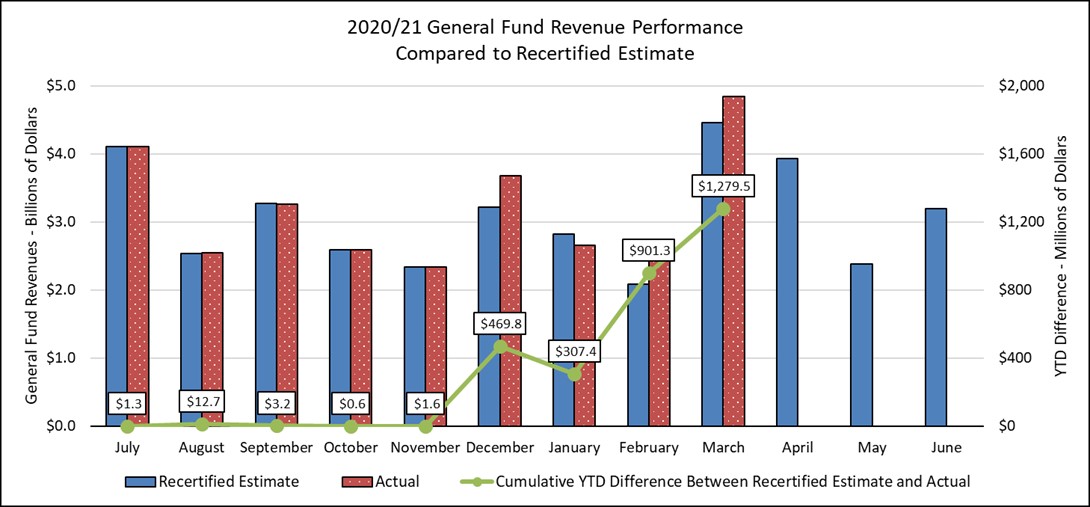

Nine months through the 2020/21 fiscal year, General Fund revenues continue to exceed the revised official estimate. Collections last month were $378.2 million higher than expected, or 8.5 percent. For the fiscal year to date, the General Fund is $1.28 billion, or 4.7 percent, above the revised official estimate.

March is typically the largest revenue month each year, and even with the major tax shifts earlier this fiscal year from changing tax due dates during the pandemic, it remains on top. The General Fund received over $4.8 billion last month. Large corporation tax payments from the gross receipts tax, the insurance premiums tax, and the bank shares tax are all due primarily in March. In addition, corporate net income taxpayers remit their first quarter estimated payments.

The select corporation tax payments were mixed, but balanced out by solid payments for the corporate net income tax. Gross receipts tax collections on utilities were $11.6 million lower than expected, or 1.2 percent. Insurance premiums taxes were $27.4 million under estimate, or 7.0 percent. Financial institutions taxes were $31.1 million above estimate, or 9.2 percent. Corporate net income taxes were $92.4 million above estimate, or 25.1 percent. About two-thirds of the CNIT overage was attributable to quarterly estimated payments, with the remainder associated with final annual payments.

Sales tax continues to outperform the revised estimate, finishing the month $85.8 million higher than expected, or 10.3 percent. Both motor vehicle collections and non-motor collections were positive. Motor vehicle collections were $21.5 million above estimate, and non-motor collections beat expectations by $64.3 million.

The personal income tax finished $95.1 million above estimate, or 7.5 percent. Employer withholdings on salaries and wages were $45.9 million better than expected, and non-withheld collections were $49.2 million more than projected.

Inheritance tax collections were significantly higher in March, exceeding estimate by $59.5 million, or 61.9 percent. While not as large in dollar terms, realty transfer tax collections also did well, finishing $16.5 million above estimate, or 45.9 percent.

Looking ahead, April could be initially lower than anticipated because the Department of Revenue has extended the personal income tax filing deadline until May 17 to remain consistent with the federal deadline extension announced by the IRS. The due date change will likely shift a good portion of PIT final annual payments from April into May. Unlike last year, this timing shift should not materially affect revenues received during the fiscal year. Also, in April, the next personal income tax quarterly estimated payment is due.

For March:

-

Total General Fund collections were $378.2 million higher than expected (8.5 percent)

-

General Fund tax revenues were $360.6 million higher than anticipated (8.3 percent)

-

Corporation taxes were $82.6 million above estimate (4.0 percent)

-

The corporate net income tax was $92.4 higher than expected (25.1 percent)

-

Gross receipts taxes were $11.6 million lower than expected (1.2 percent)

-

Insurance premiums tax collections fell short of estimate by $27.4 million (7.0 percent)

-

Financial institutions taxes were $31.1 million above estimate (9.2 percent)

-

Sales and use tax collections exceeded projections by $85.8 million (10.3 percent)

-

Cigarette tax collections were $16.5 million higher than expected (23.3 percent)

-

Personal income tax collections were $95.1 million more than expected (7.5 percent)

-

Realty transfer tax revenues were $16.5 million (45.9 percent)

-

Inheritance tax collections were $59.5 million higher than estimated (61.9 percent)

-

Non-tax revenues were $17.6 million above the official estimate (17.4 percent)

For the 2020/21 fiscal year to date:

-

General Fund tax revenue are $1.24 billion higher than projected (4.7 percent)

-

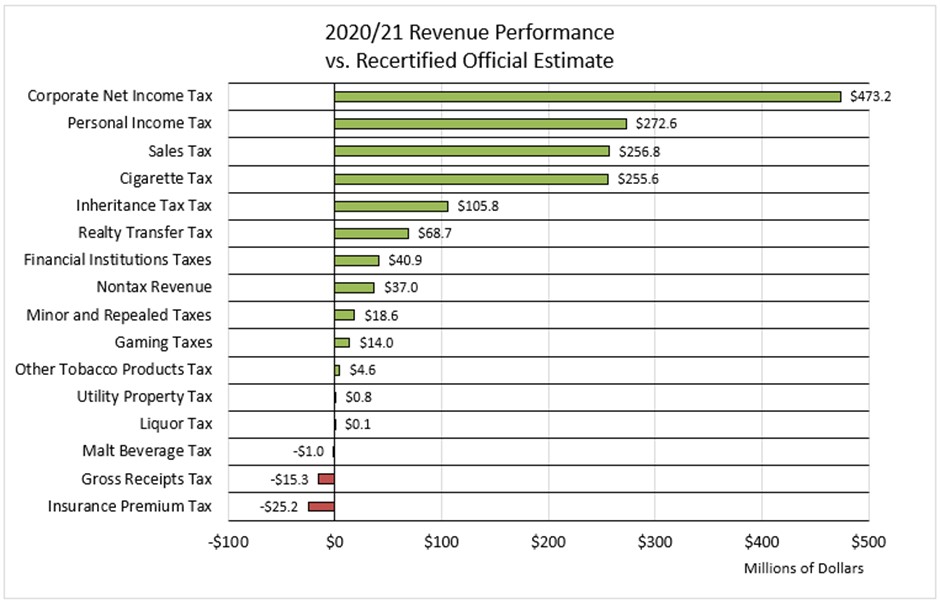

Corporate net income tax revenues are $473.2 million more than expected (20.2 percent)

-

Sales and use taxes are $256.8 million more than expected (2.8 percent)

-

Personal income tax collections are $272.6 million more than anticipated (2.5 percent)

-

Non-tax revenues are $37.0 million above the estimate (4.7 percent)

|

General Fund Revenues - Year-to-Date Performance vs Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

27,434.5

|

28,714.0

|

1,279.5

|

|

Tax Revenue Total

|

26,646.2

|

27,888.7

|

1,242.5

|

|

Corporation Taxes

|

4,161.3

|

4,638.0

|

476.7

|

|

Corporate Net Income Tax

|

2,343.0

|

2,816.2

|

473.2

|

|

Gross Receipts Tax

|

1,003.6

|

988.3

|

(15.3)

|

|

Utility Property Tax

|

2.3

|

3.1

|

0.8

|

|

Insurance Premiums Taxes

|

453.4

|

428.2

|

(25.2)

|

|

Financial Institutions Taxes

|

359.0

|

399.9

|

40.9

|

|

Consumption Taxes

|

10,214.9

|

10,501.1

|

286.2

|

|

Sales and Use Tax

|

9,026.1

|

9,282.9

|

256.8

|

|

Cigarette Tax

|

766.9

|

792.6

|

25.7

|

|

Other Tobacco Products

|

94.6

|

99.2

|

4.6

|

|

Malt Beverage Tax

|

17.4

|

16.4

|

(1.0)

|

|

Liquor Tax

|

309.9

|

310.0

|

0.1

|

|

Other Taxes

|

12,270.0

|

12,749.6

|

479.6

|

|

Personal Income Tax

|

10,935.9

|

11,208.5

|

272.6

|

|

Realty Transfer Tax

|

396.9

|

465.6

|

68.7

|

|

Inheritance Tax

|

857.4

|

963.2

|

105.8

|

|

Gaming

|

153.0

|

167.0

|

14.0

|

|

Minor and Repealed

|

(73.2)

|

(54.6)

|

18.6

|

|

Non-Tax Revenue

|

788.3

|

825.3

|

37.0

|