General Fund Revenue Update - February 2021

By Eric Dice , Assistant Executive Director | 4 years ago

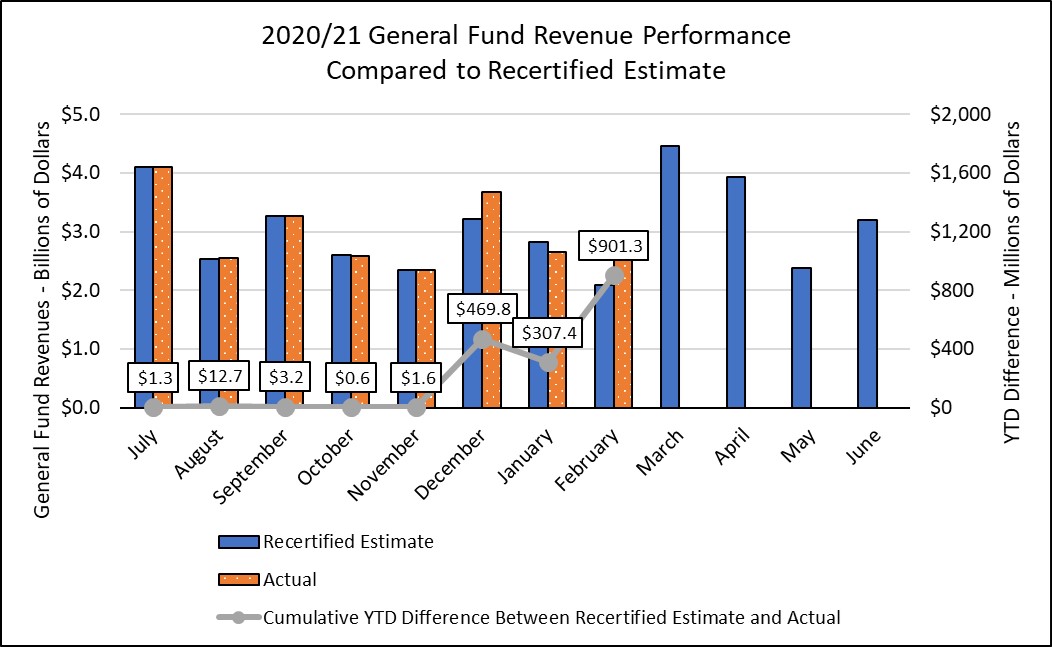

February revenues exceeded the revised official estimate by $593.9 million. For the year to date, General Fund revenues are $901.3 million higher than projected.

60 percent of February’s surplus is attributable to individual estimated payments for the personal income tax. Under the due date schedule, these payments are generally paid in January. However, the Department of Revenue’s processing facility in Harrisburg was temporarily closed in late January due to COVID-19 health and safety protocols. This closure impacted check deposits and delayed revenues from January into February.

Sales tax collections also ran significantly higher than projected, finishing $106.7 million higher than expected, almost all within the non-motor vehicle category.

March is traditionally the largest revenue month of the fiscal year. Major corporation tax payments are due in March, including the first quarter corporate net income tax payment, personal income tax final payments also start to ramp up as taxpayers start to file their annual returns leading up to the deadline in April.

For February:

- Total General Fund collections were $593.9 million higher than expected (28.4 percent)

- General Fund tax revenues were $598.6 million higher than anticipated (28.9 percent)

- Corporation taxes were $22.4 million above estimate (24.2 percent)

- The corporate net income tax was $346,000 higher than expected (0.5 percent)

- Insurance premiums taxes were $14.0 million higher than estimate (106.6 percent)

- Sales and use tax collections exceeded projections by $106.7 million (13.3 percent)

- Non-motor collections were $104.8 million higher than projected (15.3 percent)

- Motor vehicle collections were $2.0 million above estimate (1.7 percent)

- Cigarette tax collections were $16.8 million higher than expected (23.0 percent)

- Personal income tax collections were $413.4 million more than expected (43.9 percent)

- Employer withholdings on wages and salaries were $32.2 million more than anticipated (3.6 percent)

- Non-withheld collections were $381.2 million above projections (818.1 percent)

- Realty transfer tax revenues were $17.5 million (71.9 percent)

- Inheritance tax collections were $17.1 million higher than estimated (20.5 percent)

- Non-tax revenues were $4.6 million below the official estimate (23.6 percent)

For the 2020/21 fiscal year to date:

- Cumulative General Fund revenues are $901.3 million higher than expected (3.9 percent)

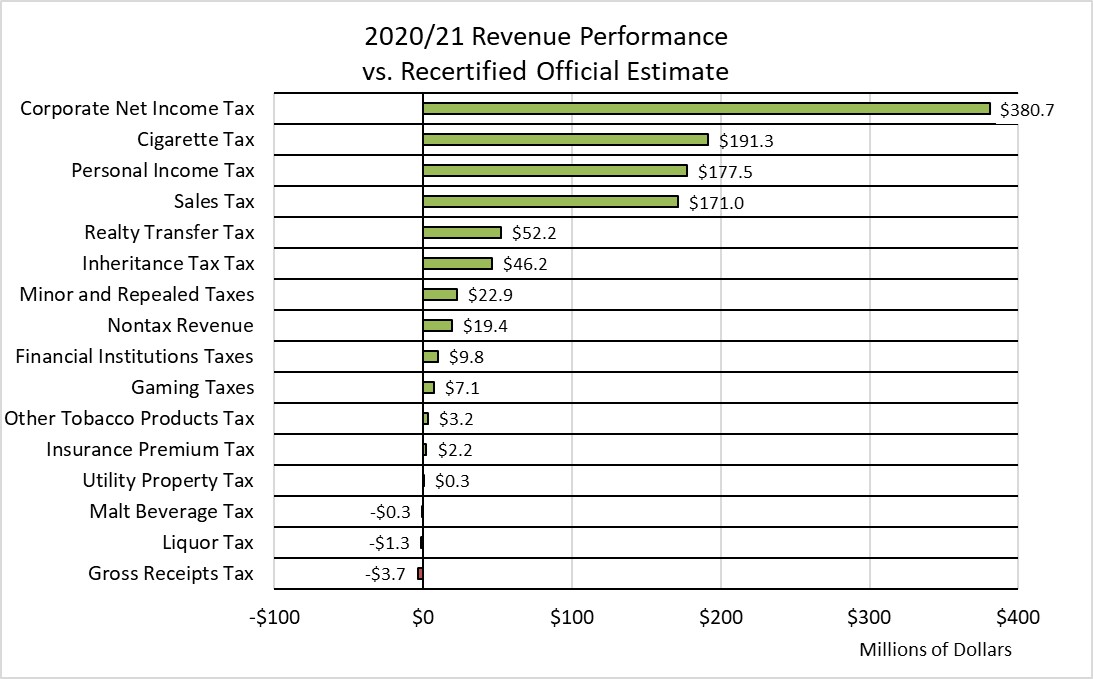

- General Fund tax revenue are $881.9 million higher than projected (4.0 percent)

- Corporate net income tax revenues are $380.7 million less than expected (19.3 percent)

- Sales and use taxes are $171.0 million more than expected (2.1 percent)

- Personal income tax collections are $177.5 million more than anticipated (1.8 percent)

- Non-tax revenues are $19.4 million above the estimate (2.8 percent)

|

General Fund Revenues - Year-to-Date Performance vs Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

22,970.0

|

23,871.3

|

901.3

|

|

Tax Revenue Total

|

22,282.9

|

23,164.8

|

881.9

|

|

Corporation Taxes

|

2,083.0

|

2,477.1

|

394.1

|

|

Corporate Net Income Tax

|

1,975.4

|

2,356.1

|

380.7

|

|

Gross Receipts Tax

|

24.3

|

20.6

|

(3.7)

|

|

Utility Property Tax

|

2.2

|

2.5

|

0.3

|

|

Insurance Premiums Taxes

|

60.2

|

62.4

|

2.2

|

|

Financial Institutions Taxes

|

20.9

|

30.7

|

9.8

|

|

Consumption Taxes

|

9,270.8

|

9,452.6

|

181.8

|

|

Sales and Use Tax

|

8,195.9

|

8,366.9

|

171.0

|

|

Cigarette Tax

|

695.9

|

705.1

|

9.2

|

|

Other Tobacco Products

|

85.7

|

88.9

|

3.2

|

|

Malt Beverage Tax

|

15.5

|

15.2

|

(0.3)

|

|

Liquor Tax

|

277.8

|

276.5

|

(1.3)

|

|

Other Taxes

|

10,929.1

|

11,235.0

|

305.9

|

|

Personal Income Tax

|

9,662.3

|

9,839.8

|

177.5

|

|

Realty Transfer Tax

|

360.9

|

413.1

|

52.2

|

|

Inheritance Tax

|

761.2

|

807.4

|

46.2

|

|

Gaming

|

138.2

|

145.3

|

7.1

|

|

Minor and Repealed

|

6.5

|

29.4

|

22.9

|

|

Non-Tax Revenue

|

687.1

|

706.5

|

19.4

|